- Home

- Trading FAQ

Trading FAQ

- Why was my position closed at the price that was not on the chart?Page issue

The charts in the trading terminal are built based on the Bid price, but only long (Buy) positions are closed at the Bid price. Short (Sell) positions are closed at the Ask price.

As a result, your short positions will be closed at the price that is not displayed on the chart, until you enable the Ask line to display in the chart settings.

In MetaTrader terminals, it can be done in "Charts" -> "Settings".

- Why was the order closed without any actions on my part?Page issue

Orders are closed automatically for the following reasons:

- In case of Stop Out (the margin level on your trading account reached the Stop Out value). Current Stop Out values can be found on the "Account types" page).

- The price reached the Stop Loss or Take Profit level.

- In case Trailing Stop was activated.

- How do I open a position in the terminal?Page issue

There are several ways to open a new position in the terminal:

1. With the help of the instrument list:

- Right-click on the instrument that you have decided to trade.

- Choose "New order" from the menu.

- Set order parameters (type, volume, Stop Loss and Take Profit levels).

- Choose the position type: long (Buy) or short (Sell) and click the corresponding button.

2. Using "One-Click Trading":

- Add "One-Click Trading" widget by right-clicking on the chart and choose the corresponding menu item.

- Specify order volume and direction (Sell or Buy).

3. Using the terminal’s main menu:

- Choose "New order" from the "Tools" menu, or click "New order" in the panel below the main menu.

- Choose the required trading instrument, and follow the instructions from point 1 of this list.

- Why wasn't my order executed at the declared price?Page issue

This may happen to Buy Stop, Sell Stop, and Stop Loss orders.

When these orders are triggered, the system sends the Market order that is executed at the current price, which may differ from the declared price.

Other types of pending orders (Buy Limit, Sell Limit, and Take Profit) are mostly executed at the specified price; and sometimes at the better price, if this exists on the market at the time of execution.

- What is leverage?Page issue

Leverage is a ratio between the trader’s own funds and borrowed funds, which a trader borrows from their broker. For example, 1:100 leverage means that for a transaction you must have a trading account with an amount that's 100 times less than the sum of the transaction.

Example: a trader chooses the 1:500 leverage and has 200 euros on their account. Leverage 1:500 allows them to buy a contract worth 100.000 euros. - What is a lot?Page issue

A lot is a unit of measure in a transaction of trades.

- How does the Stop order work?Page issue

The Stop order is a requirement, and when it is met, the platform generates the corresponding Market or Limit order.

- A Market order is created in case of Buy Stop and Sell Stop orders (orders to buy/sell an asset), and when the asset price reaches the Stop Loss level (an order to close the position).

- A Limit order is created in case of a Stop Limit order, when the asset price reaches the Stop level specified in the order.

- How are profits and losses calculated when trading Forex instruments?Page issue

When you trade on the Forex market, your profit and losses are calculated as the difference between opening and closing prices.

Orders can be opened both to buy a currency pair (in this case, a trader benefits from the growth of the asset price) and sell it (eventually, in the future, a trader expects a lower price in comparison with the entry point). If the market moves in the opposite direction to traders' forecasts, they incur losses.

Let’s consider an example:

Please note that the example does not take into account spreads and (or) brokers’ commissions.

You purchased 1 lot of EURUSD at 1.2291, which means that you paid 122,910 USD to buy 100,000 EUR because 1 lot equals 100,000 units of the base currency.

Let’s assume that the asset price rose and you decided to close your position. At that moment, the price of EURUSD was 1.2391.

It turns out that you will have to give 100,000 EUR, which you had bought earlier, back to the market. However, they now cost 123,910 USD.

Your profit will be the difference of the asset market prices at the time of purchase and sale: 123,910 USD – 122,910 USD = 1,000 USD.

In case EURUSD started falling and you closed your position at 1.2191, you will incur losses, which are calculated in the same way:

1.2191 * 100,000 = 121,910 USD

121,910 USD – 122,910 USD = (-1,000 USD)In this case, your losses are 1,000 USD.

- How is a Swap calculated?Page issue

In the Forex market, traders incur Rollover (Swap) charges for transiting the position over midnight. The Swap amount depends on the difference between bank rates of the base currency and the secondary currency in a currency pair. Swaps can have either positive or negative value.

RoboMarkets swap rates are established in accordance with swap rates from our liquidity providers. Current swap rates for each trading instrument can be found in the "Contract Specifications" section of our website.

- Why can I not sell at the weekend?Page issue

The market is closed over the weekend.

- How risky are Forex operations?Page issue

Trading currencies, stocks, and other investment products is of the market nature and always involves significant risks. Owing to sharp market fluctuations, you may both make much of your investments and completely loose them.

You may manage the risks (the ratio of possible financial losses to profits) by using the leverage value, and specific types of orders (Stop Loss / Take Profit) or other available tools. You should always remember that the higher the leverage and possible profit, the higher the risk level and potential loss.

- What types of pending orders are there?Page issue

A pending order is the client's order to buy or sell a financial instrument at the specified price in the future.

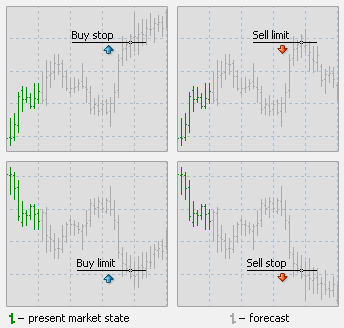

There are four types of pending orders:

Buy Limit — to buy, when the future "Ask" price is equal to the specified value. The current price level is higher than the value of the placed order. Execution of this type of order means that the transaction will be made at the price specified in the order or at the price that is lower. Orders of this type are usually placed in anticipation that the instrument price, having fallen to a certain level, will increase.

Buy Stop — to buy, when the future "Ask" price is equal to the specified value. The current price level is lower than the value of the placed order. Execution of this type of order means that the transaction will be made at the price set at the moment when the order is executed, which may be different from the price specified in the order. Orders of this type are usually placed in anticipation that the instrument price, having reached a certain level, will keep increasing.

Sell Limit — to sell, when the future "Bid" price is equal to the specified value. The current price level is lower than the value of the placed order. Execution of this type of order means that the transaction will be made at the price specified in the order or at a higher price. Orders of this type are usually placed in anticipation that the instrument price, having risen to a certain level, will decrease.

Sell Stop — to sell, when the future "Bid" price is equal to the specified value. The current price level is higher than the value of the placed order. Execution of this type of order means that the transaction will be made at the price set at the moment when the order is executed, which may be different from the price specified in the order. Orders of this type are usually placed in anticipation that the instrument price, having reached a certain level, will keep decreasing.

Ask

Our consultant will answer your question shortly.