What is P/E, and How to Use It for Assessing Stocks?

7 minutes for reading

Before selecting stocks or packages of stocks for investments, investors study company charts and reports but often miss an important coefficient/index – The P/E (Price/Earnings). Let us try to find out what this index is, and how we can use it.

What is P/E?

The P/E is a multiplier that tells investors how much a company is worth. It is used as the fastest way of checking if a company is overvalued or undervalued, thereby showing its primary investment attractiveness. Based on the P/E, you can conclude how fast your investments in a company will pay back.

How P/E is calculated

P (Price) is the company’s capitalisation or, in other words, its exchange price. It is calculated by multiplying the price of one stock by the whole number of stocks in circulation.

For example, X company has one million stocks in circulation, and the current stock price is 2 USD. This means the company’s market capitalisation is 2 million USD.

E (Earnings) is the company’s net profit for the reporting period. Normally, for calculations, we use the data from the last calendar year. Also, in certain cases, we use the forecast profit that the company will receive in the future or the sliding profit. Note that sometimes this index is overstated to make the company more attractive, and might decline at a later stage. To put it simply, the P/E tells us how long it will take to recoup your investments.

The lower the index, the sooner this will happen.

However, things are not as simple as they seem. A low P/E value means that the company is underpriced and its stocks will be moving towards a fair price, which will make the earnings of the investor in the long run. On the other hand, low P/E might be the result of some negative background or serious issues in the company.

A P/E value higher than the market average means that the company is overpriced, so investments in it might not be recouped in the medium or long run.

Three ways of calculating the P/E

There are three ways of calculating the P/E, which are:

- Yearly (normal) is the P/E of the previous calendar year

- Sliding P/E is the P/E of the previous four quarters, regardless of the quarter when it is calculated

- Forward P/E is the forecast P/E. The calculation is made for the future at the beginning of the fourth quarter

Example:

Yearly P/E: in the new 2021, we calculate the P/E based on the profit and stock rise in the previous 2020.

Sliding P/E: at the end of Q1 2021, we form the P/E based on the three quarters of 2020 and the first quarter of 2021.

Forward P/E: at the beginning of Q4 2021, we forecast the P/E. The values of Q4 2020 will be nonobjective due to the change in market conditions. We calculate the multiplier for the next quarter based on preliminary calculations and forecasts. The calculation will be conditional, however, it will show some prospects of the company and make forecasts accordingly.

How to use the P/E ratio

To determine the investment prospects in a certain company, knowing its P/E ratio is not enough. You need to also compare it with other indices, which are:

- Average market P/E

- Average P/E in the sector (eg., healthcare)

- P/E of rivaling companies, or those from a similar sector

- P/E of the company in previous report periods

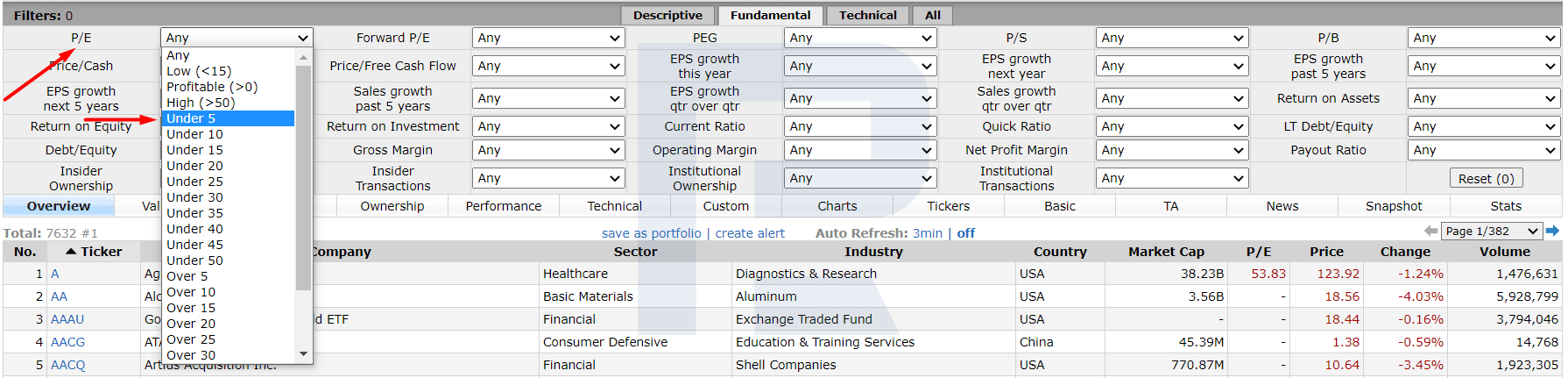

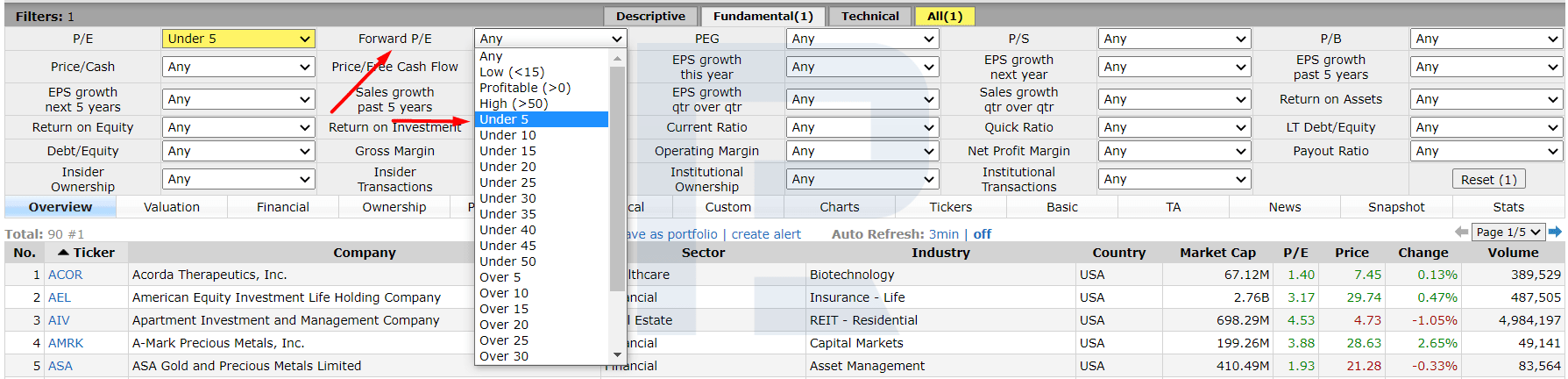

Thanks to developing computer technology and the Internet, investors no longer need to manually calculate the P/E ratio. This index is ready for analysis and comparison on popular resources relating to stocks and the stock market.

In the screener, you can specify the calculation period for the P/E (up to five years) and analyse the data.

Advantages and disadvantages of the P/E

Advantages:

- The P/E helps when looking for companies with a positive investment potential that are underestimated in the market or, perhaps, ones that are not known to the wide circle of investors

- It speeds up the process of selecting stocks in your sector

- It simplifies the evaluation of the company’s attractiveness: it allows you to easily sift out companies with too low/high P/E

- It simplifies forecasting price movements: an underestimated company has better growth potential

If the average value in the sector is 15, and the P/E ratio of the company you are interested in is 10, the company has some room to grow. If, on the contrary, the average value is 15, and the company has a P/E of 25, the potential for growth is low.

Disadvantages:

- The P/E cannot be applied to losing companies – for such companies, the P/S (Price/Sales ratio) can be used instead. The P/E only analyses the ratio of the fair price to the market one. However, other parameters influence the growth of the company (dividends, market/sector situation). You cannot compare the P/E of different sectors (eg., it is incorrect to compare the P/E of the biotech sector and the heavy industry)

- It is also incorrect to compare companies in different stages of development. Young companies spend a large part of their profit on capital expenses; and as a result, their P/E is high. “Mature” companies have smaller profits but also smaller spending, which makes their P/E lower

- Investors only need to decide which company to choose: a swiftly developing one with a high P/E, or a stable one with low growth potential and low P/E

For the US market, the normal P/E is between 15 and 20. The P/E is conditional because both profits and market prices keep changing both in positive and negative directions.

Conclusion

It is incorrect to assess stocks just by the P/E, however, it is an important part of such assessment. A full-scale assessment requires taking many parameters into consideration.

Also, note that it differs not only from sector to sector but also from country to country. The US market is more conservative, hence, the average P/E will be high. Here, investors are ready to wait for 15-20 years for stocks to pay off.

Other important criteria for assessing stocks are dividend payments, trade values per session, recommendations of analysts, insider trades, and market capitalisation. In subsequent articles, we will talk about all the above in detail.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high