A Simple Guide to Buying Apple, Uber, Facebook Stocks From a Broker

6 minutes for reading

A stock is a security representing a share of the company that has issued it. When buying stocks, the owner has the right to a share of the company's income in the form of dividends. In addition, the stockholder has the right to participate in managing the company and is entitled to a part of the company's property in case of liquidation.

Why do investors buy stocks?

Stocks are one of the most popular investment instruments. Apart from earning a small dividend income, the stockholder can make a profit from the changes in their price. If the company is developing and its economic performance is good, the stock price will be increasing, bringing a satisfactory income to its owner.

Stocks are normally bought on the stock market via a broker. A broker is a company, a professional market player, that is licenced to operate on the stock market on behalf of its clients. Clients open trading accounts with a broker company and use these to buy and sell stocks.

How much can be earned on the growth of stock?

To invest properly, you should learn to evaluate the performance and potential of the company whose stocks you are planning to purchase. There are certain economic ratios that can guide you. These are published by the companies in their regular reports. Also, the overall political and economic situation in the world is to be assessed to evaluate whether stock markets are growing or correcting.

Let's take a world-famous company as an example – Apple Inc. The corporation regularly demonstrates good economic performance, with its stock growing stably for years.

In January 2021, Apple's stock was trading at $150.00 per share. Today, the price is $266.70. which means that this year Apple has seen a $117 growth per stock. In terms of percentage, the result is even more impressive: if we had bought the stocks in January 2021, the profit by the end of the year would have been as high as 78%! Plus, some dividends.

Stocks or CFDs?

The purchase of stocks is one of the strategies for long-term investment. The theory behind a long-term investment is to buy promising stocks and hold on to them until the planned revenue is reached.

A CFD is a contract for difference – a marginal instrument more suitable for aggressive, short-term trading. The contract is signed for the change in the stock price. A CFD allows using increased leverage – normally 1:20, the commission fee is minimal, and the dividends are also paid out.

Thanks to the leverage, CFDs feature increased trading opportunities as more stocks can be purchased for the same amount of money; however, the risks involved and the losses in the case of position moving are also increased. If you use CFDs, you need to be more careful about the market state, and learn to control risks. This instrument is, therefore, more suitable for traders than investors.

A simple guide to buying stocks

Let's discuss the steps you'll need to take to buy Apple, Uber, Facebook, or other stocks from RoboMarkets (European broker regulated by the CySEC, license No. 191/13).

Opening an account

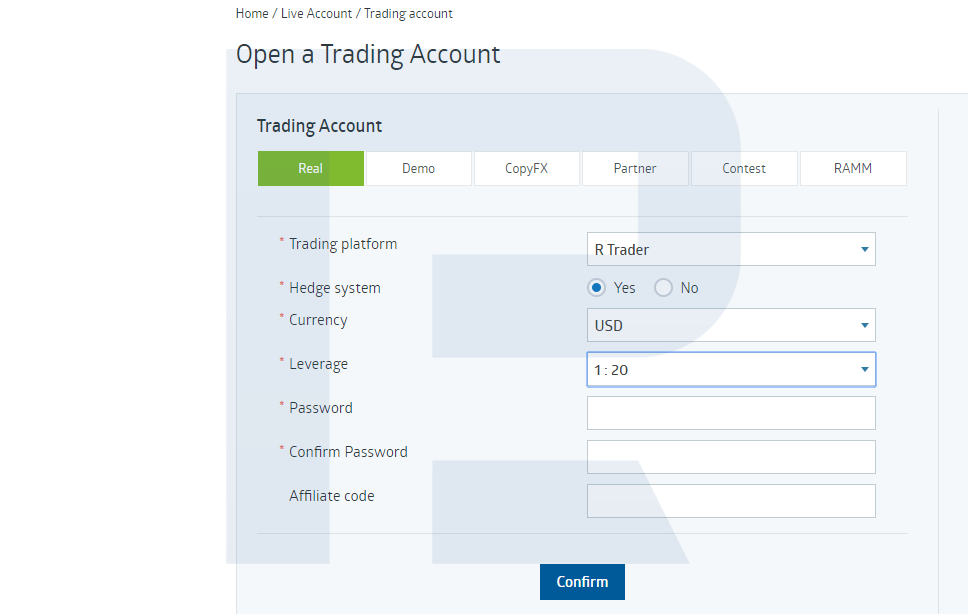

First, you need to register your Members Area at www.robomarkets.com and verify your personal data. The next step is to log in to your Members Area, and via the menu Account select Open account, then select the R StocksTrader terminal, the currency, and the leverage; and thereafter type in and save your password.

The R StocksTrader web platform boasts both modern technology and a comfortable interface. It features more than 12,000 financial instruments, including stocks, CFDs on stocks, CFDs on indices, CFDs on ETFs, and a variety of other instruments for trading. You don't have to pay or install anything — the R StocksTrader platform is free to use and runs directly in your browser in multiple languages.

Depositing funds into your account

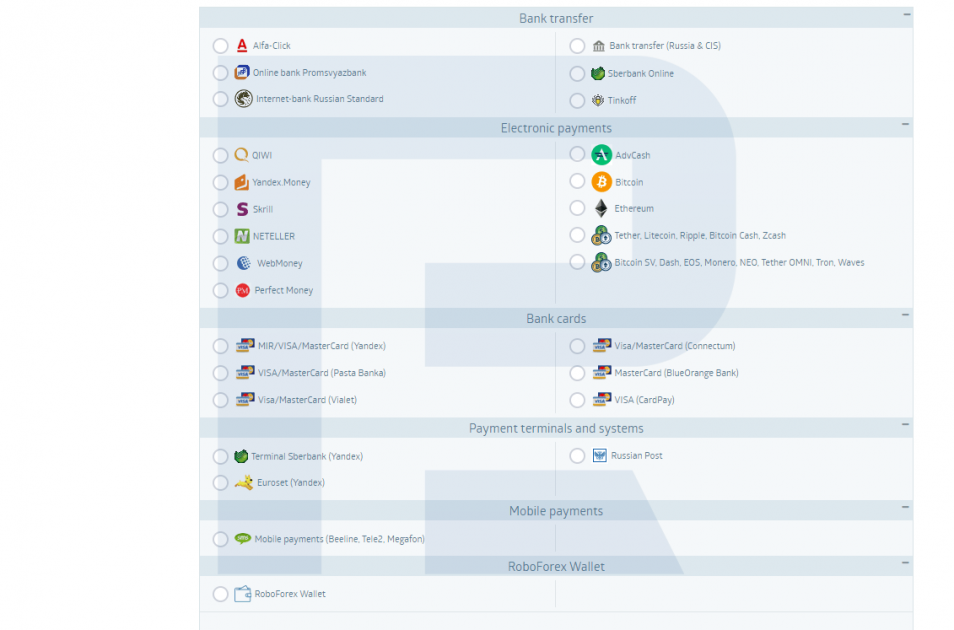

After opening your account, you need to deposit the amount you are planning to spend on buying stocks. You can deposit funds into your account by using any payment method comfortable for you, such as electronic payment systems, Visa/MasterCard, or bank transfer. The minimal deposit for R StocksTrader is just $100.

Buying stocks

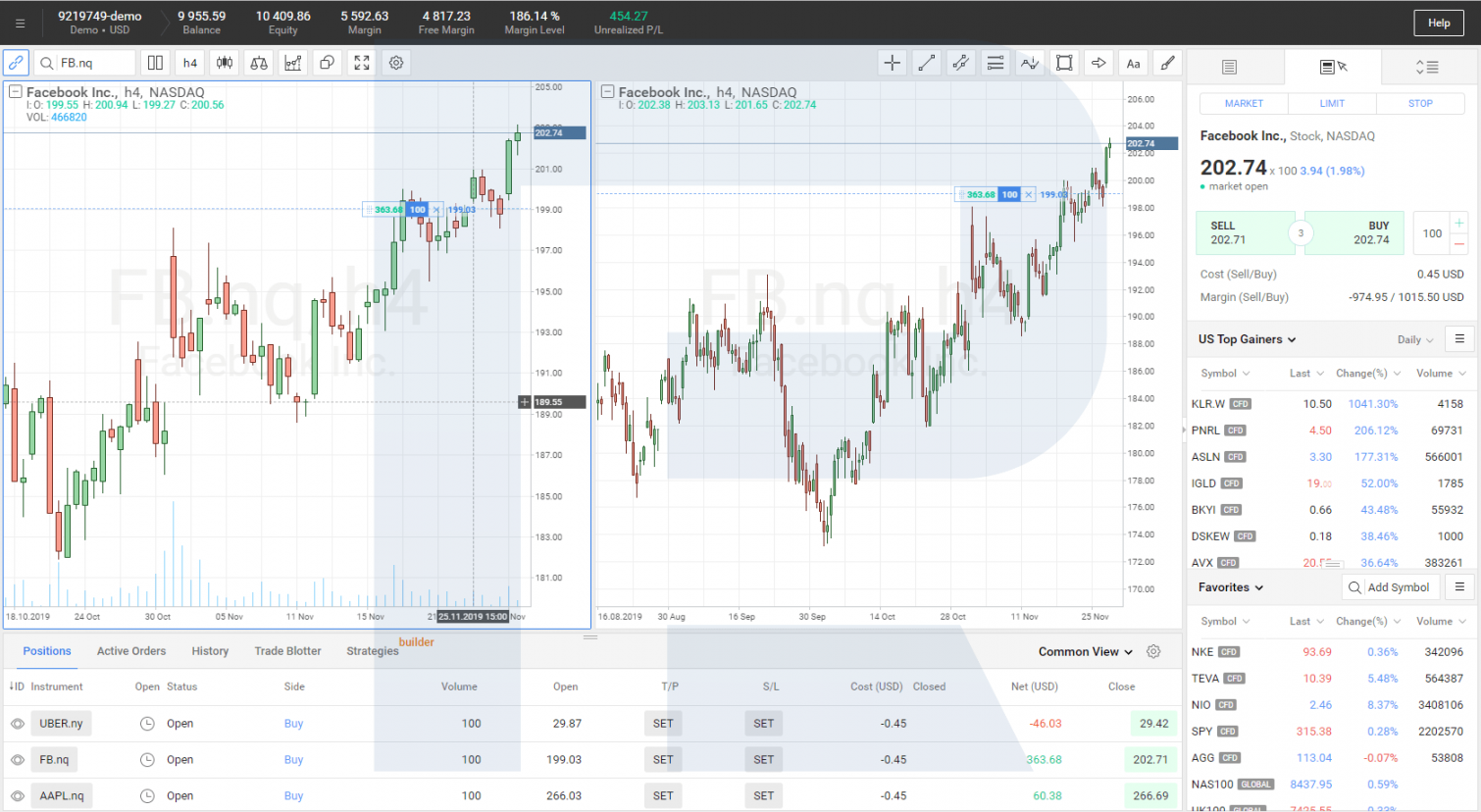

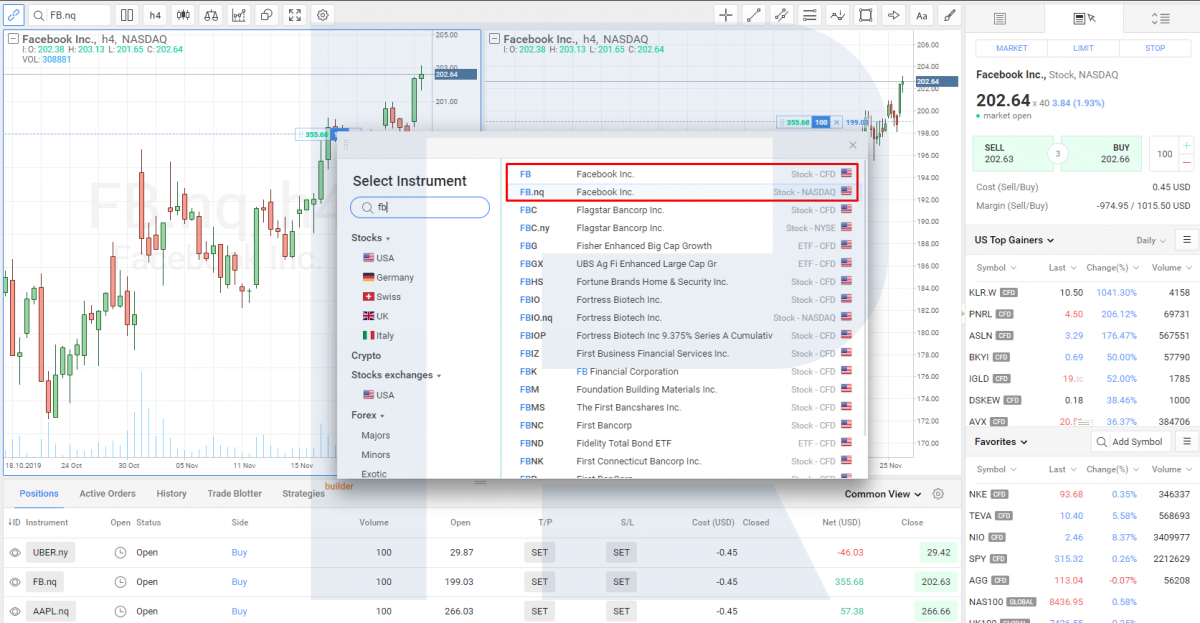

To purchase stocks, you need to access R StocksTrader - stockstrader.robomarkets.com – and log in to your account by typing your login and password. Thereafter, you need to open the chart of your required instrument via Search Instrument, and introduce its ticker or select it from the list – for example, (ticker FB) for Facebook stocks. The next step is to choose to buy either stocks or CFDs.

You can view the trading window and the customisable list of instruments, which is positioned on the right of the price chart. In the first one, there is the current selling price named SELL, the current buying price named BUY, the number of stocks, the commission fees, and the margin. You can purchase some stocks at the current price, or put a LIMIT or STOP order and buy at a later stage at your preferred price.

After your purchase, an open position will appear under the price chart with the number of stocks bought, the price, the commission, and your current profit/loss. You can place a Stop Loss to limit losses, and a Take Profit to lock in profit. You will be receiving daily reports on your email, updating you on the status of your account with the number of stocks purchased, and with the profit and losses specified.

Closing thoughts

As you can see, buying stocks from a broker is quite easy. Simply open an account, choose a promising company, and buy its stocks. If you have made the right choice of company, the stocks will grow in price and bring you a profit. However, you should always consider the risks involved.

The stock market tends to grow in the long term; while in the short term, there are corrections and declines. If you have bought a stock at its peak and this was followed by a correction, you will have to wait for some time until the price recuperates and resumes growth.

So, to invest successfully in the stock market, you need to conduct a thorough analysis before buying stocks. You could consult professional analysts and managers for this, or develop your own fundamental and technical analysis skills.

* - Past performance does not predict future returns.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high