How to Select Stocks for Short-Term Investing?

10 minutes for reading

There are several ways of investing in the stock market:

- You can hold stocks for a long period of time while making money from the dividends and the growth of the stock price. This is called long-term investing.

- Another option is to buy stocks and hold them for a short-term investment, making a profit following a future event in the company, such as the publication of quarterly reports. This is short-term investing.

- You can also speculate on stocks during a trading session. This is called intraday trading.

We've already spoken about how to select stocks for long-term investing, so today we will focus on how to pick stocks for the short-term investing strategy.

The theory of short-term investing

Short-term investing entails waiting for a certain event that's expected in the near future. Depending on your strategy, you may be holding the stock for any time between one day and several months.

The holding period of an open trade in short-term investing is conditional. In this article, when referring to short-term investing, we mean holding your position for longer than one trading session, and up to several months.

It is worth noting that there are no boundaries between short- and long-term investing. It all depends on how long it will take for the event to happen. Quite often, a short-term investment turns into a long-term one, as the investor does not dare to sell the stock after having reached the goal.

The process of selecting stock for short-term investing consists of two parts:

1. Choosing the stock based on tech analysis.

2. Choosing the stock based on fundamental analysis.

In fact, stocks are rarely purchased based on just one type of analysis. Sometimes the decision is affected by technical analysis, while at other times it is determined by the fundamental one. In any case, if both types of analysis tell you the same thing, then you know you've made the right choice.

Choosing stocks for short-term investing based on technical analysis

Let's talk about choosing stocks based on tech analysis.

To be able to make the right choice of stock, you must at least have a beginner's knowledge in technical analysis. What you need to know:

1. The basic graphic patterns.

2. How to identify and use support/resistance levels.

3. The basic technical indicators, and how to work with them.

Searching for graphic patterns will help you make your choice of stock in the easiest way. For this, you will need Finviz.com.

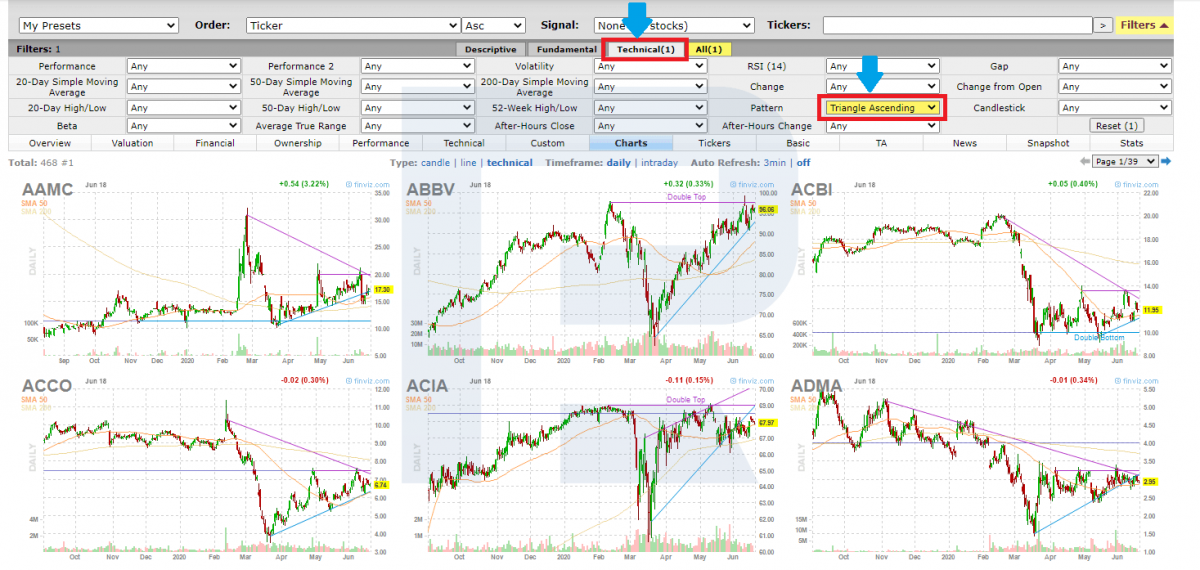

In the stock scanner, select tech analysis, and mark the patterns you are interested in. In our example, we will look for a Triangle chart pattern.

The website uses special software to identify the patterns. However, the software does not always conduct a thorough and correct search; so we recommend you to assess the offered variants yourself by checking at least three pages.

From the stocks below, select the ones featuring the most attractive Triangle – the price hardly escapes the borders, and the overall pattern looks like a triangle.

A Triangle on the stock of Acco Brands Corporation

Let's have a look at the stock of Acco Brands Corporation (NYSE: ACCO). The chart shows a sharp horizontal line, of which a breakaway will signal you to buy the stock. There is also the lower line pushing the price to the upper border.

The ready-made trading strategy we get features:

1. An entry point (the breakaway of the resistance level).

2. The level for taking the profit (the width of the Triangle).

3. The escape point (the return of the price into the Triangle) in case the price moves in an unplanned direction.

We will now wait for the entry point to appear. Meanwhile, we can assess the situation: one of the options here is to follow the news about the company, and calculate how many days are required to hold the position open for this short-term investment.

This can be determined by checking the history to find out the number of days the price needed to cover such a distance earlier. We learn that the stock needed a minimum of 10 and a maximum of 27 days to reach 3.5 USD. If this method was used to calculate the average, we will need to hold the stock for about 18 days.

Choosing stock based on other parameters of tech analysis works in the same way. In any case, you will have an idea that your chosen stock may be good to invest in.

Now, let's have a look at an earlier, similar chart pattern.

The price formed a Triangle, and the stock was caught by Finviz.com, where you could find it. Then the resistance line was broken at 27.70 USD, and the price reached its goal after 14 days.

Choosing stocks for short-term investing based on fundamental analysis

Logically speaking, fundamental analysis seems more trustworthy as it allows us to examine the financial state of the company, which should affect the stock price. However, the real state of affairs in the company quite often differs significantly from what is actually going on with the stocks.

For example, Tesla (NASDAQ: TSLA) was unprofitable for four years in a row, its stock kept growing in price. This shows us that it may be unwise to fully rely on fundamental analysis. Nevertheless, certain information may be useful for short-term investing.

Short-term investing with dividends

Let's look at an example of a short-term investment with dividends. Things seem very clear: you buy a stock, hold it for a long time, and get dividends paid out to you. In reality, if you know the date of the dividend payout, you may earn more than the actual dividend.

How to use the information on the dividends for short-term investing

To make the right decision, you need to find out which companies are giving dividends, and on what conditions. The size and date of the dividend payments are decided at the shareholder's meeting. The shareholders also decide whom to pay out the dividends to, and they set the date on which the stockholder must hold the stock in their portfolio.

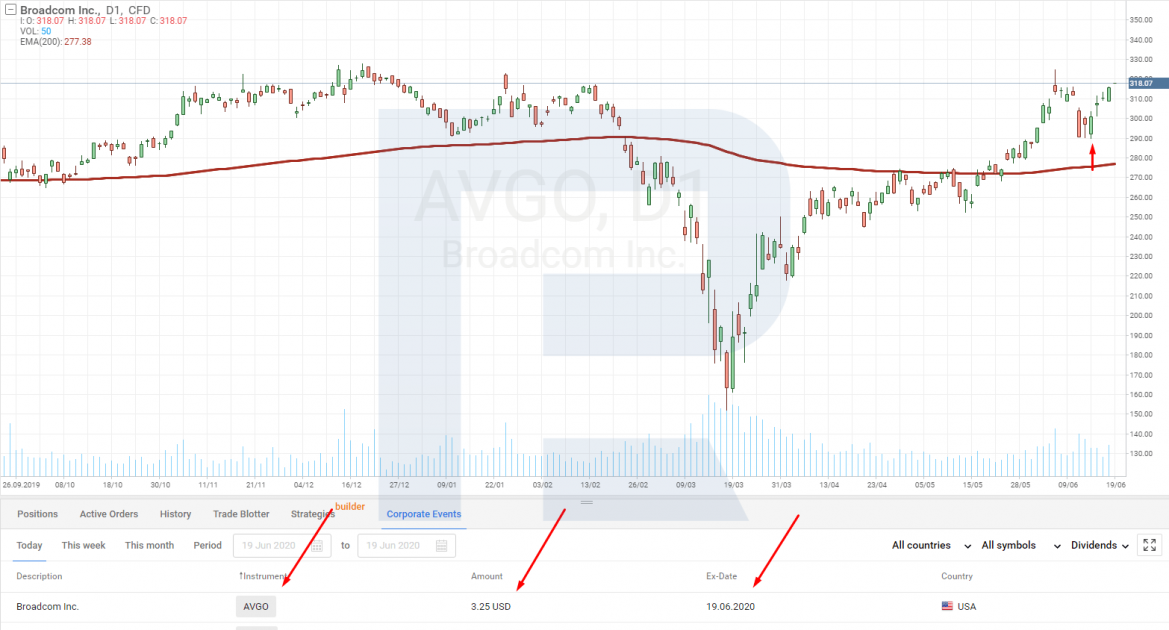

This day is called the Ex-date. The R StocksTrader platform features a built-in stock scanner that shows the Ex-dates. By knowing the Ex-date, traders can buy a stock one day before the dividend payout, and sell the security at the market opening on the following day.

This is a hidden opportunity to increase investments, not only on dividend payments but also on the growth of the stock price. However, as the Ex-dates are announced to the public, very few investors are prepared to hold on to the stock for years when they can receive the dividend paid out all at once. As a result, several days before the Ex-date, the demand for the stock increases, and so does its price. This is the right time to sell stocks at their highs, and sometimes the total profit may be several times bigger than the dividends.

Let's look at the example of the Broadcom Inc. (NASDAQ: AVGO) stock.

The Ex-date set was 19 June, which means that you could buy Broadcom Inc. stock on 18 June. The dividend payment amounted to 3.25 USD per stock. If you bought 100 stocks, your dividend payout would have amounted to 325 USD. However, four days before the Ex-date, the stock price jumped from 290 to 315 USD, meaning you could earn 2,500 USD from 100 stocks. This is quite a popular scheme for making money among traders.

Of course, the devil is in the details: for a company to make a profit in this way, it has to be financially strong, and the size of the dividend must be attractive enough to investors. If the company only were to pay 2-3 cents per stock, there would be no interest in it, and consequently no price growth. You can play on some future events, both negative and positive, in the same way.

Say, the keynotes of Apple (NASDAQ: AAPL). These are announced beforehand, and most often the stock price starts increasing several days before the event.

Short-term investments and Apple Inc. Keynote

On 22 June, the company presented its new product. A week before the event, the demand for its stocks increased, and the stock price surged from 332 to 350 USD.

On 10 September 2021, Apple presented its new products: the iPhone 11 Pro, iPhone 11, Apple Watch Series 5, and iPad. Five days before the keynote, the stock price went up from 205 to 214 USD.

This clearly shows that there is a group of investors who make short-term investments by calculating future events.

When trading fundamental events, the buying price is set during the trading session – in other words, it is not bound to any level. You only define the day on which the stock is bought. The method is similar when taking the profit.

The stock should be sold on the day before the event, as you never know how the event will affect its price. Of course, you may prefer to take the risk of waiting for the news – if the market interprets it as positive, your profit will increase. However, sometimes it happens that the stock price drops even following positive news because the latter is already accounted for by the stock price. All things considered, if you hold the stock for too long, your risks increase.

To sum up

Unlike long-term trading – for which you may rely on the ratings of the largest agencies that analyse the financial results of companies – for short-term investing, your personal knowledge and wit are required.

Of course, short-term investing has its advantages. You may decide on the strategy you will be implementing and stick to its rules. At some point, you will become an expert in your field, and you'll eventually be capable of understanding stock movements thanks to your past experience.

The R StocksTrader platform features over 12,000 instruments, from which you can select the ones that suit you every new day, not having to focus on just one stock.

* - Past performance does not predict future returns.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high