Understanding Ray Dalio's All Weather Portfolio: A Diversified Investment Approach

5 minutes for reading

Ray Dalio is an American financial expert, billionaire investor, and founder of the Bridgewater Associates hedge fund. In 1996, he developed the All Weather Portfolio, an investment approach that helps investors protect their assets in any economic situation.

Dalio’s idea was to build a portfolio that would probably earn less in favourable market conditions but would not lose during a crisis. Let’s look at the basic principles and components of this strategy and talk about its advantages and disadvantages.

What is an All Weather Portfolio?

Ray Dalio is known for his investment philosophy and approach to financial management. They are based on the principles of diversification and risk management, as well as forecasting economic cycles.

A portfolio based on the All Weather Portfolio principles should demonstrate stable yields in any economic environment and minimise risks for the investor. Such a portfolio consists of four asset classes: stocks, bonds, gold, and commodities.

Each of these classes has a different degree of risk protection, which is why, according to Ray Dalio, such investment makes it possible to mitigate risks and optimise risk management. The portfolio needs to be rebalanced regularly to keep an effective variety of assets. We explain how to do this below.

Asset allocation in the All Weather Portfolio

- Stocks: 30-40% of the portfolio. These can be shares of large companies included in the S&P 500 index

- Long-term bonds: 15-40%. These can be government or corporate bonds as well as high-yield bonds

- Short-term bonds: 15-40%. For example, corporate bonds with low credit value or treasury bills

- Gold: 7.5-10%. This is used as a hedge against inflation and market fluctuations

- Commodities: 7.5-15%. These can be investments in funds that invest in goods traded on stock exchanges

The asset allocation in the portfolio depends on the investor’s individual objectives and attitude to risk.

All Weather Portfolio principles

- The portfolio must hold all the above asset classes to minimise risks and increase potential returns

- It is necessary to rebalance the portfolio regularly to maintain an effective mix of assets

- The portfolio must include liquid assets, such as short-term bonds that could be sold quickly if necessary

- The portfolio should be based on a systematic approach to investing that implies the use of mathematical models and algorithms to analyse the market and make decisions

All Weather Portfolio historical performance

According to Bridgewater Associates, the average annual return for the All Weather Portfolio from 1996 to 2020 inclusive was 9.7%. The average annual return of the S&P 500 for the same period was 7.6%.

It should be remembered, however, that past performance does not guarantee future returns, which is why each investor should assess risks and potential returns for themselves.

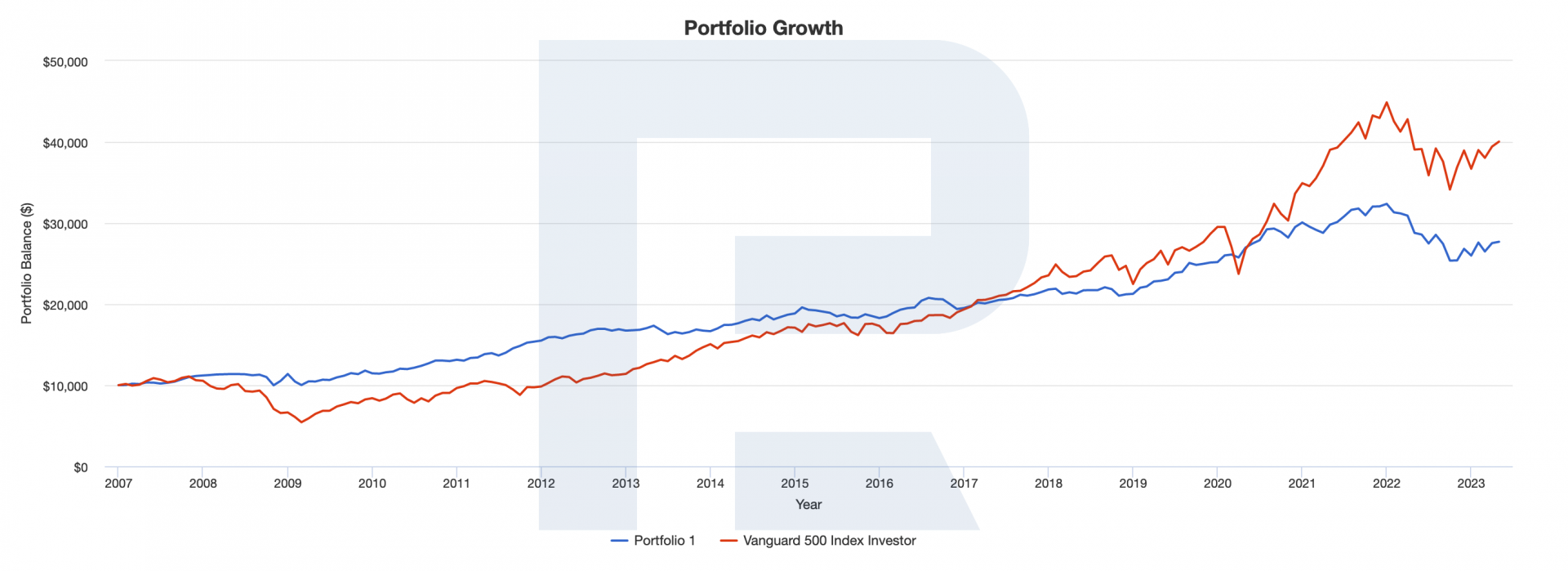

As an example, by using the Portfolio Visualizer resource we will independently analyse a portfolio in which assets are allocated as follows:

- Stocks – 30%

- Long-term bonds – 40%

- Short-term bonds – 15%

- Gold – 7.5%

- Commodities – 7.5%

The results obtained show that the portfolio’s rate of return from the end of 2007 to the end of 2016 inclusive, exceeds the Vanguard 500 Index Investor rate of return. The maximum low in the index returns reached −50.97% in February 2009, and the portfolio’s returns for the same period dropped to −21.62%.

From January 2017 to April 2023 inclusive, the index rate of return exceeded that of the All Weather Portfolio. In March 2020, the yield curves converged briefly, and the returns levelled off for just one month.

Monitoring and rebalancing the portfolio

Assets can rise or fall in value significantly over time, so investors need to monitor this and rebalance their portfolios as necessary. This is the process of regularly adjusting the number of assets in the portfolio to restore their original balance.

For example, if the value of one asset has increased significantly following its appreciation, the investor should rebalance by selling some of that asset and buying other assets whose share has decreased in the portfolio. The main aim of such rebalancing is to reduce the level of risk, rather than to pursue potential profits.

The frequency and method of rebalancing may vary depending on investors' objectives. Some prefer to rebalance their portfolio quarterly or annually, while others rebalance their portfolios when certain asset allocation levels are reached.

All Weather Portfolio advantages

- Stability of returns

- Risk diversification

- Clear logic of approach and its accessibility to a wide range of investors

All Weather Portfolio disadvantages

- Risk aversion limits returns

- Low performance in extreme market conditions

- Careful adherence to the key principles of the strategy is required

Summing up

The All Weather Portfolio is a diversified investment approach developed by Ray Dalio that helps investors protect their assets from risks in the financial market under all market conditions. This strategy is characterised by precise requirements for asset allocation in the portfolio to reduce risks.

However, it should be noted that the endeavour to distribute and control risks reduces the potential returns of the portfolio. Having said that, this approach is clear even to novice investors thanks to its consistency and simplicity of logic.

* – Past performance is not a reliable indicator of future results or future performance.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high