Agilent Technologies To Spend Up to 2 Billion USD on Stock Buybacks

5 minutes for reading

2022 set a record in the amount of money spent on stock buybacks: companies have announced having allocated 1.26 trillion USD to this, out of which only 1.03 trillion USD was eventually used. Stock buybacks were carried out in the background of constantly increasing interest rates, and the QT policy, which was meant to slow down the growth of the economy.

Nevertheless, companies might not feel the effect of the Fed's actions until way into 2023, which will push them towards cutting down on expenses and making use of their cash in alternative ways. For example, instead of spending money on stock buybacks, they will allocate it to research and development with the aim of generating profit in the future.

In any case, these are just speculations since it seems that companies have no intention of slowing down their buyback processes. For example, the board of directors of Agilent Technologies Inc. (NYSE: A) has just approved a new stock buyback programme for 2023, which involves two billion USD. Let's get acquainted with the corporation, find out how much it has already spent on share repurchases, and analyse how it will be able to fulfil its plan.

Agilent Technologies in brief

Agilent Technologies Inc. is an American company that produces measuring equipment, medical electronics, and devices for chemical analysis. Formerly one of Hewlett-Packard's departments, in 1999 it was singled out to form a separate company with the other HP departments that were not directly involved in producing computer systems.

In the same year, Agilent Technologies carried out an IPO, which helped the company gather 2.1 billion USD, thereby setting a record among Silicon Valley issuers.

Buyback programmes of Agilent Technologies

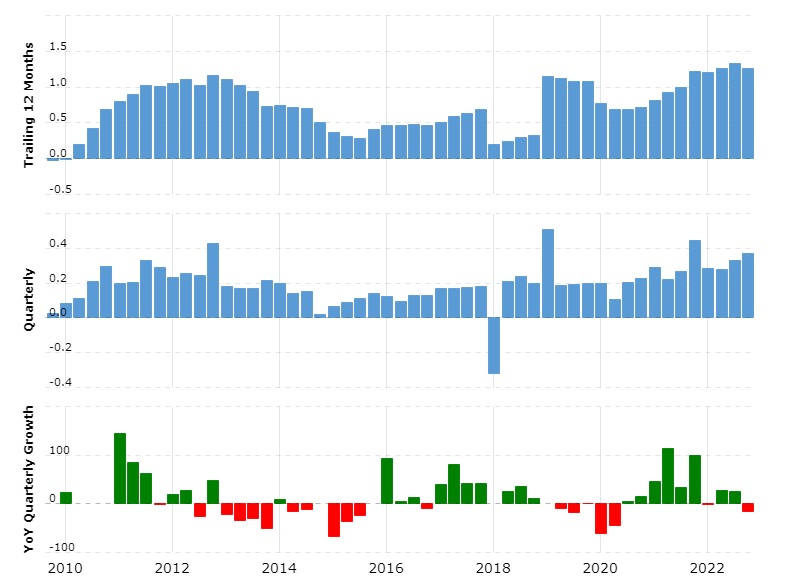

Agilent Technologies launched a stock buyback programme in 2010. Out of 798 million USD of the net profit generated in that year, 71 million USD was spent on share repurchases. The corporation kept growing over the next years, and so was its budget for stock buybacks.

In 2020, the company spent 469 million USD in financing share repurchases; in 2021, the number was 788 million USD, and in 2022 the company allocated 1.13 billion USD to its buyback programme. This year, the management plans to spend up to two billion USD. The corporation specified that the stock buyback procedure will start on 1 March, and the number of securities purchased will depend on their price, economic and market conditions, as well as corporate and legal issues. Moreover, it must be remembered that the yearly profit of the company is one of the main factors that impact the programme.

Agilent Technologies dividends

The company began paying dividends in 2012. Over the last decade, the maximum EMS reached 1.15% per year, which is quite low, especially with the current inflation rate exceeding 6.5%.

Note that the company spends more money on repurchasing shares than on dividends: in 2022, around 250 million USD was allocated to dividends and 1.13 billion USD to its buyback programme.

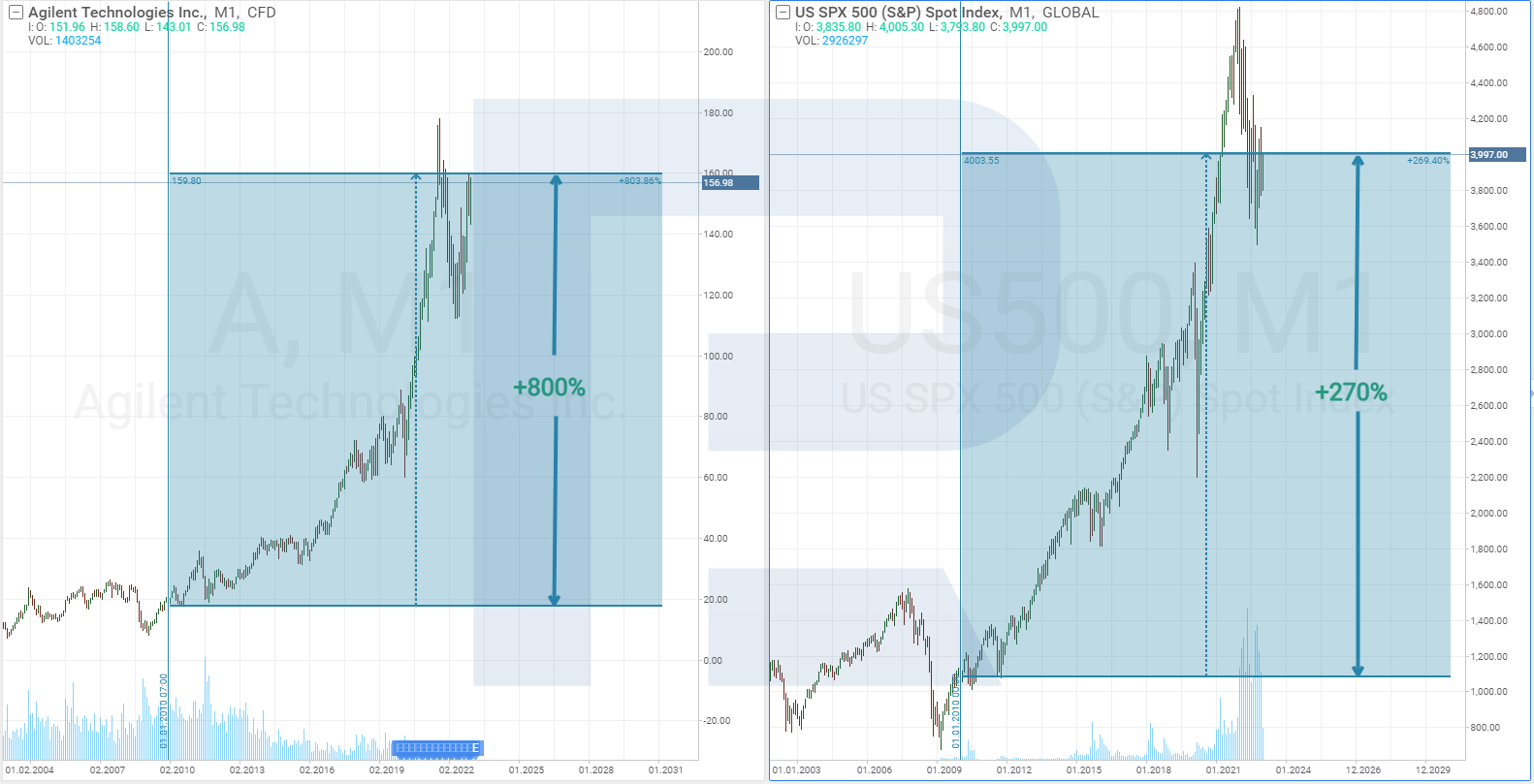

It may be concluded that with such a financing pattern, the securities of the company give a good yield. As a matter of fact, we can see on the chart below that since 2010, the shares of Agilent Technologies have recorded a remarkable growth of 800%, while the S&P 500 index grew by just 270%.

What can increase the yearly profit of Agilent Technologies?

As was stated above, the buyback programme of Agilent Technologies depends, among other things, on the sum of its net profit for the given year. Let's try to analyse what might influence this index.

Agilent Technologies received FDA approval

On 12 December 2022, the US Food and Drug Administration (FDA) approved Agilent Resolution ctDx FIRST as a companion diagnostic (CDx) test to identify advanced non-small cell lung cancer (NSCLC).

This is the most widespread type of cancer in the US, which accounts for 25% of all cancer-associated deaths. The FDA approval means Agilent Technologies can commercialise the product, and make a profit by selling it.

Agilent Technologies buys Avida Biomed

On 4 January 2023, Agilent Technologies announced the acquisition of Avida Biomed which specialises in creating instruments and technology for cancer research. In theory, this deal will seriously reinforce the company's position in the fast-growing market of cancer research and diagnostics. This, in turn, might increase the revenue of the company, thereby making it more attractive to investors.

Agilent Technologies increases its production capacity

On 9 January 2023, it became known that Agilent Technologies was investing 725 million USD to expand its production capacity for active pharma ingredients used in the therapy of a wide range of diseases. The new plant will be built in Frederick, Colorado.

The decision to build a new production facility is explained by the expected serious growth of the therapeutic oligonucleotides (short DNA & RNA molecules) market: by 2027, this is forecast to reach 2.4 billion USD.

Summary

Agilent Technologies became profitable in 2010 and launched a stock buyback programme for 71 million USD. Since then, the sums allocated for this have been growing speedily. In 2023, the company plans to spend two billion USD on share repurchases.

The extent to which the company realises the plan depends on the yearly profit made. Agilent Technologies impressed its investors with some good news, which allow us to think that the probability of organising a buyback for such a big sum is rather high. However, in the event that the corporation fails to reach its goal, this will have a negative effect on its stock price.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high