Boeing Stock Tumbles Following Alaska Airlines Incident: Stock Analysis and Forecast for 2024

9 minutes for reading

On 2 January 2024, Boeing Company’s stock surged to 267 USD per unit, reflecting a 42.5% return in just two months. However, by 22 January 2024, the share price had plummeted by over 19%, reaching 215 USD.

In this article, we aim to explain the reasons behind the decline in the stock value of one of the world’s largest aircraft, space, and military machinery manufacturers. We will examine the company’s financial reports, conduct a technical analysis of its stock, and share experts’ forecasts for the stock outlook for 2024.

Boeing’s Q3 2023 report

The Boeing Company released its Q3 2023 report on 25 October 2023. Revenue from July to September rose by 13.46% to 18.1 billion USD compared to the same period in 2022. Net loss decreased by 50.48%, down to 1.64 billion USD or 2.70 USD per share.

The company’s profitability ratios for Q3 2023 are not likely to please investors and analysts: the operating margin was −1.93%, and the profit margin reached −3.74%. Expenses amounted to 18.7 billion USD, exceeding revenue by 687 million USD. The company must borrow funds to support its operations.

When and why did Boeing become loss-making?

The Boeing Company reported a negative annual profit in Q4 2019 and has been unable to return to positive territory since then. The financial challenges began after the crash of a 737 MAX 8 on 10 March 2019, leading to the ensuing ban on the 737 MAX aircraft in numerous countries. Subsequently, a crisis emerged due to the COVID-19 pandemic, pushing many air travel and aircraft industry representatives to the brink of collapse.

The Boeing Company had to borrow funds, thereby increasing the debt burden. In Q1 2019, its long-term debt stood at 11.3 billion USD; by Q4 2020, it reached the highest value of 61.9 billion USD. In Q2 2019, all debt obligations exceeded the company’s total assets, and the situation has not improved.

As for The Boeing Company’s stock, it headed down on 13 February 2020, losing nearly 75% by 18 March 2020 and dropping to a low of 89 USD.

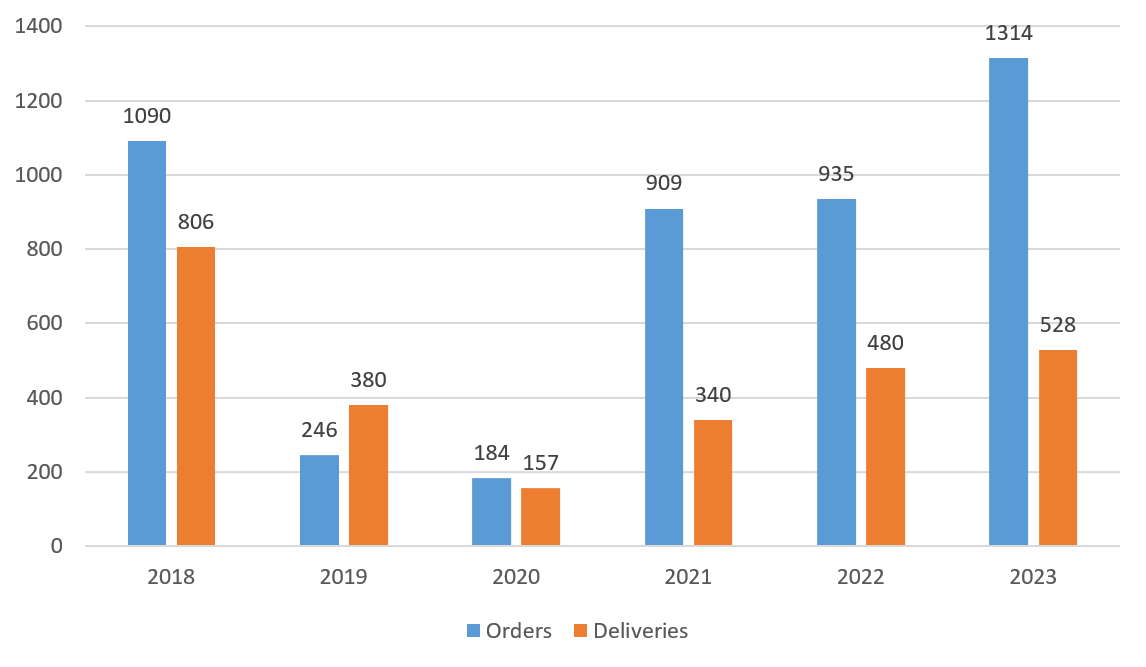

Dynamics of Boeing order volumes

To better understand the scale of challenges The Boeing Company has faced over the past few years, we will examine the statistics on airliner order volumes and deliveries from January 2018 to December 2023.

In 2018, there were 1,090 orders for airliners, but the actual deliveries amounted to 806 units.

In 2019, the number of orders decreased to 246 aircraft, while deliveries surpassed the order figures, thanks to a large order in 2018, reaching 380 units.

In 2020, with the announcement of the COVID-19 pandemic, the number of orders decreased to 184 aircraft, and deliveries dropped to 157. In 2021, the situation changed dramatically, with orders reaching 909 units and deliveries standing at 340. The positive trend persisted in 2022, with 935 units ordered and 480 delivered.

In 2023, orders surpassed the 2018 record, reaching 1,314 aircraft, while deliveries increased to only 528.

Boeing received a 52 billion USD order from Emirates

The Dubai Airshow, one of the world’s largest aerospace exhibitions, took place in Dubai from 13 to 17 November 2023. On the inaugural day, Boeing secured six deals with airlines to deliver 269 planes.

The most significant order that day came from Emirates for 35 units of Boeing 777-8, 55 units of Boeing 777-9, and 35 units of Boeing 787. The total value of the order reached 52 billion USD, marking the largest deal in the commercial segment based on the number of planes ordered by one airline at the airshow. On the second day of the Dubai Airshow, the company received orders for another 36 units.

Who is Boeing’s main competitor?

Boeing’s major competitor is Airbus Group SE, a European multinational corporation that designs, manufactures, and sells civil and military aviation products worldwide.

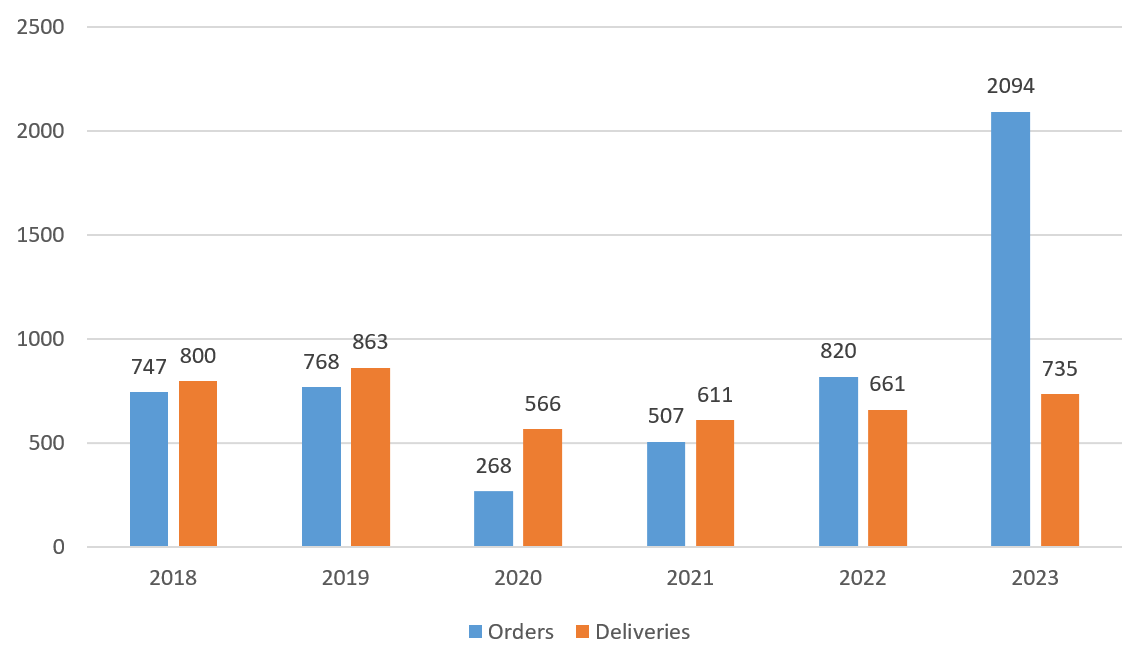

Below, we have provided an infographic of Airbus Group SE orders and deliveries from January 2018 to December 2023 inclusive.

Unlike The Boeing Company, which has a significant backlog of deliveries compared to orders, Airbus Group SE has seen deliveries exceeding orders from 2018 to 2022. The reason is the accumulation of old orders. Based on the 2023 results, demand for the European company’s airliners has sharply increased, reaching a record value of 2,094 units.

While these two aircraft industry representatives had their deliveries at nearly the same level until 2019, The Boeing Company began to lag in 2019 and still has not caught up with its competitor. Nevertheless, Airbus Group SE received orders for only 66 planes at the Dubai Airshow, considerably less than the US company.

New issues with Boeing’s products

Boeing Company’s stock started 2024 with a decline. The primary reason for investor sell-offs is airlines’ complaints about aircraft quality. According to the BBC, a bolt with a missing nut was discovered in the rudder control system on a 737 MAX on 28 December 2023. Subsequently, the manufacturer urged all airlines to inspect aircraft of this model available in their fleets.

Despite Boeing Company’s positive end to 2023 (highlighted by orders at the Dubai Airshow and deliveries to China), investors responded to new challenges in early 2024, with the stock price plummeting from 261 USD on 2 January to 244 USD per unit on 3 January.

A more serious incident occurred on 5 January when a fuselage door plug detached on a 737 Max 9 aircraft owned by Alaska Airlines, leading to rapid airplane decompression. Fortunately, no one was injured. Following the incident, the US Federal Aviation Administration (FAA) temporarily grounded the 737 Max 9 airplanes operated in the country, jeopardising deliveries to China.

The Alaska Airlines incident happened on a Friday evening when the trading session was closed. However, on Monday 8 January, trading opened with an 8.3% drop in Boeing Company’s stock value, down to 228.00 USD. By 16 January, the shares reached a low of 199.50 USD, marking a 19.5% decline.

Risk of customer rejection for Boeing’s airplanes

According to Air Current, the incident aboard the Boeing 737 Max 9 involved a new aircraft delivered to Alaska Airlines on 31 October 2023. This information suggests that the issue lies not in the aircraft’s wear and tear but in its assembly’s quality. It remains uncertain whether the airline will seek an alternative manufacturer. It is worth noting that only two mass-scale manufacturers of narrow-body medium-range aircraft exist globally, namely The Boeing Company and Airbus Group SE.

Furthermore, it is essential to note that airlines anticipate manufacturers fulfilling their orders over several years. Suppose an order for Boeing 737 aircraft with potential delivery in several years is revoked. In that case, placing a new order with an alternative manufacturer will probably result in an even lengthier fulfilment period. Such delays may lead to the airline losing its market share. Furthermore, transitioning to new aircraft models might require pilots and maintenance staff to undergo retraining.

Following each incident, an investigation occurs, with the aircraft manufacturer addressing all defects at its expense, which implies that all aircraft issues will likely be resolved by the time the order placed in 2023 is fulfilled. Given the above, the likelihood of airlines refraining from purchasing Boeing aircraft appears low.

Aircraft deliveries to China jeopardised again

Boeing 737 MAX aircraft deliveries to China were suspended in March 2019 after two crashes in Indonesia and Ethiopia resulted in 346 fatalities. In January 2023, the Chinese regulator permitted national airlines to operate the Boeing 737 MAX 8 airplanes already in their fleet. Since then, Boeing has been striving to resume deliveries of accumulated orders to its Chinese clients.

In July, David Calhoun, the company’s CEO, informed that Boeing had 85 aircraft in inventory intended for Chinese companies, and that new buyers from other countries were found for another 55 units designated initially for delivery to China.

In December 2023, the US aircraft manufacturer obtained approval from the Chinese regulator for aircraft deliveries, with the first Boeing airplane delivery to China taking place in that very month.

However, following the incident with the Alaska Airlines airplane, the Chinese regulator directed local airlines to conduct additional safety inspections of the Boeing 737 MAX aircraft in their fleets, suspending new deliveries to China.

Expert forecasts for Boeing stock for 2023-2024

- According to Barchart, 15 out of 20 analysts rated The Boeing Company’s stock as Strong Buy, one as Moderate, and four as Hold, with an average price target of 230.00 USD

- Based on the MarketBeat information, 13 out of 17 experts assigned a Buy rating to the shares, while four gave a Hold rating, with an average price target of 258.88 USD

- According to TipRanks, 18 out of 23 analysts designated a Buy rating for the US plane-maker’s stock, while five gave a Hold recommendation, with an average price target of 267.84 USD

- As Stock Analysis reports, 13 out of 48 specialists rated the stock as Strong Buy, nine as Buy, 21 as Hold, three as Sell, and two as Strong Sell. The average 12-month price forecast for The Boeing Company’s stock was 120.24 USD

Boeing stock analysis

Since 30 March 2020, Boeing Company’s stock has traded between 120 USD and 260 USD. Investors actively buy these shares at the price drop to 120 USD, as they consider this price level acceptable for investing in the company.

When approaching 260 USD, the stock sees an increase in sales. With the aircraft maker’s debts exceeding its assets, investors likely view 260 USD as the maximum price for its shares.

In December 2023, the stock quotes attempted to break above the resistance level of 260 USD but failed due to the 737 Max 9 incident, dropping the share price to 200 USD. The Boeing Company’s stock purchases resumed on 17 January, enabling the quotes to rise to 215 USD by 22 January.

If investors believe the company can address aircraft quality issues, stock purchases will likely gain momentum, with the quotes testing the resistance level of 260 USD again. Its breakthrough may serve as a catalyst for further price growth to the next resistance level of 300 USD.

Technical analysis of Boeing Co.*

Conclusion

The growth in orders in 2023 will likely create favourable conditions for Boeing Company’s revenue increase. However, significant changes in financial statistics will probably depend on optimising business processes, enhancing aircraft assembly quality, and completing defence orders, which account for most losses.

The resumption of the US aircraft manufacturer’s product deliveries to China may also increase company orders. Given the above information, it is fair to presume that The Boeing Company has the potential to improve its financial position, although it is unlikely to turn profitable in 2024. More time is probably needed for a corporation of this scale to achieve net profit. As for force majeure events, another aviation incident could be considered as such in this forecast.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

The stock charts in this article are provided by the TradingView platform, which offers a wide range of tools for analysing the financial markets. It is a convenient, high-tech online market data charting service that allows users to perform technical analysis, research financial data, and communicate with other traders and investors.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high