How AMD Stock Reacted to the Release of the MI300X Processor

6 minutes for reading

Advanced Micro Devices Inc. (NYSE: AMD) unveiled the MI300X processor, which is designed to work with artificial intelligence, on 14 June 2023 at the Data Center and AI Technology Premiere. This development marks the company’s entry into the AI market. In this article, we will explain the factors that help the MI300X to compete with NVIDIA Corporation (NASDAQ: NVDA) products and explore the companies that have taken an interest in the new chip.

The MI300X in brief

The MI300X processor is the latest development by Advanced Micro Devices Inc. for generative artificial intelligence. This is a combination of several GPU chiplets with 192 GB of HBM3 memory and a memory bandwidth of 5.2 TBps.

AMD claims this is the only chip capable of processing large language models with up to 80 billion parameters in memory. It also supports AMD’s ROCm 5 AI software development platform, which allows to run PyTorch models on AMD Instinct accelerators. The MI300X, with NVIDIA’s H100 as its main competitor, is expected to become available for sale in the third quarter of 2023.

AMD MI300X and NVIDIA H100 benchmark comparison

- Memory capacity. MI300X – 192 GB, H100 – 128 GB

- Memory bandwidth. MI300X – 5.2 TBps, H100 – 3.2 TBps

- PyTorch support. The MI300X can run any models or applications developed with PyTorch on AMD Instinct accelerators through a partnership with the PyTorch Foundation. The H100 requires the use of CUDA to work with PyTorch

- Performance. The MI300X can run the whole AI model with tens of billions of parameters in memory. This reduces the number of required GPUs and enhances the performance and efficiency of AI learning and inference. To conduct this task, an NVIDIA customer would have to buy multiple GPUs

In addition, the use of chiplets in the MI300X makes it possible to combine different types of computing. According to Advanced Micro Devices Inc., this can enhance efficiency and performance while reducing the number of GPUs required and their overall cost.

AMD’s competition with Intel

Advanced Micro Devices Inc. and Intel Corporation (NASDAQ: INTC) are the world’s largest processor manufacturers. In 2010, AMD’s saw a lower market share and decline in the company’s profitability due to its outdated product architecture and declining production process efficiency. The FX series, based on Bulldozer architecture, was unable to compete with the Intel Core series in terms of both performance and energy consumption.

However, in 2017, Advanced Micro Devices Inc. released the Ryzen series based on the new Zen architecture. Ryzen offered more cores, threads, and cache memory than the Intel Core series and supported faster memory and more PCIe lanes. Having said that, the new series was not more expensive than its competitor’s products. AMD later introduced the Threadripper series for high-performance desktops and the Epyc series for servers, which further intensified competition with Intel Corporation.

AMD’s competition with NVIDIA

Advanced Micro Devices Inc. and NVIDIA Corporation are major graphics card manufacturers and hold dominant positions in the global market. They have been competing since the late 1990s when the first GeForce graphics processor was released and AMD acquired the leading graphics card manufacturer ATI.

In 2020, Advanced Micro Devices Inc. released the Radeon RX 6000 series based on RDNA 2 architecture, which had much better performance, efficiency, and functionality indicators compared to the previous generation, and could compete with NVIDIA’s GeForce RTX 3000 series based on the Ampere architecture.

In 2021, NVIDIA Corporation released the GeForce RTX 4000 series based on the Lovelace architecture. It outperformed not only the previous generation line-up but also AMD's Radeon RX 6000 series in most benchmark tests. In response, Advanced Micro Devices Inc. released the Radeon RX 7000 based on the RDNA 3 architecture in 2022.

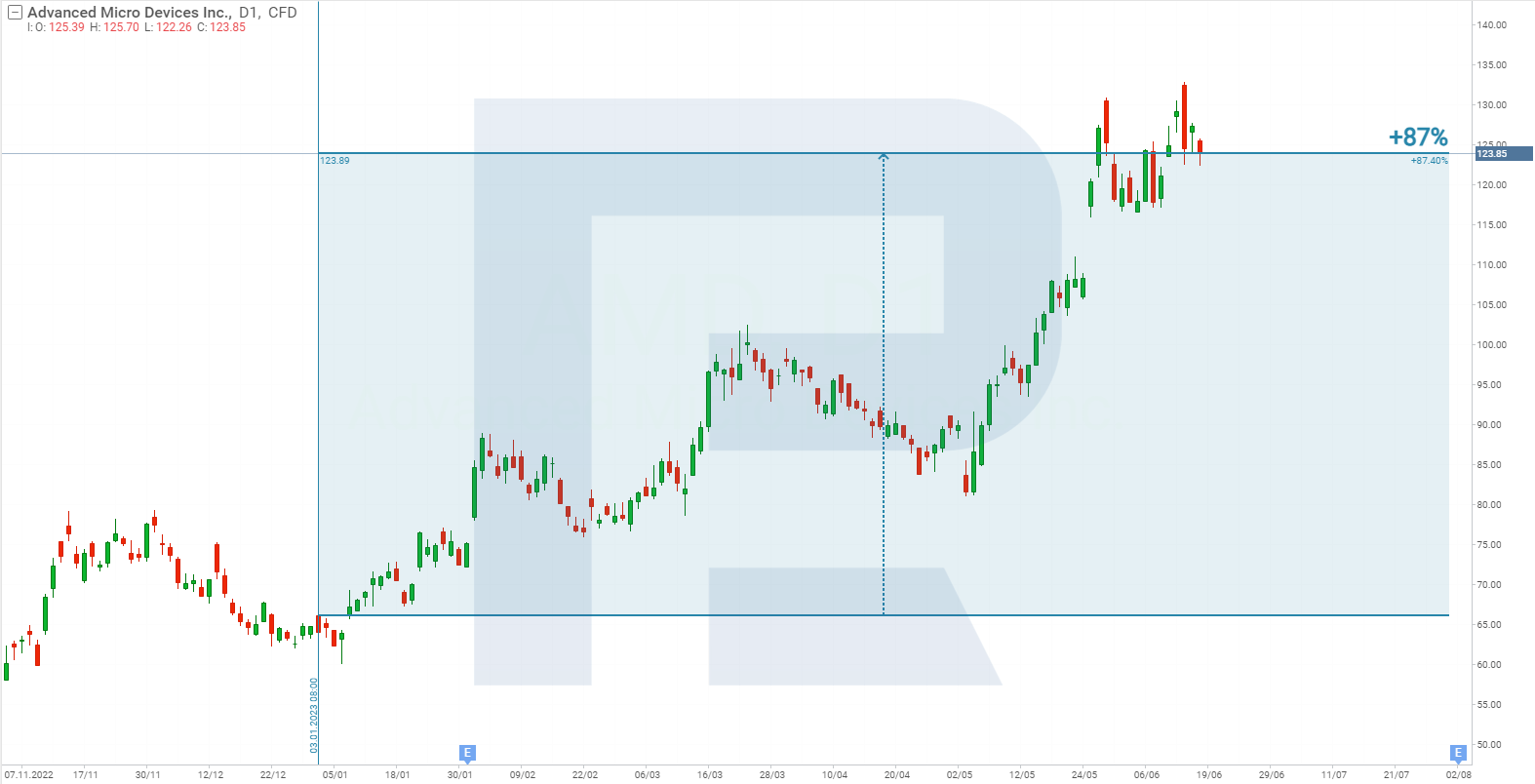

AMD’s stock reaction to the news

Advanced Micro Devices Inc. stock gained 87% since the beginning of the year. This surge in the company’s stock price is attributed to the hype surrounding GhatGPT and AI technologies in general. During the same period, NVIDIA Corporation’s stock skyrocketed 188%.

AMD’s share value rose by 2.5% during the presentation of the new MI300X processor designed for AI operations. However, at the end of the trading session the quotes fell by 3.5%.

This market reaction is likely due to the lack of confirmed information about new contracts signed for the purchase of the MI300X. It is only known that Amazon.com Inc. (NASDAQ: AMZN), OpenAI OpCo LLC, Siemens AG (XETRA: SIEG), and Lockheed Martin Corporation (NYSE: LMT) have shown interest in the chip.

Summing up

According to Counterpoint Technology Market Research, Intel Corporation’s share in the CPU market was 71% in 2022. According to WCCF Tech, NVIDIA Corporation accounted for 88% of the graphics card market. However, Advanced Micro Devices Inc. is a strong competitor for these corporations. For example, based on data from Counterpoint Technology Market Research, AMD’s market share in 2021 was 12%, and reached the level of 20% a year later.

This competition has a positive impact not only on the development of companies, but also on the entire sector as a whole: innovative solutions are being developed, high-tech products are being launched, the choice and range of products are expanding, and the flexibility of manufacturers’ pricing policy is increasing.

Advanced Micro Devices Inc.'s experience and technologies allowed the company to enter the market for AI products. A decline in the stock price on the day of the new MI300X processor launch is a short-term investor reaction to the event. However, given the technical characteristics of the chip and the interest shown in it by large corporations, it will be possible to assess the impact of this product on AMD closer to the end of 2023, when it goes on sale.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high