Invesco QQQ Trust Stock Analysis: Is There Potential for Further Growth?

5 minutes for reading

Investing in shares requires a meticulous analysis of each company, necessitating skills, experience, and time. To manage risk effectively, diversifying your investment portfolio is often necessary, even if it means spending more time finding suitable assets.

For a simpler and faster investment process, consider exchange-traded funds (ETFs). ETFs are managed by professionals who have already created portfolios with a predefined set of stocks. The structure of these portfolios and their weightings may change periodically to align with the selected investment strategies.

Today, we will focus on one such ETF: Invesco QQQ Trust (NASDAQ: QQQ). We will look at its portfolio, examine its return statistics, and conduct a technical analysis of its stock.

Invesco QQQ Trust in brief

Invesco QQQ Trust is an ETF established by Invesco PowerShares on 10 March 1999. This fund tracks the performance of the NASDAQ-100 index, which consists of stocks from the 102 largest capitalization companies on the NASDAQ. At the time of writing on 16 October 2023, Invesco QQQ Trust had approximately 200 billion USD under management.

What stocks are included in Invesco QQQ Trust’s portfolio?

According to data as of 12 October 2023, the top 10 holdings in Invesco QQQ Trust’s portfolio include:

- Apple Inc. (NASDAQ: AAPL) – 10.95%.

- Microsoft Corporation (NASDAQ: MSFT) – 9.62%.

- Amazon.com Inc. (NASDAQ: AMZN) – 5.30%.

- NVIDIA Corporation (NASDAQ: NVDA) – 4.50%.

- Meta Platforms Inc. Class A (NASDAQ: META) – 3.98%.

- Alphabet Inc. Class A (NASDAQ: GOOGL) – 3.25%.

- Tesla Inc. (NASDAQ: TSLA) – 3.25%.

- Alphabet Inc. Class C (NASDAQ: GOOG) – 3.20%.

- Broadcom Inc. (NASDAQ: AVGO) – 3.01%.

- Costco Wholesale Corporation (NASDAQ: COST) – 2.09%.

It is worth noting from the above list that Invesco QQQ Trust invests in both Class A and Class C shares of Alphabet Inc., with a total holding of 6.43%. Recall that holders of Class C shares have no voting rights at meetings.

Interestingly, regular adjustments are made to the portfolio's stock weightings, particularly for shares beyond the top 5. Fund managers continually monitor the market, rebalancing the portfolio to optimise potential returns.

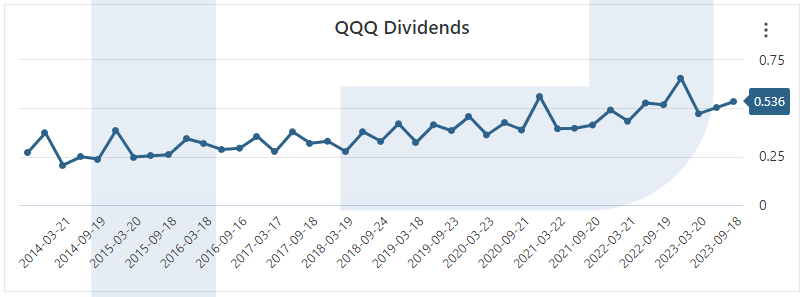

Dividend payouts by Invesco QQQ Trust

Invesco QQQ Trust pays its shareholders quarterly dividends based on the fund’s financial performance and market conditions.

The chart shows that dividend amounts typically increase by the end of the year. As of October 2023, the annual dividend yield stands at 0.58%, considerably lower than the 3.7% yearly inflation in the US. Consequently, most investors’ profits from Invesco QQQ Trust will likely be generated from stock value increases.

Annual return of Invesco QQQ Trust

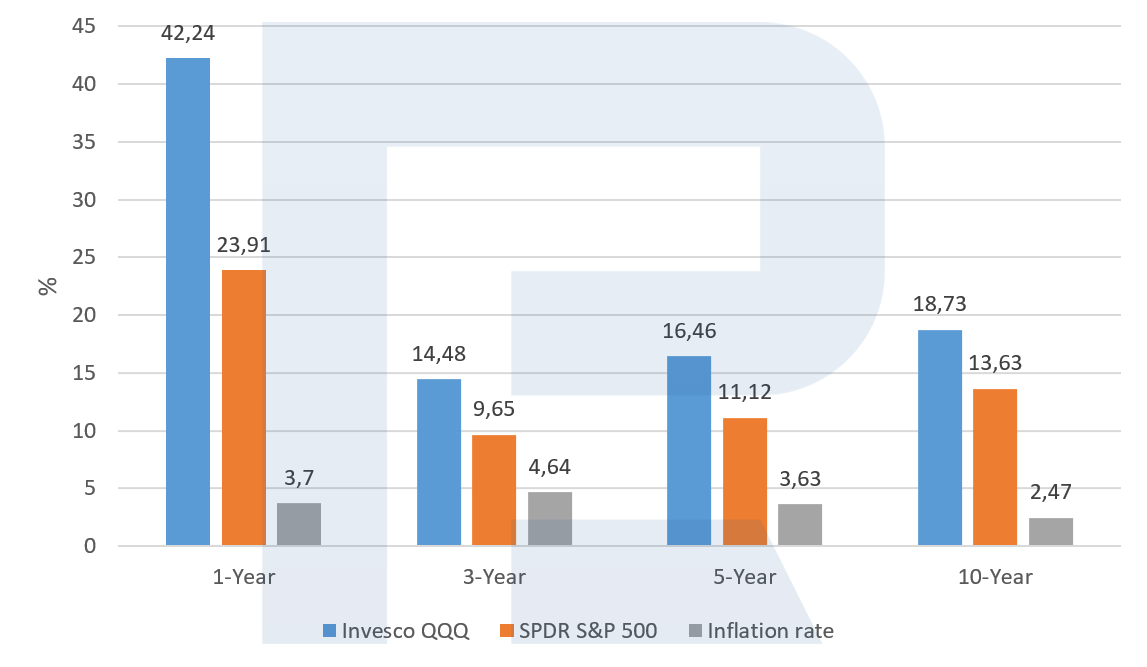

Let us analyse the annual return of Invesco QQQ Trust and compare it with the return of SPDR S&P 500 Trust (NYSE: SPY). It is worth remembering that this ETF invests in the S&P 500 stocks.

The above chart shows that the average return of two funds surpasses the inflation rate. In addition, investments in Invesco QQQ Trust generated more profit at various times than SPDR S&P 500 Trust.

Invesco QQQ Trust live price chart

Technical analysis of Invesco QQQ Trust shares

At the time of writing, Invesco QQQ Trust stock is trading above the 200-day Moving Average, indicating a prevailing uptrend. Furthermore, the quotes have rebounded from the support line, suggesting a potential price rise to resistance at 387 USD. Should this level be breached, the price may reach an all-time high of 400 USD.

The previously formed double-bottom pattern also signals a potential upward price movement. Technical analysis of Invesco QQQ Trust stock shows that its value will likely increase.

An optimistic scenario for the fund’s shares may be cancelled by a support level breakout at 353 USD. In this case, the quotes might drop to 320 USD.

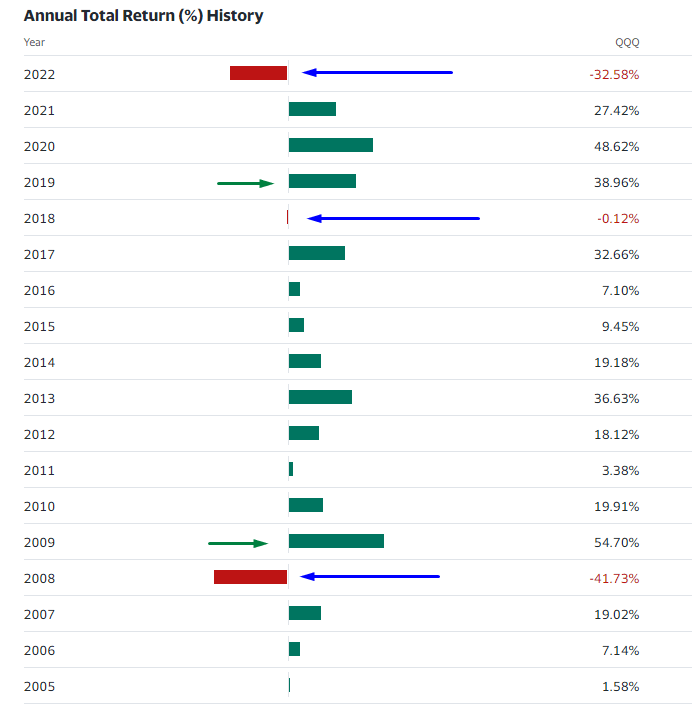

Another noteworthy factor suggests that Invesco QQQ Trust may end 2023 with record returns. According to historical data, whenever the fund’s stock ended the year with a negative return, the return ratio for the next year usually approached record levels, sometimes exceeding them. It is worth reminding that the fund’s stock saw a negative return of -32.58 % in 2022.

Summary

Based on historical annual returns from 2005 to 2022, there is potential for Invesco QQQ Trust’s figure to exceed average values. Since the beginning of the year, the fund’s share prices have risen by 42%, surpassing the average values of the past three, five, and ten years.

Technical analysis shows the potential for further growth in the fund’s shares. Another catalyst for increased returns in Invesco QQQ Trust could be a signal from the US Federal Reserve indicating the end of the monetary tightening cycle. However, adverse scenarios for the fund’s shares may arise from escalated Middle East conflicts, which could lead to higher oil and gas prices, potentially triggering another round of inflation. Subsequently, this might compel the Fed to raise interest rates again.

This situation may create favourable conditions for energy companies. However, technology corporations, which form the core of Invesco QQQ Trust’s investment portfolio, might encounter challenges related to rising energy costs and increased borrowing expenses. Given these circumstances, the fund’s shares may face obstacles in their upward trajectory.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high