Is Buffett’s Stake in the Oil and Gas Sector Paying Off?

7 minutes for reading

Warren Buffett continues to increase his investments in oil companies. Why? In this article, we will check out the Q3, 2022 financial performance of some of the oil and gas sector representatives, and analyse their stock levels.

Buffett invests in Occidental Petroleum

This year, the media has been actively discussing Warren Buffett’s fund purchasing stock of Occidental Petroleum Corporation (NYSE: OXY). It should be mentioned, however, that shares of this company first appeared in the portfolio of Berkshire Hathaway Inc. (NYSE: BRK-A) already in 2019.

At that time, the shares of Occidental Petroleum took up 0.5% of the fund, and in 2020 they accounted for 0.6%. Berkshire Hathaway bought Occidental Petroleum shares in Q1, 2022 for 7.7 million USD; and in Q2, it purchased more stock for 9.3 million USD, increasing the volume to 6.3%.

In August, the fund received approval from the US regulator to acquire up to 50% of Occidental Petroleum. This means that Warren Buffett will most probably continue investing in the said oil company in Q3. We will find this out on 8 November, when Occidental Petroleum will present its report for July-September. For now, let's look at the quarterly results of other representatives of the sector.

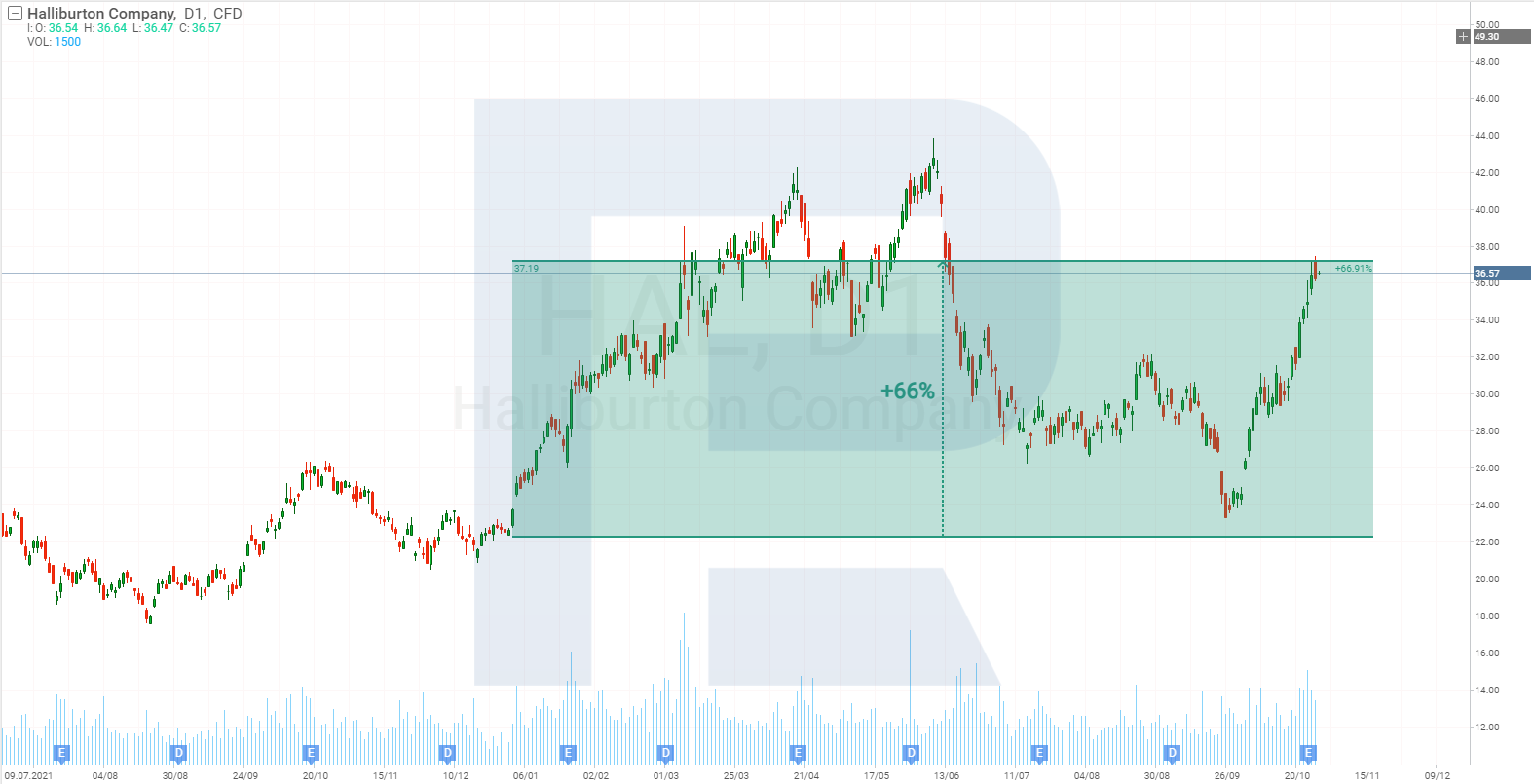

Halliburton Company

Halliburton Company (NYSE: HAL) provides services to companies working in the oil and gas sector. The increase in the number of drilling rigs in the world has a good influence on the income of the issuer, because of the simultaneous growing demand for the equipment it sells.

This is confirmed by the report for Q3, 2022 published on 25 October. The revenue of Halliburton Company exceeded expert forecasts, reaching 5.4 billion USD, which is 29% more than in Q3 last year, and the EPS skyrocketed by 130.8% to 0.6 USD.

The company's shares started rising already one month before the report, with the good quarterly performance speeding up the movement. As a result, over the past month, Halliburton Company saw a 56% growth, recording 66% growth since the beginning of the year. For comparison purposes, note that the S&P 500 index (US500) lost 20% since January.

Valero Energy Corporation

This summer, the US faced an unprecedented increase in fuel prices. High gasoline and diesel prices have a good impact on the revenue of oil and gas companies – including Valero Energy Corporation (NYSE: VLO) which produces and sells transport fuel as well as petrochemical products.

On 25 October, the company shared its positive results for Q3, 2022: revenue increased by 24% to 44.45 million USD, and EPS skyrocketed by 580% to 7.14 USD. Since the beginning of the year, the shares of Valero Energy Corporation recorded a growth of 80%; and when this article was being prepared, they traded at their all-time highs.

The prices in the US stock market have stabilised by now, although this must be a short-term phenomenon as a consequence of the fuel crisis in the EU. With the ban on the import of fuel from countries under sanctions coming into force in February 2023, US companies, with Valero Energy Corporation amongst them, will most probably try to cover up for the low market volume. Consequently, this will affect fuel prices in the US, and export restrictions will be the only solution in this situation.

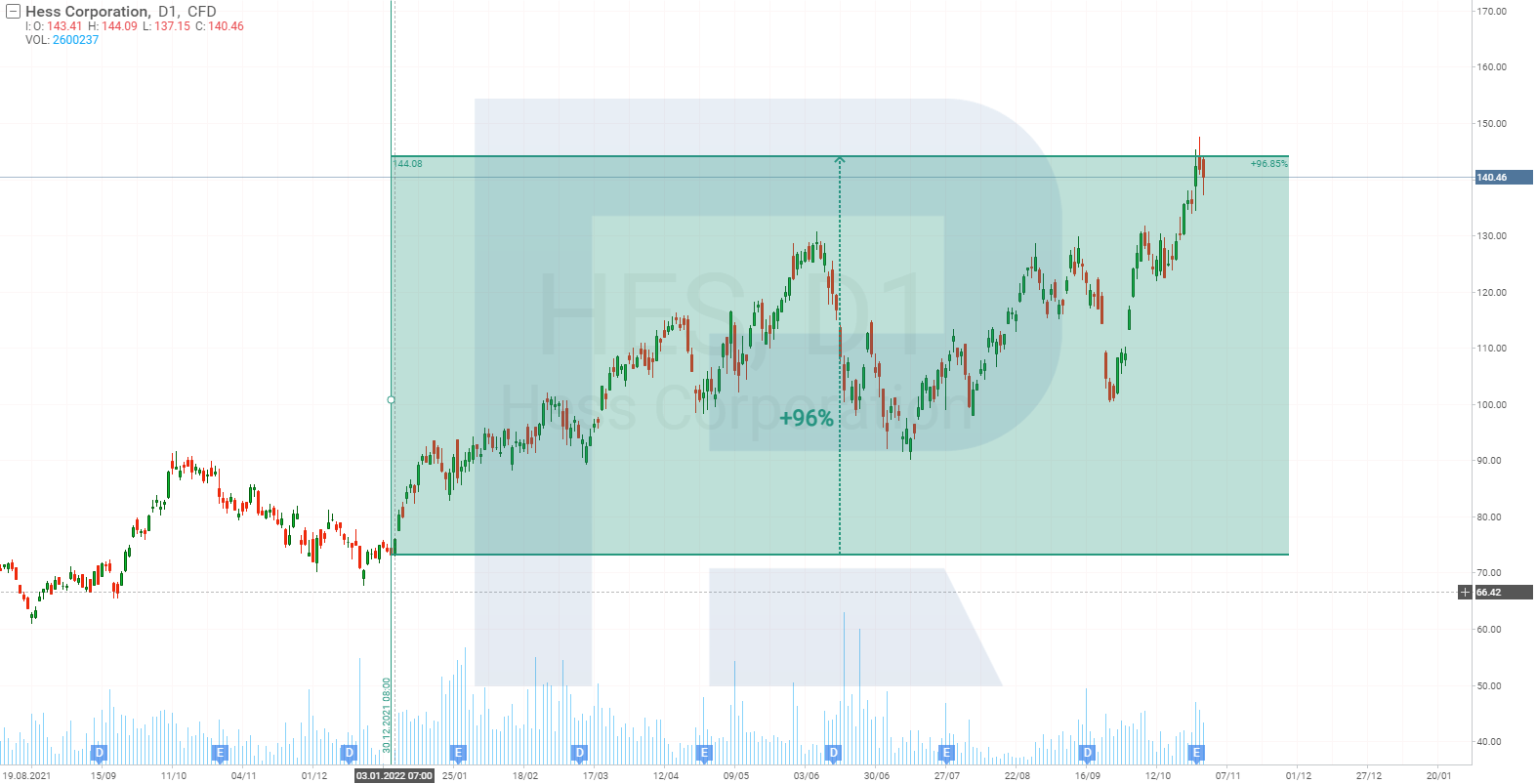

Hess Corporation

As for the companies that directly mine and produce crude oil products, the majority will present quarterly reports in November, with some having already published theirs, including the Hess Corporation (NYSE: HES).

With the current oil prices, Hess Corporation has already reached a 15.8% profitability. Its earnings in Q3 increased 74% to 3.16 billion USD, and EPS skyrocketed 575% to 1.89 USD.

The shares of the Hess Corporation (NYSE: HES) are trading at their all-time highs, recording a 96% growth since January. This constitutes the highest profitability number among the above-mentioned issuers.

The Hess Corporation report suggests that the quarterly results of other issuers are also expected to impress.

A short analysis of the crude oil market

The continued energy crisis implies that crude oil prices will remain at the same level or grow. Since it is in the interest of OPEC+ to bolster oil prices, it is drastically cutting down on the production supply to achieve this.

The US is trying to create conditions for the quotes of crude oil to slide so as to keep selling it from reserves. This has already led to a decrease in the crude oil reserves to the level of 1984. At the same time, the number of drilling mills in the US is not increasing (let's discuss this in detail a bit later).

Experts think that sales from the reserves will come to an end after the Senate elections, which will inevitably impact the price of crude oil. The situation will then become even tighter because the US will need to restore the spent reserves, which means the demand from the US government will add up to the general market demand.

However, it should not be neglected, that the Central Banks in developed countries in their attempts to fight back inflation are increasing the interest rate, thereby slowing down the global economy. The energy crisis in the EU has led to many enterprises closing down, and the demand for crude oil is falling accordingly. In such circumstances, crude oil prices might slide, and oil-making companies are likely to get on the very verge of profitability once again.

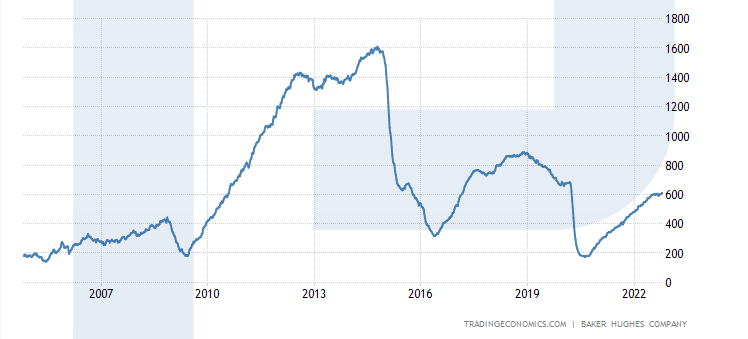

Oil companies are not rushing at increasing production

After the financial crisis of 2008, the price of black gold headed upwards, and by 2010 it had risen over 100 USD per barrel. The price got stuck there until 2014, after which it started falling.

Take a look at the chart that demonstrates the number of drilling rigs in the US. In 2010, this number returned to the pre-crisis levels of 2007 and continued growing. Supply exceeded demand, and by 2015 crude oil quotes had dropped from 150 USD to 60 USD a barrel.

It seems that oil-making companies have learned their lesson. Two years have passed since the crisis caused by COVID-19, but the number of drilling rigs is not increasing – compared to the statistics of 2019, it is twice lower.

It can be supposed that the representatives of the sector are not in a hurry to increase the production of hydrocarbons for the supply to remain limited. In these circumstances, it will be difficult for oil prices to drop below current levels.

Summary

Since the beginning of the year, oil-making companies have demonstrated the best performance growth compared to stock indices and other sectors of the economy. Time will show whether these dynamics will preserve.

If hydrocarbons remain expensive, this can help oil companies to keep paying dividends and increase sums allocated for stock buybacks.

It seems that Warren Buffett’s stake in oil and gas companies is paying off, and he is indeed the Oracle of Omaha.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high