Which Companies Can Become Beneficiaries of DEF Shortage in US

6 minutes for reading

The longer the sanction between Russia and the West lasts, the more weak spots emerge in various sectors of the economy on both sides. For example, the US is facing a shortage of Diesel exhaust fluid (DEF). This is the fluid used for the reduction of air pollution caused by exhaust gases of diesel vehicle engines.

The main suppliers of DEF are Russia and China. China earlier limited the export of DEF, and Russia has recently imposed its own limitations in response to the sanctions. Consequently, US carriers are facing a shortage of DEF with rising prices on it.

And as always, there are beneficiaries that can make a profit from this situation. First and foremost, these are the DEF manufacturers, and this article will be about them.

What is Diesel exhaust fluid?

Diesel exhaust fluid is a solution of urea (32.5%) and deionised water (67.5%) used in the exhaust system of vehicles with diesel engines to help reduce the level of harmful compounds in exhaust gases. At petrol stations, DEF is sold under the name AdBlue.

Diesel motors usually work on a depleted mixture, which means the amount of air in the fuel mixture is much larger than the amount of diesel. This helps reduce the amount of fuel used, but the air in the mixture creates compounds polluting the atmosphere. In 2007, the US Environmental Protection Agency (EPA) introduced requirements for the reduction of environment-polluting chemicals. The transition period lasted until 2010.

Manufacturers of powertrains for cars started introducing systems of the additional procession of exhaust fumes where DEF is used. This technology was created in 1957 for large plants.

When the transition period was over by 2010, the infrastructure was ready, and EPA requirements became tougher. From then on, all vehicles had to comply with the lowered norms of emission. Consequently, US-made diesel vehicles have been equipped with an extra tank for DEF since 2010.

When this tank of a diesel vehicle runs out of the solution, an alert signal appears on the dashboard, and the car's speed automatically falls under 20 km/h. This allows the car to reach the nearest petrol station, but with limited movement. Hence, it can be supposed that the shortage of DEF will have a serious negative impact on logistics.

What DEF is made of

As mentioned above, DEF consists of urea and deionised water. The first ingredient is also known as carbamide, and it is the most widespread mineral nitrogen fertiliser. The second ingredient is water from which all positive and negative ions have been chemically removed.

The US is an importer of urea and its main suppliers are Canada, Russia, and China. China has limited the export of this chemical to support its domestic market, while Russia did so in response to the sanctions imposed on the country. Lastly, there is Canada that might follow China's example in an attempt to fight back against the shortage in the Canadian domestic market.

Apart from fossil minerals, ammonia used for making urea can be produced from natural gas. The US has fewer issues with this: the country not only satisfies its own demands but also exports gas to Europe. Presumably, companies making urea with natural gas will benefit from the shortage of DEF.

Companies that produce and sell urea in the US

In total, there are ten companies in the US market that supply DEF, out of which only two are public – CF Industries Holdings Inc. and Nutrien Ltd. These two are also the leaders of the segment.

CF Industries Holdings

CF Industries Holdings Inc. (NYSE: CF) produces and sells fertilisers, fluid for exhaust fumes of diesel motors, urea solution, ammonia acid, and other products used in agriculture and industry. It produces ammonia from natural gas.

CF Industries is primarily interesting because it produces DEF, and urea that other companies can use for producing DEF. Moreover, it works in farming, which has recently faced an acute shortage of fertilisers.

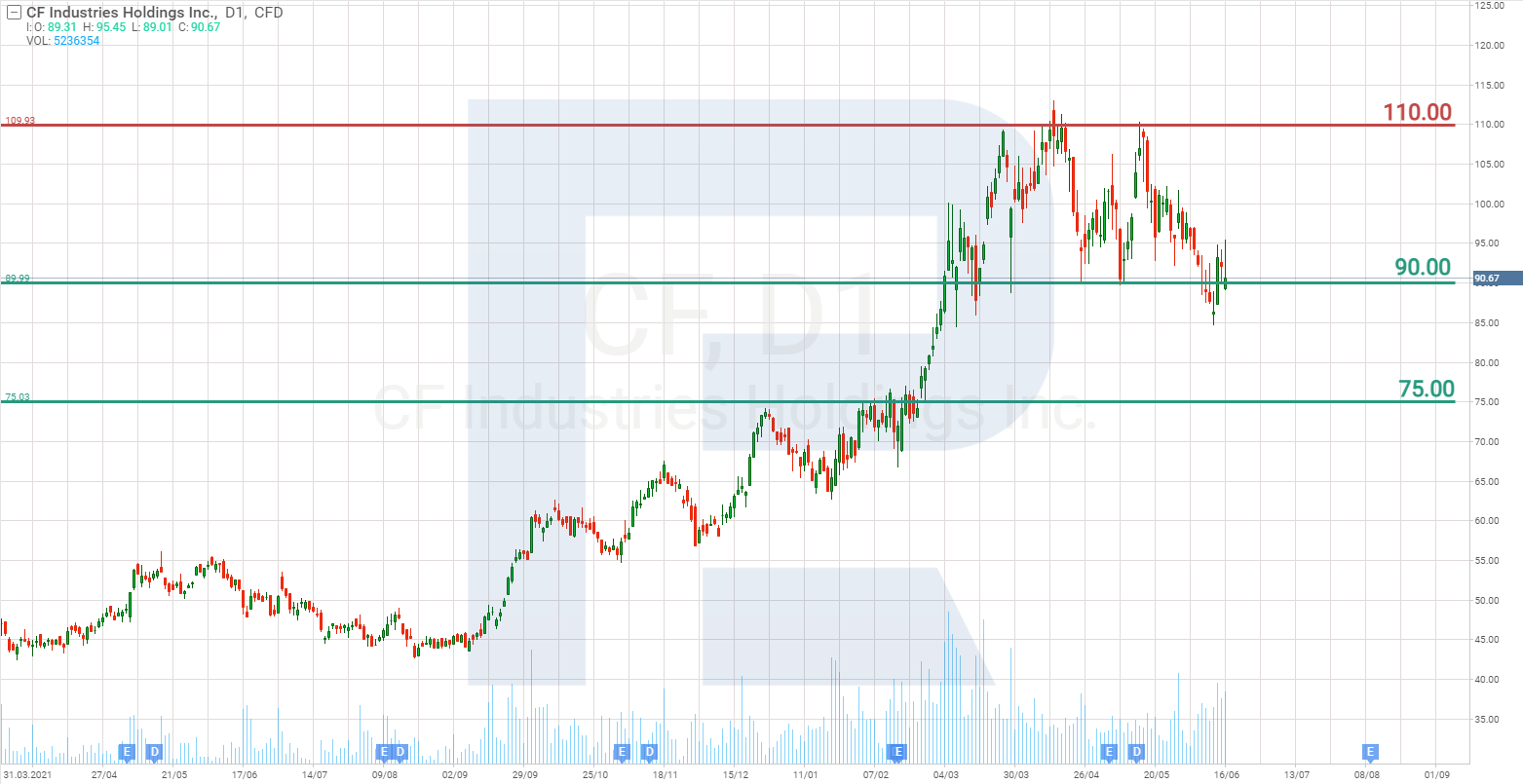

The shares of CF Industries Holdings Inc. have corrected by 20% from the all-time high, and are now trading at the support level of 90 USD.

Nutrien

Nutrien Ltd. (NYSE: NTR) makes fertilisers for agriculture and DEF for industry and transport. It works in the markets of the US, Canada, South America, and Australia.

The limitations imposed by Russia on exports primarily affected the South Korean and Australian markets. As long as Nutrien works in Australia, the demand for its products in the country is likely to grow. Moreover, the shortage in the US can also improve the earnings of Nutrien.

It should be noted separately that Nutrien is a supplier to Canadia, where there are officially 1.1 billion metric tons of fossils for fertilisers. This will be enough to supply the whole world for hundreds of years, which means the company has more than enough material for making urea.

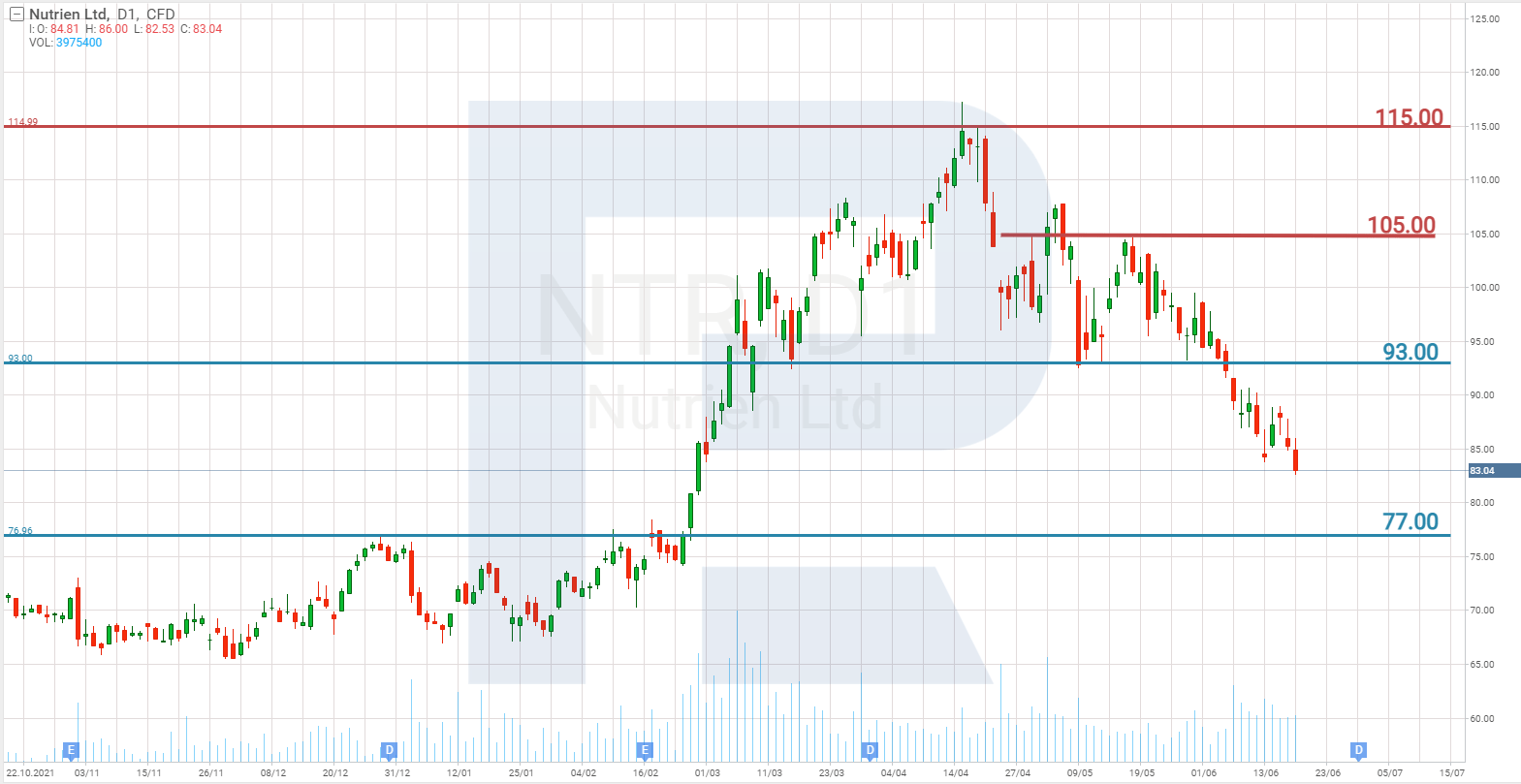

The shares of Nutrien Ltd. lost 29% over two months. The nearest support level is 77 USD.

Are there risks of investing during shortage of DEF

Diesel exhaust fluid is meant for reducing harmful emissions in the atmosphere. The norms of concentration of polluting compounds in vehicles with exhaust fumes are regulated at the state level. If the DEF shortage develops into a critical situation, Joe Biden might probably decide to temporarily abolish these norms.

The DEF shortage issue could be resolved by the car drivers themselves, simply by switching off the system; yet, in doing so, they would get fined at the first check. Car owners or companies that hold car parks would assume financial risks when switching off the system of exhaust fumes cleaning.

Closing thoughts

The DEF shortage is a short-term issue, which is bound to be solved with time. Farmers are already through the season during which they used urea due to the shortage of fertilisers, and they are now loading stocks for the next season. There is only industry and transport left, but these two industries are in need of DEF all year round.

Presumably, the shortage of urea and the rising prices will affect the earnings of manufacturers of this product in Q2 and Q3. However, it should be noted that the company also makes fertilisers, and with the sanctions imposed on Russian and Belarusian manufacturers, Nutrien and CF Industries Holdings can capture their part of the market. If these two companies take advantage of the prevailing circumstances wisely, their earnings might grow in the future above current levels.

* - Past performance does not predict future returns

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high