Which Stocks Are Chosen by Directors of Large Companies

6 minutes for reading

The inflation data from the US shocked market participants. The index had been expected to drop to +8.1% y/y, but it factually remained at +8.3%. This means that inflation is declining, but not as fast as it should.

Jerome Powell, the head of the Federal Reserve System, mentioned in his recent speech that the 1970s soft policy of the Fed for fighting inflation was a mistake; and the regulator will be taking a tougher approach this time.

Market participants hoped that a serious decrease in inflation will make Jerome Powell change his mind, but alas, after the report it was clear that this was not to happen: the Fed will continue with the planned interest rate hikes, so the market is now waiting for the 0.75% rise in September.

An increase in the rate and a decrease in balance is a serious blow to the stock market. In such circumstances, stock price growth will be hindered. Investors have three choices: go cash, buy bonds, or form long-term portfolios.

Which companies are worth paying attention to in such a situation? Among the numerous options for selecting stocks are dividend stories, and copy-trading (following Warren Buffett, for example). And today we will tell you which stocks are bought by influential people who have the full volume of info about a company from primary sources.

Information about large trades made by top managers can be found on Finviz.com. When sorting the data by trade type, we have singled out the biggest trades. On the list, there are such companies as American Homes 4 Rent (NYSE: AMH), Medpace Holdings Inc. (NASDAQ: MEDP), and Energy Transfer LP (NYSE: ET). More than 1 million USD have been invested in their stocks.

Note that the data on Finviz.com is updated daily, so when this article comes out, you will have the most recent information at hand.

American Homes 4 Rent

American Homes 4 Rent is a trust that invests in real estate for rent. The company is the leader in the market of homes for rent in the US. According to the website of the company, it owns 55,000 houses in 22 states.

American Homes 4 Rent was founded in 2012 by Wayne Hughes.

In 2019, his daughter Tamara Hughes was appointed chairwoman of the board of trustees. She is a shareholder of American Homes 4 Rent and Public Storage (NYSE: PSA).

According to the data from open sources, Tamara Hughes started selling Public Storage shares in August 2022, and in September she bought shares of American Homes 4 Rent. She purchased a total of 422,203 company shares for 15.4 million USD at an average purchase price of 36.6 USD.

Public Storage invests in warehouses for business. With the rising interest rates and the growth of the economy slowing down, the demand for warehouses is declining. At the same time, mortgage interests are rising. Currently, the interest rate is at 6% a year, which is twice as higher as last year. Hence, fewer people can afford a mortgage.

Consequently, most people are forced to rent their house as they cannot afford to pay the mortgage to buy it, thereby increasing the demand for houses to rent. According to the statistics published on 14 September, the number of mortgage applications in the US is at a low since December 1999.

Energy Transfer LP

Energy Transfer LP is a large energy company that works in the gas, oil, and electricity markets. It owns gas and oil storage facilities, pipelines for transporting natural gas, and a processing plant. It sells oil products, provides natural gas compression services, and rents out coal processing facilities. Moreover, the company produces and sells electricity. It also sells wood.

Energy Transfer LP was founded in 1995 by Kelcy Warren and Ray Davis. According to the company's report, Kelcy Warren, who is now the chairman of the board of directors, bought 2,428,747 company shares for a total of 29.2 million USD on 12 September. The average purchase price was 12.04 USD.

The company has quite a high dividend yield of 7.8%, which is higher than the market average. It is now building two processing plants: one is scheduled to start work at the end of 2022 and the other one in the middle of 2023.

In August this year, Energy Transfer LP bought Woodford Express LLC and secured a long-term contract for gas supply that will increase its money flow.

Energy Transfer LP generally works on long-term contracts with fixed prices. Its earnings depend on the price of energy resources, but not to the point that the company risks getting on the brink of survival if commodity market prices fall. So, it is quite possible that Energy Transfer LP will sustain a positive money flow and will continue paying dividends.

Medpace Holdings Inc.

Medpace Holdings Inc. provides clinical research outsourcing services to biotech, pharma, and medical companies.

79% of the company's clients are small biopharma companies: it helps them get approval from the US Food and Drug Administration (FDA) for commercialising their products.

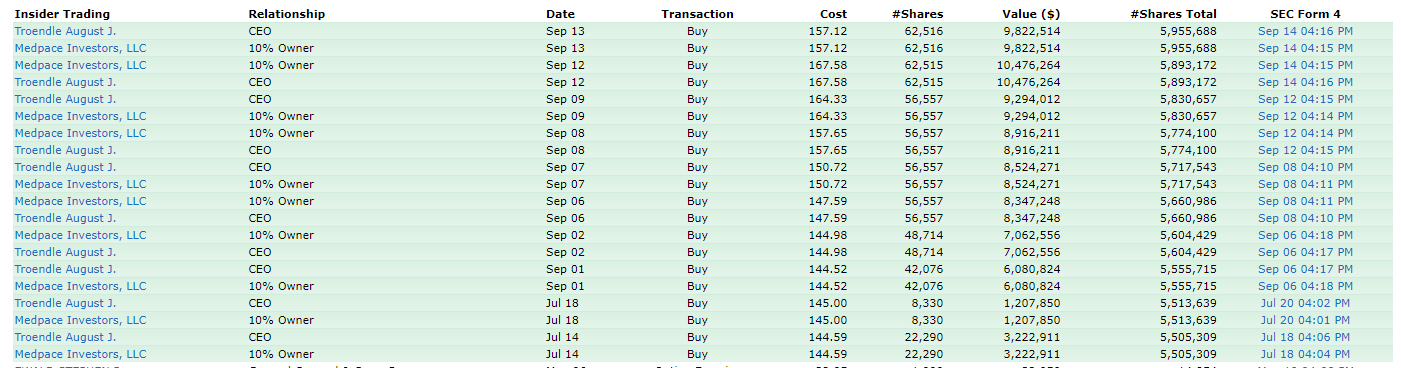

The shares of Medpace Holdings Inc. were bought by August Troendle, the company's CEO and chairman of the board.

The grid of the trades is worth noting: it looks like in August, Troendle and Medpace Investors bought the exact same number of shares for the exact same sum. Yet, in fact, Troendle is the owner of Medpace Investors, so the company's trades equal its own trades. The total sum of investments in Medpace Holdings Inc. was 68.5 million USD.

It can be supposed that the reason for such major investments is the increasing healthcare expenses. Due to the COVID-19 pandemic, investments in the sector increased, which positively affected the development of not only anticovid vaccines. As a result, demand for clinical tests increased, which can be seen in the report of Medpace Holdings for Q2 2022 indicating that sales recorded a 26% growth y/y.

Conclusion

The above info does not give any hint about the best company to invest in. Even managers of large corporations sometimes make mistakes that end up in a decrease in the issuer's earnings.

A bright example here is Peloton Interactive Inc. (NASDAQ: PTON): when demand for its products was high during the pandemic, the co-founders of the company John Foley and Hisao Kushi pushed forward the decision to seriously increase production volumes; with management now having to sell facilities and layoff employees as a consequence. Moreover, Peloton Interactive shares crashed, and both co-founders lost their jobs as a result.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high