Why Intel’s CEO Is Buying His Own Company’s Stock

8 minutes for reading

For the last couple of years, Advanced Micro Devices Inc. (NASDAQ: AMD) has been capturing part of the market that belongs to Intel Corporation (NASDAQ: INTC). In fact, in 2021, Intel in its quarterly report for July-September revealed a decline in sales, while AMD reported growth in earnings over the same months. Since then, even conservative investors have been doubting Intel, with its shares currently trading 52% below their all-time high as a result.

With all the issues faced by Intel and the negative news surrounding it, it seems particularly odd that the company's CEO, Patrick Gelsinger, is actively buying its shares.

Should we follow his example? In this article, we will look into the details of the current situation at Intel Corporation, and try to find out whether its management has any ideas that could improve the company's position in the market.

Why Intel is losing positions

It seems that Intel management was taking it too easy while the company was the monopolist in the chip market. In the meantime, its rivals have been developing products with the same or even better characteristics.

In 2017, Intel took up 98% of the server chip market, in 2019 this was 92%, and in 2021 this figure dropped to 77%. At the same time, AMD expanded its presence from 1% in 2017 to 18% in 2021. According to the Q2 2022 statistics, Intel's market part has dropped to 73.7%. This means the company cannot stop losing its market presence or reverse the negative trend.

Moreover, in August this year, AMD presented the new generation CPU Ryzen 7000, which will be released for sale already in September. As you know, the company bit off quite a large share of the chip market with the previous Ryzen 5000 model. What happens to Intel after the AMD Ryzen 7000 goes on sale?

In such circumstances, investments in AMD look more appetising. AMD announced that its Q2 earnings have increased 83% against earnings in Q2 2021. Demand for Ryzen and Threadripper CPUs is high, allowing for not only preserving but also increasing the company's part of the market.

How many Intel shares has Gelsinger bought?

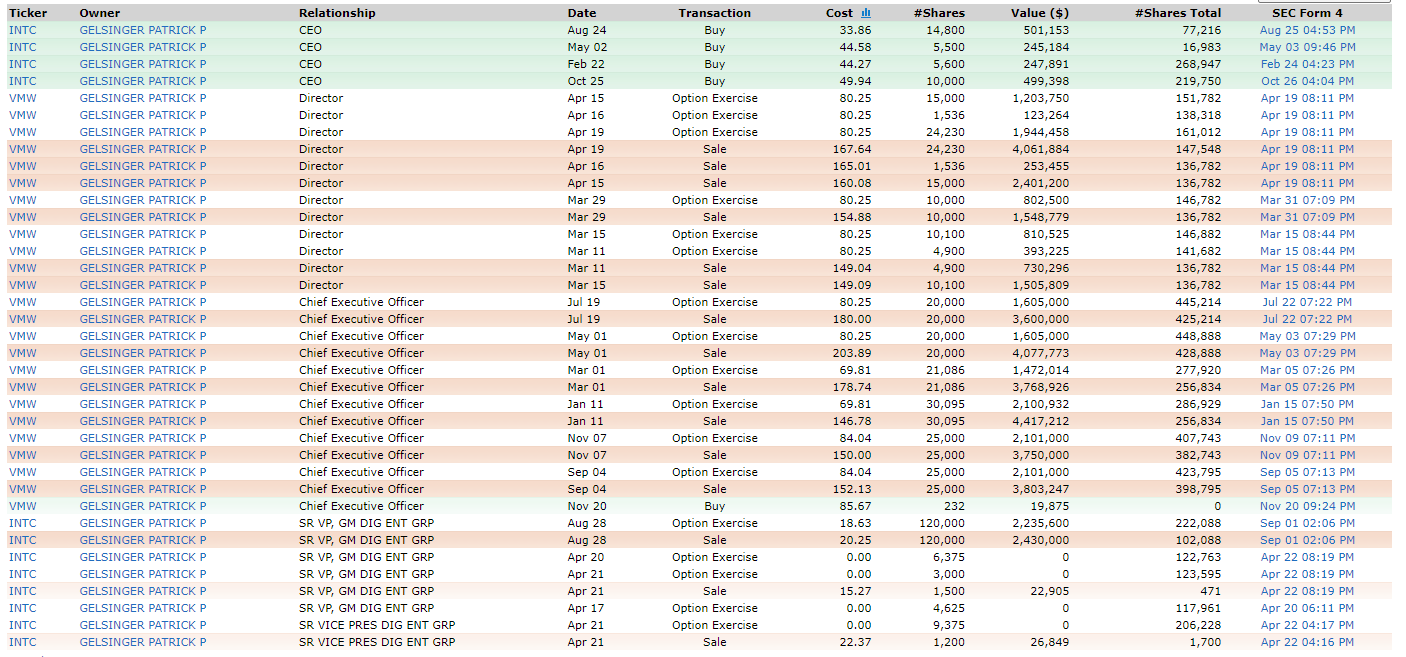

Patrick Gelsinger became CEO at Intel in February 2021. In the previous nine years, he was the head of VMware Inc. (NYSE: VMW). Looking at insider trades, we notice that Gelsinger is not one for buying shares often.

He only bought VMware stock once, in 2012, when he started managing the company. Since then, the share price of VMware rose once to 200 USD, but it is currently trading at 115 USD.

With Intel shares, there is a similar pattern: Gelsinger became CEO in February 2021 and began buying shares nine months later. The first trade was made for 49.94 USD and a total of 499,398 USD. Intel quotes kept falling, while its CEO went on adding to his positions. In February 2022, he bought 5,600 shares more, in May he added 5,500 shares, and in August he bought 14,800 shares.

Possible reasons for Gelsinger’s decision

If things are not that good at Intel, why is Gelsinger buying its stock? We can name the three most obvious reasons for such a decision:

Intel is in haste to bring Raptor Lake CPU to market

Indeed, the corporation is losing its share of the market, but this does not mean that its products cannot compete with others. In October, the company is planning to present a new CPU called Raptor Lake, which will be 60% faster than Alder Lake, the previous one.

AMD has started selling its new CPU for 299 USD each, while Intel has a more flexible pricing policy for the Core line – clients can select a CPU themselves based on their needs. For example, for Core-12, the price started at 97 USD for a simple Core i3 12100F and ended at 739 USD for an excellent Core i9 12900KS.

Another advantage of Intel CPUs is their interchangeability. In other words, Core-13 chips can be installed on a motherboard used by Core-12 chips. Ryzen 7000 requires an AM5 socket new generation motherboard. This means, that whoever buys a Ryzen 7000 from AMD, will also have to purchase a motherboard.

AMD sacrifices its earnings for increasing market share

Intel's profitability is 26%, and the company pays dividends of 4.57%. The profitability of AMD is 14.5%, but it pays no dividends. Of course, in the future, the dividend policy of both companies might change.

Currently, AMD has decided on bringing down prices in an attempt to bite more of the market: The price will practically remain the same, so it will not be changing in accordance with inflation. However, the main supplier of microchips for the company remains Taiwan Semiconductor Manufacturing Company Ltd. (NYSE: TSM), which does not share the same philosophy and takes inflation into consideration when setting its prices.

The logical outcome is the compromise of AMD's earnings. Intel, on the contrary, has announced its plans to increase prices at the end of 2022 due to inflation.

Intel invests in building new plants

The company counts on increasing production power, so it has initiated an extensive programme of modernising old ones and building new ones. For such an ambitious plan, the company can spend more than 100 billion USD.

Intel cannot afford such investments alone and has therefore signed a contract with Brookfield Infrastructure Partners (NYSE: BIP) that entails joint financing of the construction of two new plants. Moreover, the company counts on subsidies from the government by a recent draft bill.

As you know, in August 2022, Joe Biden signed a draft bill about allocating 52 billion USD for companies that were building plants to produce microchips and research centres.

Intel’s advantages following the building of new plants

On the global market of semiconductors, there are three main producers – Taiwan Semiconductor Manufacturing Company Ltd., Samsung Electronics Co Ltd., and United Microelectronics Corporation. The first one covers 52% of the market, the second one accounts for 18.3%, and the third one for 7% of the market.

Taiwan Semiconductor and United Microelectronics have their main production powers situated in Taiwan. This island is frequently mentioned in the news due to its geopolitical situation. Should a war action start there; the world might feel an acute shortage of semiconductors again.

If Intel's plan comes true, the company will satisfy its own demand for semiconductors and will be able to also provide for other large tech corporations, such as AMD, NVIDIA, Tesla, Apple, etc. This means that the loss of Intel's part of the CPU market can be compensated for by sales in the global semiconductor market.

As we can see, the company is trying to invest in the future. According to Gelsinger, we will only be able to appreciate the first results in 2025.

How investors look at Intel’s plans

Investors are worried about whether the company will remain stable because its development will entail colossal spending. Hence, Intel might decide against paying dividends.

Currently, the free money flow of the corporation amounts to 27 billion USD. But for how long will this last? If expenses begin to grow, financial performance will drop, and the company will have to increase sales. But as we mentioned above, Intel sales are prone to decline, alongside its shrinking market share. Meanwhile, its rivals, AMD first hand, are raising their heads.

In such circumstances, rating agencies will be revising their ratings of Intel shares, which will have a negative influence on the corporation while the interest rate is growing. All the thoughts above make it clear why investors are nervous. Nowadays, only those who are absolutely confident about Intel's potential and prospects invest in it.

Conclusion

The dynamics of Intel share prices signify a lack of investor confidence in the company. We tried to find out who believes in the success of the tech corporation more than others. It turned out to be Vanguard, BlackRock, and State Street: Between them, they hold 880 million of the company's shares. As you know, these funds are global leaders in terms of the money managed.

Of course, this does not guarantee Intel's future success but still makes us think that perhaps there is still light at the end of the tunnel for Intel, and Pat Gelsinger might be right, after all.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high