Why Investing in Green Energy Has Become More Popular

6 minutes for reading

The energy crisis, which is currently looming in the EU countries, is bound to influence the development of the energy sector, although no one can give an exact answer as to how. We can only suggest different options and look at how market participants will react.

According to some data from open sources, people are actively investing in companies that develop green energy. So, today, we will talk about enterprises that work with renewable energy sources in the EU.

Why investors are interested in green energy

The answer is obvious now: because it is affordable. Previously, when hydrocarbons in the EU were much cheaper than they are today, green energy could not compete with them. With the aim of developing the renewable energy sector, European authorities have introduced incentives to motivate companies and people to switch to green energy. At the same time, they increased the charges to companies that were still using traditional energy sources.

In other words, the new conditions that were gradually created made it more affordable to use renewable energy sources. However, the energy crisis struck and soon became the centre of attention, overtaking the news about green energy, and thereby creating the impression that people had suddenly stopped caring about renewable energy.

The fact is that the sector has not stopped being in the limelight, it is just the necessity to propel it that has faded. Traditional energy sources have become so expensive, making renewable ones more affordable in comparison. This is particularly the case in EU countries. One year ago, natural gas cost 300 USD per thousand cubic meters, while the current price is 2,000 USD. As for coal, in 2019 it cost 100 USD per ton, with the current price being 430 USD, and not just in Europe.

1 MW of energy produced from traditional sources in the EU now costs more than 400 USD. In August, the price reached 438 EUR in the UK, 547 EUR in Italy, and 465 EUR in Germany. Let's now compare this to the price of solar energy: 78 EUR in the UK, 33 EUR in Italy, and 52 EUR in Germany. With such differences in prices, neither people nor businesses need the motivation to switch to green energy because the economic advantages are obvious. However, the problem is in the limited supply of such energy.

Demand level for green energy in the EU

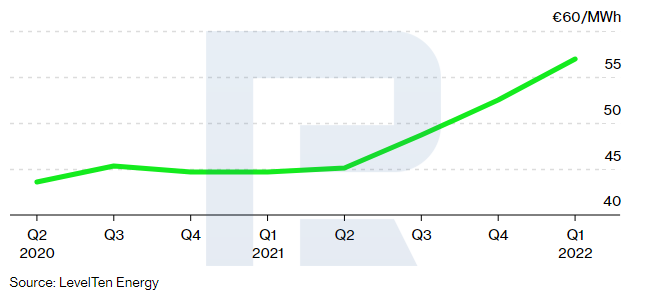

Prices for renewable energy have been growing since Q2 2021 due to the increased demand from companies. Over the last year alone, the number of long-term contracts for the supply of green energy increased by 71%. With these contracts, companies are trying to secure prices for energy carriers.

The rise in renewable energy prices was a consequence of the increased prices for equipment accessories. However, this does not impede the process of rejecting hydrocarbons, which is speeding up without any stimulation from the government.

How investors in the European market are reacting

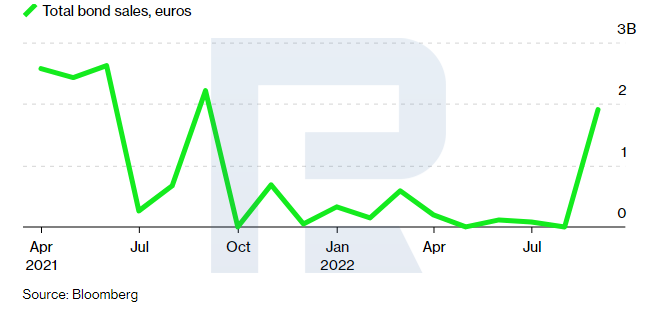

Market participants are counting on renewable energy sources in the long run, but are not doing so in the traditional way. Instead, they are buying convertible bonds that expire in 2025-2027. Throughout this period, they will receive coupon payments and will be able to trade bonds for stocks in due course.

The price of conversion is contracted during the emission time, which means if by the time of conversion, the stock price will have exceeded this price, the investor will make a profit on just holding this stock; they will thereby be able to sell the stock and make more money than on the bond payoff.

According to Bloomberg, the mass purchase of convertible bonds began in the second half of 2022.

Which companies are investors interested in?

In Europe, many companies work with developing renewable energy sources, and a part of such companies is not public. Out of all the segment representatives that are interesting for investors, we have singled out three: Energiekontor AG, SMA Solar Technology AG, and Schneider Electric SE.

Energiekontor

Energiekontor AG (XETR: EKT) is a German company that specialises in building and maintaining wind and solar electric plants. In other words, it sells ready-made electric plants and maintenance services.

The company was founded in 1990 and has built 132 wind electric plants and 13 solar ones until now; with their total power exceeding 1gW. For clarity: this energy will provide enough energy for a town with a population of 250,000 people for a year, excluding industrial production.

The main market for Energiekontor is Germany, Portugal, and Great Britain. If you visit the company’s website and check out the news, you'll see that the most frequent message is about the sale of yet another plant.

Since 2020, the share price of the company has increased by 500%, with growth accelerating further since February 2022. This confirms the theory that switching to green energy has become more active.

SMA Solar Technology

The German SMA Solar Technology AG (LSIN: ONIF) produces equipment for solar electric plants. It was founded in 1981 and works in 18 countries.

Its product range includes storage batteries, solar inverters, nuclear and reserve power sources, and technologies for energy consumption management. The clients of SMA Solar Technology are equally divided between individuals and industrial companies.

The company used to actively acquire enterprises working in the same sphere. For example, in 2011 it merged with the Polish DTW Sp. z o.o., which previously supplied SMA Solar Technology with electronic components. In 2013, the company bought the controlling stake in Danfoss Ltd., a Danish manufacturer of solar inverters. In 2016, SMA Solar Technology acquired 27% of Tigo Energy Inc. As a result, the company does not only receive income from its main business, but also from other companies in which it holds shares.

The growth of the company’s share price accelerated in February 2022. The quotes are currently 166% higher than the lows of 2020.

Schneider Electric

Schneider Electric SE (EURONEXT: SU) is a French company that develops and produces equipment for saving electric energy. While it does not work with renewable energy sources, the demand for its products and technologies might grow in the current situation.

Schneider Electric offers digital transformation of energy consumption management and automatisation in buildings, data processing centres, infrastructure, and industrial facilities. The company works in more than 100 countries and is the segment leader.

Since 2020, the shares of Schneider Electric have grown 89% and are now trading at the support level of 110 EUR.

Closing thoughts

Investments in companies that work with renewable energy sources have increased due to the energy crisis in Europe. Investors are mostly focused on sellers of green energy, as well as developers and producers of the necessary equipment. Moreover, they are focused on enterprises whose products help to decrease energy consumption.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high