Will a New 2.2 Billion USD Funding Boost NIO Stock?

6 minutes for reading

On 18 December 2023, at the opening of trading, NIO Inc. (NYSE: NIO) stock gained over 7%, reaching 8.60 USD. This surge was likely driven by the news of a 2.2 billion USD investment in the company’s share capital.

Today, on 25 December 2023, we will provide more details about the new funding of the Chinese automaker, examine its financial reports, conduct a technical analysis of the stock, and share experts’ 2024 forecasts.

NIO’s new funding terms

Established in 2014, NIO Inc. specialises in the development and manufacturing of electric vehicles (EVs), EV batteries, and autonomous driving technology. The company went public on the NYSE on 12 September 2018.

According to Tracxn, the Chinese company held 17 funding rounds, raising 10.3 billion USD. On 18 December, it was announced that CYVN Holdings LLC, in which Abu Dhabi’s government has the controlling interest, intends to invest 2.2 billion USD in NIO Inc. by the end of 2023.

CYVN Holdings LLC will acquire 294 million of the automaker’s shares priced at 7.5 USD per unit, with a commitment not to sell them for six months. The investment fund will become the largest investor in the Chinese corporation, with a total investment of 2.93 billion USD and a 20.1% stake in NIO Inc. This gives CYVN Holdings LLC the right to appoint two directors to the Chinese corporation’s board.

NIO’s financial performance

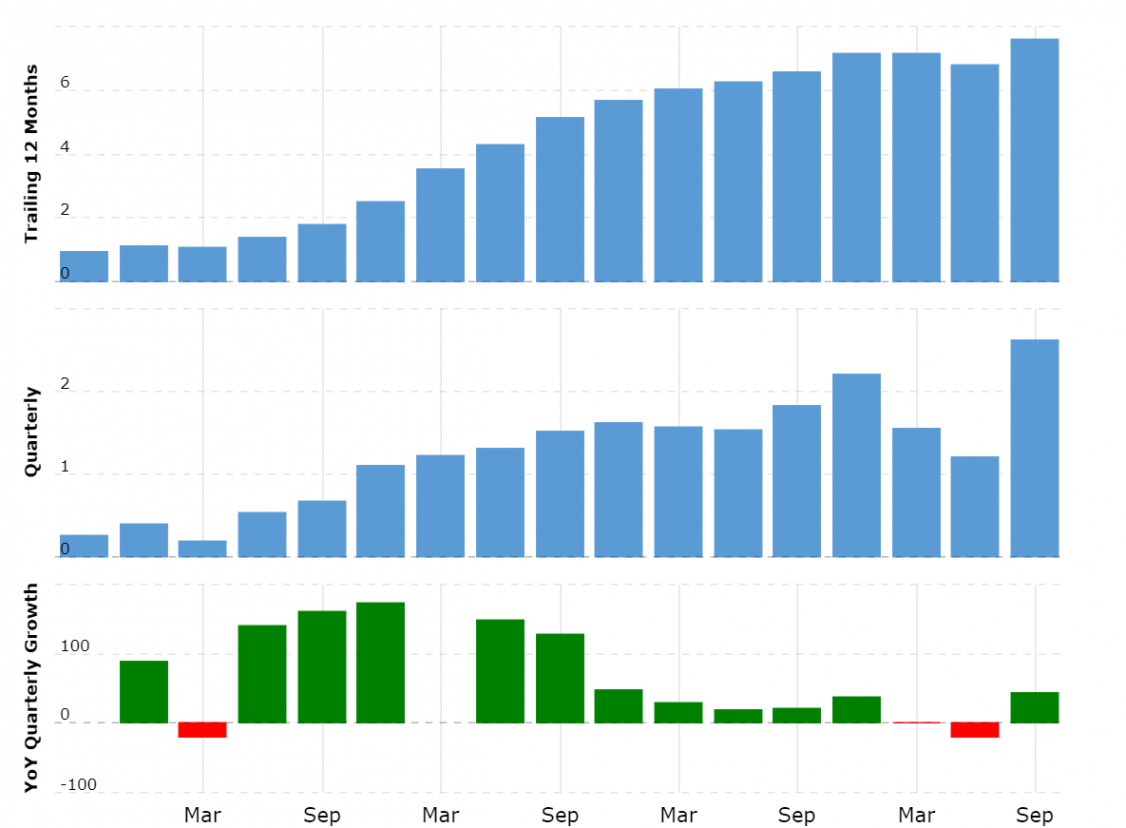

According to NIO Inc.’s Q3 2023 report, revenue for July to September rose by 46.64% compared to the same period in 2022, reaching 2.61 billion USD, and net loss increased by 10.85% to 624.55 million USD.

From Q3 2019 to Q3 2023 inclusive, revenue skyrocketed by 915.63%, while net loss surged by 77.03%.

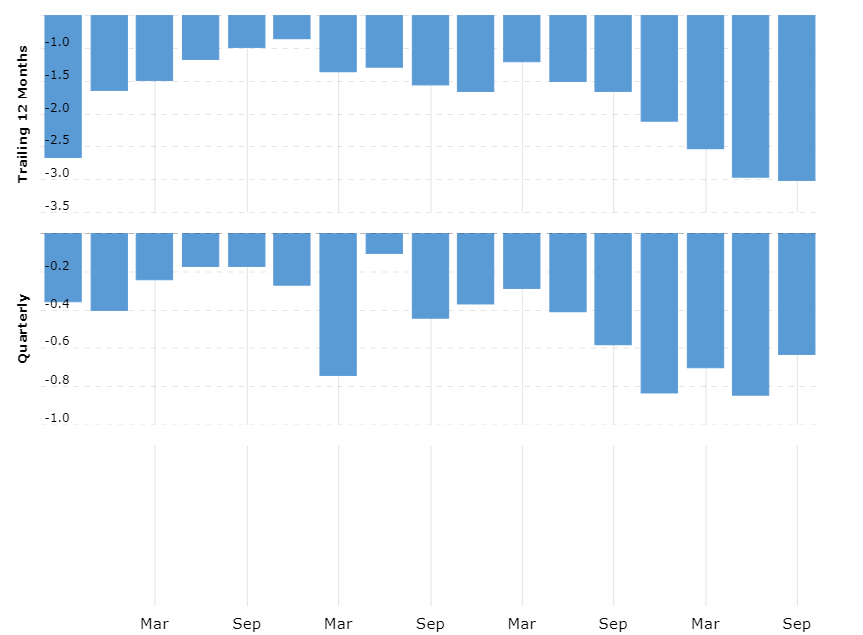

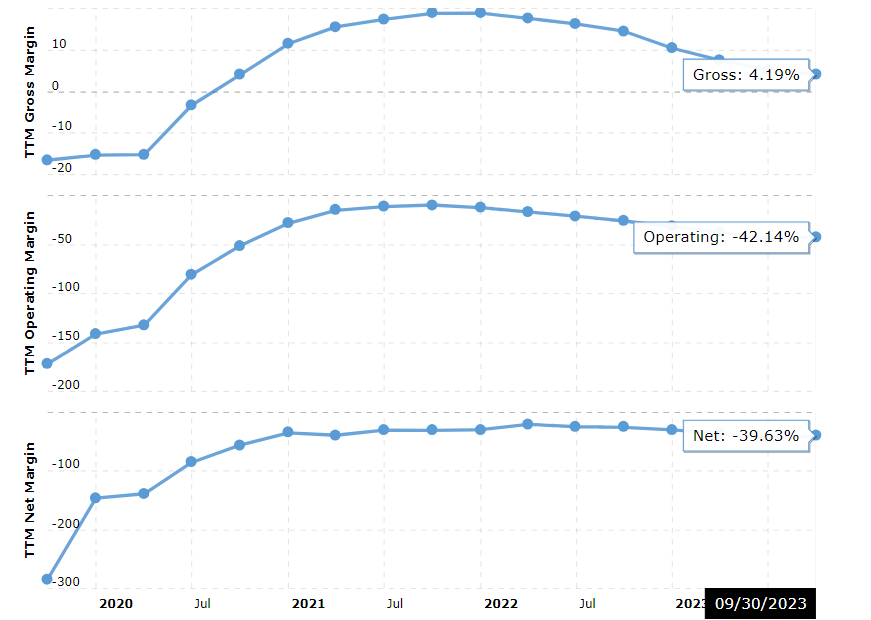

The chart shows that the automaker’s losses started to rise from Q1 2022, which could be attributed to a decline in gross margin. In Q4 2021, the figure reached a high of 18.88% and gradually decreased to 4.19% by Q3 2023. Achieving a positive operating margin and profitability is presumably nearly impossible with such gross margin values. Based on the Q3 2023 results, the operating margin reached −42.14%, with the net margin at −39.63%.

As the company does not generate net profit, it must attract investors and raise borrowed funds to ensure its operations and development, resulting in 17 funding rounds and an increase in the debt load from 2.85 billion in Q3 2019 to 11.86 billion USD in Q3 2023.

On the upside, the balance of cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits amounted to 6.2 billion USD on 30 September 2023. Given the above information, securing an additional 2.2 billion USD in financing from CYVN Holdings LLC may strengthen the financial position of the Chinese corporation.

NIO’s electric vehicle sales

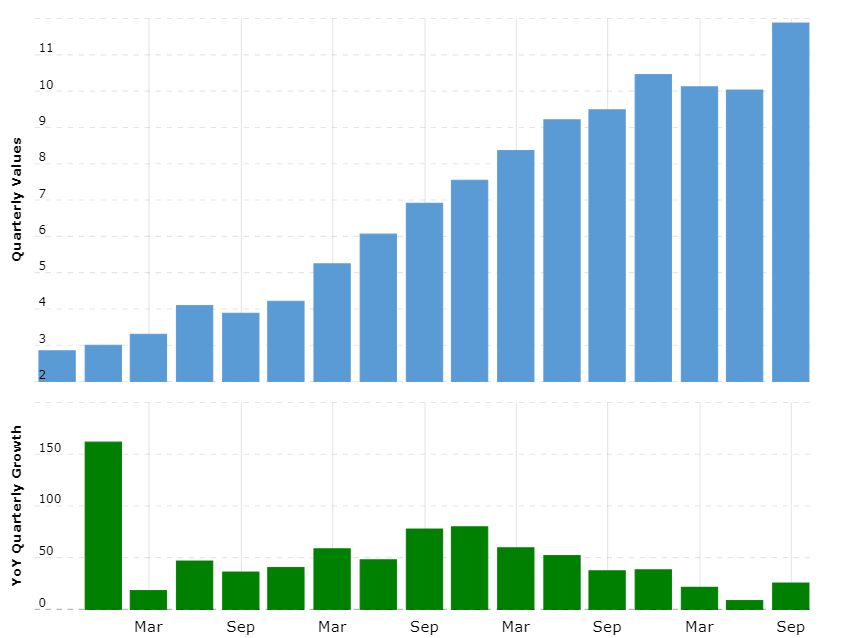

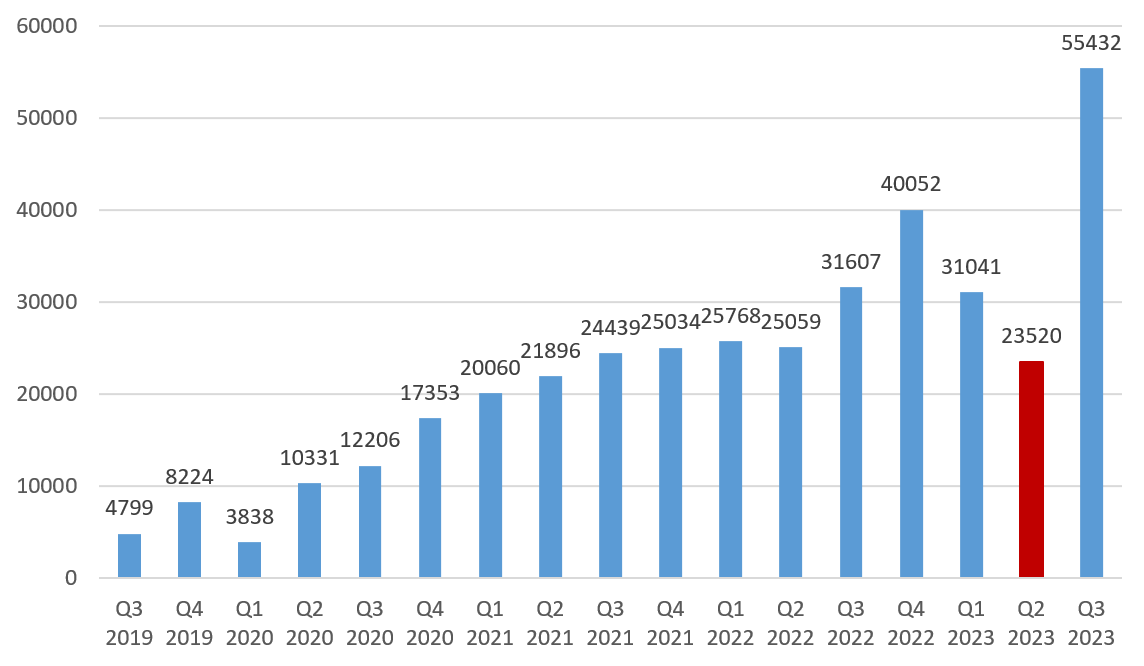

NIO Inc.’s delivery volumes surged by 1055.07% from Q3 2019 to Q3 2023 inclusive, rising from 4,799 to 55,432 electric vehicles.

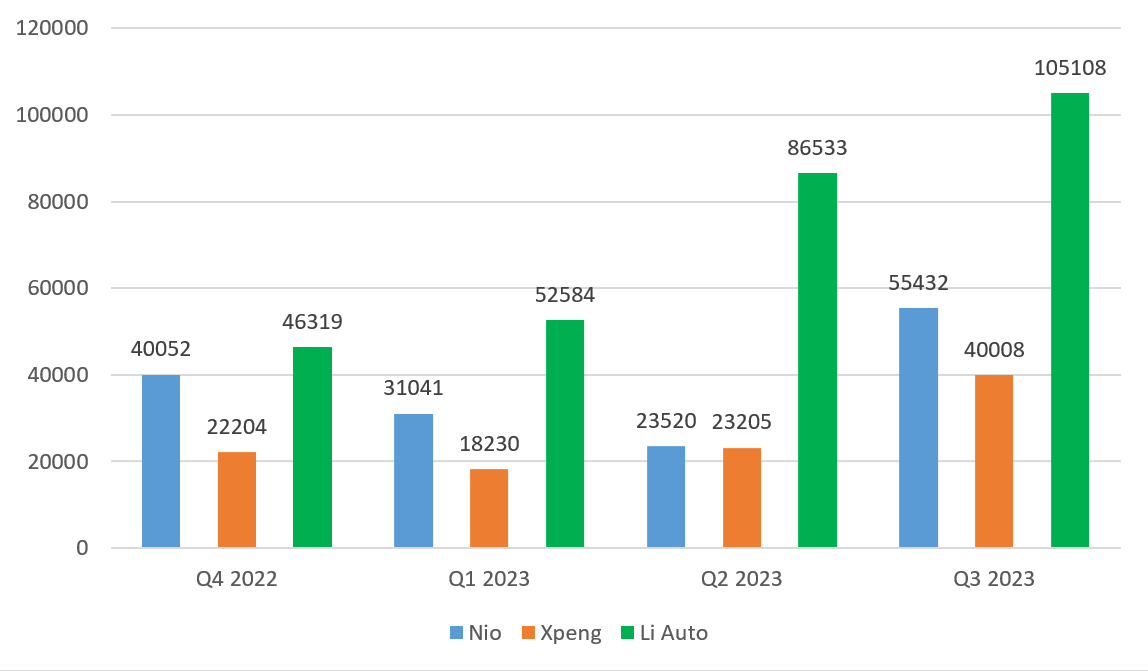

Compared to the statistics of primary competitors, from Q3 2022 to Q3 2023, Nio Inc., Xpeng Inc. (NYSE: XPEV), and Li Auto Inc. (NYSE: LI) deliveries increased by 61%, 35%, and 296%, respectively.

Competition from Tesla

NIO Inc.’s financial results will likely be adversely affected by Tesla Inc. (NASDAQ: TSLA) lowering prices across its model line-up in China. In October 2022, the American corporation announced a 5-9% price reduction. In January 2023, the cost decreased by 13-24% compared to September 2022 prices.

On 12 June 2023, NIO Inc.’s management announced slashing its electric vehicle prices by 6-9%. The company was compelled to end free battery swapping for new clients to offset a decline in revenue.

NIO’s strengths

- When purchasing an NIO electric vehicle, customers have the option to lease the battery instead of buying it, significantly impacting the overall cost. Furthermore, they can choose batteries based on capacity and their immediate plans, such as opting for a more powerful battery before embarking on a long-distance journey

- NIO Inc. has built a network of stations for rapid battery replacement in its electric vehicle models. Owners of these brand electric cars can save time by swiftly replacing the battery in a few minutes rather than waiting for a traditional charging process

- As reported by Carnewschina, on 17 December 2023, NIO Inc.’s CEO William Li conducted a test on a new battery with a capacity of 150 kWh. The electric vehicle equipped with this battery achieved a range of 1,044 km. This battery has standard dimensions for the brand’s models and is compatible across the entire model range

NIO stock analysis

Since 13 October 2023, NIO Inc.’s stock has been trading from 7.10 USD to 8.50 USD. The recent news of substantial investments led to a breakthrough above the upper boundary, propelling the price to 8.83 USD. However, by 20 December, the quotes retraced within their range, retesting the resistance level at 8.50 USD. If they surpass this level again, they will likely rise to 10.00 USD and potentially even reach 11.35 USD. An additional signal for potential price growth could be the breakout of the 200-day Moving Average located at 9.17 USD.

Expert predictions for NIO stock

- According to Barchart, five out of twelve analysts rated NIO Inc.’s shares as Strong Buy, one as Moderate Buy, and six as Hold, with an average target price of 11.96 USD

- Based on MarketBeat data, three out of nine experts assigned a Buy rating to the stock, while six experts gave a Hold rating, with an average target price of 12.55 USD

- As per TipRanks, seven out of nine analysts gave a Buy recommendation to the Chinese corporation’s shares, while two designated a Hold rating. The average target price is 11.36 USD

- According to information from Stock Analysis, four out of ten specialists rated the carmaker’s stock as Strong Buy, one as Buy, and five as Hold. The average 12-month stock price forecast is 12.14 USD

Given the above information, it is noteworthy that none of the experts covering NIO Inc.’s stock recommends selling the shares. On 25 December 2023, their value reached 8.42 USD, with the average target price ranging from 11.36 to 12.55 USD, suggesting 34-49% potential for growth.

Conclusion

According to Carnewschina, NIO Inc. plans to launch new brands, Firefly and Alps, to expand its audience and enter the low-cost, environmentally friendly vehicle market. Electric vehicles for the mass market will be developed and produced under these brands.

Given this information and the news of significant investments, the representative of China’s automotive industry will likely have prospects for potential further development and net profit. However, it is worth keeping in mind the investigation by the European regulator and possible sanctions for Chinese electric vehicle makers, which could impede NIO Inc.’s entry into the EU market.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

The stock charts in this article are provided by the TradingView platform, which offers a wide range of tools for analysing the financial markets. It is a convenient, high-tech online market data charting service that allows users to perform technical analysis, research financial data, and communicate with other traders and investors.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high