Banking Sector in Centre of Investor Attention Again

7 minutes for reading

The shares of the largest global corporations are falling extremely fast: Meta Platforms Inc. (NASDAQ: FB) stock is 50% off its last all-time high. Citigroup Inc. (NYSE: C) stock plunged 30%, Microsoft Corporation (NASDAQ: MSFT) dropped 22%, and Apple Inc. (NASDAQ: AAPL) is down 17%.

On the charts of developing companies, the picture is even more dramatic. For example, the shares of Peloton Interactive Inc. (NASDAQ: PTON) are currently trading 86% below the all-time high, and the shares of ChargePoint Holdings (NYSE: CHPT) have just started to recover after the 76% loss.

Even the shares of Tesla Inc. (NASDAQ: TSLA), which had started making a net profit, are now trading 30% below the all-time high. The question is: is now a good time to buy these stocks?

Why are the stock prices falling?

At first glance, it might seem that the lower the stock prices fall, the more one can earn on them when they bounce back to the initial levels. However, things are not that simple in the stock market: if the prices of certain shares are dropping, there are definitely valid reasons behind their fall.

For example, the 50% decline of Meta Platforms stocks can be attributed to investors fearing that the share price has reached its peak. The sharp decline was recorded after the publication of the quarterly report, which implied slowing user growth in the near future. The revenue did not reach the expected levels and the management gave a weak forecast of future income. If the reasons for the fears are valid, the shares will never return to previous highs.

So, we conclude that looking for obvious outsiders to invest in is not the best of strategies. A more profitable option is investing in companies that have a chance to increase their income. And this should not be subject to the talent or charisma of the company management, but is to be based on the overall economic situation that presumes an inflow of money into a certain sector.

Who profits from the interest rate rise in the US?

On 16 March 2022, the Fed decided to raise the interest rate from 0.25% to 0.5%. Stock indices normally start falling after such news, but this time was different: investors had predicted the rise and had therefore already included the expectations in the prices. This is why the stock indices headed up after the release of the Fed meeting outcome.

Investors are certainly not pleased with the rising interest rate, and it is important to know what the Fed intends to do next. Inflation in the US has risen to its highest point in 25 years. The head of the Federal Reserve, Jerome Powell, reported that the regulator plans several interest rate hikes this year.

For companies with large debts, this is bad news: their financial load will grow because the cost of new loans will increase, while old loans with floating interest will need more money for maintenance. Thinking logically, we can easily find the beneficiary of these changes: the banking sector.

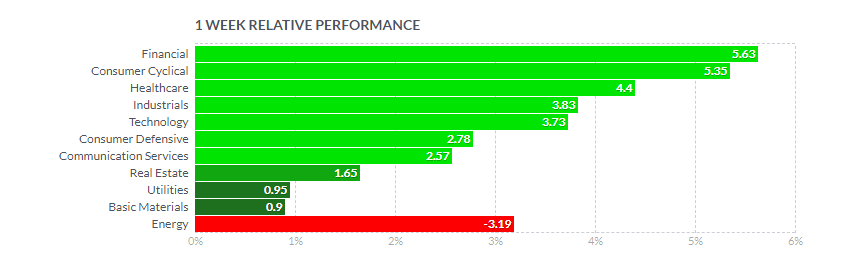

Our conclusion can be confirmed by the growth of its share prices. The stock price movements from different sectors of the economy are on the diagram below. It is obvious that the leader is the financial sector.

How to select shares in the financial sector

Our attention is focused on the US interest rate - therefore, look for financial companies from this country. Go to Finviz.com, use scanning and filtering tools to find companies with the largest market capitalisation.

One of the companies in the list will be Warren Buffett's company, Berkshire Hathaway Inc. (NYSE: BRK), yet this is not exactly that is matching our filters, as the shares have risen to their all-time high.

Also, the company deals with insurance, railway transportation, production, and sales of electric energy; meaning its income is widely diversified and is not impacted much by the rise of the interest rate. It is, therefore, crucial to check the activities of the company before considering its stock for investment.

Among leaders of financial institutions that give out loans are JPMorgan Chase & Co. (NYSE: JPM) and the Bank of America (NYSE: BAC).

Characteristics of JPMorgan Chase & Co. shares

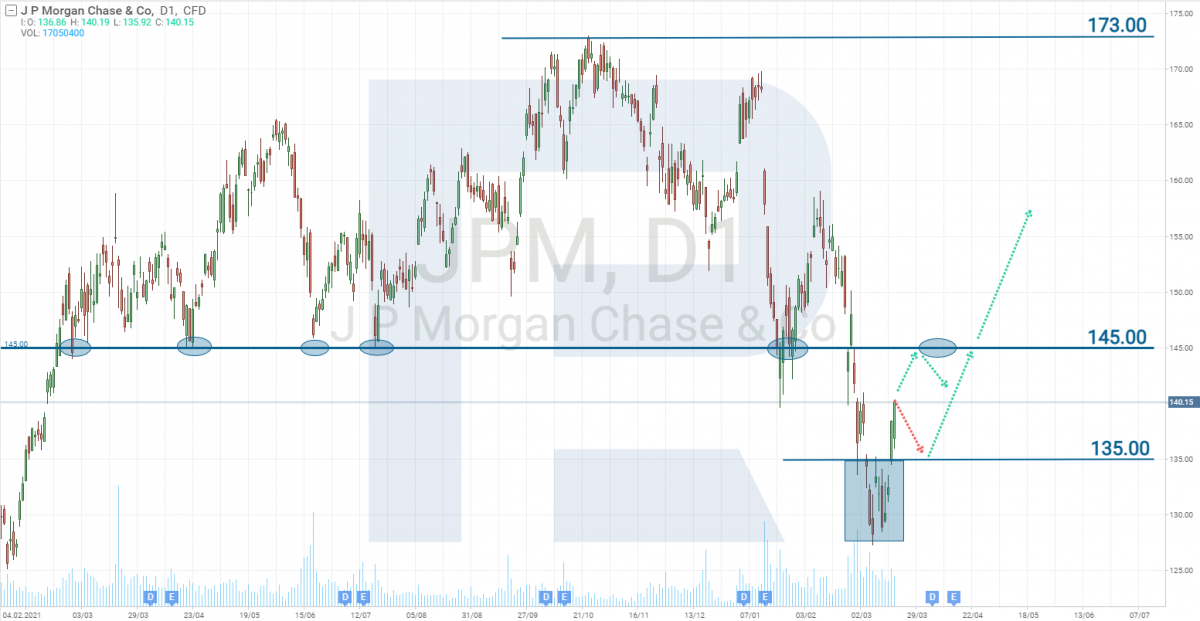

Take a look at the price chart: the shares of JPMorgan Chase & Co. are trading 20% off their all-time high. However, they started growing after the release of the Fed's meeting outcome. Moreover, there is a reversal Double Bottom pattern on the chart, and the key level of 135 USD that can signal growth has already been broken.

Apart from fundamental factors that drive money in banking entities, we have a confirmation of growth by tech analysis.

A stronger resistance level is at 145 USD. If the stock quotes manage to rise above it, it can be a signal further growth, even to the 173 USD high.

Characteristics of Bank of America shares

The shares of the Bank of America are down 23% from their high but have recovered by about 10% over the last few days. Also, note that this bank is one of the largest ones to give out loans to businesses.

The report for Q1 2022 will only be presented in April. But looking at the results of Q4 2021, we can be optimistic. Compared to the statistics of the same part of 2020, revenue increased 10% and the EPS grew 29%.

The management of the Bank of America forecasts a further increase in the 2022 income, the reason being more demand for loans this year thanks to the end of the pandemic and the interest rate rise.

The shares are now testing at 43 USD. The stock quotes are not likely to manage to rise above this price at the first attempt. Over the last eight days, the shares saw a 10% growth, with a correction needed to the 41.5 USD price point.

Tech analysis shows that the shares might attempt to hit the 43 USD price again. If the breakaway does happen, further growth to 50 USD might follow.

If a breakaway of the resistance level of 43 USD will be without a correction than one of the reasons might be that investors are extremely interested in the Bank of America shares. In this case, there is opportunity that the quotes can reach the price of 50 USD very fast.

Closing thoughts

We saw the logic of identifying companies from a promising sector of the economy and named the two largest representatives of the said sectors in terms of market capitalisation. This time, it is the financial sector that's attractive for investments, with JPMorgan Chase & Co and Bank of America stocks.

Moreover, we analysed the main factors that are influencing the stock market: the growth of the shares of financial entities and the increase in the US interest rate. The last cycle of such increases lasted from December 2015 to March 2019. Over this period, the Bank of America shares skyrocketed 200%. They might renew their all-time highs also now.

* Past performance does not predict future returns.

Risk Warning: The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high