Copper: Idea for Long-Term Investment

7 minutes for reading

Switching to green energy implies an expansion in the output of products containing copper. Consequently, demand for this metal is likely to rise in the long term.

Goldman Sachs experts state that the price of $15,000 per tonne is a very conservative forecast – it may well reach $50,000. The reason for this growth is the limited supply of copper and the extremely long mine life cycle.

Given the circumstances, we may assume that copper-mining companies might benefit hugely from the global switch to alternative energetics. These companies are the stars of today’s article.

What we should know about copper

Copper is a malleable, ductile, pinkish-orange metal, that is an effective conductor of heat and electricity. It is used almost in all spheres of human activity, such as transport, industrial and medical equipment, electrical appliances, construction, finance, and, of course, energetics.

The price of copper is an indicator of the global economy's health: when its price starts plunging, this means that the global economy is experiencing a slowdown. In the current situation, it might even be considered the “messenger” of a recession.

What influences the price of copper?

Political and ecological issues may have a significant influence on copper prices. Ecological regulatory tightening will force enterprises to upgrade their facilities and increase the usage of renewable energies, and all these measures will include copper in various amounts. Politically-motivated decisions, such as sanctions, for example, might complicate exports of copper from some specific regions.

Strikes in mines, natural disasters, military conflicts – the list of impact factors is quite long, but the most important of them is the growth of the global economy, which causes output production expansion and a higher demand for the metal.

For example, in the last decade, demand for copper was mostly created by the Chinese economy, and this is now happening also in India. Copper consumption in India is predicted to double up by 2025.

How copper is mined

To keep copper prices stable for all market participants, the demand/supply ratio should be close to one. Switching to green energy implies a higher demand for copper, which, in its turn, requires increased production. But is it really easy to accomplish?

As of now, Chile and Peru are covering 50% of the global copper production. China is ranked third in the production of copper, but it is also the largest copper importer. This means that the volume of copper produced in China is not enough to satisfy domestic demand.

In addition, China is demonstrating an active growth in electric car manufacturing, which requires about 150% more copper in comparison to conventional vehicles.

In Chile, the government is planning to introduce amendments to the constitution: the new draft contains regulations that complicate the process of mineral extraction approval.

20 years ago, the US ranked amongst the Top 3 copper-producing countries. However, the procedure for mineral extraction approval has become more difficult over the years, which resulted in the production of copper declining by about 100%.

The world is now facing a rather unusual situation: it’s no secret that the need for copper will rise, and many countries are already introducing ecological regulations to boost demand. But, at the same time, the process of mineral extraction approval is becoming more complicated.

There are two more ways to increase the copper supply – recycling and introducing higher rates of ore depletion. However, even these methods aren’t likely to fill the void, because they will still require exploration for minerals and the construction of new mines.

What are the complications with new mines?

If any sector of the economy demonstrates growth, this fact immediately attracts investors who want to make a profit from it. The same is expected to happen with copper: money will be invested in the exploration of new deposits.

However, according to the International Energy Agency (IEA), the entire process, from opening to mining the first batch of copper, takes more than 16 years.

As a result, even the most optimistic forecasts say that mining companies won’t be able to keep up with the rising demand in the next 5-10 years. In this light, the opinion expressed by Goldman Sachs experts that the price of copper might exceed $15,000 seems quite reasonable.

What is currently happening to the prices of copper?

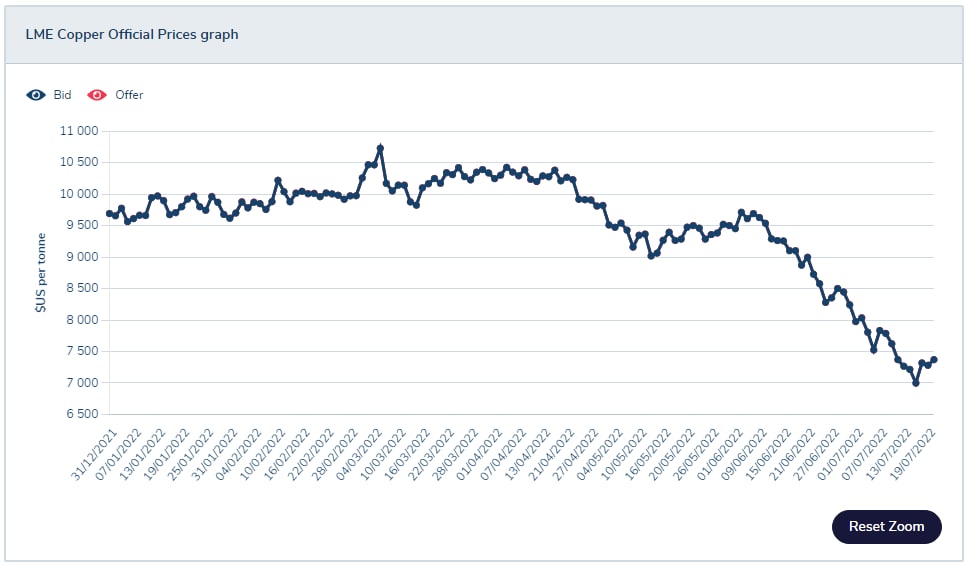

Just like we mentioned before, copper prices are an excellent indicator of the global economy's health. In March 2022, they reached a new high at the London Metal Exchange and started falling slowly thereafter. By now, they have dropped almost 30%.

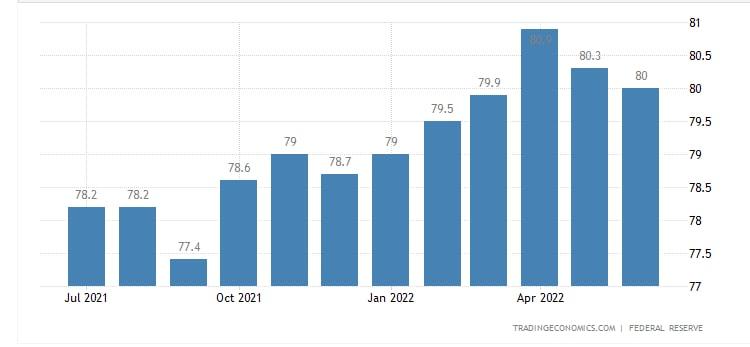

The first reason for this decline was the quarantine restrictions in China. In 2022, China introduced numerous quarantine restrictions, which reduced the capacity utilisation rate from 77.4% to 75.1% and led to copper demand contraction.

The second reason is the global economic slowdown. High energy prices drive up the cost of production and raise consumer prices. As a result, consumer demand started plunging, warehouses were full of goods in stock, and manufacturers had no other choice other than reducing production targets.

These dynamics can be easily seen in the capacity utilisation rate in the US. In April, it reached 80.9%, but currently it’s only at 80%.

In terms of investments, the situation can be called unique. Switching to green energy implies a long-term growing demand for copper, but its price is currently 30% below the all-time high. By the time the global economy starts gaining momentum, copper might cost over $10,000 per tonne.

Similar price fluctuations are happening to copper mining/selling companies – these stocks are now trading far below the highs reached earlier in 2022.

Who is leading the copper mining industry?

The largest companies in this industry in terms of capitalisation are Freeport-McMoRan Inc. (NYSE: FCX) and Southern Copper Corporation (NYSE: SCCO). They are estimated at $40.2 billion and $36.6 billion, respectively.

There is a correlation between these two stocks – they have both been plunging since April; the difference is by how much. After reaching their highs in April, Freeport-McMoRan declined 44%, while Southern Copper Corporation lost 36%.

Southern Copper Corporation is focused on working with metals in general and copper in particular. Freeport-McMoRan, apart from metals, is engaged in extracting and selling fossil fuels, such as oil and gas. The mining facilities of both corporations are located in Chile and Peru, which, as mentioned before, are the largest exporting countries of copper.

Risks of investing in the copper mining industry

When the price of a product remains very high, manufacturers start looking for a way to replace it. Cheaper metals such as nickel, lead, ferrum, and aluminium, can be alternatives to copper.

Of course, replacing copper might lead to a reduction in the quality of the other products, but if copper prices remain too high, manufacturers might take these odds by going with the alternatives. In this case, copper might slow down or even reverse to the downside.

In addition, copper prices will definitely suffer from the global economic slowdown or a possible recession.

Summary

The trend is our friend. When it comes to copper, stick to this rule. Switching to green energy is the key driver of the rise in the price of copper. However, this process is scheduled up to 2050, and there might be several crises during this period that will force copper prices either to rise or fall.

Still, the general tendency implies copper consumption expansion in all industries. If we look at the current movements from this angle, the decline we are witnessing today might be considered a correction within the uptrend.

* — Past performance does not predict future returns

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high