How Netflix Made Walt Disney Shares Fall

7 minutes for reading

The shares of Netflix Inc. (NASDAQ: NFLX) have lost 72% of the price since December 2021. Such a decline could make us think that the corporation is on the verge of bankruptcy, yet the finance of Netflix is all right.

Moreover, the management of the streaming service might start a stocks buyback programme, because the company is almost on the trajectory of positive free money flow.

Why then did the decline of Netflix shares dragged in tow the quotes of Walt Disney Company? This is what, among other things, this article answers to.

Why Netflix shares are falling

Firstly, the stocks of the corporation are overbought. In August 2021 appeared the first hints on the decline. Then the effect of the pandemic subsided: while over the first couple of years of it, Netflix used to enjoy an inflow of new users, these days not so many investors fight over the shares that cost 700 USD each.

Secondly, the growth of the number of new subscribers has started to slow down. And in Q1, 2022 the company registered a decline in this venue for the first time in its history. On 20 April, when the quarterly statistics was published, the quotes dropped by 35%, and when this article was being prepared, they kept crawling down.

Whose shares were affected by the fall of Netflix

The share price of Roku Inc. (NASDAQ: ROKU) dropped by more than 22%, Warner Bros. Discovery (NASDAQ: WBD) - by 20%, Walt Disney Company (NYSE: DIS) - by 12%. Many investors wonder why.

For example, Walt Disney Company has its business diversified, and its streaming business Disney+ has adopted a different model of development. It might be that excessively negative reaction of market players to Netflix report just creates the chance to buy the shares of competitors at a lower price.

What Netflix and Disney+ tread on

Netflix attracts new users by creating a lot of shows so that everyone could find something for themselves. However, as soon as quantity becomes the main emphasis, quality inevitably suffers. As a result, an initially efficient pattern tend to become less and less so

Disney+, on the other hand, shoots new shows only if the potential audience is sufficient; it abstains from broadcasting a vast variety of shows at once. This is done, among other things, to attract attention to a certain actor or actress as this way it will be easier to make money on next shows with them.

Another feature is broadcasting each product once a week. Such a pause agitates active audience and creates activity around the show in social networks. To enhance the effect, the media giant launches impressive advertising campaigns.

Previously, Netflix also used to employ this strategy but seems to have changed the tactics. While the situation was favorable, the company tried to attract as many users as possible. It did reach the goal, now it starts working on the quality to keep users involved. However, this is not a simple task, and shrinking audience confirms this.

What are Disney+ plans

The number of Disney+ users is growing fast: between 2020 and 2022, its audience increased from 26.5 million to 129 million people. Netflix had 182 million in 2020 and over 2 years, the audience grew by just 40 million people.

One reason for the number of Disney+ users to grow faster is the price of subscription. The most popular Netflix subscription now costs 15.49 USD and Disney+ subscription — 7.99 USD.

We may conclude that, unlike Netflix, Disney+ is still growing. According to the forecast of Walt Disney management, by 2024 the number of subscribers will have reached over 230 million people.

The company plans to employ one more way of attracting new users — launching a free subscription plan with ads. Work on this is planned to be over by the end of 2022. By the way, Netflix is considering the same.

On 11 May, a quarterly report will be published. It will demonstrate the dynamics of new audience growth. If the trend is positive, this will mean a part of Netflix clients has opted for Disney+.

What is going on with Walt Disney’s offline business

For Walt Disney, the streaming service is not the only source of income. The conglomerate owns cinema houses, entertainment parks, cinema studios, travel facilities, and cruise lines.

A part of the business that is offline has suffered from the pandemic. Annual turnover dropped from 26.5 billion USD in 2019 to 6.5 billion USD in 2021.

However, at the same time, it's streaming service has become more popular, which let the company increase earnings in the media segment from 26 billion USD in 2019 to 50 billion USD in 2021.

In the offline segment, the situation is now changing: summer is coming, and almost all coronavirus restrictions have been abolished. In such circumstances, the undermined part of Walt Disney's business can soon return to its pre-crisis levels.

Whether the leader always sets up the trend

The leader of broadcasting Netflix is losing subscribers, so it would be logical to expect other representatives of the segment to follow. But are things that simple?

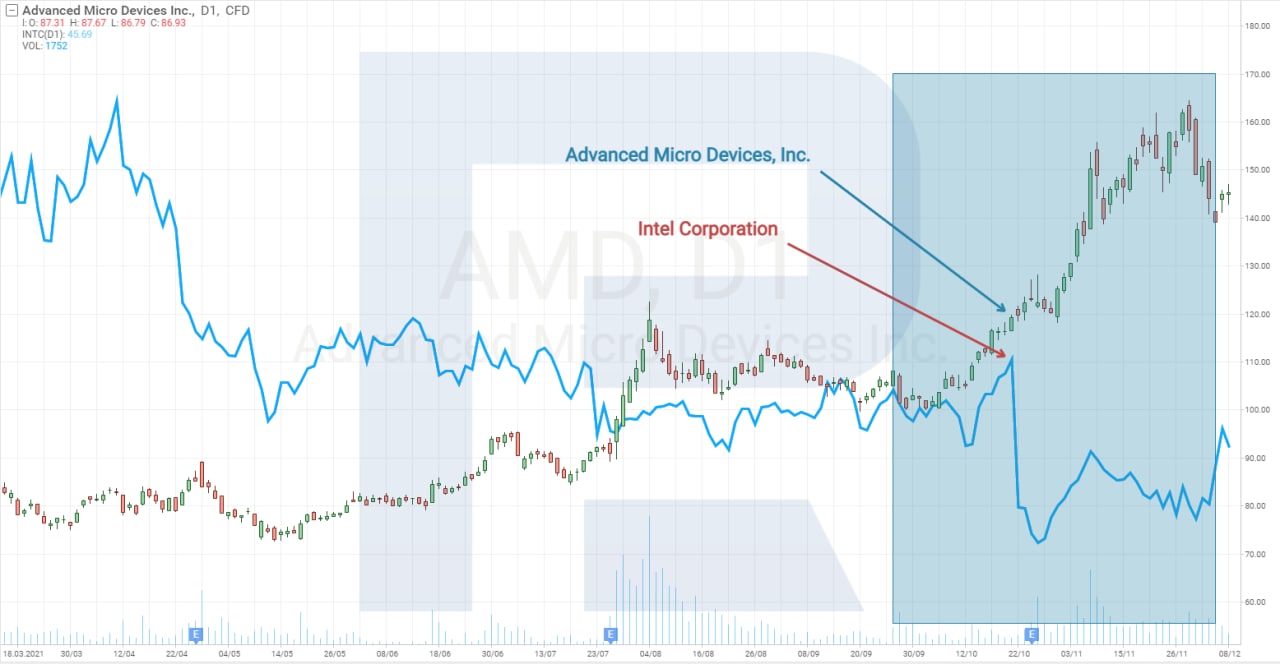

Something similar has happened in the semiconductor industry. When the market leader Intel Corporation (NASDAQ: INTC) announced a decline in PC chips sales, investors rushed at playing short in the shares of the rival — Advanced Micro Devices Inc. (NASDAQ: AMD).

However, when AMD published a quarterly report, revealing actual growth of microchip sales, investors changed their minds immediately, and AMD shares sky-rocketed while Intel shares sped up in their downtrend.

What are investment risks for Walt Disney shares

On 21 April 2022, a law was adopted that canceled the status of a special tax area for Reedy Creek starting 1 June 2023. Walt Disney Company actively uses the opportunity of this area founded in 1967 within the outer borders of Orange and Osceola Counties in Florida.

Reedy Creek functions on the taxes of landlords, the largest one being Walt Disney. The district is ruled by a supervisory board that is, to put it bluntly, virtually controlled by the company. It assumes the responsibility to pay for communal, healthcare, fire-fighting services, constructs and maintains roads — in short, it fully pays for functioning of the district.

In exchange, the company gets tax breaks and literally allows itself building entertainment facilities and chooses service providers itself as well. All in all, the company enjoys unlimited authority and no obstacles for the development of its business on this territory.

If Reedy Creek loses its special status, it will complicate certain business processes for the company and increase tax burden. However, the company will get free from supporting the district and will be able to compensate for the increased spending by raising the prices.

As for the state of Florida, it will have to start paying for the necessities of the district — which is about 160 million USD a year — and pay back to Walt Disney its bond debts of 1 billion USD.

The state with Governor Ron DeSantis at the steering wheel, thus reacted to the criticism expressed by the corporation in relation to the law banning gender equality lessons at kindergartens and elementary schools.

DeSantis is trying to attract the attention of the electorate to himself by this conflict with Walt Disney as he considers participating in the presidential election in 2024.

When politicians intervene with the business, the outcomes are really hard to predict. So this risk should not be shaken off: no one can say what other steps the governor is able to make seeking attention.

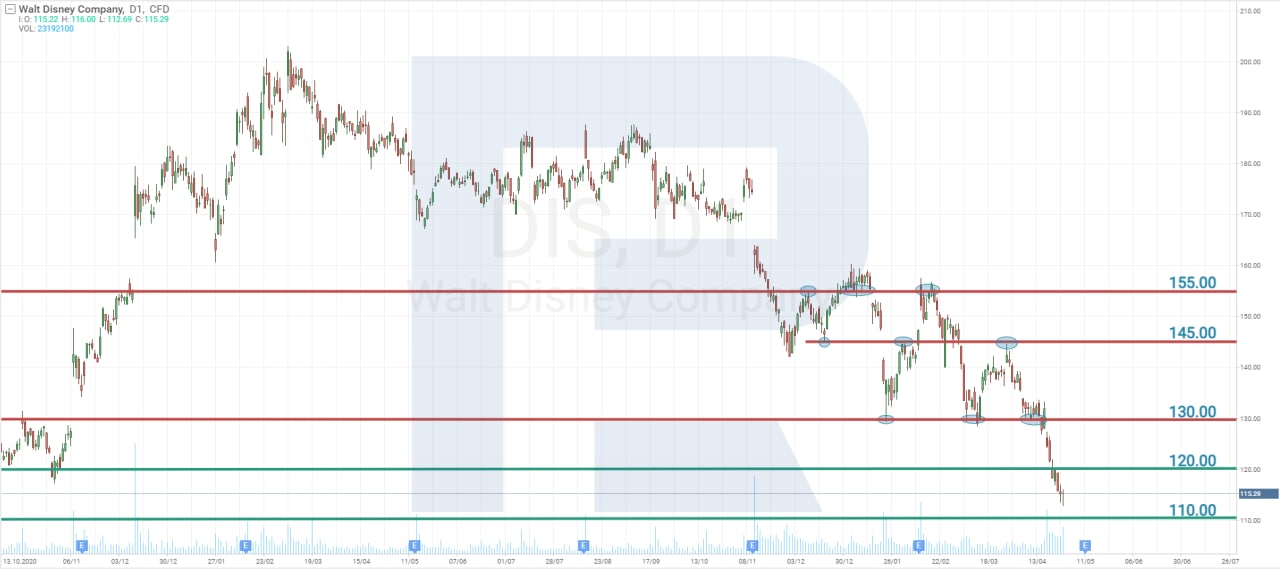

Tech analysis of Walt Disney shares

With the number of Netflix subscribers shrinking, bad news from Florida, and the general decline of stock indices, Walt Disney shares are also declining. The nearest support line is at 110 USD, the nearest resistance level is at 120 USD.

Closing thoughts

The shares of Walt Disney Company is more suitable for the portfolio of a long-term investor. The company has been paying dividends for more than 50 years.

Many market players are now waiting for the quarterly report due on 11 May. Of the number of Disney+ subscribers keeps growing, the downtrend in the quotes of the corporation is likely to come to an end. Otherwise, we might see even better prices for investments.

* - Past performance does not predict future returns

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high