How to invest in ESG Companies

8 minutes for reading

ESG investments are a popular topic of discussion in the media nowadays. So, what is ESG? Is it just a new trend, or a necessary credential for companies? Let's find out.

What is ESG?

ESG is a set of business standards of a company. Responsible investors use it for making investment decisions. ESG is an acronym for Environmental, Social, and Governance.

The Environmental criterion implies the ecological factor, under which we understand how much the company cares for the environment. It encompasses greenhouse gas and pollution issues, the use of natural resources, and adherence to environmental standards.

The Social criterion analyses and evaluates the attitude of the company towards its employees, suppliers, and clients. This includes healthcare and safety issues in the company, the professional development of the employees, and respect for their rights. No slavery, no child labour, alongside responsibility for the quality of the products are also parts of the Social criterion.

The Governance criterion evaluates corporate management: work efficiency, wages, career prospects, shareholders' rights, anti-corruption activities, and gender equality.

How ESG standards are changing the market

Investors who care about ESG standards push global businesses towards social responsibility. Clearly, businesses might be objecting for now, as "green" initiatives generate smaller profits than traditional oil-mining processes in these times of rising commodity prices. However, large funds are already investing in companies that follow these new standards.

In April 2021, 35 investors of the Institutional Investors Group on Climate Change (IIGCC) called for the world's largest banks to refrain from financing companies that mine fossil fuels, and shift their focus towards allocating funds for the development of green energy companies.

Investors of pension funds supported this initiative and advised their managers to prefer ESG companies to other investment options.

Investment fund managers are now actively looking to buy stocks of such companies. So, when the appropriate candidate company appears in the market, fund managers invest billions of dollars in it, making its shares grow noticeably fast.

The attention of Investment funds towards ESG companies also spreads to the "traditional" companies that cooperate with them. So in the end, it's a win-win situation for all the parties in the chain of conscious and ecologically clean business.

ESG credentials also affect everything from the employee value proposition, to retention and productivity. Besides the remuneration package on offer, the working conditions, and the growth prospects, more and more qualified candidates look into the ESG reputation of a company. As a result, such companies get the chance to make promising employment decisions, which further increases the interest of investors in them.

Can ESG lose topicality?

We would all like to believe that socially-oriented investors will never give up on ESG ideas, as very few other things matter as much as the environment. However, trends are not endless, and the market is always prone to change.

At the end of the previous century, the media massively discussed bans on investing in "sin stocks". These included stocks of companies that engaged in business or industries that are considered unethical or immoral, such as alcohol, tobacco, and gambling.

It seemed that propelling morals that would hold prudent people back from investing in unethical corporations was successful.

Nevertheless, the profitability of those shares eventually exceeded the market, thereby making ETFs emerge, which specialised in sin stocks in particular. The media's interest in sin stocks gradually faded into history, and very few people remember that once-popular trend.

Hopefully, with ESG standards the situation will be different. What's important here are laws to impose increased taxes on imports from countries that exceed admissible greenhouse gas emissions. In other words, commodity countries will have to care for the environment so as not to lose the market.

However, ESG is not only about ecology, which is unlikely to ever lose topicality, but also about social issues. Things are more complicated with ESG because with time the environmental, social, and governance factors tend to get distorted and fade into empty formality. The media should keep fueling interest in social and corporate responsibilities until these become an integral part of our way of life.

How to choose an ESG company for investing

There are agencies that analyse the business of companies and rate them by their compliance with ESG standards. To choose a company to invest in, we just need to study the rating thoroughly and formulate filtering criteria.

Lists of ESG companies are formulated by such agencies as Bloomberg, S&P Dow Jones Indices, JUST Capital, MSCI, etc. Some share the information for free, while others require a paid subscription. We would draw your attention to the Top 100 ESG companies list by Corporate Knights.

Vestas Wind Systems

On the Corporate Knights list, number one is the Danish Vestas Wind Systems A/S (XETRA: VWSB), which produces wind generators. Over the last nine years, its shares saw a growth of 6600%. This growth indirectly demonstrates the development of the renewable energy sector and the inflow of investments in it.

In January 2021, the shares of Vestas Wind Systems reached a high of 1,600 DKK. Later, the company carried out a stock split at a ratio of 1:5, which resulted in a serious decline in the share price. Currently, Vestas Wind Systems shares cost 200 DKK.

Autodesk

Number three on the Corporate Knights list is American company Autodesk Inc. (NASDAQ: ADSK), which develops software for architects, engineers, and constructors.

Over the last six years, Autodesk shares saw a 740% growth. This growth cannot be attributed to ESG investments only but is also mostly owing to the general and fast digitalisation of economies during the pandemic, and the overall growth of the tech sector.

Autodesk shares corrected from their highs by 45%, giving ESG investors a good chance to buy them at an affordable price.

American Water Works Company

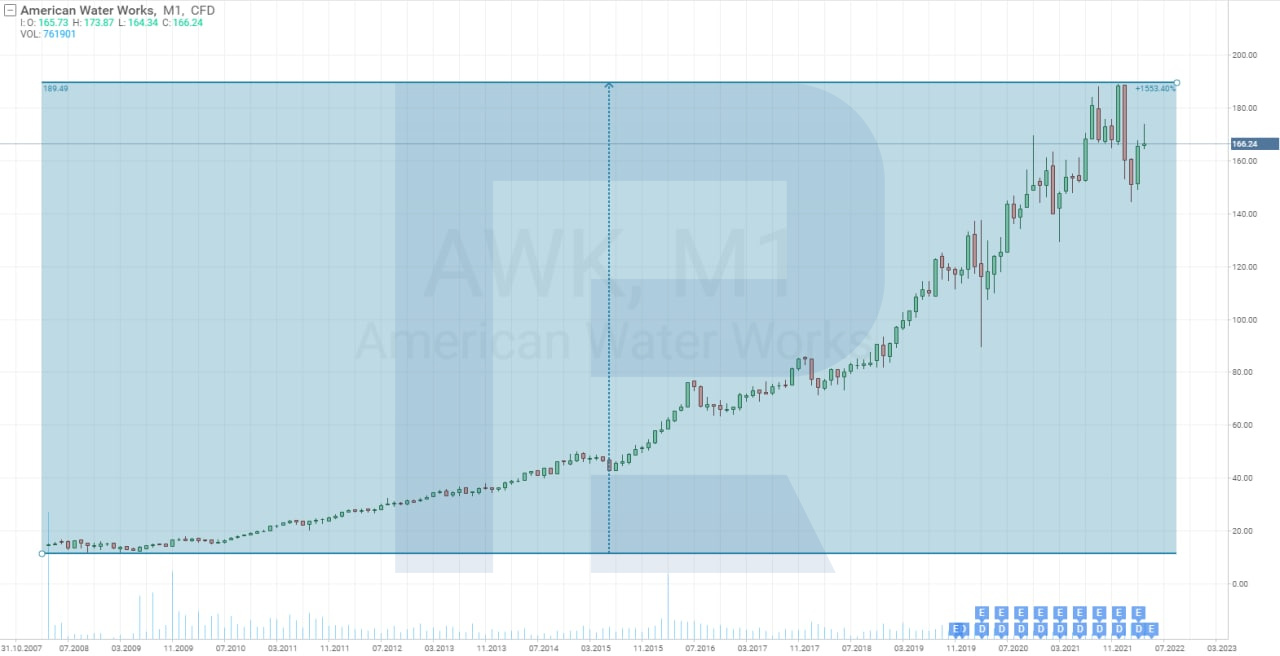

Number six on the Top 100 list in question is American Water Works Company Inc. (NYSE: AWK), which provides water supply services in the US. It publishes annual reports on what it has achieved in relation to ESG.

Since the IPO, the shares of American Water Works Company have risen more than 1,500%. However, buying the shares should not be rushed since the chart demonstrates increased volatility, which is a warning for a possible correction. In other words, there might be a chance to invest in the corporation under better conditions.

Conclusion

ESG standards have every right to exist, yet the current times are not the best ones for popularising them. Rising inflation and high commodity prices are pushing the global economy towards recession.

Socially responsible investing appeared in 2018, and those first investments have already yielded a substantial profit. Hence, there is a chance that investors will start taking the profit, making the shares fall as a result. So, we should perhaps try to wait for better prices for ESG investments.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high