Investment Ideas from Michael Burry

8 minutes for reading

In the previous article, we analysed Warren Buffett's investment portfolio. Despite his impressive age, Buffet still participates in investment choices made by his fund, Berkshire Hathaway.

However, Buffett is mostly famous for his long-term investments, which sometimes do not yield profits until after more than a decade. Not many traders are ready to invest for such a prolonged time.

This article is about the shares another investor bought in Q1 2022, namely Michael Burry. He is a younger but no less famous financier, whose investment horizons are seldom longer than several months. Many traders keep a close eye on his activities as well as those of Warren Buffett.

What we know about Michael Burry

Michael Burry is an American investor and founder of a hedge fund, Scion Asset Management. He has medical education and a license. Prior to the appearance of Scion Asset Management in 2013, Burry was studying economics and writing analytics for a forum, Silicon Investor.

His investment choices were so wise that he attracted the attention of major market players like Vanguard and White Mountains Insurance Group.

Burry's trading strategy was based on value investing, described in detail in a book by Benjamin Graham and David Dodd titled "Security Analysis", published in 1934.

Four years after the Scion Asset Management hedge fund was founded, Burry was already managing 600 million USD. When he reached this level, he stopped contracting with new investors.

How Burry forecasted the mortgage crisis in the US

Michael Burry became especially famous after the mortgage crisis of 2008: as a matter of fact, he had forecasted the crash of the real estate market several years before it actually happened. At some point during the crisis, the profitability of his fund reached 489%.

Not all investors of Scion Capital approved of this rate and claimed a withdrawal of funds, while those who stayed with Burry received a profit of 700 million USD. In 2008, Scion Capital hedge fund was shut down, and Burry, having made a profit of 100 million USD, focused on his own investments.

What shares does Scion Asset Management invest in?

In 2013, Michael Burry started a new hedge fund, which he named Scion Asset Management this time, and is still managing it. The profitability of the new fund is now nearing 300%, while the S&P 500 stock index has grown 200%.

In the reports of Scion Asset Management, we can see which shares Michael Burry is currently investing in. Unlike Buffett's large portfolio which contains 52 companies, Burry's is easier to analyse because it only holds 12 companies.

For ease of analysis, we will break the portfolio of Scion Asset Management into sectors: entertainment, consumer goods, technology, healthcare, oil and gas.

Entertainment

To this sector belong the shares of Alphabet Inc. (NASDAQ: GOOG), Meta Platforms Inc. (NASDAQ: META), Nexstar Media Group Inc. (NASDAQ: NXST), and Warner Bros. Discovery Inc. (NASDAQ: WBD).

Nexstar Media Group and Warner Bros. Discovery

Both companies work with media content but they are not competitors. Discovery produces info and entertainment content, while Nexstar Media Group distributes the content via telestations.

We presume that Burry is counting on the growth of profitability of the media entertainment sector. As you remember, Warren Buffet also invested in it in Q1 via the shares of Paramount Global (NASDAQ: PARA), which produces and distributes media content.

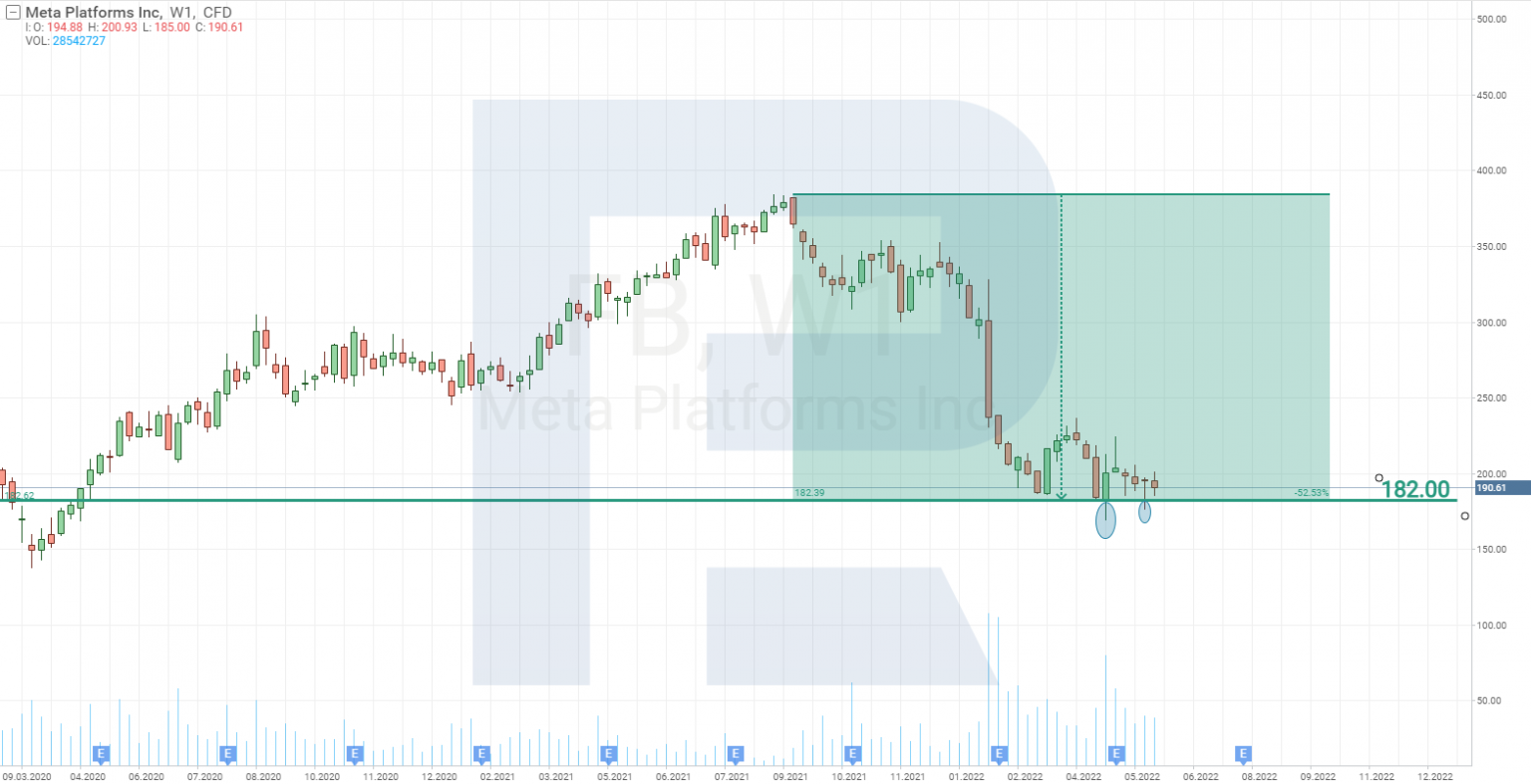

Meta Platforms

First and foremost, Meta Platforms brings hope for the development of the metaverse, in which more and more investors express their interest every day. Moreover, the shares of Meta Platforms have corrected with a 50% decline from the all-time high. As we know, the corporation is a worldwide leader amongst social networking systems, has a low debt load, and has a positive net profit.

There is another indirect sign of Meta Platforms becoming an investment opportunity: its shares have been trading near the price of 182 USD since February 2022. As soon as this drops, investors rush at buying them, making the price rebound to above 182 USD.

Alphabet

Presently, no one can compete with Alphabet Inc. Its yearly income reaches 270 billion USD, which is more than the GDP of many countries, and the net profit is above 74 billion USD.

Such companies can be considered for investing in when the share price drops seriously, which is quite a rare occasion. Alphabet shares are currently trading 22% below the all-time high.

In Q1 2022, Burry bought the shares at quite a high price: the average price of the investment was 2,781 USD, which is a 15% discount from the current price.

Consumer goods and services

In this sector, we can find the shares of such companies as Booking Holdings Inc. (NASDAQ: BKNG), Stellantis N.V. (NYSE: STLA), and Sportsman's Warehouse Holdings Inc. (NASDAQ: SPWH). All of them work in different spheres and there is no rivalry between them.

Booking Holdings and Sportsman’s Warehouse

Booking Holdings represents the tourism industry, where the gradual growth of income is quite possible since COVID-related restrictions have been lifted all over the world now.

Sportsman's Warehouse Holdings supplies goods for hunting, fishing, camping, and other outdoor activities. This niche is also expected to return to the pre-pandemic rhythms and sales volumes.

Stellantis

Stellantis is a member of the Top-5 list of the world's largest car manufacturers. It produces cars under 16 brands: Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS, Fiat, Fiat Professional, Jeep, Lancia, Maserati, Mopar, Opel, Peugeot, Ram, and Vauxhall; and employs over 300,000 people.

Burry has invested in Stellantis 9.7 million USD, which is 4.85% of the whole portfolio. This is not much compared to other investments, yet every share was bought for 1 USD more than it currently costs.

Tech sector

Michael Burry has added the shares of only two companies from the sector to his portfolio, these being Global Payments Inc. (NYSE: GPN), and Apple Inc. (NASDAQ: AAPL). The first he specialises on payment technologies and services. As for the second one, the investor expects its share price to fall and bought Put options for the shares of this company to make money on them.

Scion Asset Management spent 35.9 million USD on it, which is 17.8% of the portfolio and is the largest investment in it. Warren Buffett looks at Apple differently: in Q1, 2022 he bought 3,787,856 shares of the tech giant.

However, as was said before, these two investors have different investing horizons. While for Buffett the short-term decline of Apple shares is a chance to buy more, Burry can make money on this movement and withdraw the profit.

Medical and oil&gas sectors

The remaining positions in the portfolio are taken by Bristol-Myers Squibb Company (NYSE: BMY), Cigna Corp (NYSE: CI), and Ovintiv Inc. (NYSE: OVV).

Bristol-Myers Squibb

This biopharma company produces drugs against cancer, heart and vascular, fibrous, and neurological diseases, as well as COVID-19. The latest tests of the drugs by Bristol Myers Squibb and Johnson&Johnson demonstrated a significant decline in the death rates of patients with COVID-19.

Cigna

The company provides medical insurance services and is amongst the global leaders in the segment. In Q1 2022, the EPS of Cigna Corp increased 11% to 3.68 USD, compared to the results of the same quarter last year.

The corporation pays dividends and carries out a stock buyback programme. The average buy price of Cigna Corp shares by Burry's hedge fund was 239.61 USD. This investment now yields a profit of 10%.

Ovintiv

The company explores, produces, and sells natural gas and oil. In the current circumstances with rising hydrocarbon prices, logistics constraints, and attempts at excluding Russian oil from the global market, investments in the oil and gas sector can have certain prospects.

It was even wiser to look out for this sector in October 2021, when profits of oil-making companies were increasing, which made their shares grow. At that time, green energy was considered to become the main driver of growth. As a result, investments in the oil and gas sector were to shrink, dragging along the market supply and rising hydrocarbon prices.

Currently, the situation has become more complicated: transition to alternative energy sources has been put aside, while the main goal is to satisfy the current demand for hydrocarbons.

Closing thoughts

In Q1 2022, Michael Burry closed 5 positions, 3 out of which were opened in Q4, 2021. This means that in certain cases his investment horizons are quite short.

Having analysed the portfolio of Scion Asset Management, it should be noted that if some positions demonstrate significant profits in the current report (i.e. if the current price is higher than that for which the fund bought the shares), in the next report we might see the positions closed. A discount from the fund's position is different: it might turn out to be a good investing idea.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high