IPO of HomeSmart Holdings: Real Estate Neo Broker

5 minutes for reading

In recent years, digital banks and financial institutions with no physical offices whose staff work remotely and communicate with their clients via mobile applications are more and more becoming part of everyday life. Similar startups are now appearing in the real estate industry.

Agents, buyers, and sellers can now all interact within a single platform. Thanks to cutting-edge technology, taking a virtual 3D tour is made possible, which significantly simplifies and accelerates a real estate transaction.

HomeSmart Holdings, the company that developed a mobile platform for all participants of real estate transactions, is planning to go public by listing on the NASDAQ under the "HS" ticker symbol. The IPO date hasn't been announced yet.

The business of HomeSmart Holdings

HomeSmart Holdings Inc. was established in 2000 with headquarters in Scottsdale, Arizona. The company is run by the founder, Matthew Widdows. As mentioned above, the issuer's top product is an integrated application for all parties involved in real estate transactions: brokers, agents, buyers, and sellers.

The platform features enhance the efficiency of all processes: potential clients can search through real estate listings, view a unit virtually, discuss any queries, and even pay online. Moreover, the application allows parties to complete all necessary paperwork and follow every stage in the process. In addition, agents and brokers can avail themselves of the marketing options.

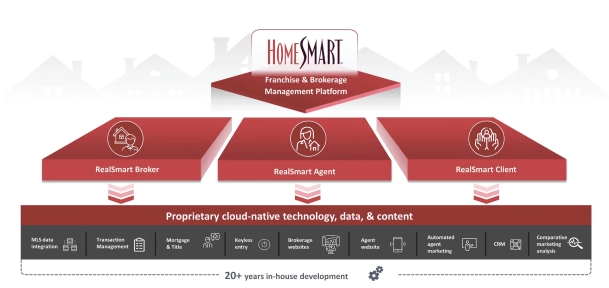

Features of the HomeSmart Holdings platform

RealSmart Broker — used by real estate brokers. A wide range of options that help to manage, control, and analyse

RealSmart Broker – used by real estate brokers. A wide range of options that help to manage, control, and analyse agents' performance.

RealSmart Agent– used by real estate agents.

RealSmart Client– used by buyers, sellers, lessees, and lessors. The application allows storing all necessary documents of a real estate unit and taking virtual tours.

Franchise Manager – intended for managing the company's franchise network.

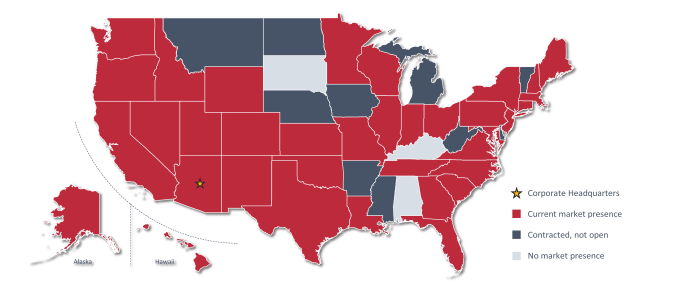

HomeSmart Holdings boasts 190 offices in 47 states. The company has consistently made the top 5 of the best real estate brokers. The issuer intends to spend the funds it will raise during the IPO on improving its online application.

The market and competitors of HomeSmart Holdings

The issuer's primary source of profit is the commission generated from real estate transactions. The company also earns on providing business analytics services and selling franchises of its in-house brands.

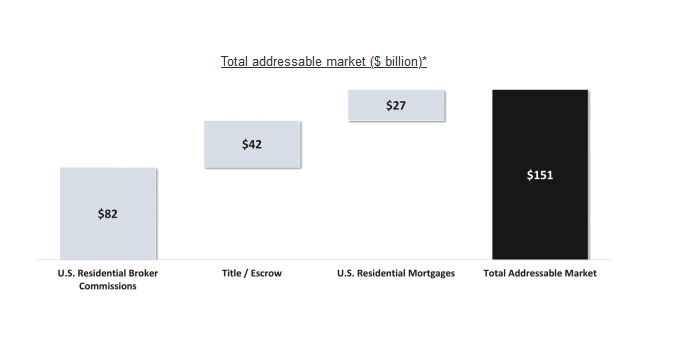

According to research conducted by HomeSmart Holdings, its target market is $151 billion. The National Association of Realtors (NAR) reported that over 5.6 million housing units were sold in 2021 at the average amount of $296,700. As a result, the volume of the real estate market has reached $1.66 trillion.

HomeSmart Holdings’ key competitors are:

- Redfin

- Compass

- Realogy

- eXp Realty

Financial performance of HomeSmart Holdings

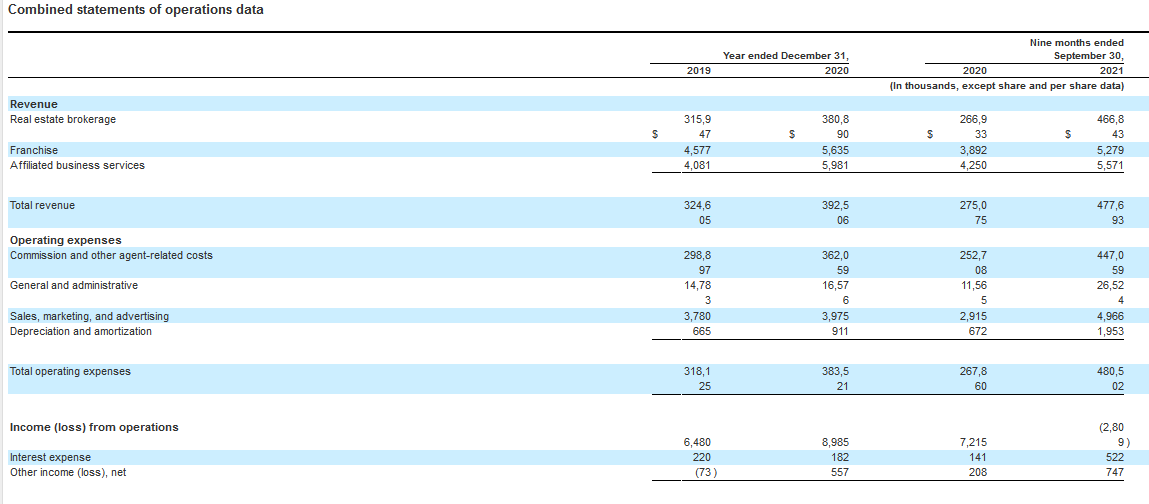

In 2019 and 2020, HomeSmart Holdings' sales were $325 million and $393 million respectively, which indicates an 18.0% growth. In 2019, the company's gross profit was $26 million while in 2020, the indicator leaped up 18% to $30 million.

The issuer's net profit over the same period of time was $6 million and $9.2 million, respectively. Its EBITDA (earnings before interest, taxes, depreciation, and amortisation) was $7.1 million and $10.5 million, respectively.

In the first nine months of 2021, the issuer's revenue amounted to $478 million, representing a 74.0% increase in comparison with the same period of 2020. The gross profit was $31 million, while the net loss was $2.3 million.

Taking into account HomeSmart Holdings' going-forward plans to develop its platform, there is every reason to believe that its business profitability might grow in the short term.

Strengths and weaknesses of HomeSmart Holdings

The advantages of investing in this stock are justified by the following:

- Strong Net profit

- Investments in innovative technological solutions

- Multiple awards and top recognition as the best in the industry

- Sound management

- Highly diversified business

- Highly liquid market

Among the investment risks, we would name:

- Low business profitability

- Strong negative impact on the business due to the pandemic

- No net profit over nine months in 2021

IPO details, and estimation of HomeSmart Holdings’ market capitalisation

The underwriters of the IPO are Stephens Inc., D.A. Davidson & Co., Oppenheimer & Co. Inc., Stifel, Nicolaus & Company, Incorporated, BofA Securities, Inc., and J.P. Morgan Securities LLC.

The number of shares to be sold hasn't been announced yet. The IPO volume is a standard $100 million with an estimated market capitalisation of $1 billion. In the case of favourable market conditions, HomeSmart Holdings might yet increase the IPO volume and raise capitalisation.

To assess loss-making companies, we use a multiplier – the Price-to-Sales ratio (P/S ratio). A P/S value for the technology sector could be 15.0-20.0 during the lock-up period. The issuer's P/S is unknown so far.

This investment might well be of a venture nature if the actual P/S is over 20. The stock could be interesting to investors who are ready to take risks.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high