IPO Of Innovative Eyewear: AR Smart Glasses for Every Day

4 minutes for reading

With the rapid advances in science and cutting-edge technologies, many devices and gadgets that were first introduced to us in science fiction films are now becoming part of our everyday lives – for example, augmented reality goggles with Internet access.

The “star” of today’s article is Innovative Eyewear Inc., the company that develops and manufactures multi-purpose innovative glasses. The company is planning to go public by listing on the NASDAQ under the "LUCY" ticker symbol, although the IPO date hasn’t been announced yet.

What we know about Innovative Eyewear

Innovative Eyewear was established in 2019. The company is focused on manufacturing optical equipment: vision improvement glasses, sunglasses, and “smart” glasses. Innovative Eyewear is headed by its co-founder and CEO Harrison Gross.

Innovative Eyewear’s flagship product is the Lucyd Lyte glasses with a range of 56 lens types and 12 different styles. With Lucyd Lyte, a person can listen to music, take and make calls, and also use voice commands to perform other popular tasks on smartphones.

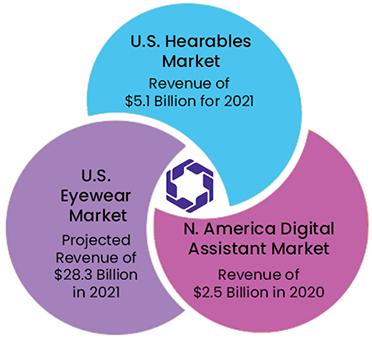

Smart eyewear is a part of a quick-growing hi-tech infrastructure, which consists of conventional glasses, in-ear headphones, and digital assistants.

Innovative Eyewear developed an application called Vyrb™, which enables users to receive and send messages on social networks and messengers via Lucyd Lyte by using voice commands. The beta version was launched in December 2021, and the updated version is expected to be released at the end of 2022.

The prospects of Innovative Eyewear’s target market

According to a market research report by Allied Market Research, the global market for AR/VR smart glasses was estimated at $8.3 billion in 2019. By 2027, it might reach $33 billion. Consequently, the Compound Annual Growth Rate (CAGR) could be 16.6%. Experts believe that the key drivers for this growth will be the demand from industrial use cases and gaming applications.

The key competitors of Lucyd Lyte from Innovative Eyewear are such products as Bose Frames, Amazon Echo Glasses, Snap Spectacles, and Ray-Ban Stories.

How Innovative Eyewear performs financially

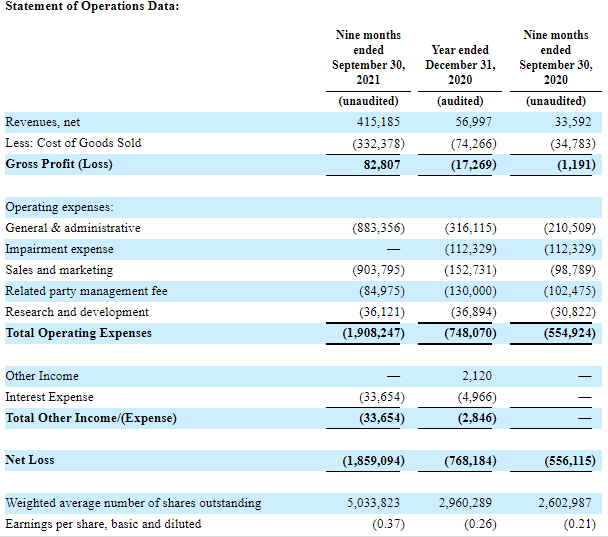

At the time of the IPO, the issuer had not generated any net profit. We will therefore analyse Innovative Eyewear's financial performance with its revenue. The financial data from the S-1 form shows a 1,0362% growth in the company’s sales in the nine-month period that ended on 30 September 2021 in comparison with the same period of 2020 – meaning up to $0.42 million. For the full year of 2020, the revenue was $0.056 million.

The issuer’s net loss in the first three quarters of 2021 was $1.85 million – this is a 234% increase in comparison with the same period in 2020. Net loss skyrocketed due to the rising marketing expenses, which increased 815%, up to $0.9 million.

Innovative Eyewear’s cash position from September 2020 through September 2021 is negative – $0.92 million. At the end of 2021, the company’s total liabilities were $0.665 million, while the cash equivalents on its balance sheet were $0.065 million. As of 30 September 2021, Innovative Eyewear had raised $3.3 million in investment.

Strengths and weaknesses of Innovative Eyewear

The company's strengths are:

- High target market growth rate

- Revenue growth rate exceeding the growth rate of losses

- Possible business expansion outside the US

- High potential of the demand for the issuer’s product

- Proprietary software and IT infrastructure

The list of key weaknesses is much shorter: small revenue, increasing losses, and no net profits.

What we know about the Innovative Eyewear IPO

The underwriter of the IPO is Maxim Group LLC. The issuer is planning to sell 2.85 million common shares at the price of $5.2 per share, as well as one warrant. Gross revenue is expected to be almost $15 million, not including conventional options sold by the underwriter. Active shareholders showed no interest in acquiring new shares at the IPO price.

Assuming the IPO is successful at the proposed price, the issuer's value at the IPO excluding underwriter options might be approximately $34 million. The Price-to-Sales ratio (P/S ratio) multiplier might reach 77.27.

Buying Innovative Eyewear shares might be considered a classic venture investment, which involves high risks and is not suitable for all investors.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high