IPO of MED-X: Investments in Green Pesticides

4 minutes for reading

Eating fruit and vegetables that have not been exposed to chemicals is considered the healthiest choice. Nevertheless, chemical fertilisers are necessary for maximising crop yield and increasing plant production quickly. Otherwise, humans would suffer from a declining number of crops or lack of these. In recent years, there is much research into solving this issue ecologically.

Today we will talk about a company called MED-X, Inc. that designs and produces harmless pesticides and painkillers. The date of the IPO has not been decided yet. The issuer plans to trade on the NASDAQ under the ticker MXRX.

What we know about MED-X

MED-X was founded in 2014, with its main office in California, the US. It is managed by director-general Matthew A. Mills who has been working in the company since it was founded in February 2014.

The issuer produces and designs natural pesticides, biological supplements, and painkillers. The main products of the company are:

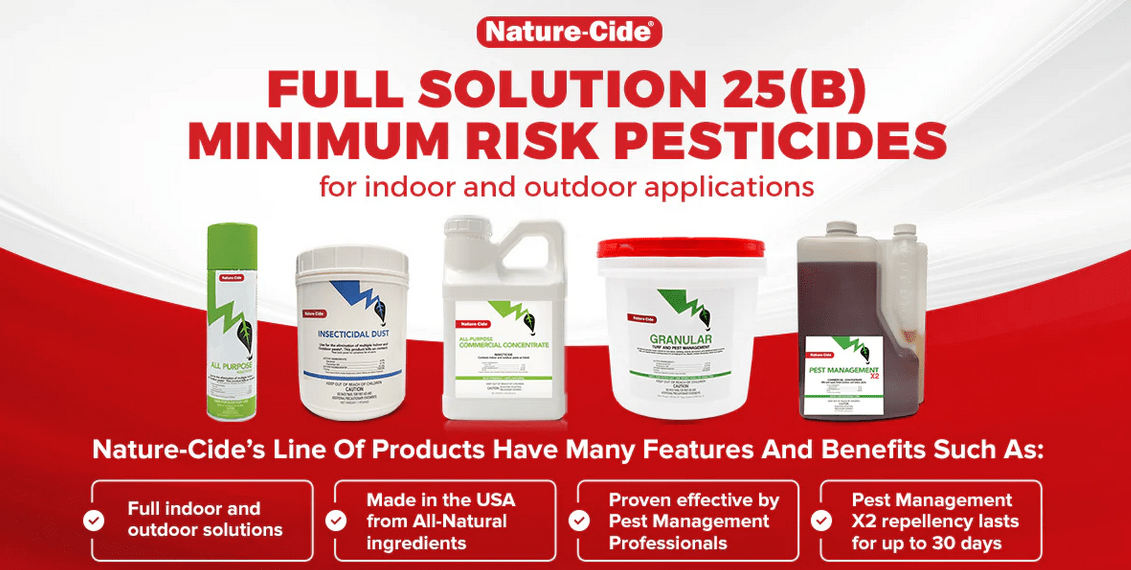

- Nature-Cide, a pesticide, and repellent is an all-natural plant-based essential oil used by the professional pest control industry. It can also be used for cleaning the home, as a scent, and as a fertiliser. This line of products develops thanks to legislation limiting the use of chemicals in certain US states and worldwide

- Thermal-Aid is a painkiller for children, grownups, and animals

- Malibu Brands is a homeopathic pain relief cream

The issuer sells its products both online and offline. It expands and diversifies its business through mergers and acquisitions. The most recent one happened in 2018 when MED-X bought Pacific Shore, the previous owner of Malibu Brands. The issuer plans to continue developing its business in this way, acquiring companies with a business model similar to its own.

For 30 June 2022, the number of investments attracted by MED-X Inc. was 23 million USD.

Prospects of the MED-X target market

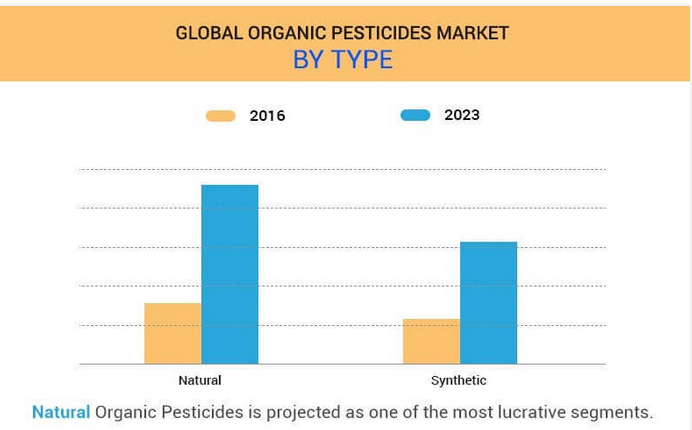

According to Allied Market Research, the global market of organic pesticides in 2018 amounted to 99.2 billion USD and is expected to reach 279 billion USD by 2023. This translates into an average annual growth in the period of 2017-2023 of 14.0%.

The highest speed of development is forecast to be achieved in the Asian Pacific region. The main factor that may influence the sector positively is the desire of consumers to use fewer toxic chemicals in foods and personal items.

Main competitors of MED-X Inc.

- Ecolab Inc.

- Envincio LLC

- The Monsanto Company

- DuPont de Nemours, Inc.

- Dow ArgoSciences LLC.

- Certis U.S.A. LLC.

Financial performance of MED-X

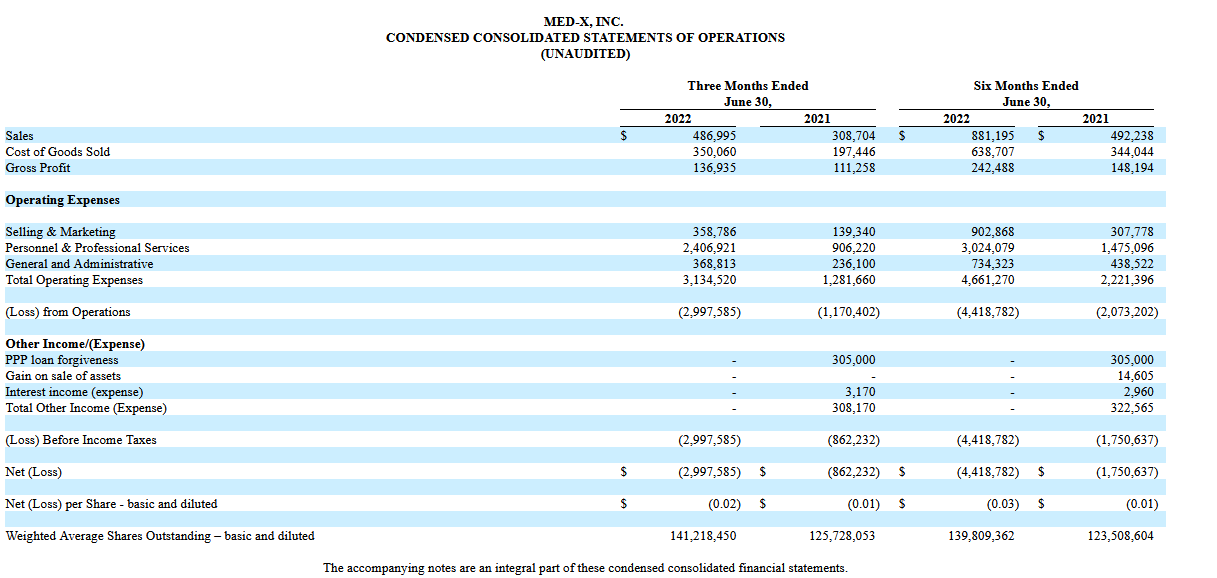

MED-X Inc. does not generate any net profit. According to the S-1 form, over six months of 2022, the net loss of the company increased by 152.57% compared to 2021, to 4.45 million USD.

Earnings of MED-X Inc. over six months of 2022 rose 79.02% to 881.19 thousand USD. This growth happened thanks to the partnership with Amazon. Nature-Cide accounted for the biggest part of sales (over 50%).

On 30 June 2022, the company had 473.38 thousand USD in its accounts and 1.69 million USD in liabilities.

Strengths and weaknesses of MED-X

Advantages:

- Popular products

- Promising and fast-growing market

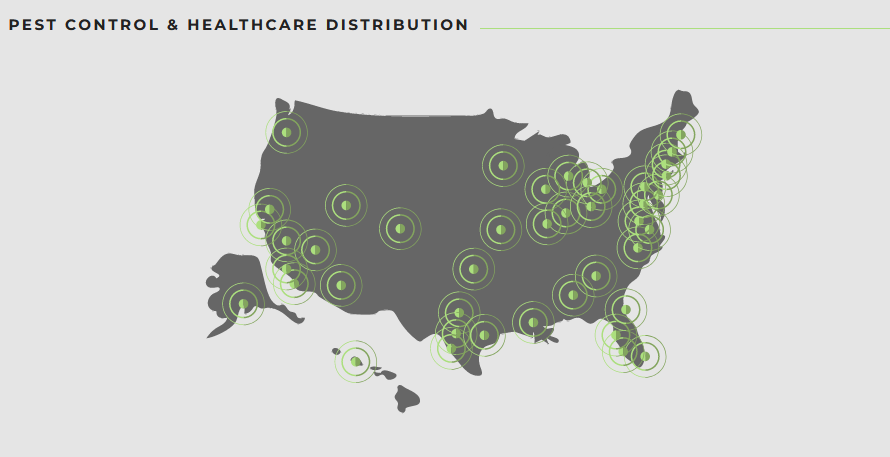

- Global business

- The company has its own platform for attracting clients

- Fast growth of earnings

- Qualified management

Drawbacks:

- High competition

- The company has been operating at a loss since its foundation

- Poor business diversity

What we know about the MED-X IPO

The underwriter of the IPO is EF Hutton, a division of Benchmark Investments, LLC. The issuer intends to sell 2.12 million normal stocks. Gross earnings from selling the securities might reach 7.37 million USD, minus normal options. This money will be used for general corporate expenses, mergers, acquisitions, and R&D. If the IPO is successful, the capitalisation of MED-X, Inc. will amount to 18.1 million USD.

The P/S multiplier (capitalisation/sales) cannot be calculated due to insufficient assets. The upside during the lock-up period is, therefore, also difficult to predict.

This means participation in the MED-X IPO is a classic venture investment that does not suit everyone.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high