IPO of Porsche: VAG's Subsidiary Is Going Public

5 minutes for reading

We've got used to IPOs usually being held by relatively young companies, which try to attract investments with the aim of expanding their businesses. However, the star of today’s article is an exception to this norm.

Porsche Automobil Holding Se, the car manufacturer with years of history and an enviable reputation, is planning to go public. The company is expected to hold an IPO on the Frankfurt Stock Exchange in early September.

What we know about Porsche Automobil Holding

The company was established in 1931 by the legendary automotive engineer, Ferdinand Porsche. Porsche Automobil Holding manufactures luxury and premium vehicles. In the past, the issuer was focused on producing sports cars only, but later entered the production of crossovers and off-road vehicles. Electric cars have recently been added to the vehicle line.

Porsche Automobil Holding is headquartered in Stuttgart. The Porsche Development Centre, which celebrated its 50th-anniversary last year, is located in Weissach. Porsche Automobil Holding is owned by Volkswagen AG since 2012.

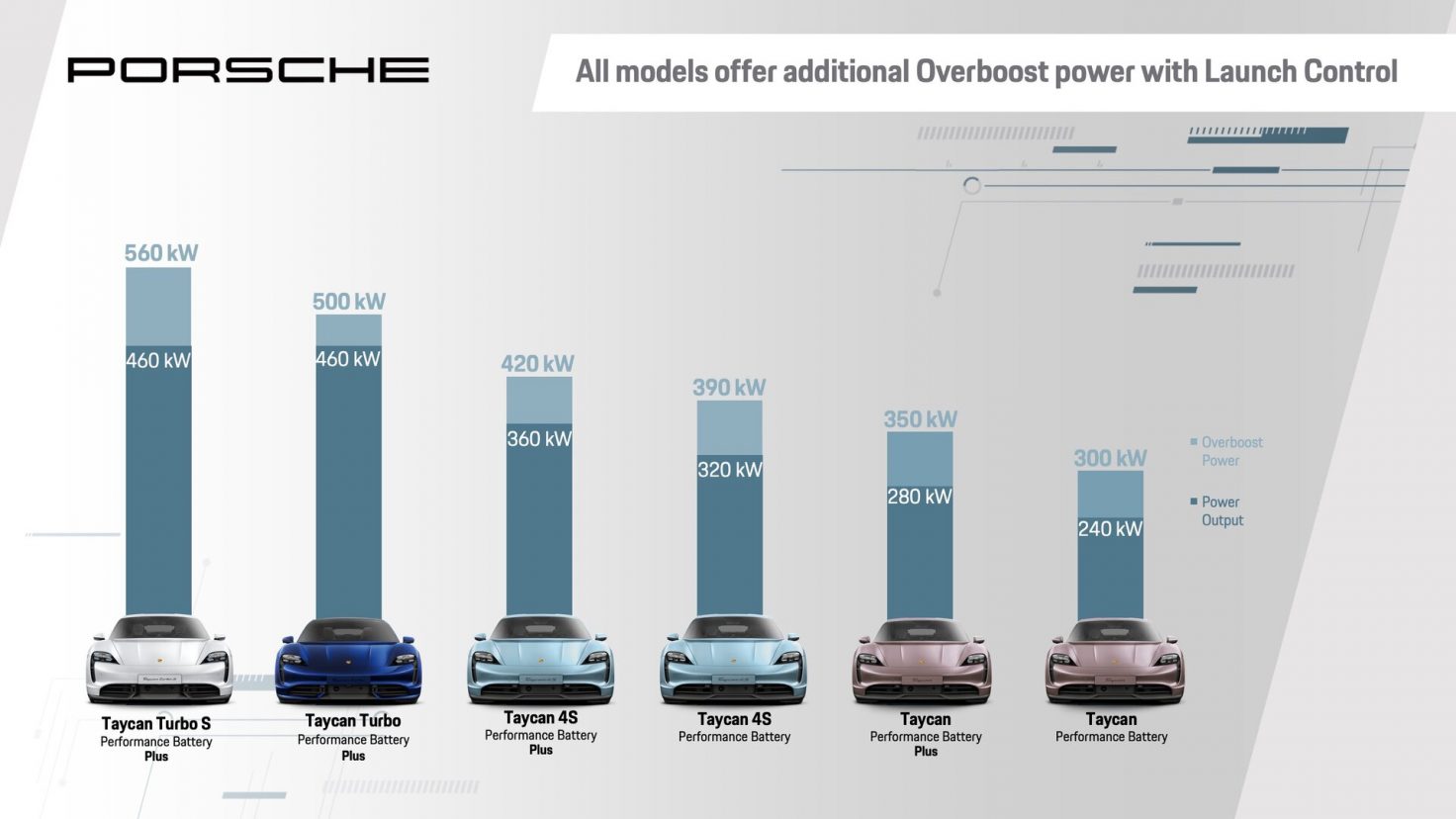

Porsche intends to develop in the area of green vehicles. The company is already producing electric versions of Taycan, and hybrid versions of Panamera and Cayenne. These cars are equipped with innovative solutions and characterised by enhanced technical specifications.

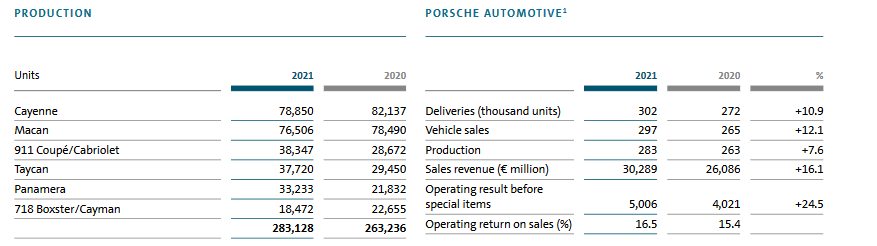

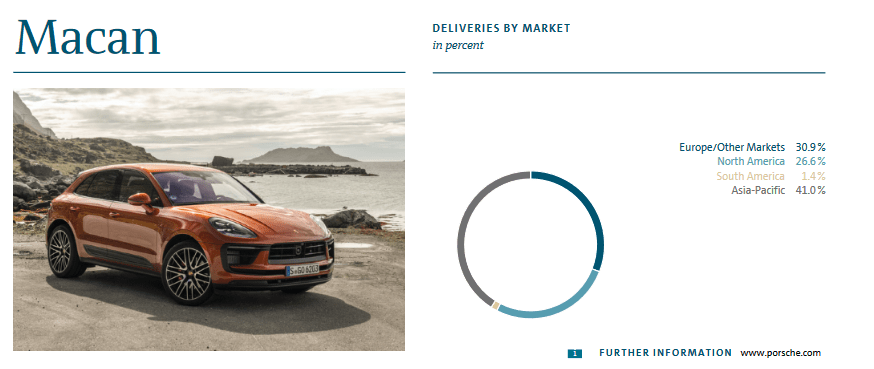

In 2021, Porsche manufactured 283,000 vehicles, which represents a 7.6% growth in comparison to 2020. The revenue percentage in the regions of the world was divided as follows: Asia-Pacific – 41%, Europe – 30.9%, North America – 26.6%, and South America – 1.4%.

The most popular make last year was the Cayenne: its sales amounted to 27.85% of the total number of cars sold by the company. There was also an increasing demand for electric versions of Taycan, with sales gaining 28.09% compared to 2020.

The target market of Porsche Automobil Holding

As mentioned before, Porsche Automobil Holding is planning to develop in the area of manufacturing electric and hybrid vehicles, and take an unconditional lead in the field.

According to the International Energy Agency (IEA), there were 11.2 million cars with electric motors in the world in 2020. By 2030, this number is expected to reach 145 million, while sales volume is estimated to probably exceed $1 trillion.

In the last five years, sales of electric vehicles have gained over 600%. If sales growth continues at this remarkable pace, 50% of all sold cars will be equipped with an electric motor by 2027.

The issuer’s key competitors are:

- Tesla

- Rivian

- BMW

- Ford

- BYD

- Honda

- Nissan

How Porsche Automobil Holding performs financially

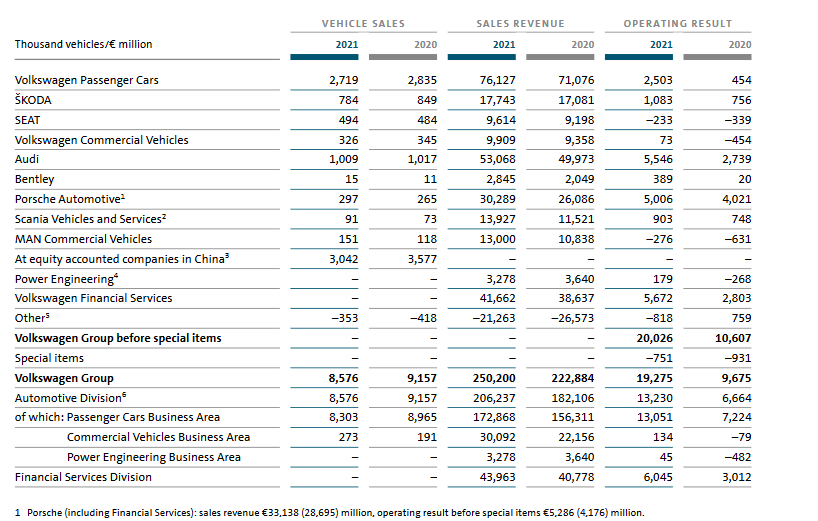

In 2021, Porsche Automobil Holding’s revenue added 16.09%, up to € 30.3 billion compared to 2020. The company succeeded in overcoming the negative consequences of the COVID-19 pandemic and minimising the “Weak Euro” effect and the raw materials price surge.

This success is also confirmed by a significant increase in operating revenue for 2021, which gained 24.5%, up to €5 billion. As we can see, the company has an excellent opportunity to pay dividends in the future.

Strengths and weaknesses of Porsche Automobil Holding

The company's strengths are:

- 90 years of market presence

- A promising area of manufacturing “green” transport

- Net profits

- A strong rebound after the crisis caused by COVID-19

- Global brand awareness

- A prospective target market

The key disadvantage is the strong competition in this segment. In addition, a further surge in prices for raw materials and energy resources might lead to a significant increase in production costs and a drop in revenue.

What we know about the Porsche Automobil Holding IPO

Detailed information about the underwriters has not been announced yet. However, T Rowe Price Group Inc. and Qatar Investment Authority might be among the potential investors.

In addition, there are rumours that Red Bull founder, Dietrich Mateschitz, and the CEO of Louis Vuitton Moët Hennessy, Bernard Arnault, are planning to participate in the IPO. This may be considered indirect evidence that the issuer’s shares might be in great demand.

We should mention that Volkswagen AG is going to keep the majority stake in Porsche Automobil Holding after the IPO. A preliminary estimate of the issuer’s capitalisation varies between $65 billion and $85 billion. In comparison, Ford Motor, Honda Motor, and Ferrari are estimated at $64 billion, $49 billion, and $38 billion respectively. This Initial Public Offering is expected to be the largest in Europe to date. The company is planning to use this money to develop its electro-car manufacturing business.

The Price-to-Sales ratio (P/S ratio) multiplier might be from 2.11 to 2.81. Buying Porsche Automobil Holding shares might be considered a risk-weighted investment.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high