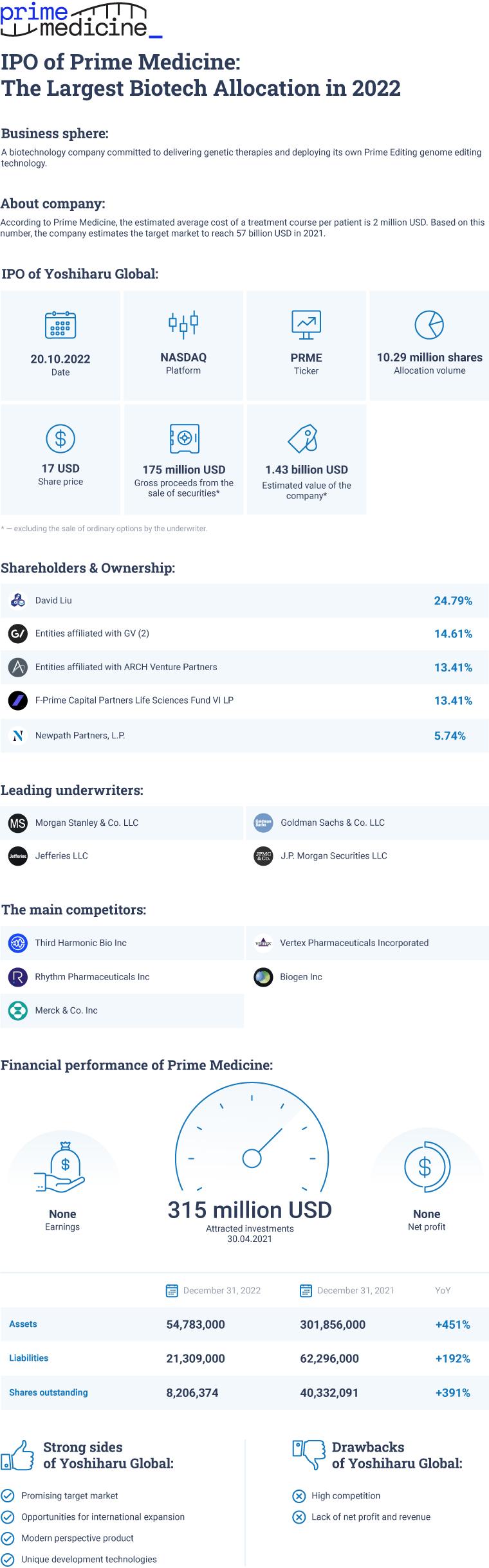

Prime Medicine IPO: The Largest Biotech IPO in 2022

4 minutes for reading

Genetic engineering is a modern and very promising sphere of biotechnology. It unites the experience gained from biology, genetics, virology, chemistry, and other sciences to alter genotypes. With artificial modifications and manipulations made to DNA and RNA using technology, organisms are given the desirable characteristics. This could cure numerous diseases.

In this respect, the stocks of companies that undertake research and development initiatives in this sphere are popular among investors. Today we will present one of these companies. Prime Medicine, Inc. placed its shares on the NASDAQ on 20 October 2022 under the ticker PRME.

What we know about Prime Medicine

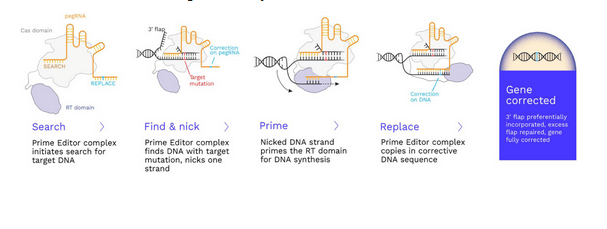

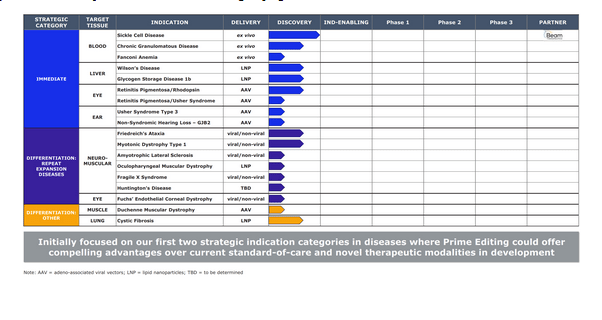

Prime Medicine Inc. is a biotech company that develops a new class of differentiated genetic drugs for curing complex diseases. It works on implementing the Prime Editing technology of gene editing.

Prime Medicine states that Prime Editing can potentially correct about 90% of all known malignant genetic mutations in many human organ cells. Drugs based on this technology could help patients if approved by the regulator.

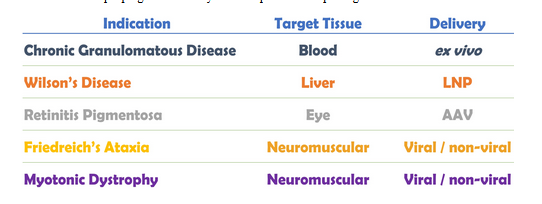

According to Prime Editing developers, the next-generation technology could be effective against the following diseases:

- Chronic granulomatous disease that affects the human immune system

- Wilson’s Disease, which is a severe hereditary disease affecting the central neural system, liver, and other organs

- Retinitis pigmentosa, a hereditary degenerative eye disease

- Friedreich’s Ataxia, which is an autosomal recessive neurodegenerative disease that affects the central and peripheral neural systems, heart, and other organs

- Myotonic dystrophy, a hereditary type of muscular dystrophy

Together with Myeloid Therapeutics, Prime Medicine develops the LINE-1 technology that can enhance Prime Editing methods, which could be effective against many more diseases, not only genetic ones.

As estimated on 30 April 2021, the investments the company attracted amounted to $315 million.

Target market prospects of Prime Medicine

The issuer assessed the potential of its target market independently. According to Prime Medicine, the average course of treatment per patient is roughly $2 million. Based on this number, the company estimates its target market at $57 billion.

The main competitors are:

- Third Harmonic Bio Inc.

- Rhythm Pharmaceuticals Inc.

- Merck & Co. Inc.

- Vertex Pharmaceuticals Incorporated

- Biogen Inc.

Prime Medicine’s financial performance

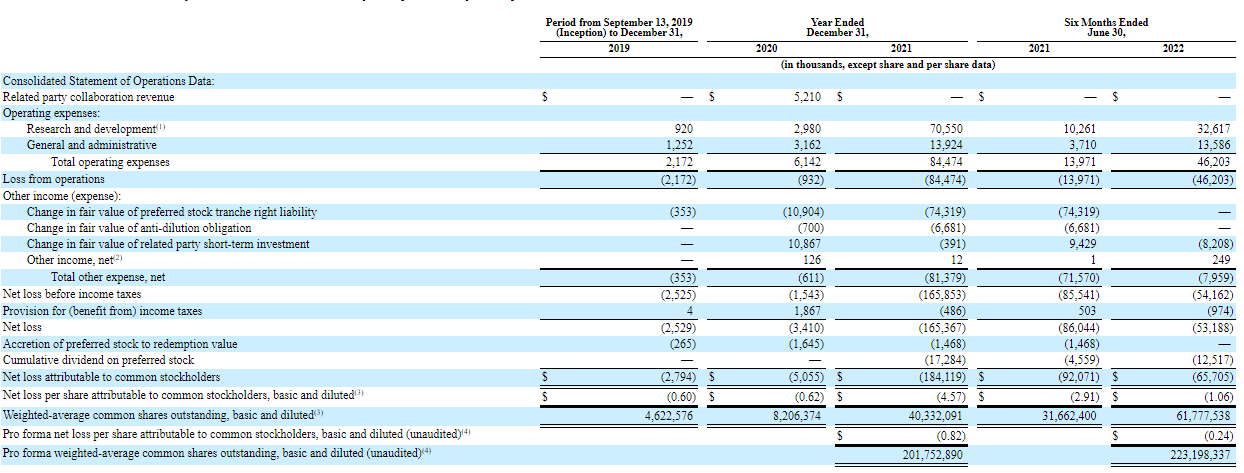

There were no earnings or profits in the S-1 financial statistics form. However, there were serious expenses on scientific research and administration.

Prime Medicine’s net loss in 2021, compared to 2020, skyrocketed 4749.5% to $165.4 million. But it is worth noting that the net loss in the period from January to June 2022, compared to the statistics of last year, dropped by 38.2% to $53,2 million.

The cash reserves of the company after the IPO are estimated at $216 million. Management believes this will be enough until 2025. The long-term liabilities of the company amount to $46 million.

Strengths and weaknesses of Prime Medicine

Advantages:

- Promising target market

- Expansion into the worldwide market

- Cutting-edge promising product

- Unique technology of development

Drawbacks:

- Strong competition

- No net profit or earnings

What we know about Prime Medicine IPO

The underwriters of the IPO of Prime Medicine, Inc. are Morgan Stanley & Co. LLC, Jefferies LLC, Goldman Sachs & Co. LLC, and J.P. Morgan Securities LLC. The issuer sold 10.29 million standard shares at an average price of $17 each.

Gross earnings from selling the shares amounted to roughly $175 million, minus standard options sold by underwriters. The current market capitalisation is $1.43 billion. Note that the IPO of Prime Medicine, Inc. is the largest biotech IPO carried out this year.

As the company does not generate any profit, the potential capitalisation cannot be estimated by classical multipliers. At the last round of financing, the company was assessed at $1.7 billion.

Participation in this IPO might be considered an investment with high risks, which is not suitable for all investors. When this article was being prepared, the shares of the issuer were still available at a price lower than the one listed for the IPO.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high