IPO of Turo: A Peer-To-Peer Carsharing Marketplace

5 minutes for reading

In the last few years, carsharing services have gained a competitive edge over conventional taxi providers thanks to their convenience and cost-effectiveness. To start such a business, you are required to have the relating software and a car park.

When individual car owners want to rent out their vehicles themselves, they can only do so by private arrangements, which is quite risky due to the possibility of damage to the car or theft.

Turo Inc. acts as an intermediary between car owners (the hosts on its marketplace) and those who want to lease a vehicle. The company is planning to go public by listing on the NYSE under the "TURO" ticker symbol. The IPO date hasn’t been announced yet, giving us plenty of time to analyse the issuer’s business and financial reports.

The business of Turo

When the company was established in 2009, it was named RelayRides. In March 2016, it was rebranded as Turo, and it relocated its headquarters to San Francisco, California. Andre Haddad has been Turo’s CEO since 2011.

Turo is not a conventional carsharing company: the issuer acts as an intermediary between the car owners and the lessees. The company’s income is generated from the commission made from every vehicle rental. Through this business model, the company avoids incurring car maintenance expenses.

Nevertheless, Turo insures cars from damages by using the services of third-party insurance companies. The insurance scheme is specified by the car owner. Among the things covered by insurance is car theft. This means that the company bears no risks.

Car owners are obliged to monitor their vehicles’ health themselves and keep them complying with Turo’s technical requirements. A lessee can return a car at an owner’s residence or a specified nearby area, and also at an airport or a railway station.

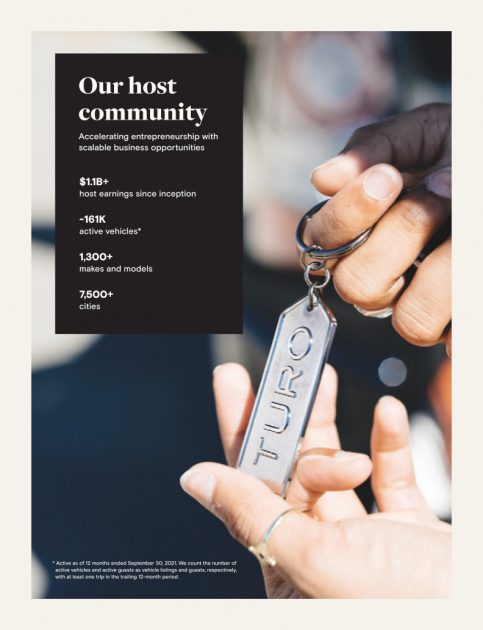

According to the report, in the nine-month period up to 30 September 2021, Turo’s platform and application had over 1.3 million active guests, 85,000 car owners, and about 160,000 active vehicles in 7,500 cities.

The market and competitors of Turo

According to the company’s research, based on the data provided by the International Road Federation (IRF), Turo’s target market is $146 billion. The issuer is expecting to monetise 749 billion miles of car rides in the US, Canada, and the UK.

If the company decides to expand to the countries of the European Community, Latin America, and Africa, its target market potential may add $230 billion.

Turo's key competitors are:

- Priceline

- Enterprise

- Hertz

- Expedia

- Budget

- Sixt

- Kayak

- Avis

- Hotwire

- Carrentals

Financial performance of Turo

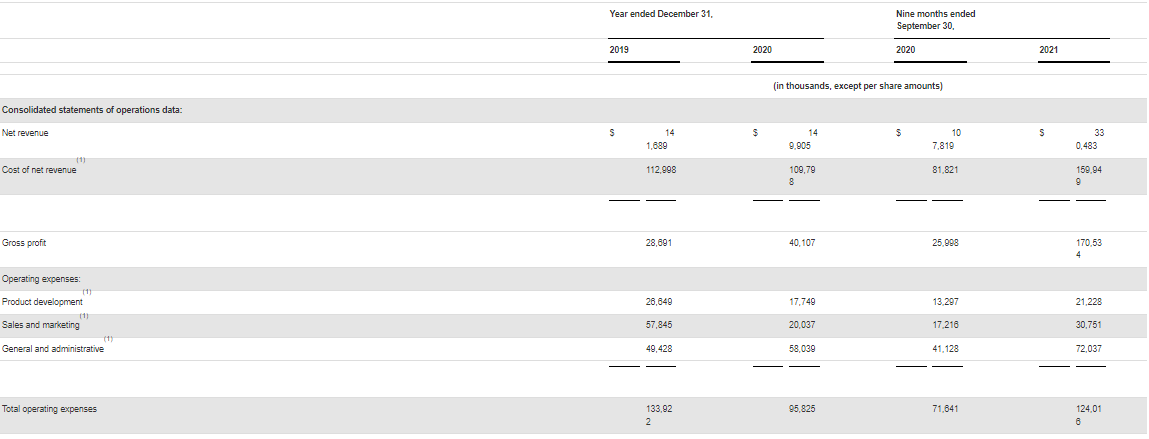

As Turo is not generating net profit, we will focus on analysing its revenue because it reflects the business growth rate. According to the financial statement, Turo’s sales in 2020 were $149.91 million, which indicates a 5.8% growth in comparison with 2019.

In the three-month period of 2021, the company’s revenue was $330.48 million – this is a 206.5% increase in comparison with the same period of 2020. In the last 12 months, the revenue amounted to $372.57 million.

The reason for such rapid growth of the company’s business was the removal of severe quarantine restrictions in Canada, the US, and the UK. Another factor that influenced the growth of revenue was the second-hand car price hikes, which boosted the demand for car rental.

In 2020, Turo's gross profit was $40.11 million – a 38.9% increase relative to the same period of 2019. In the nine-month period of 2021, the gross profit amounted to $107.53 million – a 555.88% increase in comparison with the same period of 2020. Turo’s losses consist of administrative and operating expenses.

The company's total liabilities are $235.49 million, and the cash equivalents on its balance sheet are $262.85 million – this implies a positive cash position of $27.36 million.

Strengths and weaknesses of Turo

The advantages of investing in this stock are justified by the following:

- Unique business model

- No expenses on car park ownership

- The revenue growth rate is over 100%

- Sound management

- Positive cash position

- Promising target market

Among the investment risks, we would name:

- Strong competition

- The company is loss-making and doesn't pay out dividends

- Growing operating expenses

IPO details, and estimation of Turo’s market capitalisation

The underwriters of the IPO are Samuel A. Ramirez & Company, Inc., Loop Capital Markets LLC, LionTree Advisors LLC, Nomura Securities International, Inc., WR Securities, LLC, D.A. Davidson & Co., Siebert Williams Shank & Co., LLC, Cowen and Company, LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Allen & Company LLC, and Morgan Stanley & Co. LLC.

The number of shares to be sold hasn’t been announced yet. The IPO volume is a standard $100 million with an estimated market capitalisation of $1 billion. In the case of favourable market conditions, Turo might yet increase the IPO volume and raise capitalisation.

To assess loss-making companies, we use a multiplier – the Price-to-Sales ratio (P/S ratio). A P/S value for the technological sector with such a rapidly-growing target market could be 15.0 during the lock-up period.

The issuer's P/S is 2.68, which indicates that the company is filing for a quite cheap IPO. Most likely, the underwriters will increase the IPO price range.

Bearing all these factors in mind, this investment might well be of a venture nature if the actual P/S is over 20. The stock could be interesting to investors who are ready to take risks.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high