IPO of Wytec International: Investment In 5G Technology

4 minutes for reading

Not every state in the US has a perfect quality level of cellular coverage. This makes the services of the companies that develop small cell networks very popular. In today's article, we will talk about one such company, Wytec International Inc.

The company specialises in developing technologies used for providing mobile communication services to small residential areas. In December 2021, the company filed for an IPO on the NASDAQ under the "WYTC" ticker symbol.

What we know about Wytec International

Wytec International Inc. develops small cell technologies that help to deploy 5G and LTE network coverage in the US. The company provides 5G network services for both households and entire towns/cities.

To build network projects, Wytec International applies technological solutions that use the capacities of several 5G equipment suppliers simultaneously combined with its proprietary small cell system LPN-16.

The key offerings of the company include its proprietary service LTE SmartDAS and the data transmission technology LPN-16. Wytec's clients are private and government agencies that want to upgrade their wireless network parameters.

Wytec International is planning to cooperate with mobile virtual network operators (MVNO). They will have the opportunity to use the company's technologies in their actual offers. Wytec International's product integration into services and systems of MVNOs is one of the company's major competitive advantages.

The issuer managed to tie up a contract with Laredo, Texas, to upgrade small cell solutions in 42 buildings. Wytec International is currently in talks with prospective clients also from other states to expand its business.

It should be noted that Wytec International's services are in demand not only in the US but also in other countries, which opens prospects for its business expansion worldwide. During several rounds of financing, the company raised over $22 million.

What are the prospects of Wytec International’s target market?

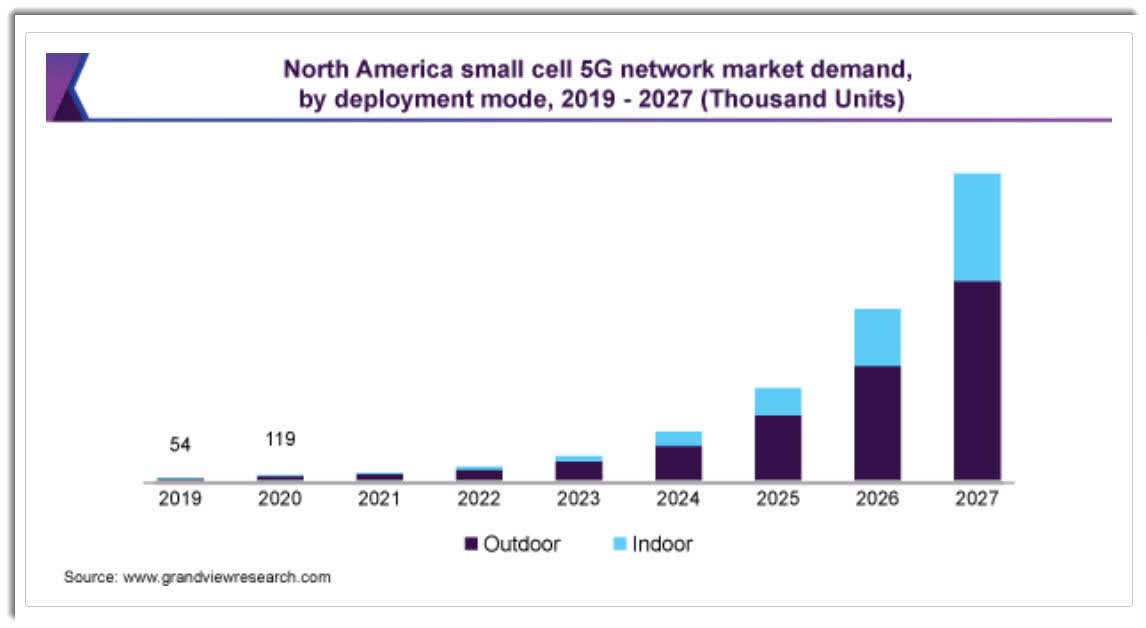

According to Grand View Research, the global market of 5G products and services for small cells in 2019 was estimated at $310.8 million. Grand View's report states that the market is expected to reach $30.8 billion by 2027, which would result in an average annual growth rate of 77.6%.

The key factors for target market growth are the rising demand for a quick connection to mobile data transmission, and mobile network operators' need for network expansion. The diagram below shows historical and predicted small cell 5G demand.

Wytec International's competitors are high-profile internet providers, small cell equipment suppliers, mobile network operators, and other companies in this industry.

How Wytec International performs financially

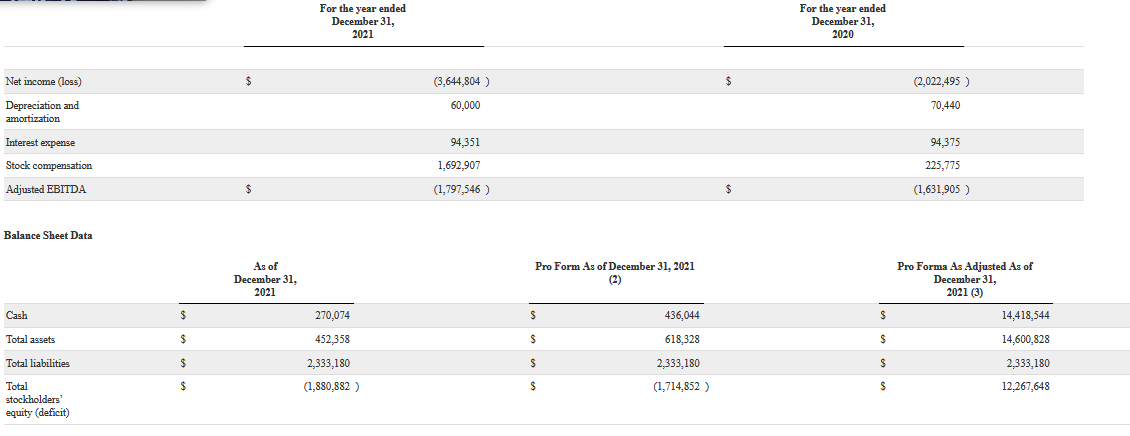

At the time of the IPO, the issuer had not generated any net profit, which is understandable for young companies at their early stage of development. We will therefore analyse Wytec International's financial performance with its revenue. In 2021, the company's sales were $0.394 million, which is only one-third of the 2020 number.

The company is actively growing its customer base and looking for new development paths. Wytec International expects the average check and the total sales figures to increase in the nearest future because the demand for 5G technologies is bound to increase in the US and worldwide.

The issuer's net loss in 2021 was $6.73 million – this is a 19.12% increase in comparison with 2020. As of 31 December 2021, Wytec International's total liabilities were $2.3 million, and the cash equivalents on its balance sheet were $0.163 million.

Strengths and weaknesses of Wytec International

The company's strengths are:

- Proprietary technology

- The company is investing a lot of money in product development

- Strategic development plan

- Prospective target market

- Sound management

The list of weaknesses is much shorter: declining revenue, no net profits, and strong competitors.

What we know about the Wytec International IPO

The underwriters of the IPO are EF Hutton and Benchmark Investments, LLC. The issuer is planning to sell 3.8 million shares at the price of $4.25 per share. The IPO volume might be about $16.15 million. If the IPO is a success, the company's capitalisation might be about $76.83 million.

Since the company doesn't generate net profit, to assess its prospects we use a multiplier – the Price-to-Sales ratio (P/S ratio). The issuer's P/S value is 195. We may assume that investors are more interested in the growth prospects of the business than its present results. Hence, buying Wytec International shares is a classic venture investment.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high