Elate Group IPO: Transport Company From New York

4 minutes for reading

Today, we will analyse Elate Group, Inc., which operates as a moving and storage services, and transport company. It is entering NASDAQ on 27 January under the ticker ELGP. Let's get acquainted with the company’s business, the prospects of its target market, its main competitors, its financial performance; and its strengths and weaknesses. We will also look at all the details of its IPO.

Brief information on Elate Group

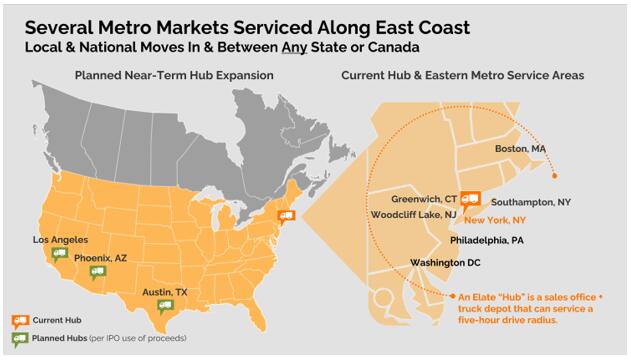

Elate Group, Inc. is an American transport company providing a wide range of moving and storage services including residential packing and moving, as well as transportation and delivery services both within and outside the US. The company was founded in 2013 in New York, and its head office remains there.

Elate Group, Inc. is managed by one of its founders, Kevin Britt. Prior to founding the company, Britt worked as a licensed investment advisor at Fordham Financial Management, Inc.

Relocation services include dismounting, mounting, packing, and unpacking of any cargo. The company manufactures a variety of special packaging for expensive, fragile, or large items; and provides long-term and short-term storage of cargo. Moreover, clients can order professional cleaning services for their place of relocation. Finally, Elate Group services VIP clients with a more individual approach, including the provision of domestic concierge services.

Elate Group’s client base comprises numerous private corporations and state organisations, among which the following are worth noting: Trump International Hotels Management, U.S. Social Security Administration, Sotheby’s International Realty, U.S. Drug Enforcement Administration (DEA), Four Seasons Hotel New York (Downtown Manhattan), United States Military Academy (West Point), New York State Insurance Fund, Keller Williams Real Estate, New York Department of Motor Vehicles, New York State Office of General Services.

On 30 September 2022, the sum of investments gathered by Elate Group amounted to 0.73 million USD.

Prospects of Elate Group’s target market

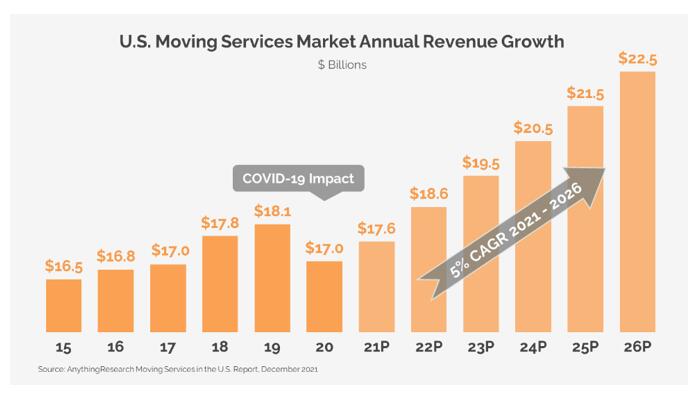

According to Berkshire Select’s Anything Research, the transportation market in the US will have reached 22.5 billion USD by 2026. Thus, the average yearly growth of the market in 2022-2026 will be 5%.

The largest part of the market, which is 61%, belongs to private transportation, while commercial orders account for 16%, and transportation of special cargo accounts for the remaining part.

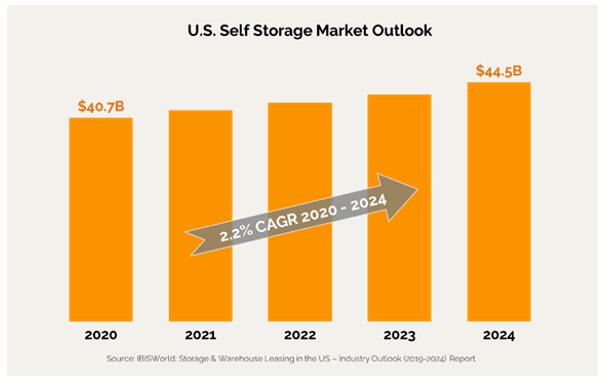

According to IBISWorld, the market for temporary storage will have reached 44.5 billion USD by 2024. The average yearly growth in 2022-2024 will amount to 2.2%.

The main competitors of the issuer are:

- United Parcel Service, Inc.

- FedEx Corporation

- J.B. Hunt Transport Services, Inc.

- Expeditors International in Washington, Inc.

- C.H. Robinson Worldwide, Inc.

- GXO Logistics, Inc.

- Landstar System, Inc.

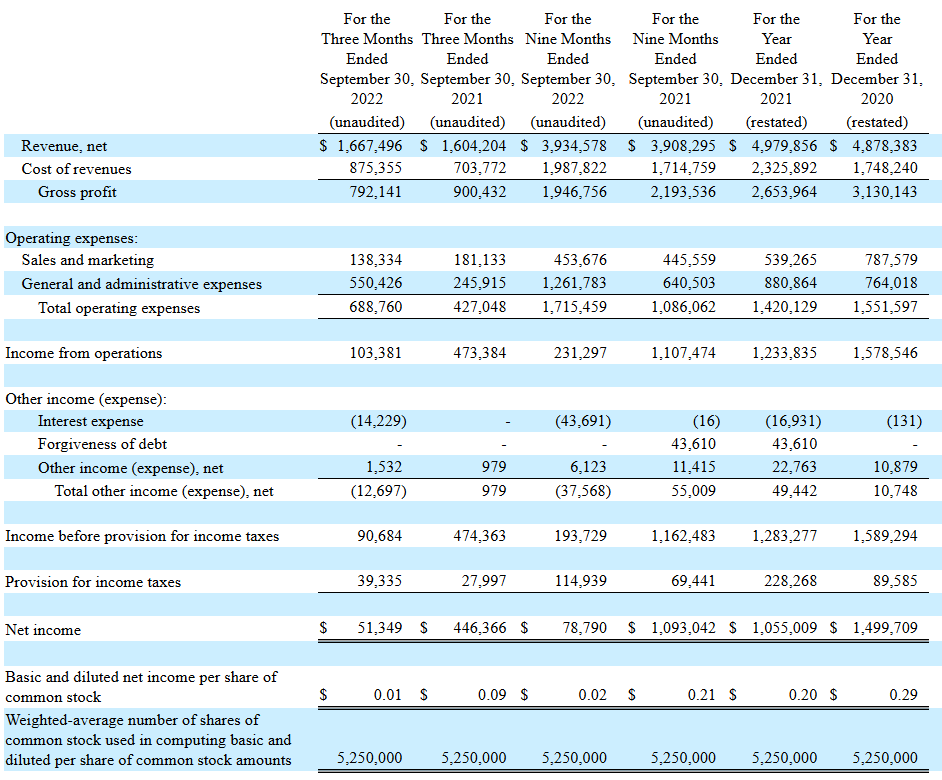

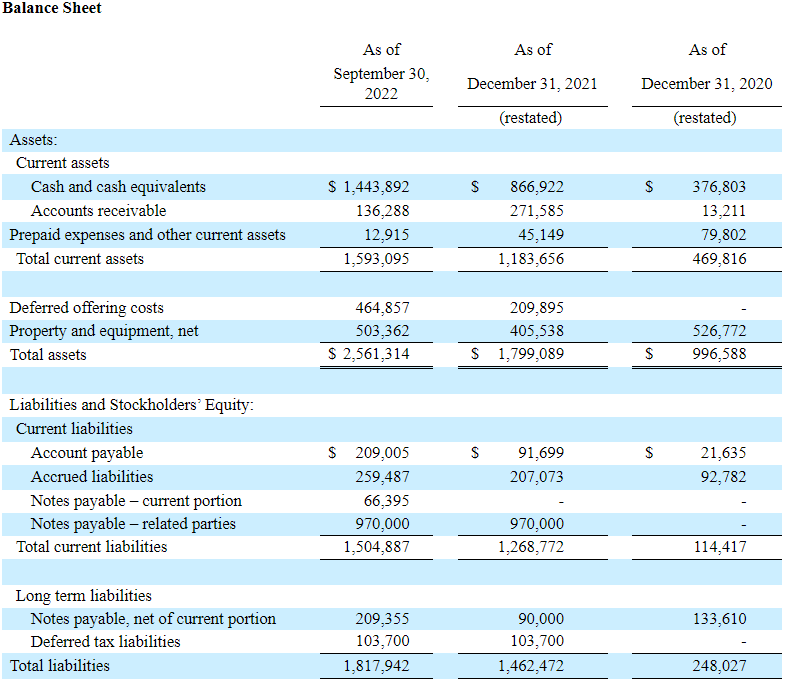

Financial performance of Elate Group

According to the S-1 form submitted by Elate Group in 2021, net profit dropped by 29.65% to 1.06 million USD compared to 2020. Over the nine months in 2022, net profit fell by 92.77% to 78.79 thousand USD. This decline is explained by the gas crisis in the US and the growth of the primary cost of services.

The issuer's revenue reached 4.98 million USD in 2021, which is 2.1% higher than in 2020. After nine months in 2022, the result grew by 0.67% to 3.93 million USD.

On 30 September 2022, the net cash flow was positive, reaching 0.87 million USD. At that moment, the company had a balance of 1.44 million USD, with 1.82 million USD in liabilities.

Strengths and weaknesses of Elate Group

Strengths:

- Promising target market

- State organisations as clients

- Renowned companies as clients

- High-qualified management

- Simple and clear business model

- Net profit

Weaknesses:

- High competition

- Falling net profit

- Dependence of financial performance on fuel prices

What we know about the Elate Group IPO

The underwriter of the Elate Group IPO is Aegis Capital Corp. The issuer plans to sell 1.3 million normal shares for an average price of 6.25 USD each. Gross revenue from selling the shares should amount to 8.13 million USD, with options sold by the underwriter excluded. The market capitalisation of the company might reach 44.15 million USD.

The P/S multiplier of the issuer might reach 8.81. The average P/S for transport companies in the US is 14.11. The upside of the securities during the lockup period might reach 60.2% ((14,11/8,81−1)*100%).

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high