IPO of Hanryu Holdings: Multi-media Platform for Fans

4 minutes for reading

This article focuses on South-Korean technology company Hanryu Holdings Inc., which plans to go public and list on the NASDAQ exchange on 5 May. The company has developed FANTOO, a global media platform for subcultures and fans of various cultural phenomena and celebrities.

Today we will talk about the issuer's business model, its financial situation, and the outlook for its addressable market. We will also list its strengths and weaknesses, name its main competitors, and look at the details of its IPO.

Hanryu Holdings in brief

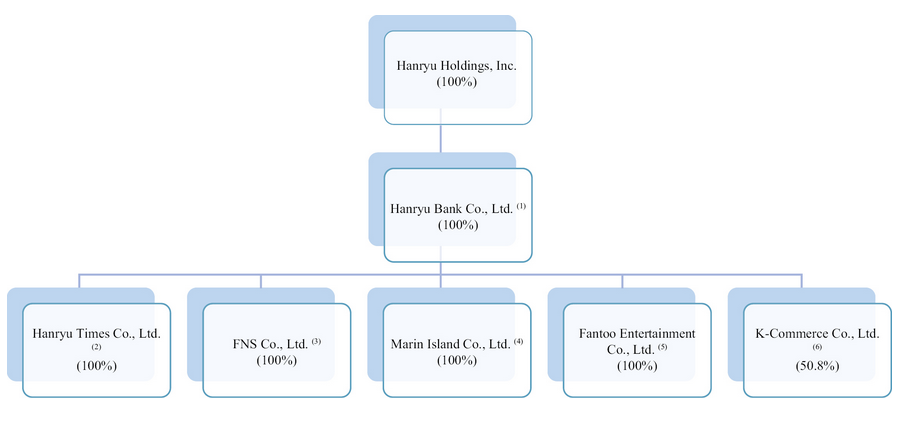

Hanryu Holdings Inc. was founded in 2018 with headquarters in Seoul, South Korea. From 2021, the CEO is Chang-Hyuk Kang, who previously held the position of auditor at Setopia Co., Ltd.

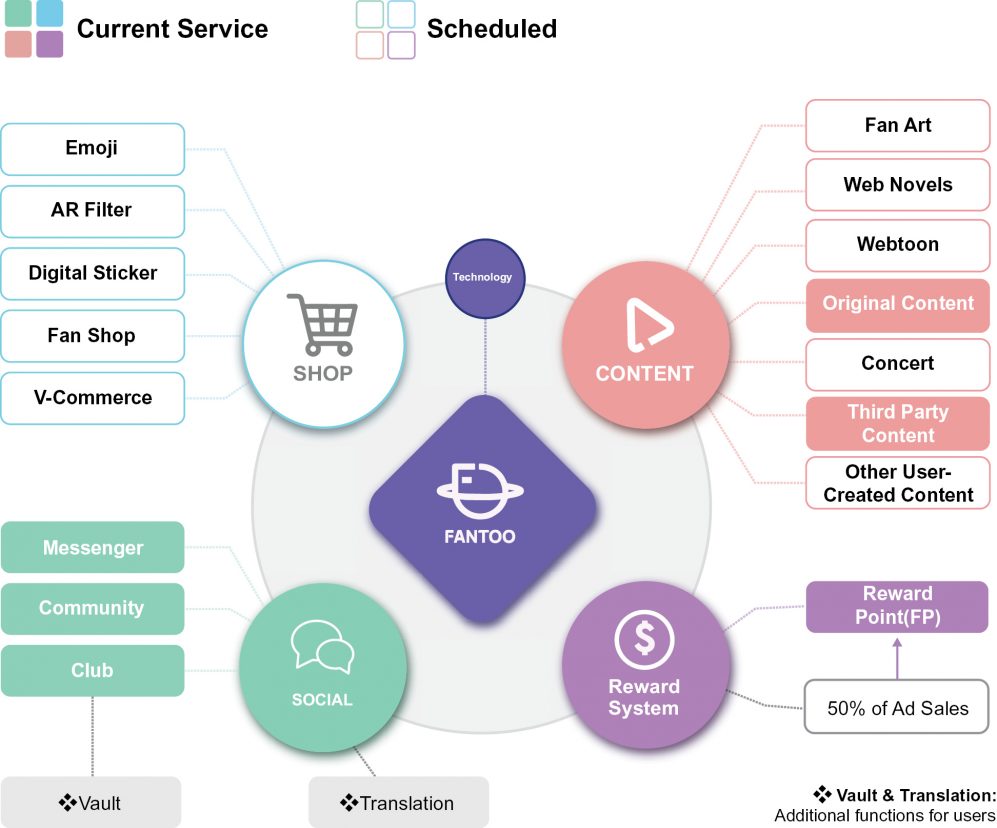

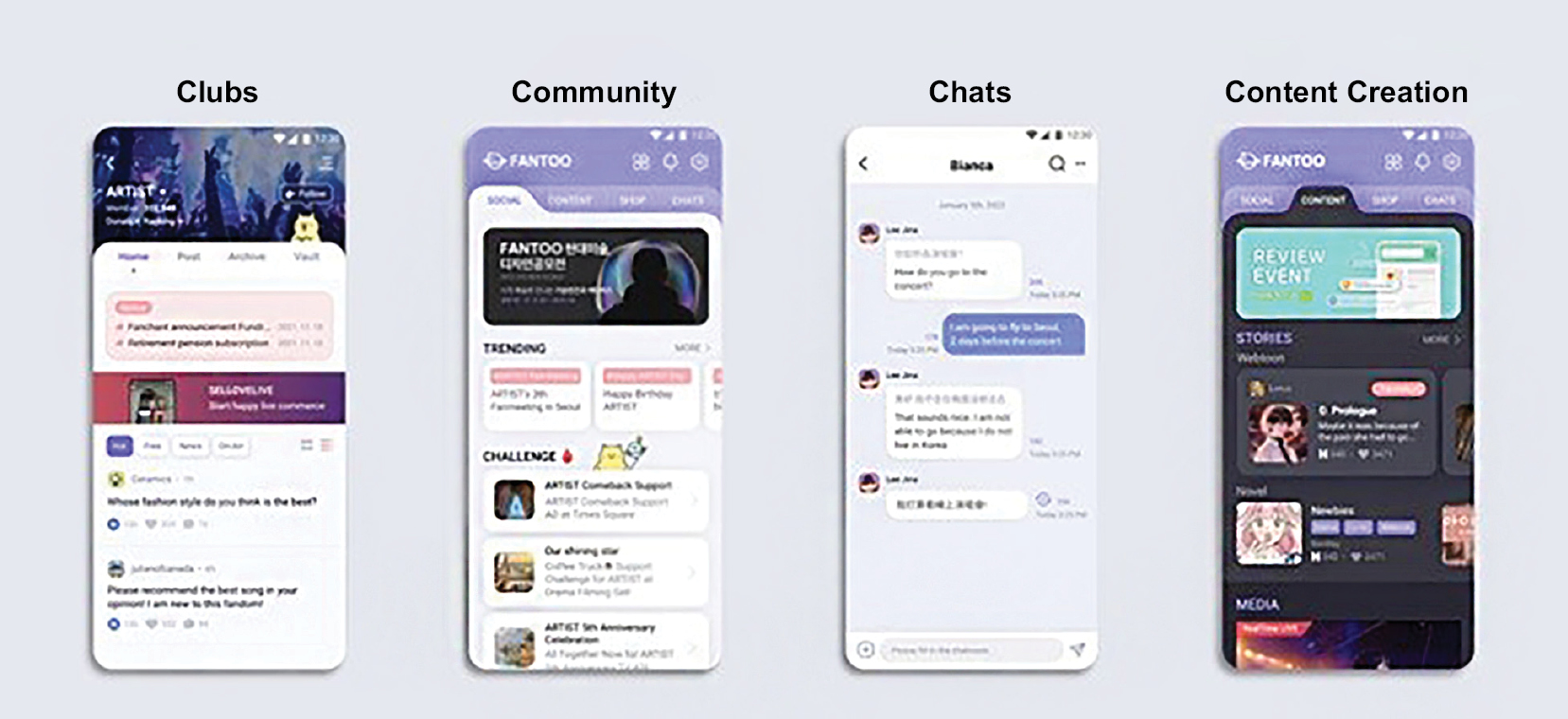

The company’s main product is the FANTOO media platform. Fans of celebrities unite into fan clubs on the platform, where they create and exchange themed content, monetise their creations, sell and buy merchandise from the fan shops, launch advertising campaigns, and communicate via messenger.

The application has its own digital currency – FP. It is distributed to the participants depending on their activity. The FP can be seen as a local digital asset within the FANTOO infrastructure.

The company earns revenue through selling ads, direct sales, and commissions from payments.

The main audience of FANTOO currently is fans of different currents of the South-Korean culture (K-culture). This phenomenon is also known as the Korean wave. The company plans in the future to enter the markets of other Asian-Pacific countries first and thereafter gain popularity in other regions.

As at 30 September 2022, Hanryu Holdings Inc. had raised investments amounting to 26.3 million USD. Its main investor is Paxnet Co., Ltd.

Prospects for the addressable market for Hanryu Holdings Inc.

According to the Korean Institute, from 2015 through 2021 the number of K-culture fans increased from 35 million to 156.6 million. Research conducted by Financial Express shows that the global market of fan activities was estimated at 10 billion USD in 2021.

Main competitors:

- Meta Platforms Inc.

- Twitter Inc.

- Reddit Inc.

- SM Entertainment Co., Ltd.

- Hybe Co., Ltd.

- Naver Corporation

Hanryu Holdings’ financial performance

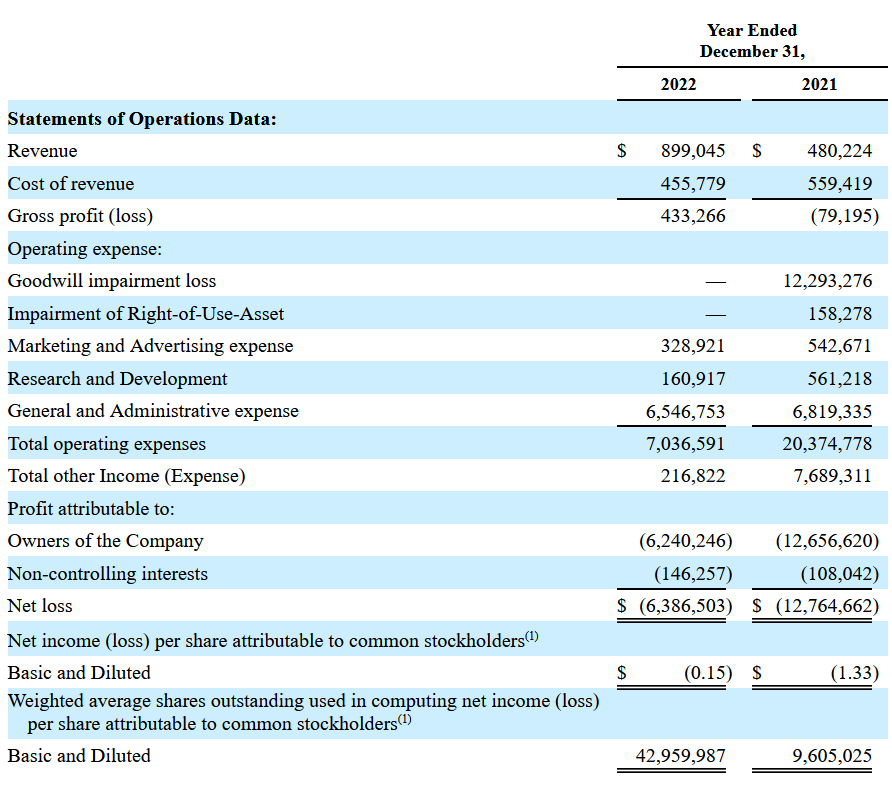

Holdings Inc’s 2022 revenue increased by 87.21% to 0.89 million USD from the figure of 2021. Net loss for the same period dropped 49.97% to 6.39 million USD.

As at 31 December 2022, Hanryu Holdings’ net cash flow was negative, amounting to 4.1 million USD. During the same period, the company had 118,950 USD in its accounts, with total liabilities reaching 7.4 million USD.

Strengths and weaknesses of Hanryu Holdings

Strengths:

- A promising addressable market

- Active young audience

- Popularity among the young

- Growing revenues

- Decreasing losses

Weaknesses:

- Intense competition

- No plans for dividend payouts

- Prevailing losses

- Lack of profits

What we know about the IPO of Hanryu Holdings

The underwriter of the IPO is Aegis Capital Corp. The securities will trade under the ticker HRYU. The issuer plans to sell 3.6 million ordinary shares at an average price of 10 USD per unit. Gross proceeds from the sale of the securities will amount to 36 million USD, excluding the sale of options by the underwriter. The firm's market capitalisation could reach 507.42 million USD.

The P/S (capitalisation/revenues) multiplier of the issuer could reach 564. This value is considered excessive for a representative of this sector. However, growth is possible during the lockup period if market conditions are favourable.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high