IPO of SolarJuice: Solar Panels in Australia

4 minutes for reading

The world is living through the transition to green energy. Most countries with developed economies are updating their infrastructure of renewable energy sources with the aim to optimise their expansion, and thereby reduce harmful emissions in the atmosphere.

Solar panels are growing more and more popular in regions boasting sunny weather throughout the year, or at least where it is sunny on most days of the year. The solar panels are mounted in the open, either on rooftops or in solar farms that are large-scale installations of solar photovoltaic (PV) panels on the ground. To stimulate such initiatives, many governments have introduced tax incentives.

Today we will get acquainted with SolarJuice Co. Ltd., a manufacturer, and distributor of solar panels and accessories. The company will enter the NASDAQ exchange on 9 February under the ticker SJA. In this article, we will present the business model of SolarJuice Co. Ltd., the prospects of its target market, its main rivals, its state of finance, its advantages and drawbacks, and the details of its IPO.

What we know about SolarJuice

SolarJuice Co. Ltd. manufactures, distributes, and mounts solar panels and related accessories. The company was founded in Australia in 2017, and its head office is in Sidney.

The issuer operates throughout Australia, New Zealand, and in five US states, namely California, Colorado, Nevada, Florida, and Texas. To enter the US market, SolarJuice acquired Petersen-Dean Inc. In the US, the company's product is known under the brand Solar4America, and in New Zealand as SJ Australia.

The company is managed by its CEO Hoong Khoeng Cheong, previously CEO at SPI Energy.

The main products of SolarJuice are:

- solar panels

- solar inverters

- batteries

- accessories

California hosts the production powers for manufacturing solar modules. The main sales market is Australia, generating 75% of the total revenue of the issuer. When this article was written, the company had 5,000 clients and was planning to increase its presence in the US market.

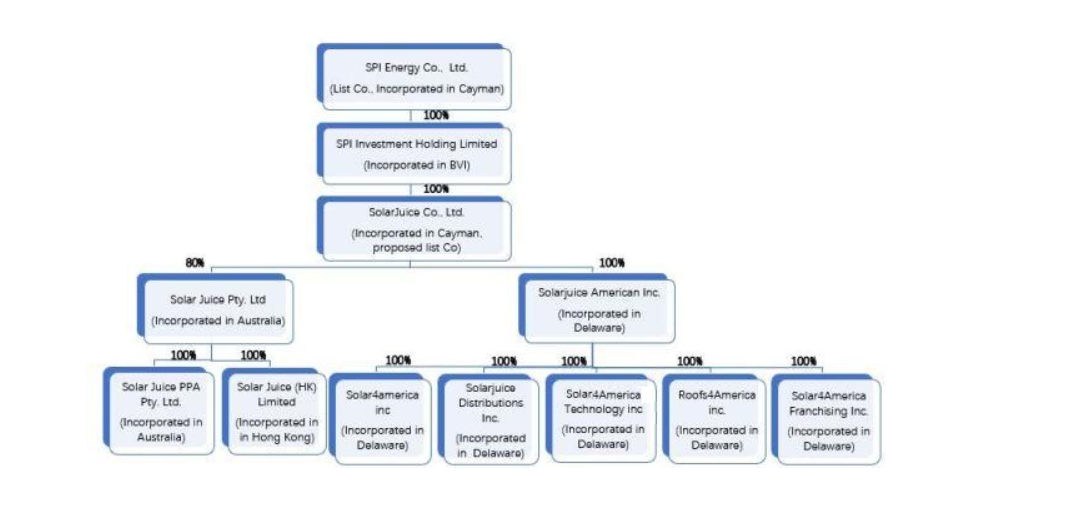

By 30 June 2022, SolarJuice Co. Ltd. had attracted 35 million USD of investments. The main investor is SPI Investments Holding Limited.

Prospects of the SolarJuice target market

According to IBISWorld, in 2022 the Australian solar panel market amounted to 3.3 billion USD and the North American market to 9.7 billion USD. Mordor Intelligence forecasts that the average annual growth of this market in 2023-2028 inclusive will be 20.56%.

These markets are expected to get stimulation from the government and various special programmes. For example, the Australian government plans to increase the volume of produced energy to 960 MW in 2023.

The main competitors of SolarJuice are:

- AGL Energy Limited

- Infigen Energy Ltd.

- Neoen SA

- First Solar Inc.

- SunPower Corporation

- Tindo Solar Pty. Ltd.

- Trina Solar Co. Ltd.

Financial performance of SolarJuice

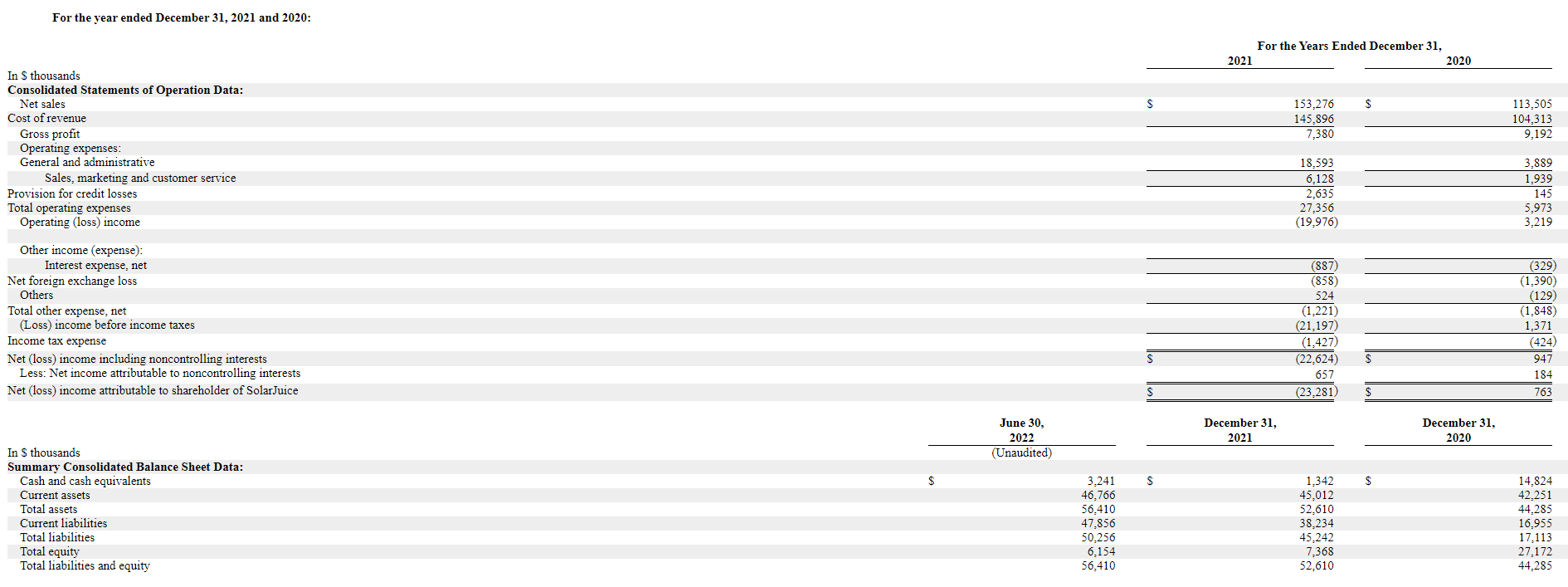

In 2021, the revenue of SolarJuice Co. Ltd. amounted to 153.28 million USD, which was 35.03% more than in 2020. By the end of the first half of 2022, this index grew by 7.55% to 81.52 million USD. From July 2021 to June 2022 inclusive, the revenue amounted to 158.99 million USD.

The net loss of the issuer in 2021 amounted to 23.28 million USD, while in 2020 the profit was 0.76 million USD. In the first half of 2022, the net loss dropped by 90.86% to 0.78 million USD.

The net cash flow on 30 June 2022 was negative, at 8.4 million USD. At the same moment, the company had 3.2 million USD on its accounts and 51.3 million USD in total liabilities.

Strengths and weaknesses of SolarJuice

Strengths:

- Promising target market

- Stable client base

- Qualified management

- Simple and clear business model

- Growth of revenue

- Shrinking net loss

Weaknesses:

- High competition

- No net profits

- Dependence on state support

What we know about the SolarJuice IPO

The underwriter of the SolarJuice Co. Ltd. IPO is Maxim Group, LLC. The issuer plans to sell 2.5 million normal shares for less than 8 USD each. The gross revenue from the sales should amount to 20 million USD, with options sold by the underwriter excluded. The capitalisation of the company might reach 220 million USD.

The P/S multiplier might reach 1.38. Note that the average P/S of companies dealing with the production and mounting of solar panels is 4.61. The upside of the stock during the lockup period might reach 234.06% ((4.61/1.38−1)*100%).

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high