IPO of Ultimax Digital: Video Games and NFTs

4 minutes for reading

The hero of this article - Ultimax Digital, Inc. – develops video games and a marketplace for selling non-fungible tokens (NFTs). The corporation plans to enter NASDAQ on 28 February under the ticker NFTU.

Let’s go into detail about Ultimax Digital, Inc.’s business model, the prospects of its addressable market, name its main competitors, analyse its financial situation, list its strengths and weaknesses, and the details of its upcoming IPO.

What we know about Ultimax Digital

Ultimax Digital, Inc. specialises in the development of video games and a marketplace for NFTs and creates the infrastructure to integrate payment solutions for buying NFTs in other developers' video games.

The company was founded in 2018 in the US, and its head office is in New York. The CEO is Jesse Sutton who held the same role at Majesco Entertainment Company.

Let us take a closer look at each of the areas of the issuer's business. Let's start with video game creation, which is handled by the Ultimax Game Studio division. The first free-to-play multiplayer fantasy game, StoneHold, has already been developed. Before that, it bought Geminose, which was adapted for the Nintendo Switch. The company plans to continue buying finished products from third-party developers and market them under its brand.

Ultimax NFT Marketplace handles the developing and launching of the NFT Marketplace. The management expects this platform to become a place where users can purchase tokens outside of the context of video games. For this purpose, the company plans to cooperate with artists and publishers of comic books. The marketplace is scheduled to launch at the end of the first quarter of this year.

The third vector is the creation of Ultimax NFT Toolkit, a payment system for buying tokens and a studio for generating them. The release of this product is announced for the second quarter of 2023. The Ultimax NFT Toolkit and marketplace should be fully operational in StoneHold, the development of which has already been completed. The beta version will be available on the Gamers First platform.

By 30 September 2022, the amount of investment Ultimax Digital, Inc. has raised has reached 2.6 million USD. The main investors are Level Up Revocable Trust, Pamar Irrevocable Trust and Symar Irrevocable Trust.

Prospects of Ultimax Digital target market

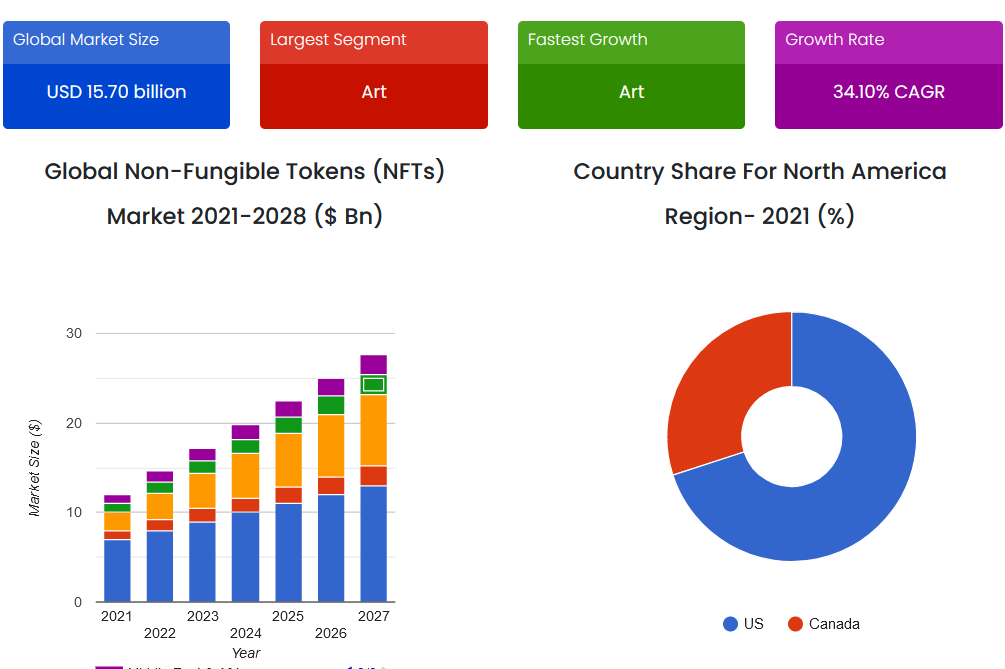

According to SkyQuest Technology, the global NFT market valuation in 2021 was USD 15.7 billion. It is expected to reach USD 122.4 billion by 2028. The projected compound annual growth rate (CAGR) from 2022 to 2028 is 34.1%.

According to a PwC study, this figure was 235 billion USD in 2022. By 2026, it is expected to increase to USD 321 billion. Thus, the projected compound annual growth rate (CAGR) from 2022 to 2026 is 17%.

The main drivers of this market's expected growth could be the increasing popularity of digital artwork, the scaling up of token integration in the entertainment industry.

Main competitors:

- Coinbase Global, Inc.

- Ozone Networks, Inc.

- Larva Labs, LLC

- Cloudflare, Inc.

- Dapper Labs, Inc.

- Binance Holdings Ltd.

- Takung Art Co., Ltd.

- The NFT Gaming Company Inc.

- Dolphin Entertainment, Inc.

Financial performance of Ultimax Digital

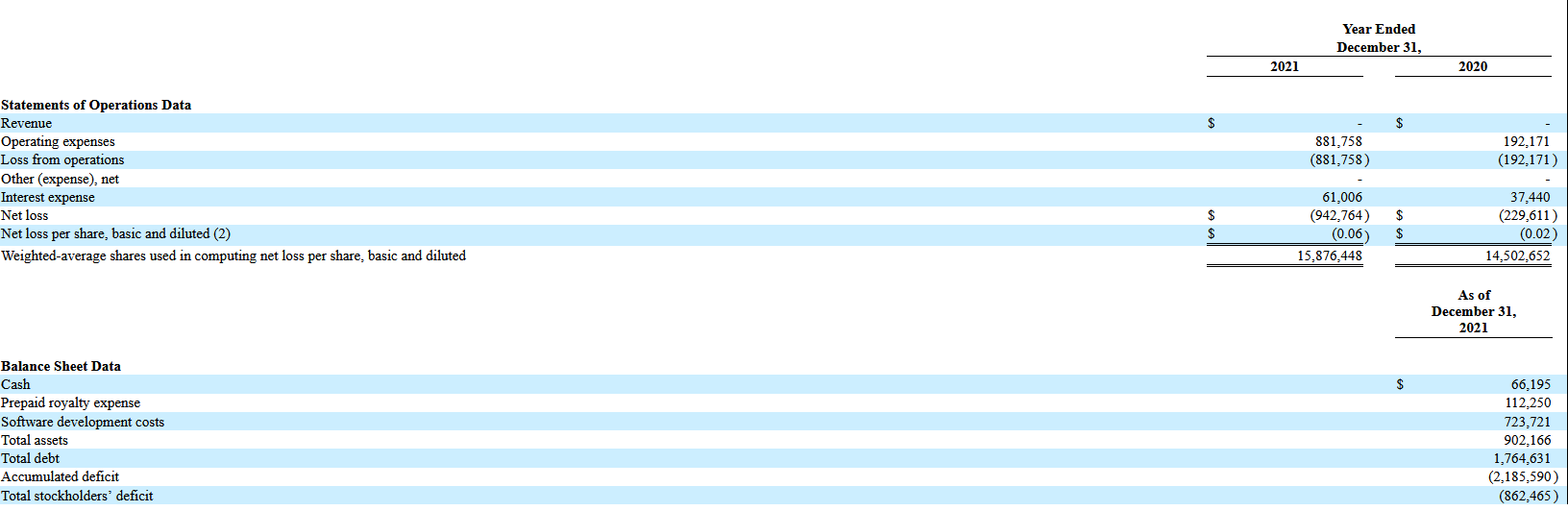

Ultimax Digital, Inc. was not generating any revenues at the time of writing. Operating expenses in 2020 were USD 192.17 thousand, and in 2021 the figure was USD 881.76 thousand. As of 30 September 2022, the corporation had 157.5 thousand USD in its accounts, with total liabilities of 3.1 million USD.

Strengths and weaknesses of Ultimax Digital

Strengths:

- Qualified management

- High growth rate of the addressable market

- Monetisation of the product via NFT

- Growing popularity of NFT

- Diversification of the addressable market

- Development of metaverses

Weaknesses:

- Strong competition

- No revenue

- The issuer does not plan to pay dividends

What we know about the Ultimax Digital IPO

The underwriter for the IPO of Ultimax Digital, Inc. is Westpark Capital, Inc. The issuer plans to sell 3.75 million common shares at a suggested average price of USD 4 per unit. Gross proceeds from the sale of securities will amount to USD 15 million, excluding the sale of options by the underwriter. The company may reach a capitalisation of USD 71.5 million. The firm does not generate any revenues, so it is difficult to analyse it through classic multiples.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high