IPO of Yoshiharu Global Co: Best Ramen in South California

4 minutes for reading

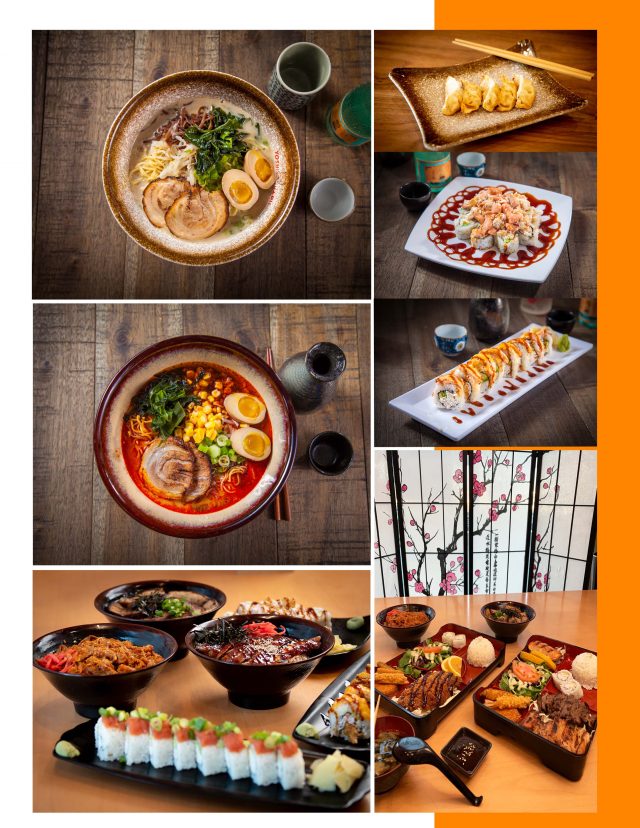

Japanese cuisine has become extremely popular in North America and Europe. It is no longer necessary to go to Japan to savor their national food: restaurants and deliveries are at your service.

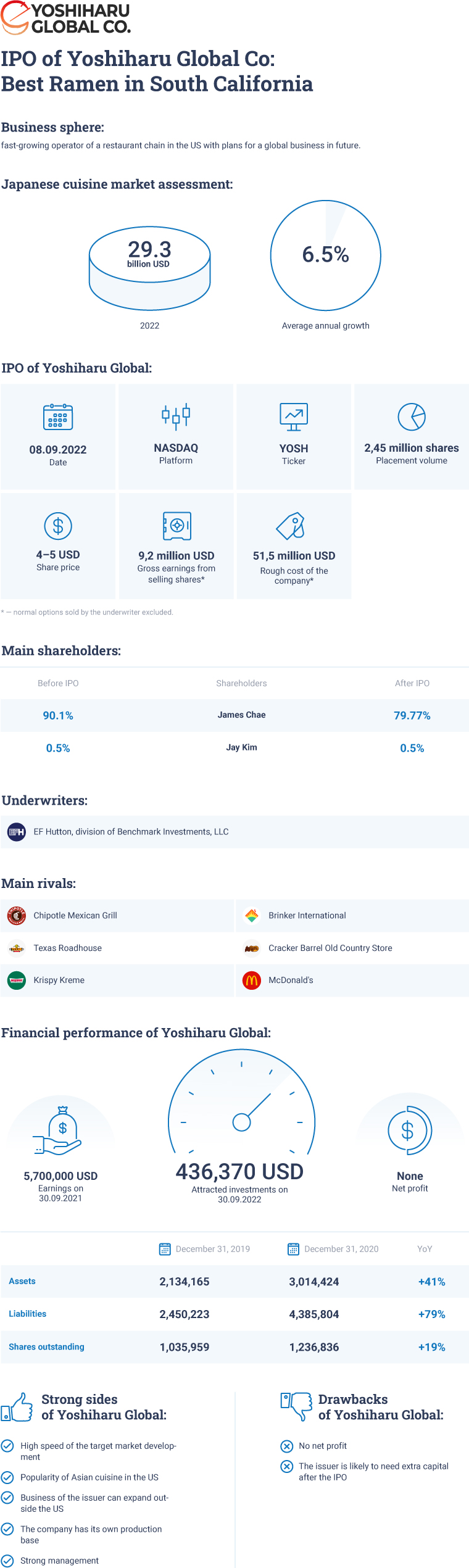

Our today's article will be devoted to a company operating a large chain of Japanese restaurants Yoshiharu Global Co. The IPO happened on 8 September at NASDAQ under the ticker YOSH.

What we know about Yoshiharu Global

Yoshiharu is a fast-developing restaurant operator whose mission is to get clients worldwide acquainted with modernised Japanese cuisine. Specialising in Japanese ramen, Yoshiharu got acknowledged as the leading restaurant in South California right after it opened in 2016. Today the Yoshiharu chain includes 8 restaurants and 1 more is under construction. The company plans to open 8 more restaurants until the end of this year, and locations for a half of them are already found. The company opens restaurants and places ads in popular malls.

The chief office of the company is in Buena Park, California. At the head of the company there stands the founder, chairman, and CEO James Chae. He has been working at Yoshiharu since it was founded in 2016, and previously he used to be President at APIIS that works in financial planning and money management.

Yoshiharu plans to launch and develop its own franchise. The management of the company expects that in the US they will be able to open up to 20 franchising restaurants a year. The company also plans to create packaged instant noodles for retail sales. All this must lead to the growth of earnings of the issuer.

On 30 September 2021, Yoshiharu Global reserved investments for a fair market price for 476.37 thousand USD total. The main investor became the CEO of the issuer James Chae. So, the issuer has quite ambitious plans for the future.

Perspectives of Yoshiharu Global target market

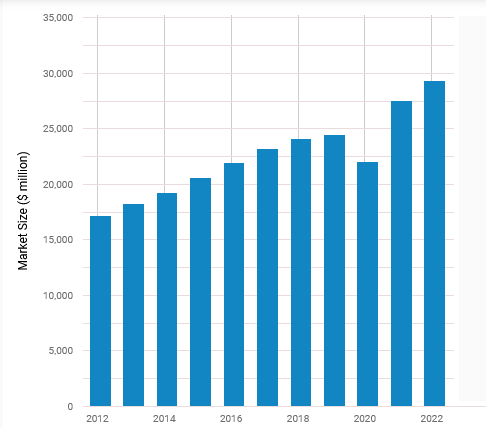

According to IBISWorld, the market of Japanese restaurants in the US is assessed for 29.3 billion USD in 2022. According to the US National Restaurant Association, earnings of restaurants in the US in 2020 amounted to 678 billion USD.

Average growth from 2017 through 2022 amounted to 6.5%.

The main rivals of the company would be:

- Chipotle Mexican Grill

- Brinker International

- Texas Roadhouse

- Cracker Barrel Old Country Store

- Krispy Kreme

- McDonald's Corp

- Wendys Co

Financial performance of Yoshiharu Global

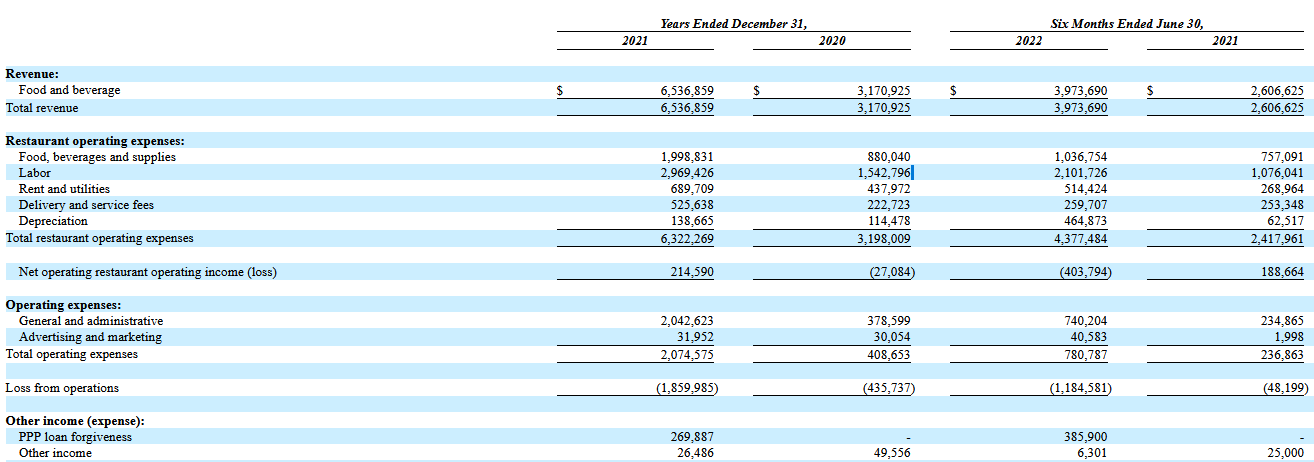

Over the first 6 months of 2022, earnings of the company amounted to 3.97 million USD — compared to the results of 2021, growth reached 52.11%. Overall earnings over 12 months was 7.90 million USD.

Net loss in 2021 amounted to 1.63 million USD — relative growth against 2020 was 262.22%. The growth was due to the increase in expenses on the product development over the named timeframe by 130.71% to 2.67 million USD.

Over the first 6 months of 2022, net loss reached 840.41 thousand USD — and relative growth against the same part of 2021 was 1284.30%. And this growth was due to an increase in wages, rents, and communal payments.

The net cash flow through the 12 months that ended on 30 September 2021 was 78.56 thousand USD.

At the end of 2021, the company had 53.29 thousand USD of cash on the accounts, while the total size of loyalties reached to 6.9 million USD.

Strong and weak sides of Yoshiharu Global

Advantages:

- High speed of the target market development

- Popularity of Asian cuisine in the US

- Business of the issuer can expand outside the US

- The company has its own production base

- Strong management

Drawbacks:

- No net profit

- The issuer is likely to need extra capital after the IPO

- Expressed growth of losses

What we know about IPO of Yoshiharu Global

The underwriters of the IPO became EF Hutton and a division of Benchmark Investments, LLC. The issuer sold 2.45 million normal shares for 4 to 5 USD each, making gross earnings of 9.2 million USD.

None of the existing or potential shareholders expressed any interest in buying the shares at the IPO prices.

After the IPO, capitalisation of the company dropped by more than 30% and reached 38.59 million USD. The P/S multiplier is 4.88. Participation in this IPO is a classical venture investment with a high level of risk.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high