Nava Health MD IPO: Premium Clinics Chain

4 minutes for reading

The development and adoption of technology have a positive impact on many life sectors, including healthcare. This applies not only to online consultations but also to innovative technologies for the diagnosis and treatment of patients.

Let's talk about Nava Health MD Inc. which owns a chain of high-tech clinics of premium quality. The company plans to carry out an IPO on the NASDAQ on 23 December 2022 under the ticker NAVA.

Brief description of Nava Health MD

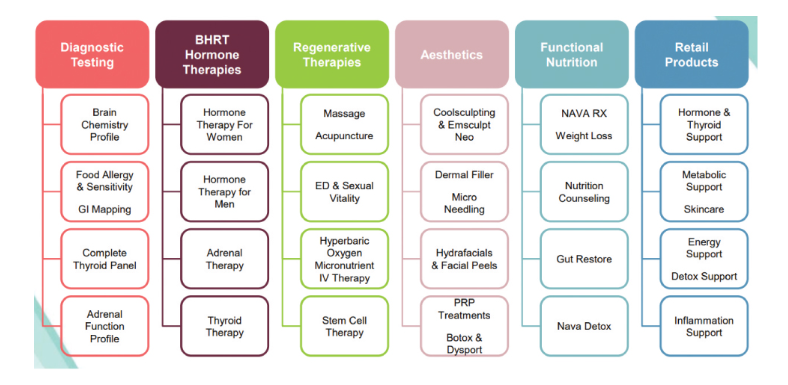

Nava Health MD Inc. was registered in 2013 in the US. It works in six main spheres:

- Bioidentical hormone replacement therapy

- Complex body diagnostics

- Regenerative therapy

- Aesthetic medicine

- Dietetics

- Production and sales of bio supplements

Since 2014, Bernie Dancel has been the CEO. He used to be a co-founder of Amerix Corporation which provides database management services. The chief physician at Nava Health MD is Douglas Lord, who has more than 40 years of experience in obstetrics and gynaecology.

Currently, Nava Health MD has four clinics in Virginia and Maryland. Also, the company provides telemedicine services in 10 states and Washington. The issuer plans to open 8 more clinics by the end of 2023.

Nava Health MD experts use an integrative approach to diagnostics, prevention, and treatment of various diseases. Moreover, the company creates and produces vitamins and bio supplements.

Thanks to the software developed by Nava Health MD experts, an individual therapy plan is outlined for every patient. The algorithms of the system are based on the therapy method designed by Douglas Lord's team.

By 30 June 2022, Nava Health MD had gathered 1.67 million USD in investment.

Prospects of Nava Health MD target market

According to Grand View Research, the global market of wellness therapy was assessed at 51 billion USD in 2021. By 2030, it is expected to reach 75.3 billion USD. The CAGR in 2022-2030 is 4.38%.

The main driver of this anticipated growth might be an increase in the demand for corporate medical services. Companies are expected to spend more on preventive healthcare tests, which are meant to increase the work productivity of their employees.

The main competitors of the company are:

- Virgin Pulse Inc.

- EXOS Inc.

- Privia Health Group Inc.

- Wellsource Inc.

- The Vitality Group Inc.

Financial performance of Nava Health MD

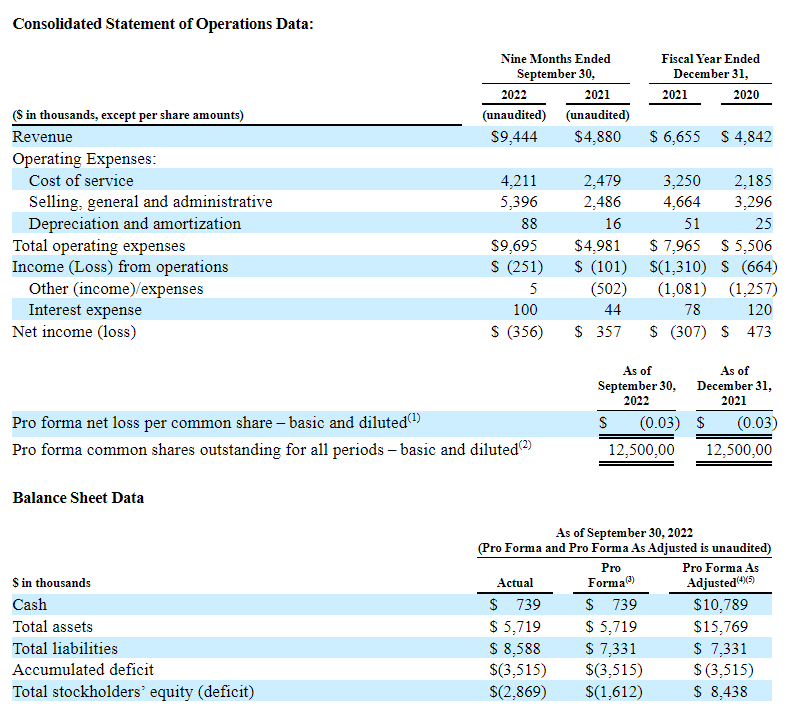

In 2021, the revenue of Nava Health MD increased by 37.44% to 6.66 million USD, compared to the statistics of 2020. From January to September 2022, compared to the same months of 2021, performance improved by 93.52%, reaching 9.44 million USD.

Net loss in 2021 reached 0.31 million USD, while in 2020 net profit amounted to 0.47 million USD. Net loss over 9 months of 2022 reached 0.36 million USD, while net profit was 0.36 million USD during the same months of 2021.

The company became losing due to serious growth of its operational expenses. For example, in the period of January - September 2022, the primary cost of goods and services compared to the statistics of the same part of last year recorded a 94.64% growth to 9.7 million USD.

On 30 June 2022, the company had 0.893 million USD in cash, while its liabilities reached 6.6 million USD.

Strengths and weaknesses of Nava Health MD

Strengths:

- Promising target market

- Fast revenue growth

- Qualified researchers

- Diversified business

- Large investments in research and development

Weaknesses:

- Strong competition

- Dependence on regulators of various states for the opening of new clinics

- No plans to pay dividends to new shareholders

What we know about the Nava Health MD IPO

The underwriter of the IPO is WestPark Capital Inc. The issuer will be selling two million normal shares. Gross earnings might reach 11.85 million USD, minus options sold by the underwriter. If the IPO is successful, the market capitalisation of Nava Health MD Inc. will reach 88.8 million USD.

The P/S coefficient can be applied for assessing the company. The current P/S is 7.91. In the current healthcare and biotech market conditions, the P/S multiplier can reach 10 during the lock-up period. In this case, the upside of Nava Health MD shares might be 26.42% ((10/7.91-1)*100%).

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high