Top 3 Companies Planning to Go Public in July 2023

5 minutes for reading

Surf Air Mobility Inc., XJet Ltd., and Med-X Inc. are on the Top 3 list of companies with the largest listings by market capitalisation scheduled for July 2023.

Today we will explore the issuers’ business models, the details of their scheduled initial public offerings, and the outlook for their target markets. We will also look at the financial position of these companies, and their strengths and weaknesses.

1. DPO of Surf Air Mobility Inc. – 597 million USD

Year of registration: 2011

Registered in: the US

Headquarters: Hawthorne, California

Sector: industrials

Date of DPO: 07.07.2023

Exchange: NYSE

Ticker: SRFM

Surf Air Mobility Inc. is involved in regional air travel in 18 US states. The issuer’s aircraft fleet is based on light turboprop aircrafts. Surf Air Mobility Inc. plans to switch to vehicles with hybrid powertrains in the near future and electric powertrains later on. The company could become one of the first fully sustainable air carriers in the country.

Investments raised (as at 31.03.2023) amount to 337.2 million USD.

The main investors are individuals, namely Liam Fayed and Sudhin Shahani.

The outlook for Surf Air Mobility’s target market

According to a report by McKinsey & Company, the US regional air travel market is valued at 15 billion USD in 2023 and could reach 22 billion USD by 2035. The compound annual projected growth rate from 2022 to 2035 inclusive is 3.2%.

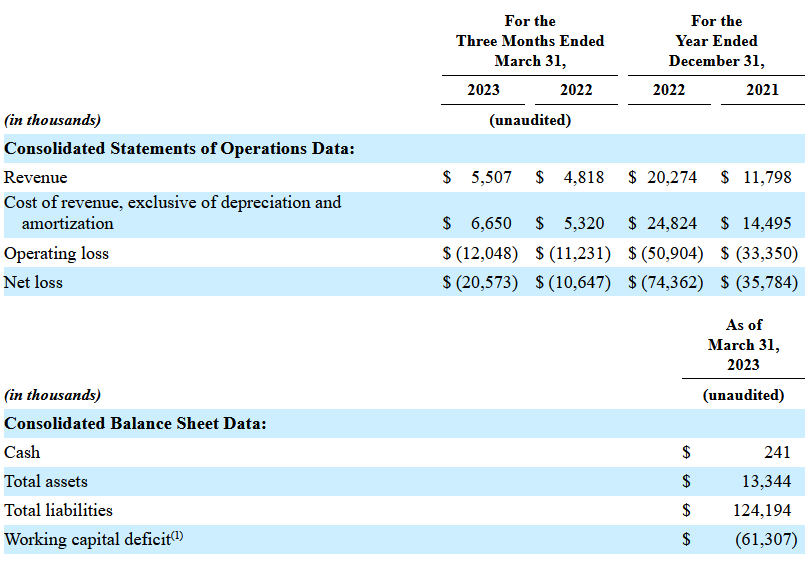

Financial performance of Surf Air Mobility

Revenue for 2022: 20.3 million USD, +71.8%

Net loss for the same period: 74.4 million USD, +107.8%

Net cash flow (as at 31.03.2023): −31.6 million USD

Cash and cash equivalents (as at 31.03.2023): 0.2 million USD

Liabilities (as at 31.03.2023): 124.2 million USD

Strengths and weaknesses of Surf Air Mobility

Strengths:

- A promising target market

- An innovative development model

- Increasing revenue

Weaknesses:

- Intense competition

- Increasing net loss

- No dividend payouts yet

Details of the Surf Air Mobility DPO

Consultant on direct listing: Morgan Stanley & Co. LLC

Volume of the DPO offering: 18.8 million ordinary shares

Average price: 11.86 USD

Gross proceeds: 222.97 million USD

Expected amount of capitalisation at the time of the DPO: 597 million USD

Potential P/S: 28.42

Average P/S value in the industry: 0.59

2. IPO of XJet Ltd. – 98.5 million USD

Year of registration: 2005

Registered in: Israel

Headquarters: Rehovot, Israel

Sector: industrials

Date of IPO: 28.07.2023

Exchange: NASDAQ

Ticker: XJET

XJet Ltd. manufactures metal parts using a 3D printer. Thanks to its proprietary technology, which involves the use of nanoparticles, the company manufactures detailed parts of complex geometric shapes.

Investments raised (as at 31.12.2022) amount to 206 million USD.

The main investors are Lucion Venture Capital Co. Ltd, ARCHina Capital Partners, and Abraxilev Ltd.

The outlook for XJet’s target market

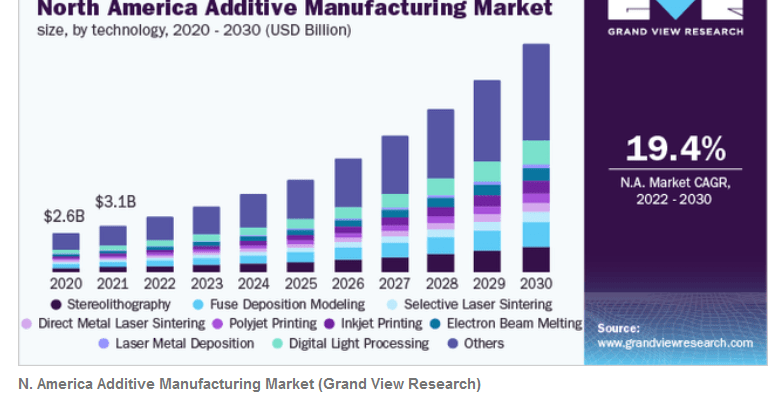

According to a report by Grand View Research, the global 3D printing market was valued at 13.8 billion USD in 2022 and could reach 75.8 billion USD by 2030. The compound annual projected growth rate from 2022 to 2030 inclusive is 20.8%.

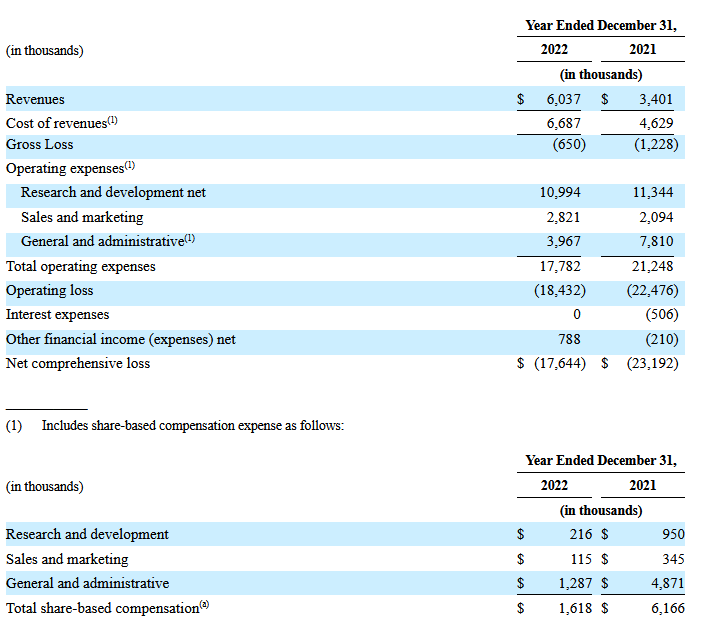

Financial performance of XJet

Revenue for 2022: 6.1 million USD, +77.5%

Net loss for 2022: 17.6 million USD, −23.9%

Net cash flow (as at 31.12.2022): −17.7 million USD

Cash and cash equivalents (as at 31.12.2022): 10.2 million USD

Liabilities (as at 31.12.2022): 14.3 million USD

Strengths and weaknesses of XJet

Strengths:

- A promising target market

- Proprietary patented production technology

- Favourable market conditions

- Increasing revenue

- Decreasing net loss

Weaknesses:

- Intense competition

- Net loss

- An early stage of the issuer’s development

Details of the XJet IPO

Underwrtiter: Aegis Capital Corp.

Volume of the IPO offering: 2 million ordinary shares

Average price: 5 USD

Gross proceeds: 10 million USD, excluding the sale of options by the underwriter

Expected amount of capitalisation at the time of the IPO: 98.5 million USD

Potential P/S: 16.33

Average P/S value in the industry: 2.07

3. IPO of Med-X Inc. – 22.8 million USD

Year of registration: 2014

Registered in: the US

Headquarters: Canoga Park, California

Sector: healthcare

Date of IPO: 13.07.2023

Exchange: NASDAQ

Ticker: MXRX

Med-X Inc. produces essential oils from natural raw materials. The main products are marketed under the Nature-Cide brand.

Investments raised (as at 30.06.2022) amount to 23 million USD.

The outlook for the Med-X target market

According to Allied Market Research, the global natural medicine market size was valued at 99.2 billion USD in 2016 and could reach 279 billion USD by 2023. The compound annual projected growth rate from 2017 to 2023 inclusive is 14%.

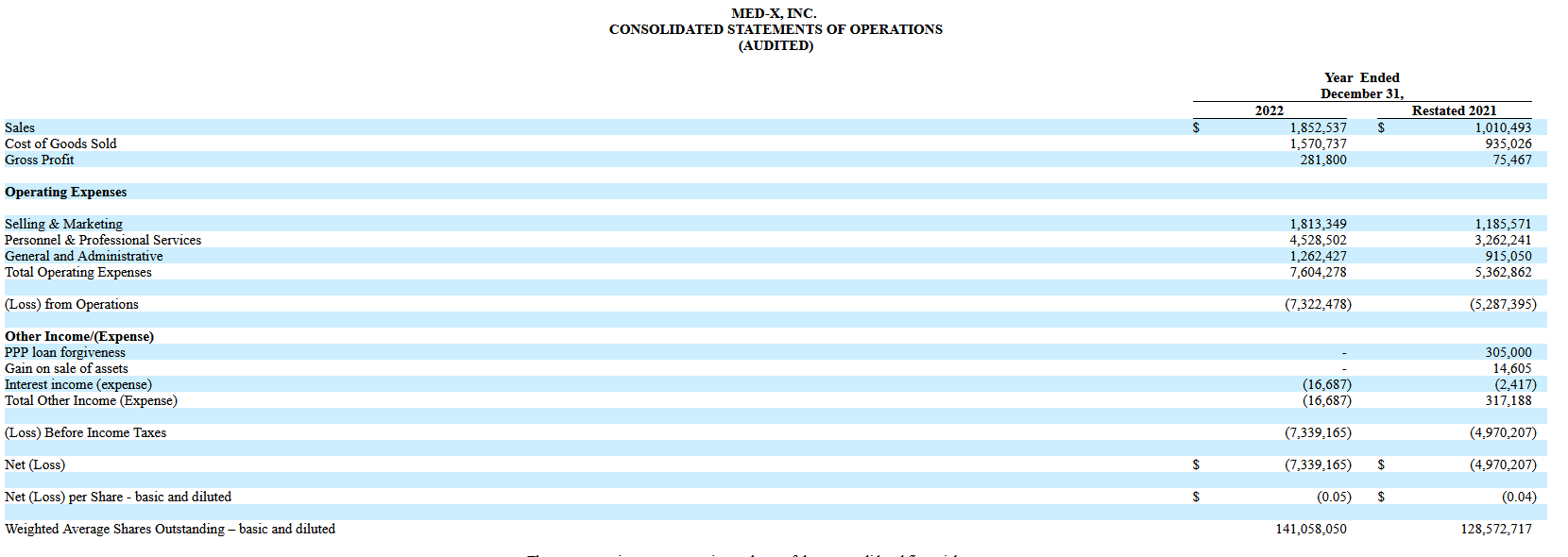

Financial performance of Med-X

Revenue for 2022: 1.9 million USD, +83.3%

Net loss for 2022: 7.3 million USD, +38.5%

Net cash flow (as at 31.12.2022): −2.5 million USD

Cash and cash equivalents (as at 31.03.2023): −4.9 million USD

Liabilities (as at 31.03.2023): 1.9 million USD

Strengths and weaknesses of Med-X

Strengths:

- A promising target market

- A diversified business

- Favourable market conditions

- Increasing revenue

Weaknesses:

- Intense competition

- Increasing debt burden

- Increasing net loss

Details of the Med-X IPO

Underwriter: R.F. Lafferty & Co. Inc.

Volume of the IPO offering: 2.13 million ordinary shares

Average price: 4 USD

Gross proceeds: 8.5 million USD, excluding the sale of options by the underwriter

Expected amount of capitalisation at the time of the IPO: 22.8 million USD

Potential P/S: 12.32

Average P/S value in the industry: 5.08

Summary

Surf Air Mobility Inc., XJet Ltd., and Med-X Inc. intend to go public in July. Their listings might be the largest placements this month in terms of expected market capitalisation. The first and second corporations represent the airline industry and special-purpose engineering industry, while the third one is involved in the healthcare sector.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high