Top 3 Largest IPOs Scheduled for May

6 minutes for reading

Azitra Inc., MDNA Life Sciences Inc., and Strong Global Entertainment Inc. are on the Top 3 list of companies with the largest IPOs by market capitalisation scheduled for this May.

Today we will talk about the issuers' business models, their financial situations, and the outlook for their addressable markets. We will also list their strengths and weaknesses and look at the details of their IPOs.

1. Azitra Inc. IPO - 65 million USD

Year of registration: 2014

Registered in: the US

Headquarters: Branford, Connecticut

Sector: healthcare

Date of IPO: 18 May 2023

Exchange: NYSE

Ticker: AZTR

Azitra Inc. develops drugs for the treatment of dermatological diseases.

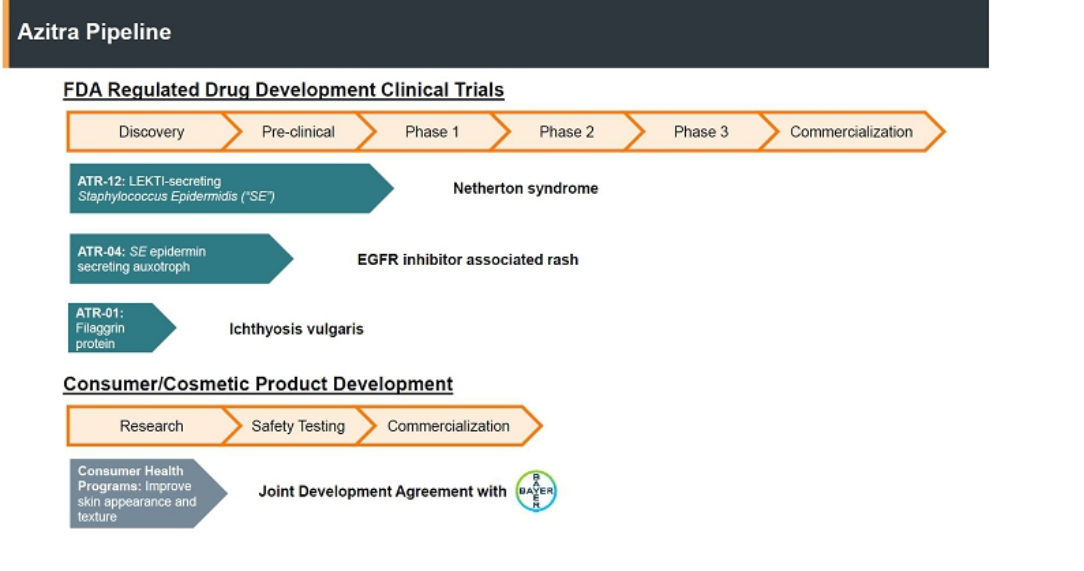

Its main drugs are:

- ATR-12 (Netherton syndrome) is at phase 1 of the clinical trials

- ATR-04 (cancer therapy-associated rash) is undergoing preclinical trials

- ATR-01 (ichthyosis) is undergoing preclinical trials

The amount of raised investment (as at 31 December 2022) is 33.7 million USD.

The main investors are BIOS Equity Partners LP, Bayer Healthcare LLC, and Connecticut Innovations Inc.

The outlook for Azitra’s addressable market

According to a Research and Markets report, the global Netherton syndrome treatment market in 2019 was valued at 19.6 million USD and is expected to reach 74.3 million USD by 2027. The compound annual growth rate (CAGR) is projected to be 20.3% from 2019-2027 inclusive.

According to Vision Research Reports, the global market of dermatological drugs was valued at 17 billion USD in 2021. The average annual expected growth rate from 2021 to 2030 inclusive is 8.8%.

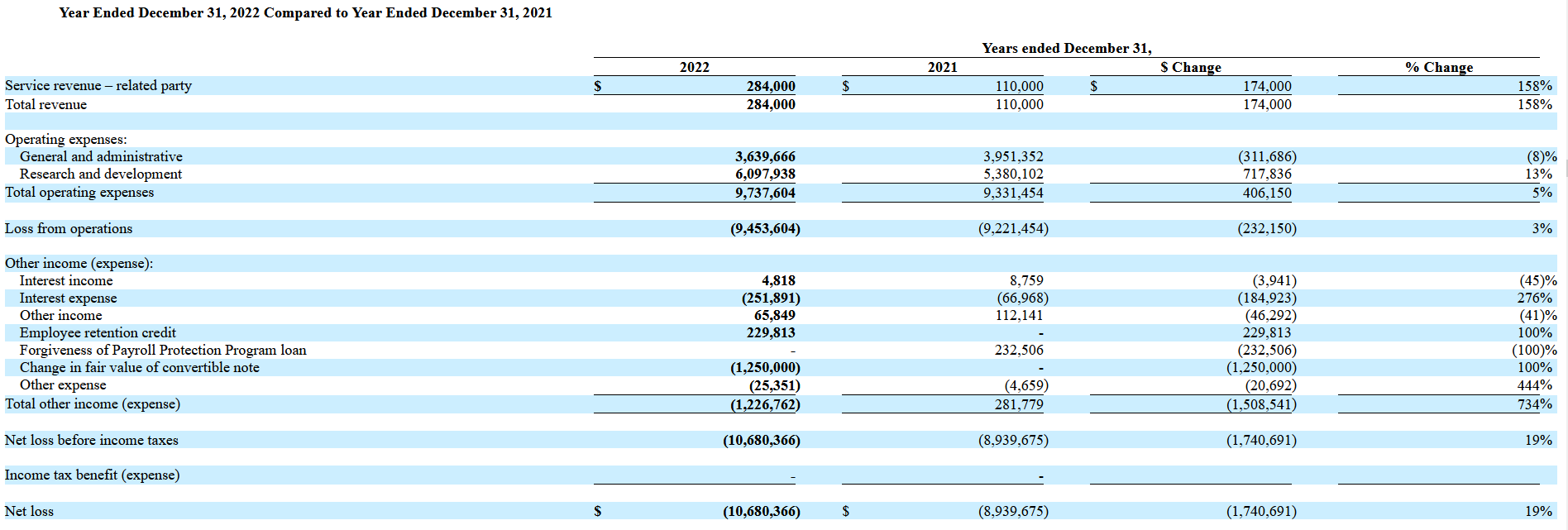

Financial performance of Azitra

Revenue in 2022 amounted to 284 thousand USD, +158%

Net loss in 2022 was 10.7 million USD, +19%

Net cash flow (as at 31 December 2022): -8.4 million USD

Cash and cash equivalents (as at 31 December 2022): 3.5 million USD

Liabilities (as at 31 December 2022): 9.7 million USD

Azitra’s strengths and weaknesses

Strengths:

- High growth rate of its addressable market

- Revenue growth

- A well-established interaction mechanism with the US regulators

Weaknesses:

- Intense competition

- Increasing net loss

- No plans for paying out dividends even if the company is generating a net profit

Details of the Azitra IPO

Underwriter: ThinkEquity LLC

Offered stock volume: 2.4 million ordinary shares

Average price: 5 USD

Gross proceeds: 12 million USD, excluding the sale of options by the underwriter

Expected amount of capitalisation at the time of the IPO: 64.8 million USD

Potential P/S (capitalisation/revenues): 228.02

Average P/S value of diagnostic test producers: 9.64

2. IPO of MDNA Life Sciences Inc. - 52 million USD

Year of registration: 2014

Registered in: the US

Headquarters: West Palm Beach, Florida

Sector: healthcare

Date of IPO: 16 May 2023

Exchange: NASDAQ

Ticker: MLDS

MDNA Life Sciences Inc. develops and produces medical tests for diagnosing various diseases even in their early stages.

The amount of raised investment (as at 30 June 2022) is 28.7 million USD.

The outlook for the MDNA Life Sciences addressable market

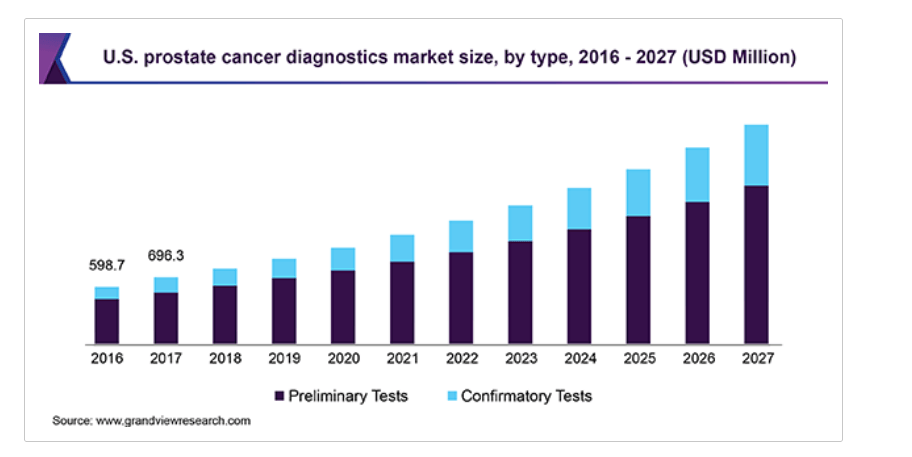

According to a report by Grand View Research, the global medical diagnostic tests market was valued at 2.8 billion USD in 2019 and could reach 7.6 billion USD by 2027. The average annual projected growth rate from 2020 to 2027 inclusive is 13.2%.

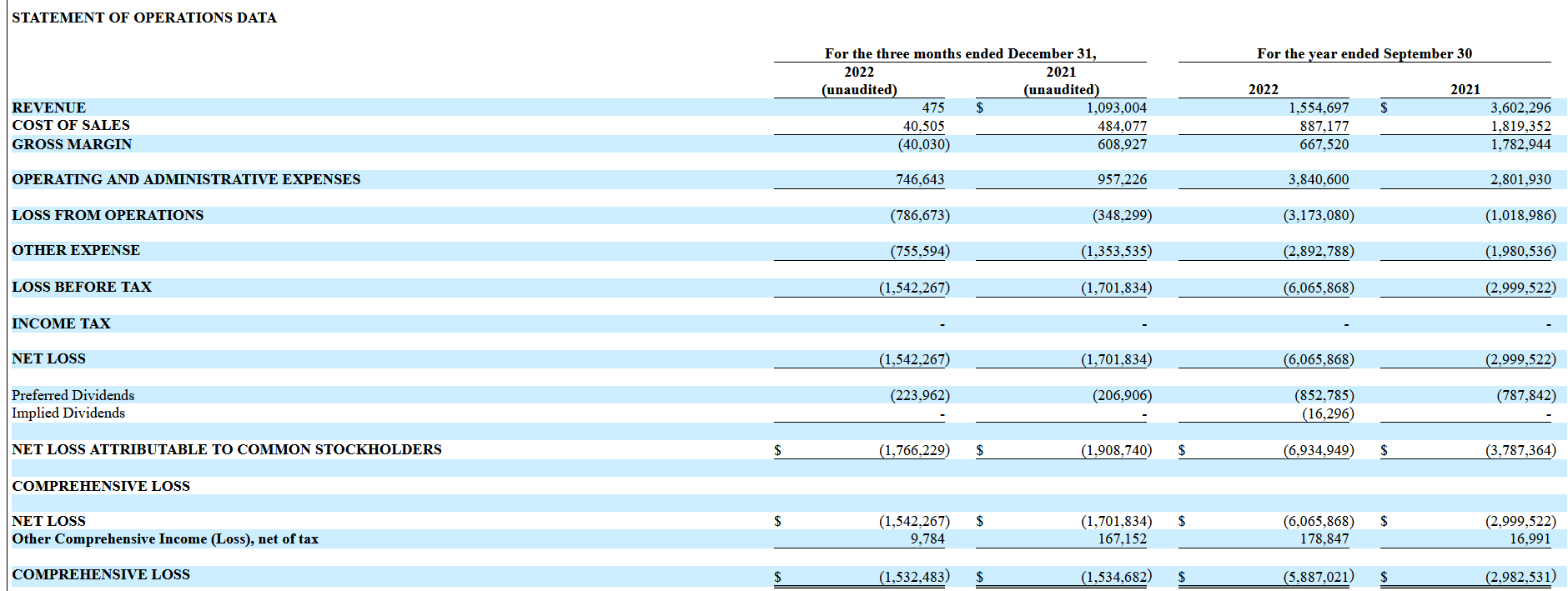

Financial performance of MDNA Life Sciences

Revenue in the fiscal year that ended on 30 September 2022 amounted to 1.6 million USD, -56.9%

Net loss for the same period was 6.1 million USD, +102.2%

Net cash flow (as at 30 September 2022): -1.9 million USD

Cash and cash equivalents (as at 30 September 2022): 38.1 thousand USD

Liabilities (as at 30 September 2022): 25.4 million USD

Strengths and weaknesses of MDNA Life Sciences

Strengths:

- A promising addressable market

- Unique technology for diagnosing cancer at an early stage

- The universal character of the developed tests for various diseases

- A well-established interaction mechanism with the US regulators

- A flexible system of discounts meant for increasing sales

Weaknesses:

- Intense competition

- Increasing net loss

- Declining revenue

Details of the MDNA Life Sciences IPO

Underwriter: EF Hutton, a division of Benchmark Investments LLC

Offered stock volume: 2.5 million ordinary shares

Average price: 5.5 USD

Gross proceeds: 13.7 million USD, excluding the sale of options by the underwriter

Expected amount of capitalisation at the time of the IPO: 51.95 million USD

Potential P/S (capitalisation/revenues): 33.52

Average P/S of biotechnology companies: 3.04

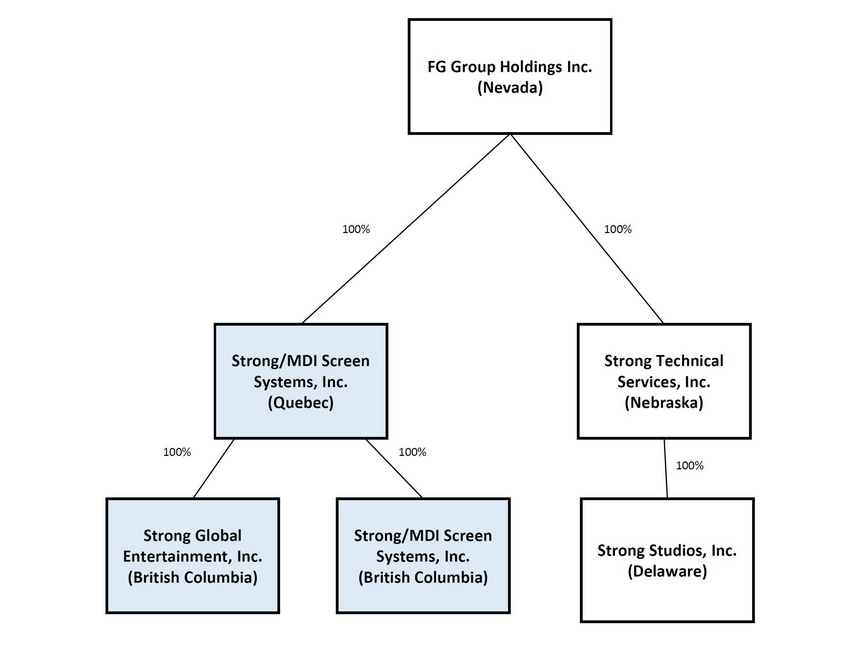

3. IPO of Strong Global Entertainment Inc. - 38 million USD

Year of registration: 2021

Registered in: the US

Headquarters: Charlotte, North Carolina

Sector: technologies

Date of IPO: 16 May 2023

Exchange: NYSE

Ticker: SGE

Strong Global Entertainment Inc. produces cinema projection screens and is the leader in this market. The company has partnerships with AMC Entertainment Holdings Inc., IMAX Corporation, and Cinemark Holdings Inc.

The amount of raised investment (as at 30 June 2022) is 13.8 million USD.

The main investor is Strong/MDI Screen Systems Inc.

The outlook for Strong Global Entertainment's addressable market

According to an Insight Partners report, the global wide-screen cinema market was valued at 7.3 billion USD in 2020 and could reach 13.5 billion USD by 2027. The projected average annual growth rate from 2021 to 2027 inclusive is 9.6%.

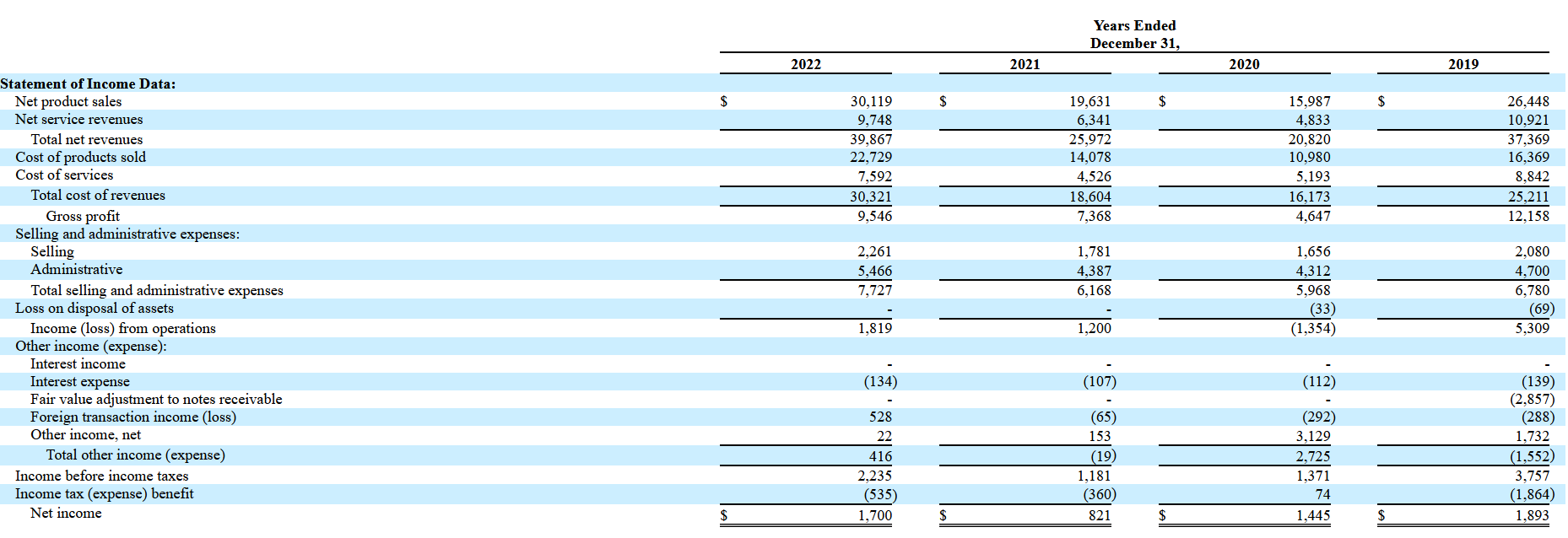

Financial performance of Strong Global Entertainment

Revenue in 2022 amounted to 39.9 million USD, +53.5%

Net profit in 2022 reached 1.7 million USD, +107.1%

Net cash flow (as at 30 June 2022): 0.82 million USD

Cash and cash equivalents (as at 30 June 2022): 3 million USD

Liabilities (as at 30 June 2022): 14.4 million USD

Strengths and weaknesses of Strong Global Entertainment

Strengths:

- A promising addressable market

- Partnerships with large cinema chains

- Leadership in the segment

- Net profit growth

- Increasing revenue

Weaknesses:

- Intense competition

- Poor diversification of business

- Strong dependence on large clients

Details of the Strong Global Entertainment IPO

Underwriter: ThinkEquity LLC

Offered stock volume: 1.6 million ordinary shares

Average price: 5 USD

Gross proceeds: 8 million USD, excluding the sale of options by the underwriter

Expected amount of capitalisation at the time of the IPO: 38 million USD

Potential P/S (capitalisation/revenues): 0.95

Average P/S value for manufacturers of wide screens: 2.47

Potential upside (stock growth potential): 160%

Summary

Azitra Inc., MDNA Life Sciences Inc., and Strong Global Entertainment Inc. are scheduled to go public in May. Their IPOs might be the largest placements this month in terms of expected market capitalisation. The first two companies are from the healthcare sector, while the third one is from the technology sector.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high