Top 3 Largest IPOs Scheduled for November 2023

5 minutes for reading

Trident Digital Tech Holdings Ltd., Planet Image International Ltd., and EV Mobility Inc. are on the Top 3 list of companies with the largest IPOs by market capitalisation, scheduled for November 2023. In this article, we will explore these issuers’ business models, examine the outlook for their target market, and the details of their scheduled initial public offerings. We will also look at the financial position of these companies, including their strengths and weaknesses.

1. IPO of Trident Digital Tech Holdings Ltd – 468.64 million USD

Year of registration: 2011

Registered in: Singapore

Headquarters: Singapore

Sector: technology

Date of IPO: 09.11.2023

Exchange: NASDAQ

Ticker: TDTH

Trident Digital Tech Holdings Ltd. works with small and medium e-commerce businesses. It designs solutions for digitising and optimising customer interactions.

Investments raised (as at 30.06.2023) amount to 36.34 thousand USD.

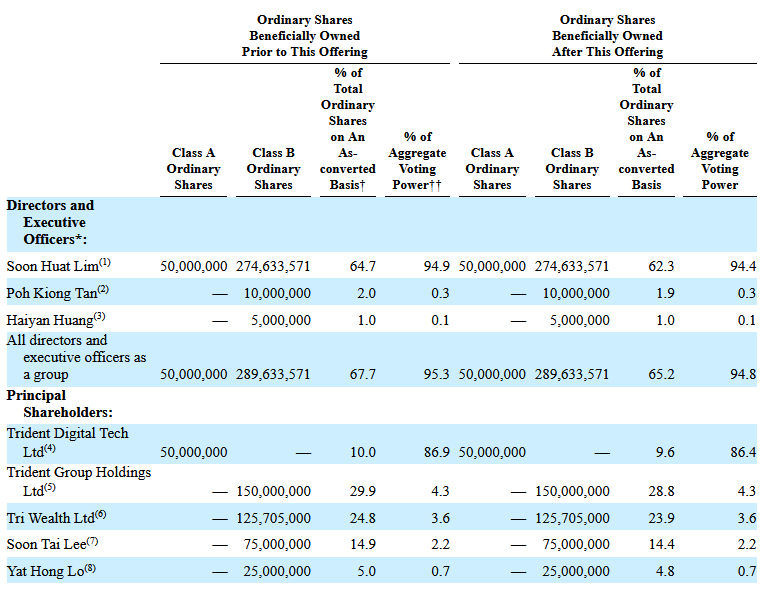

The main investors are Trident Digital Tech Ltd., Trident Group Holdings, Tri Wealth, Soon Tai Lee, and Yat Hong Lo.

Trident Digital Tech Holdings market assessment

According to a report by Frost & Sullivan, specified by the issuer in its prospectus, the global e-commerce market might be valued at 189.23 billion USD in 2023, possibly reaching 1.59 trillion by 2027. The projected compound annual growth rate from 2023 to 2027 inclusive is 70.2%.

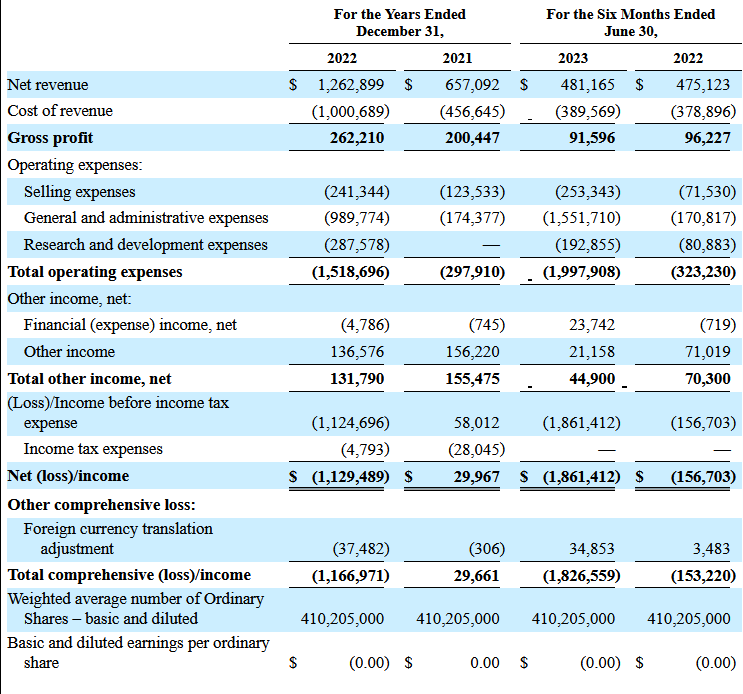

Financial performance of Trident Digital Tech Holdings

Revenue for 2022: 1.26 million USD, +92.2%

Net loss for 2022: 1.13 million USD

Net cash flow (as at 30.06.2023): 3.1 million USD

Cash and cash equivalents (as at 30.06.2023): 4.0 million USD

Liabilities (as at 30.06.2023): 11.0 million USD.

Strengths and weaknesses of Trident Digital Tech Holdings

Strengths:

- A fast-growing target market

- Company's own developments

- Increasing revenue

- An effective marketing strategy

Weaknesses:

- Intense competition

- An increasing net loss

- Absence of dividend payment plans

Details of the Trident Digital Tech Holdings IPO

Underwriter: US Tiger Securities Inc.

Offering volume: 1.9 million ordinary shares

Average price: 9 USD

Gross proceeds: 17.1 million USD

Expected amount of capitalisation at the time of the IPO: 468.64 million USD

Potential P/S: 369.01

Average P/S value in the industry: 4.51

2. IPO of Planet Image International Ltd. – 254.4 million USD

Year of registration: 2011

Registered in: Cayman Islands

Headquarters: Georgetown

Sector: consumer protection

Date of IPO: 16.11.2023

Exchange: NASDAQ

Ticker: YIBO

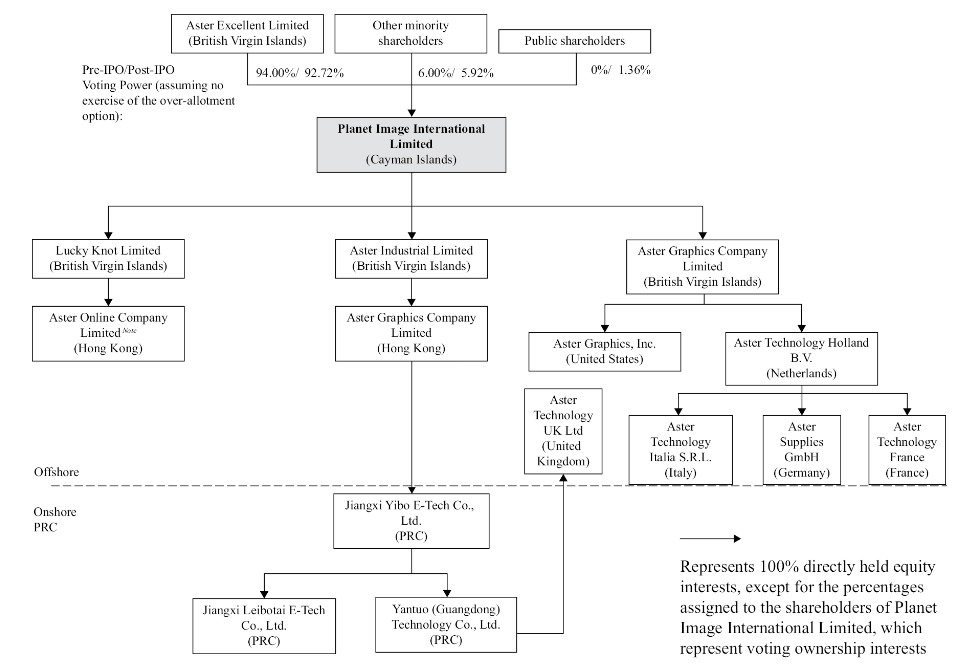

Planet Image International Ltd. produces and sells cartridges for printers. Its primary markets are North America, Europe, and China. The company owns such brands as TrueImage, CoolToner, and AZtech.

Investments raised (as at 30.06.2021): 15 million USD

The main investors are Aster Excellent Limited, Juneng Investment (Hong Kong), and Eagle Heart Limited.

Planet Image International market assessment

According to research by Maximize Market, the global cartridges market was valued at 14.1 billion USD in 2022 and is projected to reach 21.5 billion USD by 2029. The projected compound annual growth rate from 2022 to 2029 inclusive is 6.2%.

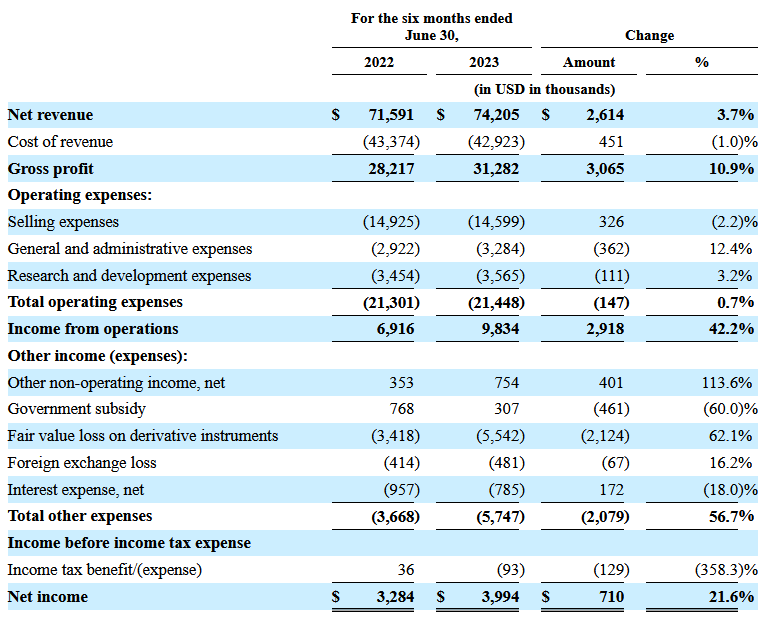

Financial performance of Planet Image International

Revenue for 1H 2023: 74.21 million USD, +3.66%

Net profit for 1H 2023: 3.99 million USD, +21.65%

Net cash flow (as at 30.06.2021): 5.3 million USD

Cash and cash equivalents (as at 30.06.2023): 34.8 million USD

Liabilities (as at 30.06.2023): 70.67 million USD.

Strengths and weaknesses of Planet Image International

Strengths:

- Increasing revenue

- Increasing net profit

- An efficient marketing strategy

Weaknesses:

- Low growth rate of the addressable market

- Low growth rate of revenue

- Absence of dividend payment plans

Details of the Planet Image International IPO

Underwriter: US Tiger Securities Inc.

Offering volume: 4 million ordinary shares

Average price: 4.5 USD

Gross proceeds: 18 million USD

Expected amount of capitalisation at the time of the IPO: 254.4 million USD

Potential P/S: 1.76

Average P/S value in the industry: 3.41

3. IPO of EV Mobility Inc. – 52.8 million USD

Year of registration: 2021

Registered in: the US

Headquarters: Beverly Hills, California

Sector: technology

Date of IPO: 12.11.2023

Exchange: NASDAQ

Ticker: EVMO

EV Mobility Inc. owns an electric car-sharing service for hotels and premium-class condominiums. A client can order an electric car at any time of the day with a mobile app designed by the company.

Investments raised (as at 30.09.2023): 71.46 thousand USD

The main investor is the company CEO Ramy El-Batrawi.

EV Mobility Inc. market assessment

According to a report by Mordor Intelligence, the global electric car rental market in 2021 was valued at 9.13 billion USD, potentially reaching 20.42 billion USD by 2027. The projected compound annual growth rate from 2022 to 2027 inclusive is 14.36%.

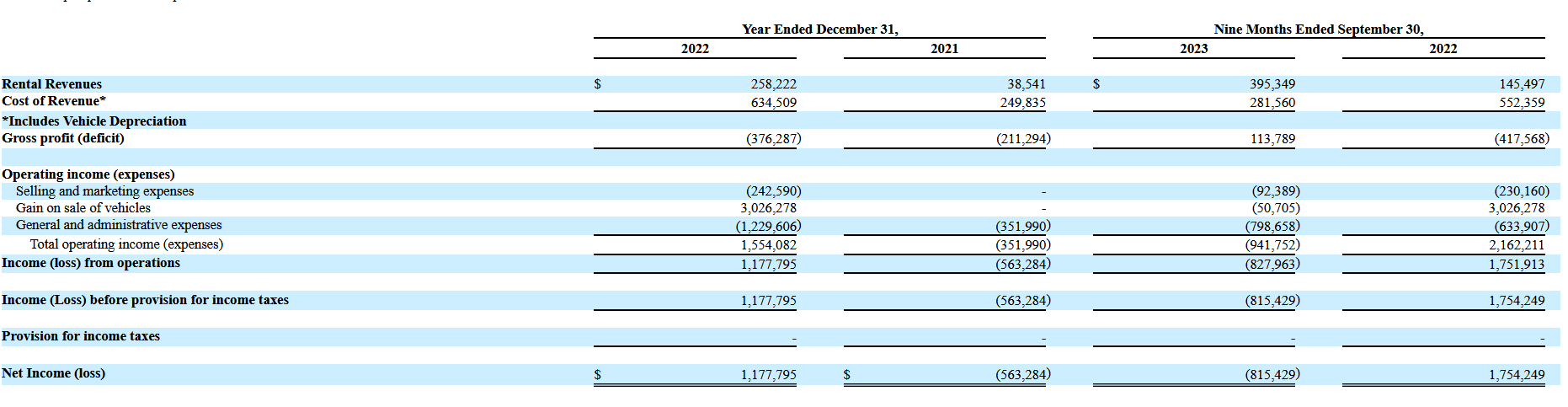

Financial performance of EV Mobility

Revenue for 2022: 258.22 thousand USD, +569.99%

Net profit for 2022: 1.18 million USD

Net cash flow (as at 30.09.2023): 1.3 million USD

Cash and cash equivalents (as at 30.09.2023): 66.55 thousand USD

Liabilities (as at 30.09.2023): 313.16 thousand USD.

Strengths and weaknesses of EV Mobility

Strengths:

- A promising addressable market

- Skyrocketing revenue

- An efficient marketing strategy

Weaknesses:

- A lack of net profit from operating activities

- A part of the car park was sold to pay off the expenses

- Absence of dividend payment plans

Details of the EV Mobility IPO

Underwriter: WestPark Capital Inc.

Offering volume: 1.8 million ordinary shares

Average price: 5 USD

Gross proceeds: 9 million USD

Expected amount of capitalisation at the time of the IPO: 52.8 million USD

Potential P/S: 203.07

Average P/S value in the industry: 4.51

Summary

Trident Digital Tech Holdings Ltd., Planet Image International Ltd., and EV Mobility Inc. are on the list of companies with the largest IPOs by market capitalisation this month. The first and third companies above represent the technology sector, while the second is from the consumer protection sector.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high