Top 3 Largest IPOs Scheduled for September 2023

5 minutes for reading

Simpple Ltd., RoyaLand Company Ltd., and Solowin Holdings Ltd. are on the Top 3 list of companies with the largest IPOs by market capitalisation scheduled for September 2023.

Today we will explore the issuers’ business models, the outlook for their target markets, and the details of their scheduled initial public offerings. We will also look at the financial position of these companies and list their strengths and weaknesses.

1. Simpple Ltd. IPO – 92.5 million USD

Year of registration: 2016

Registered in: Singapore

Headquarters: Singapore

Sector: technology

Date of IPO: 05.09.2023

Exchange: NASDAQ

Ticker: SPPL

Simpple Ltd. develops software products for digitalising construction processes, helping clients automate and streamline their workflow.

Investments raised (as at 30.06.2022) amount to 1.4 million USD.

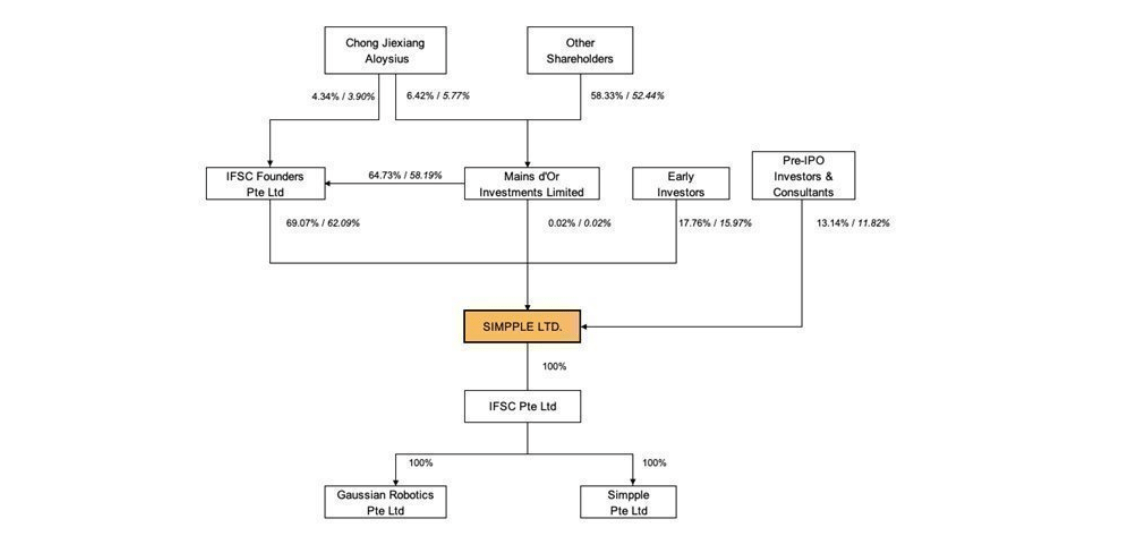

The main investors are IFSC Founders Pte. Ltd and Mains d’Or Investments Limited.

The outlook for Simpple’s target market

According to a report by Gen Consulting Company, the Singapore real estate management market was valued at 0.97 billion USD in 2021 and could reach 1.12 billion USD by 2028. The compound annual projected growth rate from 2022 to 2028 inclusive is 2.1%.

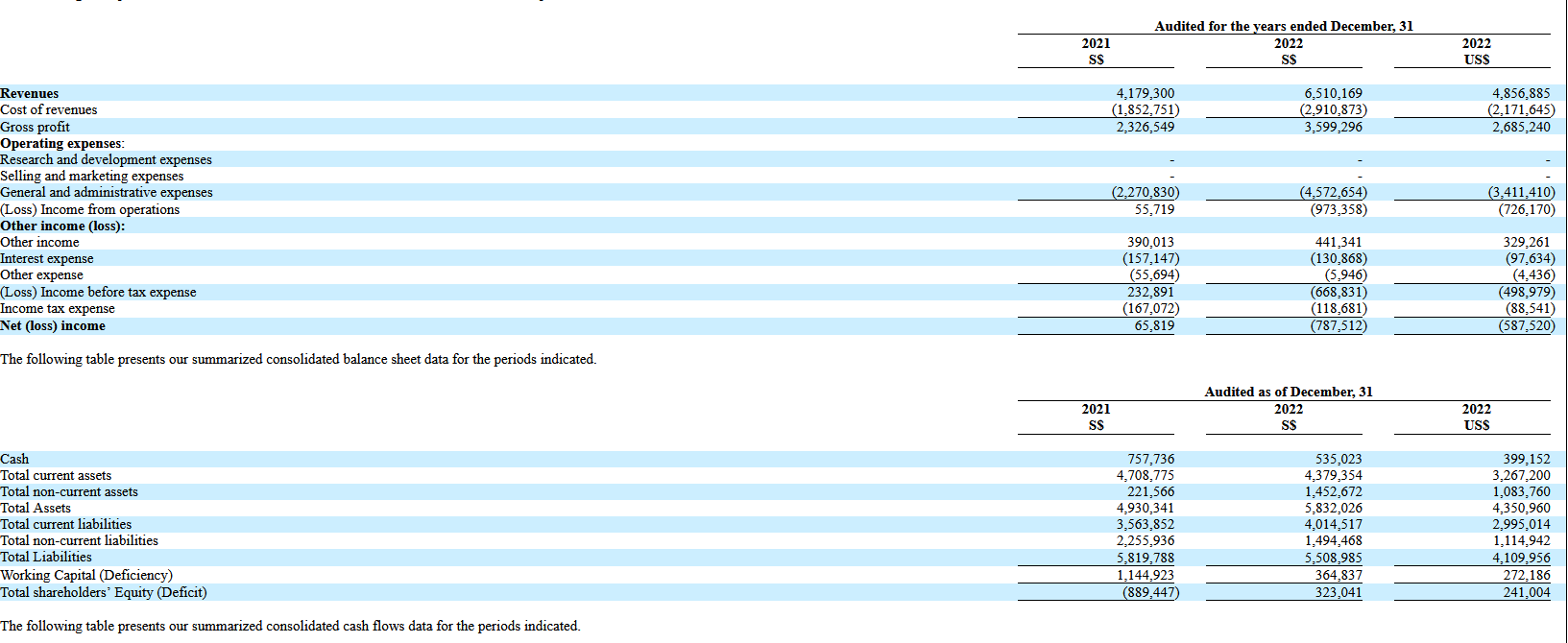

Simpple’s financial performance

Revenue for 2022: 4.86 million USD, +55.8%

Net loss for 2022: 0.59 million USD

Net cash flow (as at 31.03.2023): −0.16 million USD

Cash and cash equivalents (as at 31.12.2022): 0.4 million USD

Liabilities (as at 31.12.2022): 4.1 million USD

Strengths and weaknesses of Simpple

Strengths:

- A promising target market

- An innovative development model

- Increasing revenue

Weaknesses:

- Intense competition

- Increasing net loss

- Absence of dividend payment plans

Details of the Simpple IPO

Underwriter: Maxim Group LLC

Volume of IPO offering: 1.6 million ordinary shares

Average price: 5.75 USD

Gross proceeds: 9.2 million USD

Expected amount of capitalisation at the time of the IPO: 92.5 million USD

Potential P/S: 19.03

Average P/S value in the industry: 7.1

2. RoyaLand Company Ltd. IPO – 77 million USD

Year of registration: 2022

Registered in: Bermuda

Headquarters: Hamilton

Sector: technology

Date of IPO: 08.09.2023

Exchange: NASDAQ

Ticker: RLND

The RoyaLand Company Ltd. is a developer of an online royalty-themed game based on fantasy events and the real historical development of royal dynasties. The issuer collaborates with members of former and present ruling royal families in Europe.

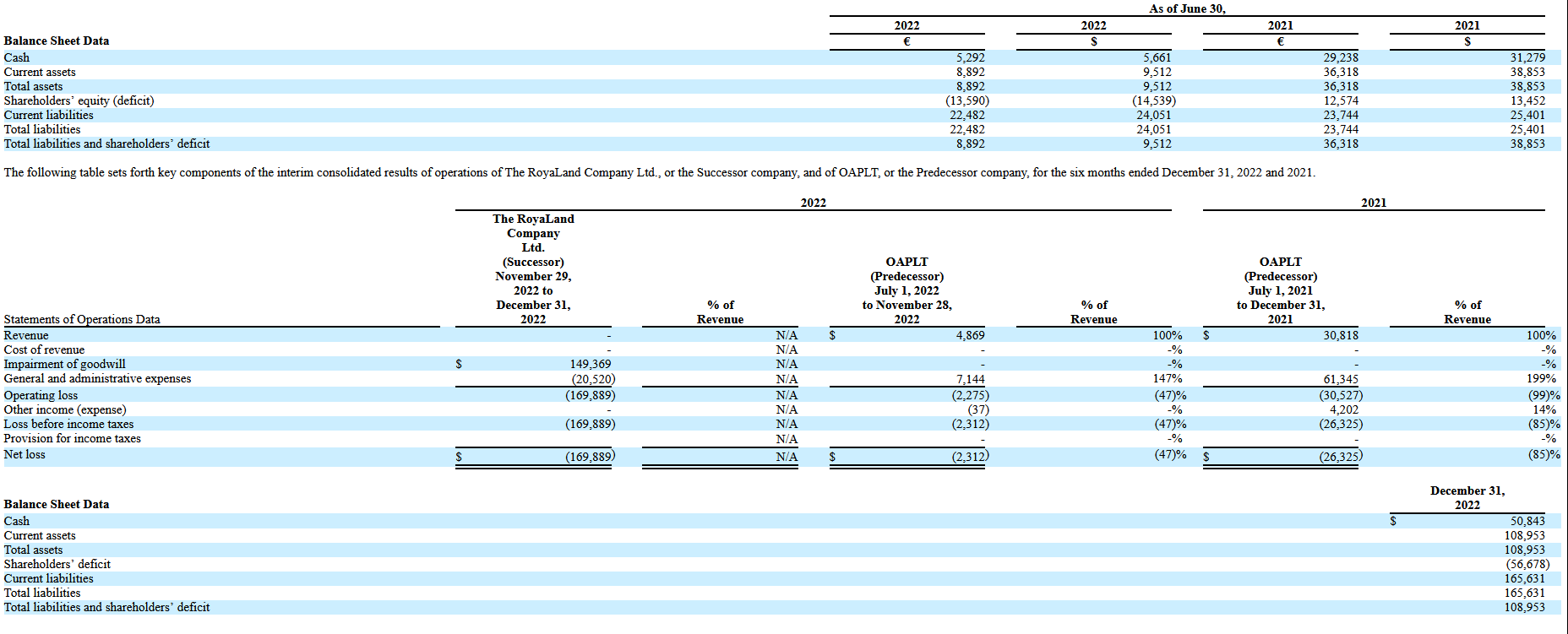

Investments raised (as at 31.12.2022) amount to 0.53 million USD.

The main investor is Pinehurst Partners LLC.

The outlook for RoyaLand Company’s target market

According to Cognitive Market Research, the global role-playing games market was valued at 18.7 billion USD in 2021 and could reach 38.5 billion USD by 2029. The compound annual projected growth rate up to 2029 inclusive is 9.4%.

Financial performance of RoyaLand Company

Revenue for 2022: none

Net loss for 2022: 0.17 million USD

Net cash flow: none

Cash and cash equivalents (as at 31.12.2022): 0.05 million USD

Liabilities (as at 31.12.2022): 0.16 million USD

Strengths and weaknesses of RoyaLand Company

Strengths:

- A promising target market

- Collaboration with members of royal families

- Favourable market environment

Weaknesses:

- Intense competition

- Lack of revenue

- Absence of dividend payment plans

Details of the RoyaLand Company IPO

Underwriter: Revere Securities, LLC

Volume of IPO offering: 1.25 million ordinary shares

Average price: 5.5 USD

Gross proceeds: 6.87 million USD, excluding the sale of options by the underwriter

Expected amount of capitalisation at the time of the IPO: 77 million USD

Potential P/S: none

Average P/S value in the industry: 7.1

3. Solowin Holdings Ltd. IPO – 72.5 million USD

Year of registration: 2016

Registered in: the Cayman Islands

Headquarters: Hong Kong, China

Sector: financial

Date of IPO: 07.09.2023

Exchange: NASDAQ

Ticker: SWIN

Solowin Holdings Ltd. has developed its proprietary trading platform, Solomon Pro, and is a provider of brokerage services in the Chinese market. The company also works with investors from Australia and New Zealand. The issuer generates most of its revenue from the provision of its investment advisory services. As at 31 March 2023, the client base of Solowin Holdings Ltd. comprised 20,000 natural persons and legal entities.

Investments raised (as at 30.09.2022) amount to 4.8 million USD.

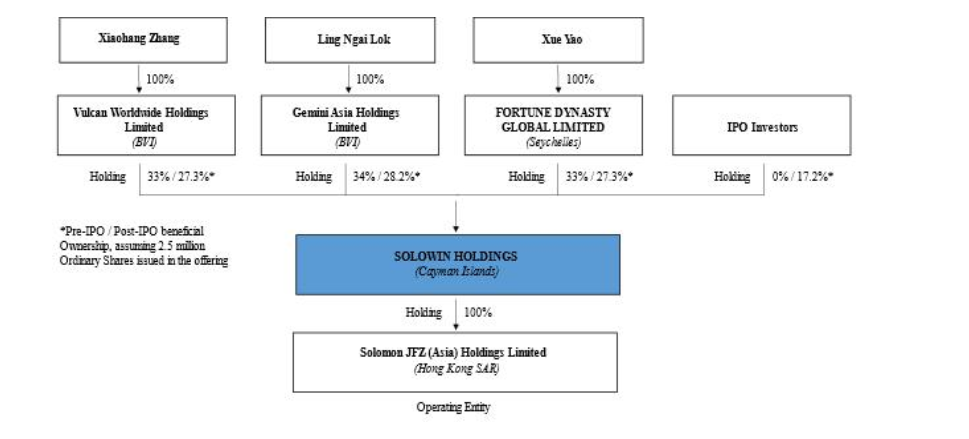

The main investors are Gemini Asia Holdings Limited, Vulcan Worldwide Holdings Limited, and Fortune Dynasty Global Limited.

The outlook for Solowin Holdings’ target market

According to the Hong Kong Trade Development Council, the capitalisation of the Hong Kong Stock Exchange reached 49.16 billion USD in August 2023. This financial platform ranks among the Top 10 world’s largest exchanges.

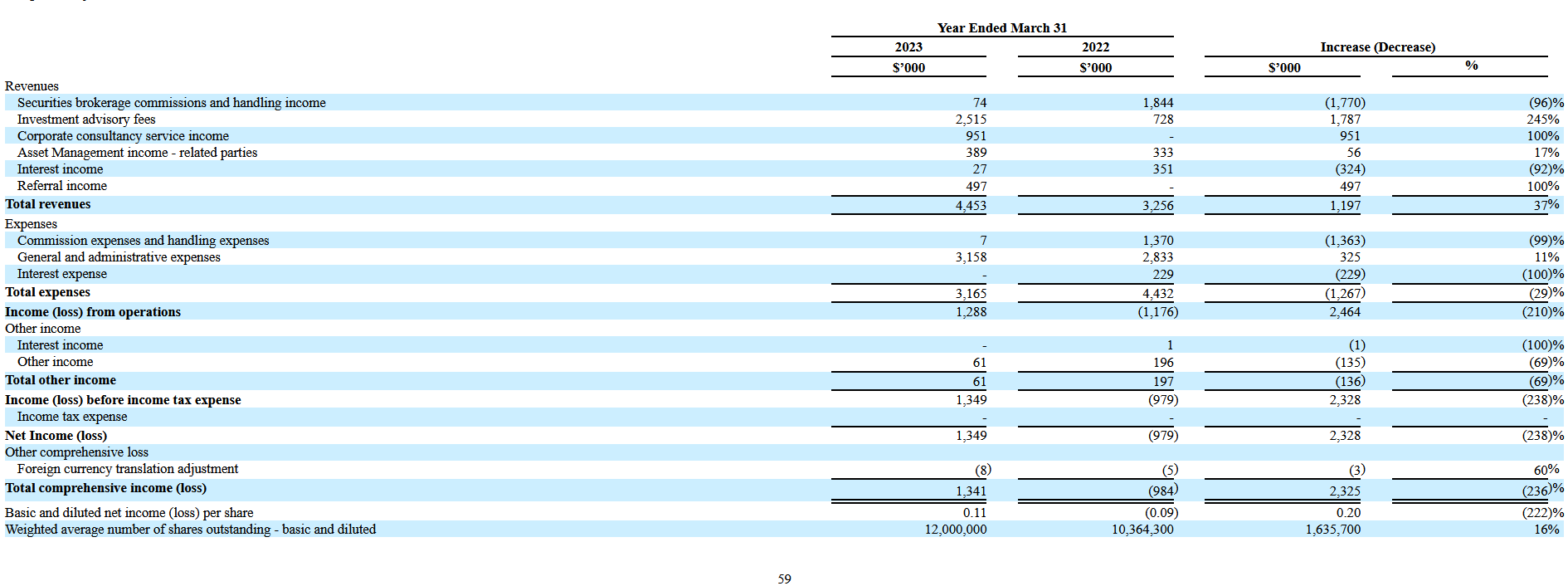

Financial performance of Solowin Holdings

Revenue for fiscal 2023 (ended on 31.03.2023): 4.45 million USD, +37%

Net profit for fiscal 2023: 1.35 million USD

Net cash flow (as at 31.03.2023): −0.44 million USD

Cash and cash equivalents (as at 31.03.2023): 1.9 million USD

Liabilities (as at 31.03.2023): 6.87 million USD

Strengths and weaknesses of Solowin Holdings

Strengths:

- A promising target market

- Increasing revenue

- Net profit

Weaknesses:

- Intense competition

- Dependence on the Chinese regulatory authorities

- Absence of dividend payment plans

Details of the Solowin Holdings IPO

Underwriter: EF Hutton

Volume of the IPO offering: 2.5 million ordinary shares

Average price: 5 USD

Gross proceeds: 12.5 million USD, excluding the sale of options by the underwriter

Expected amount of capitalisation at the time of the IPO: 72.5 million USD

Potential P/S: 16.29

Average P/S value in the industry: 2.9

Summary

Simpple Ltd., The RoyaLand Company Ltd., and Solowin Holdings Ltd. are planning to go public this month. Their IPOs could be the largest in terms of expected market capitalisation for September. The first two corporations are in the technology sector, while the third one operates in the financial sector.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high