Trio Petroleum IPO: Oil for California

5 minutes for reading

Trio Petroleum Corp. and its IPO on the NYSE will be in the spotlight today. The IPO is scheduled for 14 April. The shares will trade under the ticker TPET. The company explores and develops crude oil and gas fields in the US.

We will discuss the details of the company’s business model, the peculiarities of the IPO, the prospect of the target market, the main competitors of the company, its financial situation, advantages and disadvantages.

What we know about Trio Petroleum

Trio Petroleum Corp. is an energy company that explores and develops crude oil and gas fields in the United States. It was founded in 2021 and has its headquarters in Danville, US. Since February 2022, the post of CEO has been occupied by Frank Ingriselli who used to hold the same office at Indonesia Energy Corporation.

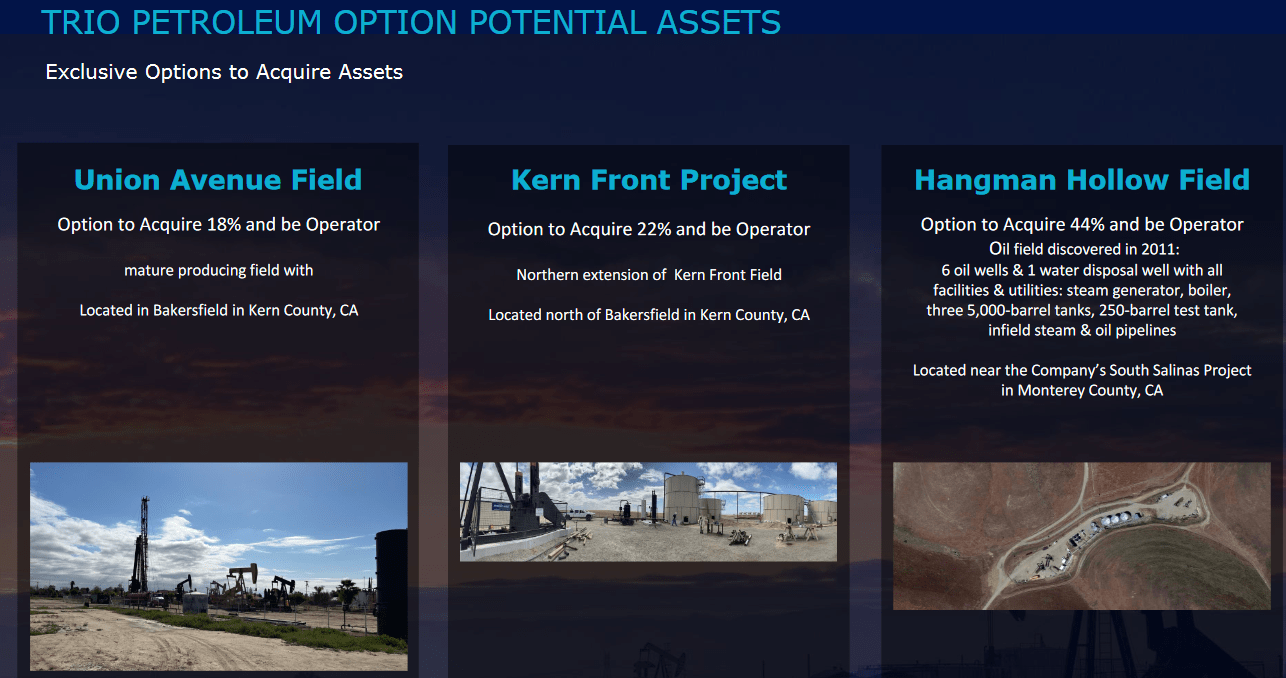

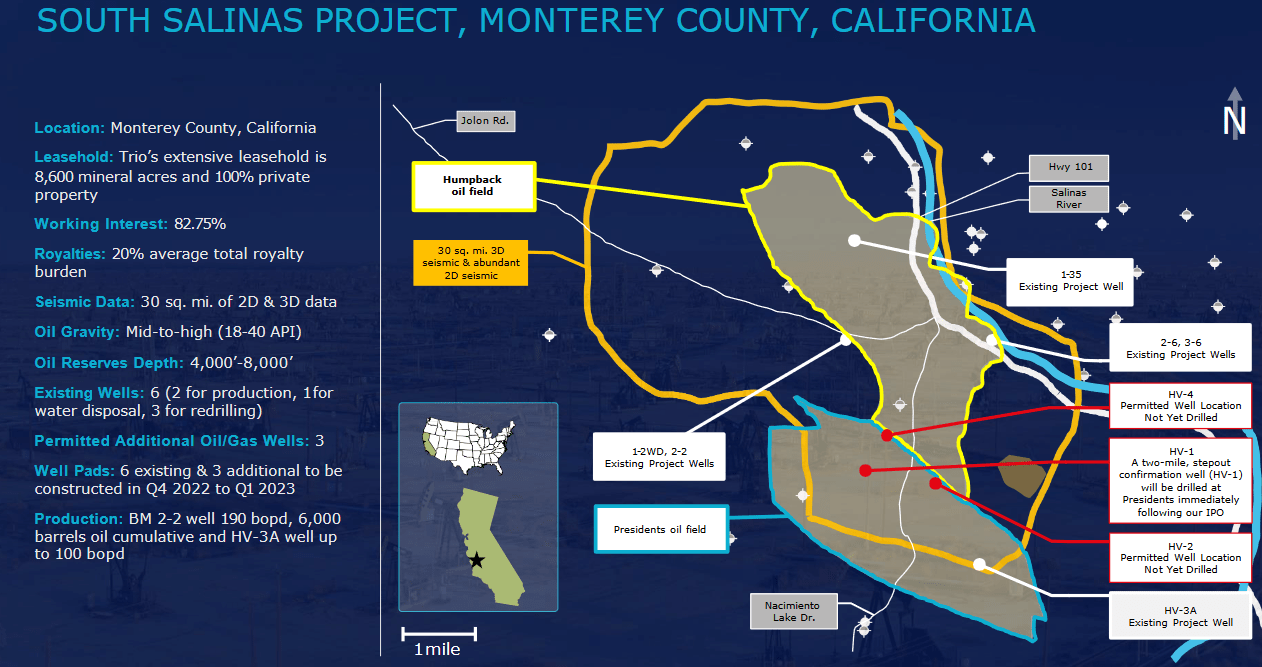

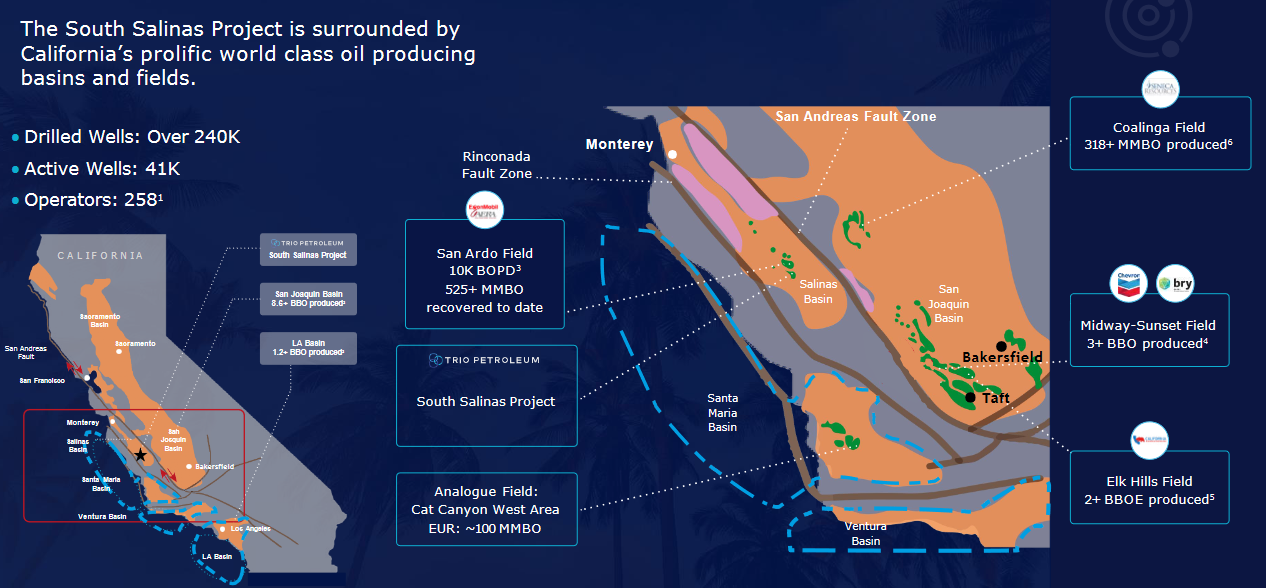

Trio Petroleum Corp. owns the South Salinas field in Monterey, California. It occupies roughly 3,480 hectares (8,600 acres). According to the issuer, the potential crude oil mining volume at South Salinas amounts to 39 million barrels and that of natural gas is 1.2 billion cubic meters. The first oil mine in this field is going to be drilled after the IPO. However, there is no data about the volumes of daily mining.

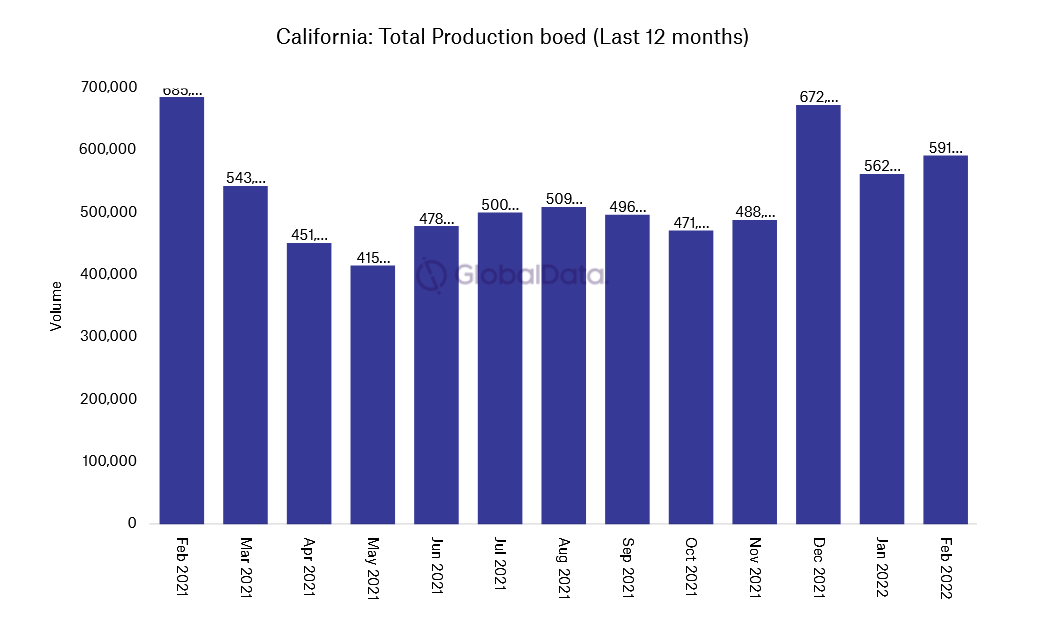

According to the Energy Information Administration (EIA), 131 million barrels of black gold were mined in California in 2021. Since 1985, when the energy crisis in the region was overcome, this figure has been falling stably.

At the current stage, Trio Petroleum Corp. plans to launch 7 oil mines in South Salinas. In the third quarter of 2024, 12 more mines will be launched. The management thinks they will become the main source of the company’s revenue.

The management plans to use the favourable global market situation. Fossil fuel does still enjoy high demand, while alternative energy sources have yet to become dominant. Moreover, for now, regulators accept nature gas as an ecologically clean fuel.

By 30 April 2022, Trio Petroleum Corp. had gathered 10 million USD of investments. Its main investors are Elpis Capital Ltd, Gencap Fund I LLC, Primal Nutrition Inc., and Naia Ventures LLC.

Prospects of Trio Petroleum addressable market

At the current stage, the issuer plans to mine and sell crude oil in California, the US. According to the EIA, 70% of crude oil consumed in the region is imported from Ecuador, Saudi Arabia, and Iraq. An increase in black gold mining in the state could strengthen its energy safety.

California is the second-largest state in the country in terms of oil consumption after Texas. According to the Offshore Technology report, 591.9 thousand barrels of oil were mined daily in the state in February 2022, while the demand was 1.97 million barrels. High prices for energy carriers on the global market stimulate the speed and volumes of crude oil mining in the US, as well as have a good influence on its profitability.

The main competitors are:

- Chevron Corporation

- Exxon Mobil Corporation

- Berry Corporation

- Sempra Energy

- Sentinel Peak Resources LLC

- Buckeye Partners L.P.

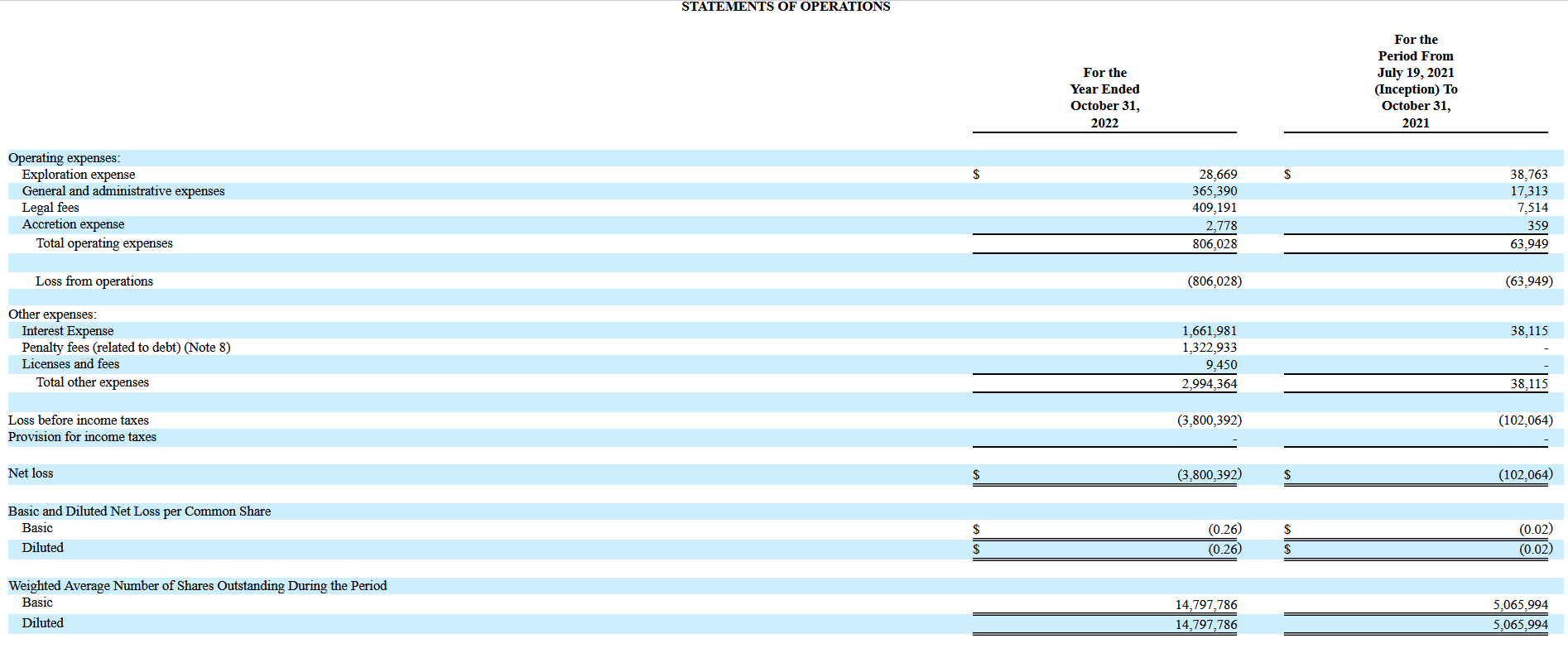

Financial performance of Trio Petroleum

When this article was written, Trio Petroleum Corp. generated no revenue. Currently, its work is maintained by increasing debt load. On 31 October 2022, the company saw a net loss of 3.8 million USD.

On 31 January 2023, the company had on its accounts 112.5 thousand USD, while its total liabilities reached 7.5 million USD.

Strong and weak sides of Trio Petroleum

Advantages:

- Promising addressable market

- Qualified management

- A share in oil fields

- Favourable market situation

- Good positioning of the business

- Conservative and time-tested business model

Drawbacks:

- High level of competition

- Increasing debt load

- No revenue

What we know about Trio Petroleum IPO

The underwriter of Trio Petroleum IPO is Spartan Capital Securities, LLC. The issuer plans to sell 1.7 million common shares at the suggested average price of 3.5 USD per unit. The gross proceeds from selling the securities could amount to 5.95 million USD, excluding the options sold by the underwriter. The market capitalisation of the corporation could reach 66.8 million USD.

Trio Petroleum Corp. does not generate any revenue, so analysing it with classic multiples is complicated. The success of the IPO and the dynamics of the issuer’s stock price depend on for how long prices in the crude oil market will remain high.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high