Peloton: A Risky Investment

6 minutes for reading

Lately the media have been attracted once again to a losing company Peloton Interactive Inc. (NASDAQ: PTON). Rumors spread that the manufacturer of sports equipment might be taken over by some large corporation. The candidates for the takeover are Amazon.com Inc. (NASDAQ: AMZN), Apple Inc. (NASDAQ: AAPL), Walt Disney Company (NYSE: DIS), and Nike Inc. (NYSE: NKE). Let us find out whether the rumors are true, and what is going on with Peloton.

History of Peloton Interactive

Peloton Interactive is a US manufacturer of sports equipment. Its main products are treadmills and exercise bikes alongside subscriptions to online training.

The company was founded in 2012 by John Foley who acted as its general manager until recently. The business idea was a simple one: creating the technology for people to exercise at home while receiving online advice from qualified coaches.

The idea turned out a success, and one month into its foundation, the company got its first investment of 400,000 USD. It managed to gather 3.5 million USD more by the end of 2012, and sell its first exercise bike in the following year.

How the pandemic affected Peloton’s business

Although Peloton was already selling its products outside the US, it had not garnered much attention prior to the COVID-19 pandemic. It became popular worldwide thanks to the quarantine restrictions. The demand for its sports equipment sky-rocketed during home quarantine times, with customers sometimes having to wait up to 10 weeks to receive their desired trainer.

Issues faced by Peloton

In 2019, the National Music Publishers Association (NMPA) sued Peloton for copyright violations related to its use of numerous songs in its workout videos. The NMPA sought almost 300 million USD in damages. At that time, the quarterly revenue of the start-up was under 230 million USD. The lawsuit was eventually settled.

But this was not the end of trouble. The company got called to court again. This time, it was about a faulty treadmill, which caused death to a child who got dragged underneath it. Subsequent to this dreadful news, the company was hit by an avalanche of claims and lawsuits. Customers reported injuries to their children and pets, which were caused by the malfunction or unsafe design of Peloton home exercise equipment. Consequently, the company had to recall the related product for improvement.

Next, Peloton equipment appeared in movies, but not in the best of contexts. In one episode, a character passed out and then away on an exercise bike, while in another one, a character had a heart attack just after his workout. This made associations with the company even worse.

Management mistakes gave rise to trouble

In 2019, Peloton carried out an IPO, trainer sales and revenue kept increasing, and the share price grew 530% over two years. However, as the company failed to satisfy the demand for the products, John Foley decided to substantially increase investments in extending production.

Peloton acquired Precor – a company that produces fitness equipment. The amount of 100 million USD was allocated for investing in air and sea transport to speed up shipping. Moreover, alongside the increased production, more staff was hired.

All these measures seemed fairly logical at the time when the demand was extremely high. However, the management neglected the fact that the demand was due to the lockdown. So, while quarantine restriction measures were becoming softer, the popularity of the products shrunk.

The situation became even worse due to rivalry from the likes of Tonal, Hydrow, Mirror, and Tempo who had entered the market, giving consumers a wide selection to choose from. On top of all, people had grown bored of being confined to their homes and headed for sporting centres.

As a result of all the above, stocks were filled up to the brim, production was put to a halt, spending hit the record, the company was operating at a loss, and 2,800 employees lost their jobs.

What Peloton did to exit the crisis

John Foley stepped aside, and his CEO position was filled by Barry McCarthy, the former CFO of Spotify Technology S.A. (NYSE: SPOT) and Netflix Inc. (NASDAQ: NFLX).

However, Foley entered the management team as Executive Chairman, keeping the majority of voices. Moreover, he appointed two managers who would support him.

How Barry McCarthy can help Peloton

Former Spotify CFO has a dark past: he used to be the chief operations manager of Clinkle, which went bankrupt and never returned the funds to its investors. Over the short course of managing this company, investors and employees voiced a lot of complaints against McCarthy.

At this stage, after over one year of operational spending of Peloton has doubled, reaching 622.4 million USD, the company needs to get its finances in order. A financial director would be perfect to achieve this goal.

However, according to research by Spencer Stuart, financial directors are least likely to bring companies to success compared to other managers. They are more conservative, with a tendency to work on a stable inflow of money instead of taking risks.

All this makes us realise that we should be expecting stability from McCarthy rather than hitting new records, especially since he does not have enough power to achieve this.

Why Peloton should get its finances in order

There is no doubt that every company's finances always need to be in good order. However, to achieve this, selling the company might be a solution. Thus, the scenario of a takeover by Amazon or Nike looks quite realistic. The question is, whether the current owners are eager to sell it at the actual price when its market capitalisation has shrunk from 50 billion USD to 12 billion USD.

According to the most recent quarterly report, the losses of Peloton over a year increased by more than 400 million USD. Moreover, the company is facing numerous rivals, its sales are dropping, and stocks are overflowing. Buying such a company can hardly be profitable.

Peloton management is currently not in a position to win negotiations, which means that the shareholders will most probably reject the offer of a merger if they receive it.

What the insider purchases of Peloton mean

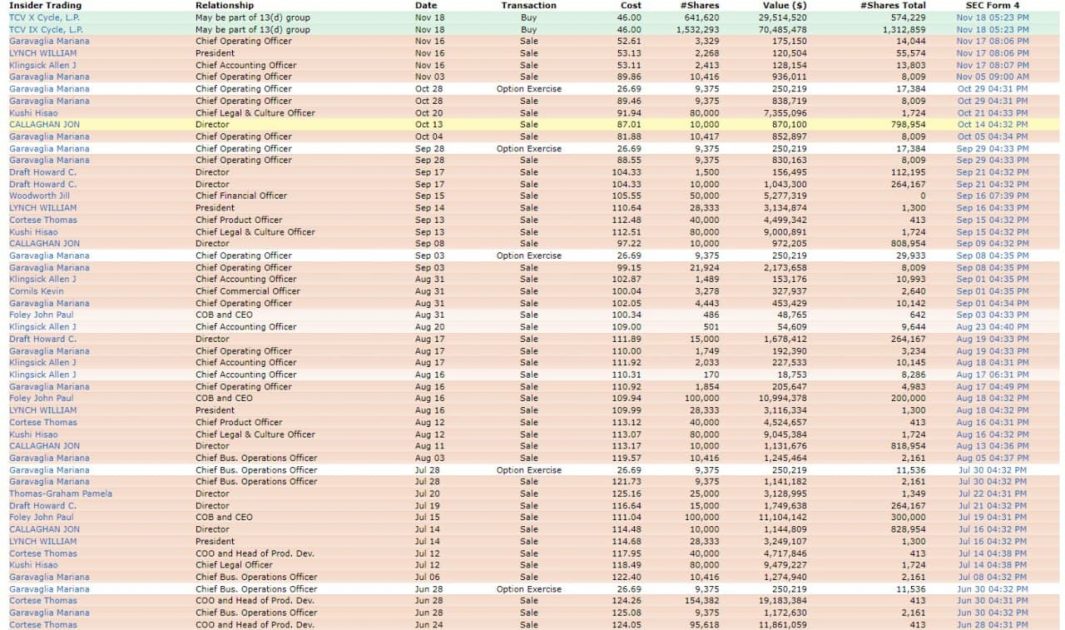

Check out the insider purchases of the company. If there were a probability of a takeover, the owners would be likely to start buying the shares.

However, since July 2021, the shares have only been selling and falling in price. There were only two purchases in November 2021. However, these were not by a physical person, they were by a Peloton subsidiary.

Based on the insider purchases and the market capitalisation decline, we can conclude that the probability of a takeover is extremely low.

Conclusion

The business idea of Peloton remains quite interesting, especially with the new normal of learning and working from home remaining popular.

However, investing in this company is risky. Nonetheless, remember that the market is full of examples of stock prices moving with no inner logic.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high