Snail IPO: Investments in the Gaming Industry

4 minutes for reading

Online games as a segment of the entertainment industry have been developing actively in recent years. A surge in their popularity could be observed during the COVID-19 pandemic when lockdowns were imposed.

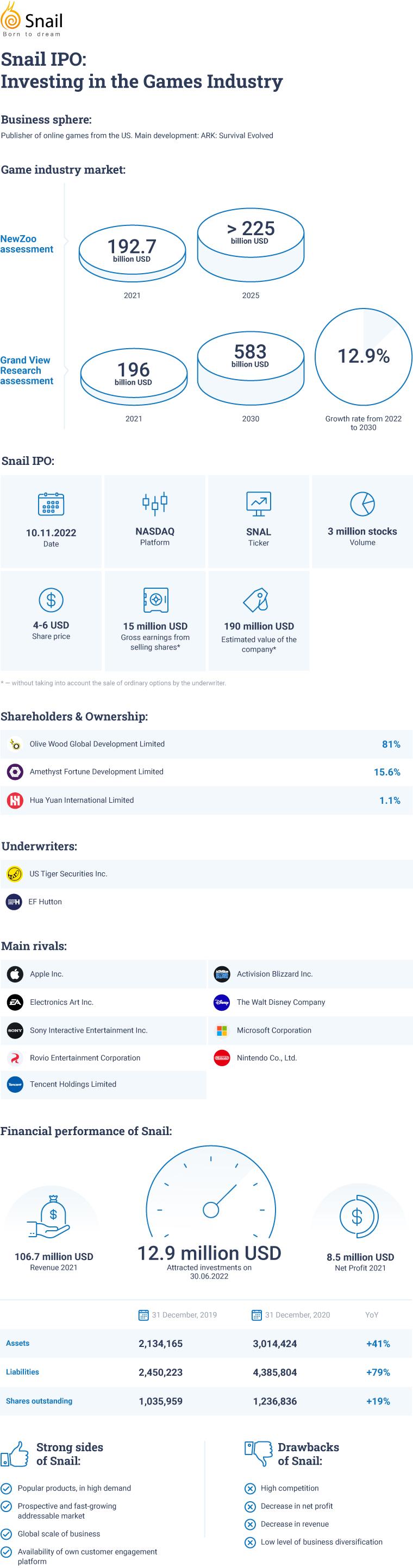

Today we will talk about Snail Inc., a tech company that develops online games, and its IPO on the NASDAQ exchange, which was conducted on 10 November under the ticker SNAL.

What we know about Snail

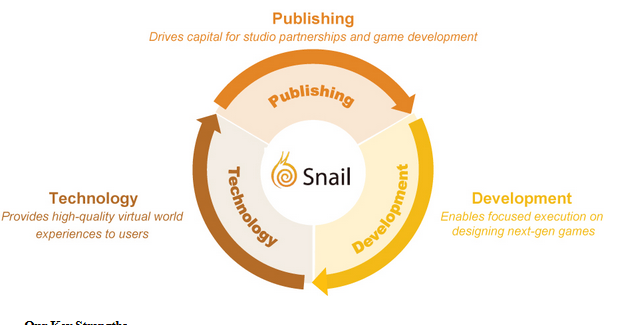

Snail Inc. was founded in 2009 and was until recently a subsidiary of Chinese online game developer Suzhou Snail Digital Technology Co. Ltd. The company develops, promotes, and sells multi-user online games in the US, and invests in the development of new gaming projects.

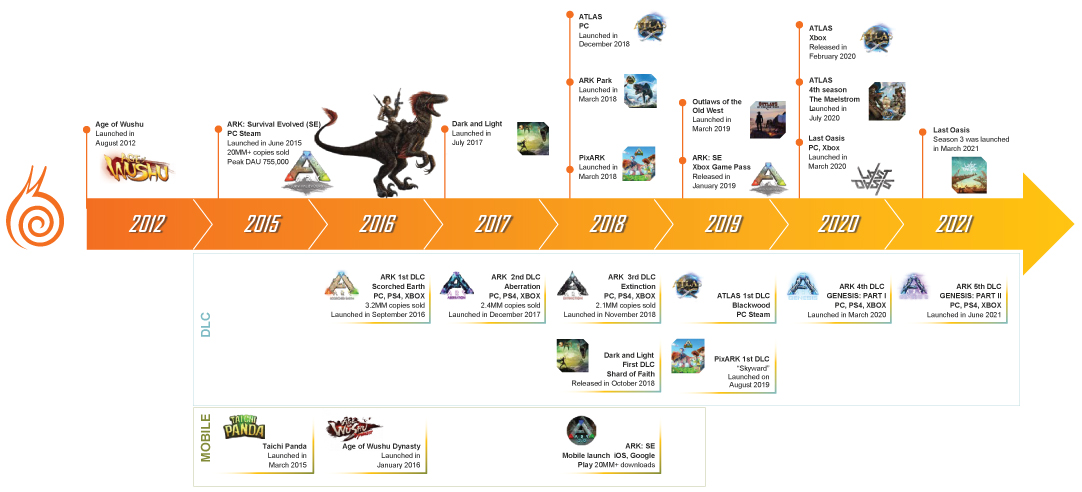

As part of its product development, the issuer does a lot of important preparation work, which includes adapting the games for the market, studying the demand, creating and carrying out marketing strategies, and localising the products. Snail boasts such franchises in its portfolio as ARK: Survival Evolved, Atlas, Last Oasis, Dark and Light, and Outlaws of the Old West.

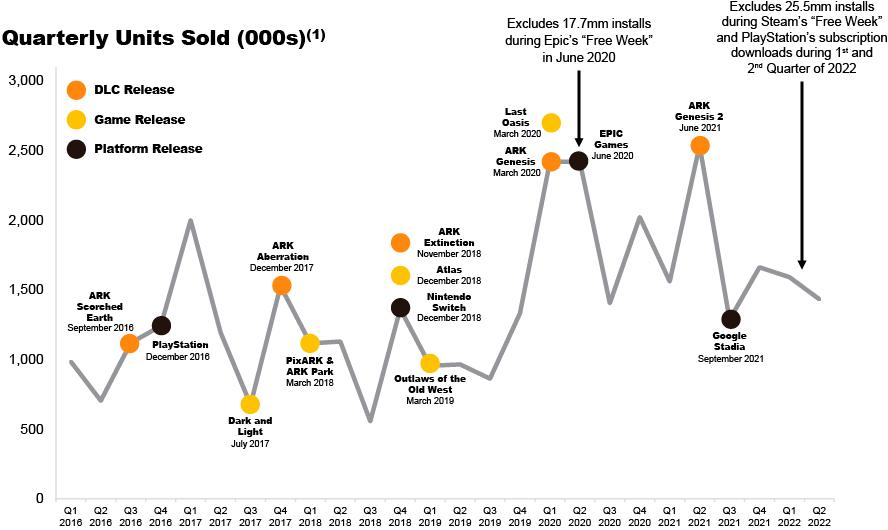

ARK: Survival Evolved has been on the Top-25 list of games on the Steam platform since 2016. By 30 June 2022, it had been installed on different devices more than 77 million times. The average daily number of active users logged in to the game is 395,150 people, while the all-time high is 755,000.

It must be noted that ARK: Survival Evolved accounts for 90% of Snail’s revenue. This means that the issuer will have to diversify its business better.

The issuer encourages the creativity of its developers by providing them with a wide range of technologies and resources. Snail Inc. has created a streaming platform called Noiz, through which it will promote its products. Snail Management is confident that Noiz will become an important instrument for carrying out the company's marketing strategies.

By 30 June 2022, Snail Inc. had attracted 12.9 million USD in investments, the main investors being Ancient Jade (East) Holding Ltd., Qianrong Capital Ltd., Hua Yuan International Ltd., Amethyst Fortune Development Ltd., Olive Wood Global Development Ltd., and Ferth Development Ltd.

Prospects of Snail’s target market

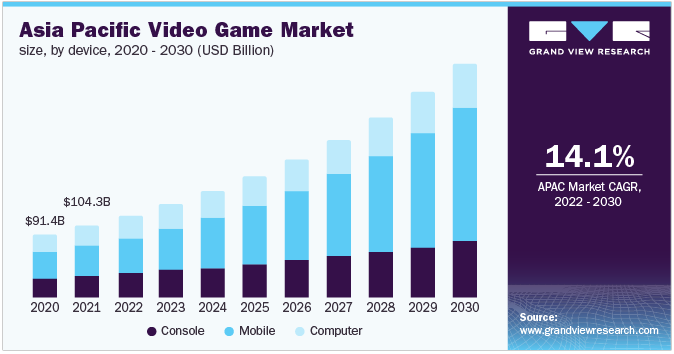

According to Newzoo, by 2021 the online gaming market had reached 192.7 billion USD, and by 2025, it will have exceeded 225 billion USD. As for Grand View Research, in 2021 it valued the online gaming market at 196 billion USD, and expects it to reach 504 billion USD by 2030. The average annual growth between 2022 and 2030 will amount to 12.9%.

The highest speed of development for this sector is forecasted in the Asian-Pacific region. The main positive factor that will influence the sector should be the monetising of games and digital marketplaces.

The main rivals of Snail Inc. are:

- Apple Inc.

- Electronics Art Inc.

- Sony Interactive Entertainment Inc.

- Rovio Entertainment Corporation

- Tencent Holdings Limited

- Activision Blizzard Inc.

- The Walt Disney Company

- Microsoft Corporation

- Nintendo Co., Ltd.

Financial performance of Snail

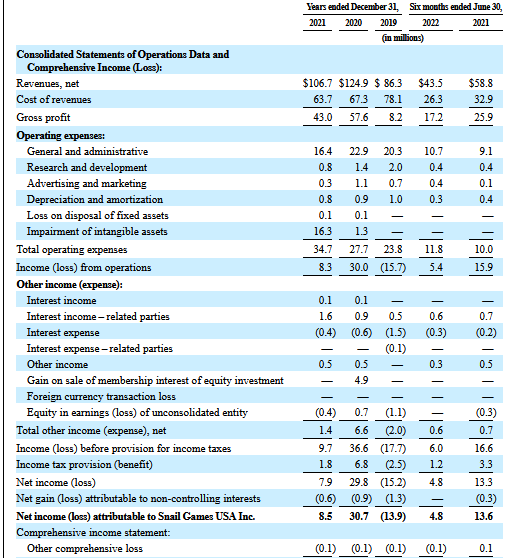

Snail Inc. generates net profit; hence, we will start by studying this result. According to the S-1 form for 2021, the net profit has dropped by 72.31% compared to the statistics of 2020 to 8.5 million USD. Over the first six months of 2022, the net profit amounted to 4.8 million USD, which translates into a 64.71% decline from 2021.

In 2021, the revenue of Snail Inc. decreased by 16.87% to 106.7 million USD. The decline was due to the falling demand for online games after the end of the COVID-19 lockdowns. In Q1 this year, the revenue dropped by 26.02% to 43.5 million USD.

On 30 June 2022, the company had 14.7 million USD in its accounts and 74.9 million USD in liabilities.

Strengths and weaknesses of Snail

Advantages:

- Popular products

- Promising, fast-growing target market

- Global scale of business

- The company’s own platform for attracting clients

- Net profit

- Qualified management

Drawbacks:

- High competition in the segment

- Falling net profit

- Falling revenue

- Poorly diversified business

What we know about the Snail IPO

The underwriters of the IPO are US Tiger Securities Inc. and EF Hutton. The issuer plans to sell three million normal shares. Gross revenue may reach 15 million USD, normal options excluded. In the case of a successful IPO, the market capitalisation of Snail Inc. will reach 190 million USD.

The P/S (capitalisation/revenue) multiplier will amount to 2.08, with the average P/S in the industry being 5. The upside during the lock-up period is 140% (5/2.08*100%-100%).

All in all, participating in this IPO is a classical venture investment that may not be suitable for all investors.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high