Top 3 Largest IPOs Scheduled for October 2023

5 minutes for reading

WeBuy Global Ltd., Healthy Green Group Holding, and CardieX Ltd. are on the Top 3 list of companies with the largest IPOs by market capitalisation, scheduled for October 2023. In this article, we will explore the business models of these issuers, examine the outlook for their target market and the details of their scheduled initial public offerings. We will also look at the financial position of these companies, including their strengths and weaknesses.

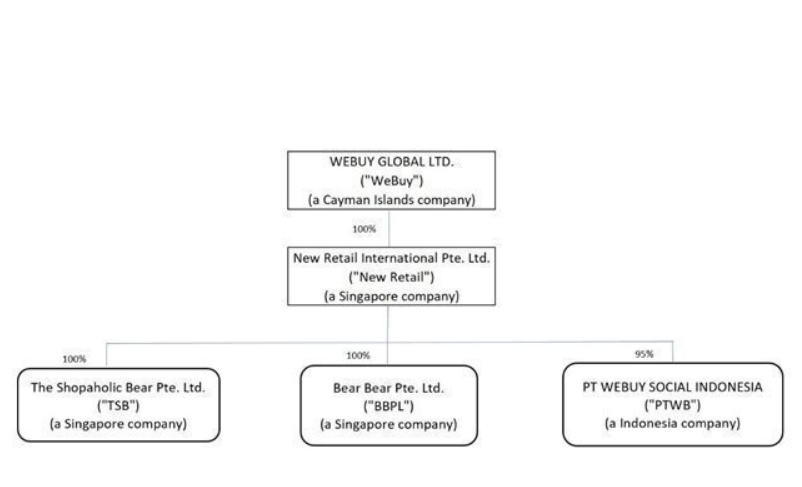

1. IPO of WeBuy Global Ltd. – 218.92 million USD

Year of registration: 2019

Registered in: Cayman Islands

Headquarters: Singapore

Sector: technology

Date of IPO: 06.10.2023

Exchange: NASDAQ

Ticker: WBUY

WeBuy Global Ltd. has developed an online platform for joint shopping, where members of messenger communities collaborate for joint or shared purchases.

Investments raised (as at 31.12.2022) amount to 16 million USD.

The main investors are Wavemaker Pacific 3, L.P., Rocket Internet Capital Partners ii Scs, TLCW VENTURES PTE. LTD, GBUY GLOBAL LTD, and TLCW VENTURES PTE. LTD.

WeBuy Global market assessment

According to a report by Statista, the social e-commerce market in Southeast Asia, where WeBuy Global operates, was valued at 20 billion USD in 2022 and is projected to reach 34.5 billion USD by 2026. The compound annual projected growth rate from 2023 to 2026 inclusive is 20%.

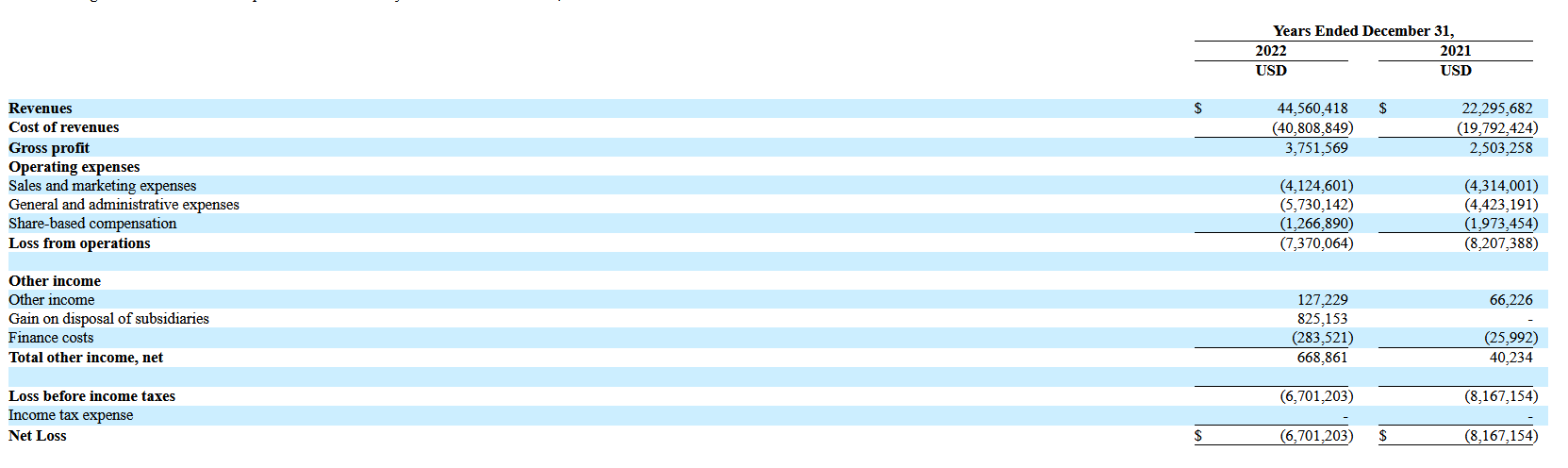

Financial performance of WeBuy Global

Revenue for 2022: 44.56 million USD, +99.9%

Net loss for 2022: 6.7 million USD

Net cash flow (as at 31.03.2023): −4.1 million USD

Cash and cash equivalents (as at 31.12.2022): 1.6 million USD

Liabilities (as at 31.12.2022): 10.8 million USD

Strengths and weaknesses of WeBuy Global

Strengths:

- A promising target market

- Decreasing net loss

- Increasing revenue

- An effective marketing strategy

Weaknesses:

- Intense competition

- The issuer operates in markets of countries with different legislation, which increases dependence on regulatory authorities

- Absence of dividend payment plans

Details of the WeBuy Global IPO

Underwriter: EF Hutton, division of Benchmark Investments, LLC

Volume of IPO offering: 3.5 million ordinary shares

Average price: 4.25 USD

Gross proceeds: 14.87 million USD

Expected amount of capitalisation at the time of the IPO: 218.92 million USD

Potential P/S: 4.91

Average P/S value in the industry: 1.63

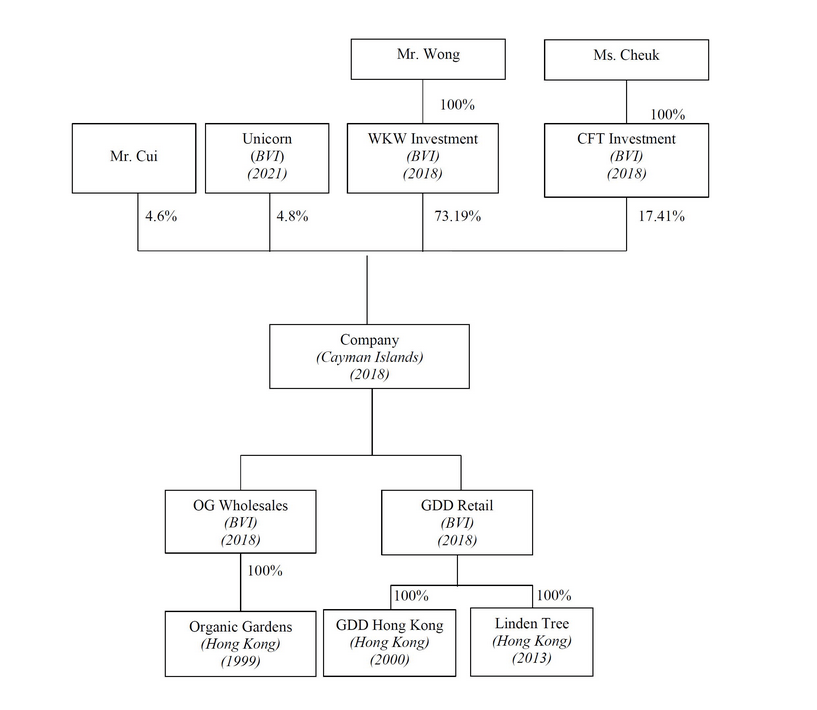

2. IPO of Healthy Green Group Holding – 73.9 million USD

Year of registration: 1999

Registered in: Cayman Islands

Headquarters: Hong Kong

Sector: consumer protection

Date of IPO: 19.10.2023

Exchange: NYSE

Ticker: GDD

Healthy Green Group Holding is engaged in the sale of natural food products through its retail chain in residential areas in Hong Kong. The company also accepts online orders.

Investments raised (as at 30.06.2022): 1.4 million USD

The main investors are WKW Investment Limited and CFT Investment Holding Limited.

Healthy Green Group market assessment

According to a report by ReportLinker, the food products market in Hong Kong, where Healthy Green Group operates, was valued at 18.3 billion USD in 2020. The compound annual growth rate from 2016 to 2020 inclusive was 1.1%.

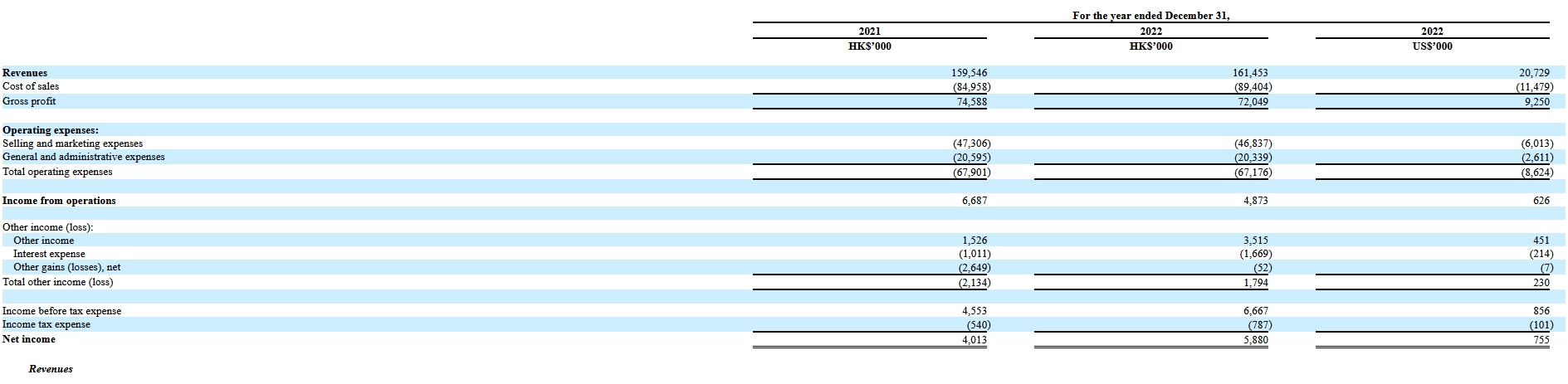

Financial performance of Healthy Green Group

Revenue for 2022: 20.73 million USD, 1.2%

Net profit for 2022: 0.7 million USD

Net cash flow (as at 30.06.2023): −0.82 million USD

Cash and cash equivalents (as at 30.06.2022): 0.23 million USD

Liabilities (as at 31.12.2022): 12.6 million USD

Strengths and weaknesses of Healthy Green Group

Strengths:

- A promising target market

- Net profit

- Increasing revenue

- A stable market share

Weaknesses:

- Intense competition

- Exposure to new coronavirus restrictions

- Absence of dividend payment plans

Details of the Healthy Green Group IPO

Underwriter: EF Hutton, division of Benchmark Investments, LLC

Volume of IPO offering: 2.0 million ordinary shares

Average price: 6.5 USD

Gross proceeds: 13 million USD

Expected amount of capitalisation at the time of the IPO: 73.9 million USD

Potential P/S: 3.56

Average P/S value in the industry: 0.40

3. CardieX Ltd – 73.9 million USD

Year of registration: 1994

Registered in: Australia

Headquarters: Sydney

Sector: healthcare

Date of IPO: 05.10.2023

Exchange: NASDAQ

Ticker: CDEX

CardieX Ltd develops medical devices for monitoring and treatment of various diseases such as hypertension, cardiovascular diseases, etc. The company’s product line includes devices for monitoring all basic human health parameters.

Investments raised (as at 30.06.2022): 1.55 million USD

The main investor is C2 Ventures Pty Limited.

CardieX market assessment

According to a report by Grand View Research, the global market of digital medical devices, where CardieX operates, was valued at 107.86 billion USD in 2022 and could reach 667.8 billion USD by 2030. The compound annual growth rate from 2023 to 2030 inclusive will be 25.6%.

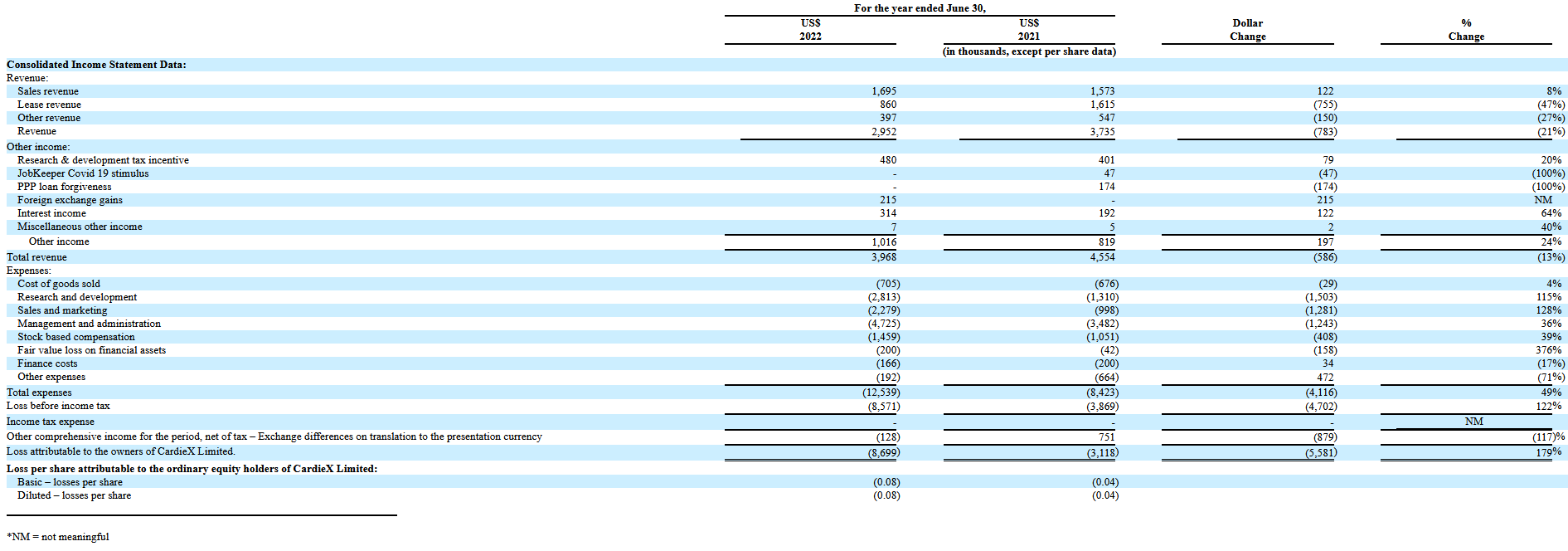

Financial performance of CardieX

Revenue for 2022 (as at 30.06.2022): 2.95 million USD, 21%

Net profit for 2022: 8.7 million USD

Net cash flow (as at 30.06.2023): −4.62 million USD

Cash and cash equivalents (as at 31.12.2022): 1.68 million USD

Liabilities (as at 31.12.2022): 6.53 million USD

Strengths and weaknesses of CardieX

Strengths:

- A promising target market

- Increasing revenue

- Proprietary technology practices

Weaknesses:

- Intense competition

- The necessity to raise funds in the future

- Absence of dividend payment plans

Details of the CardieX IPO

Underwriter: Roth Capital Partners, LLC

Volume of IPO offering: 1.33 million ADS

Average price: 7.4 USD

Gross proceeds: 9.84 million USD

Expected amount of capitalisation at the time of the IPO: 73.9 million USD

Potential P/S: 6.8

Average P/S value in the industry: 3.7

Summary

WeBuy Global Ltd., Healthy Green Group Holding, and CardieX Ltd. intend to go public in October. Their IPOs are expected to be the largest placements this month in terms of anticipated market capitalisation. The first one of these companies operates in the technology sector, the second one is associated with the consumer protection sector and the third one is involved in the healthcare industry.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high