Top 5 Stocks in June: Risers and Fallers

8 minutes for reading

The Top 5 list of securities that demonstrated the most prominent growth in June includes the stocks of Turning Point Therapeutics Inc., Mirati Therapeutics Inc., New Oriental Education & Technology Group Inc., Li Auto Inc., and Chewy Inc.

On the other hand, the top fallers are the stocks of Royal Caribbean Cruises Ltd., Comstock Resources Inc., Callon Petroleum Company, Globalfoundries Inc., and Victoria's Secret & Co.

Selection criteria

- The stocks are traded on the NYSE and NASDAQ

- Their share price is above $2

- The companies are not funds

- Their market capitalisation is over $2 billion

- Their average trading volume over the last 30 days is more than 750,000 shares

Growth and decline are expressed in percentage as the difference between the closing prices on 31 May and on 30 June 2022. The market capitalisation of each company is relevant to the time when the article was being prepared.

Shares with the most prominent growth in June

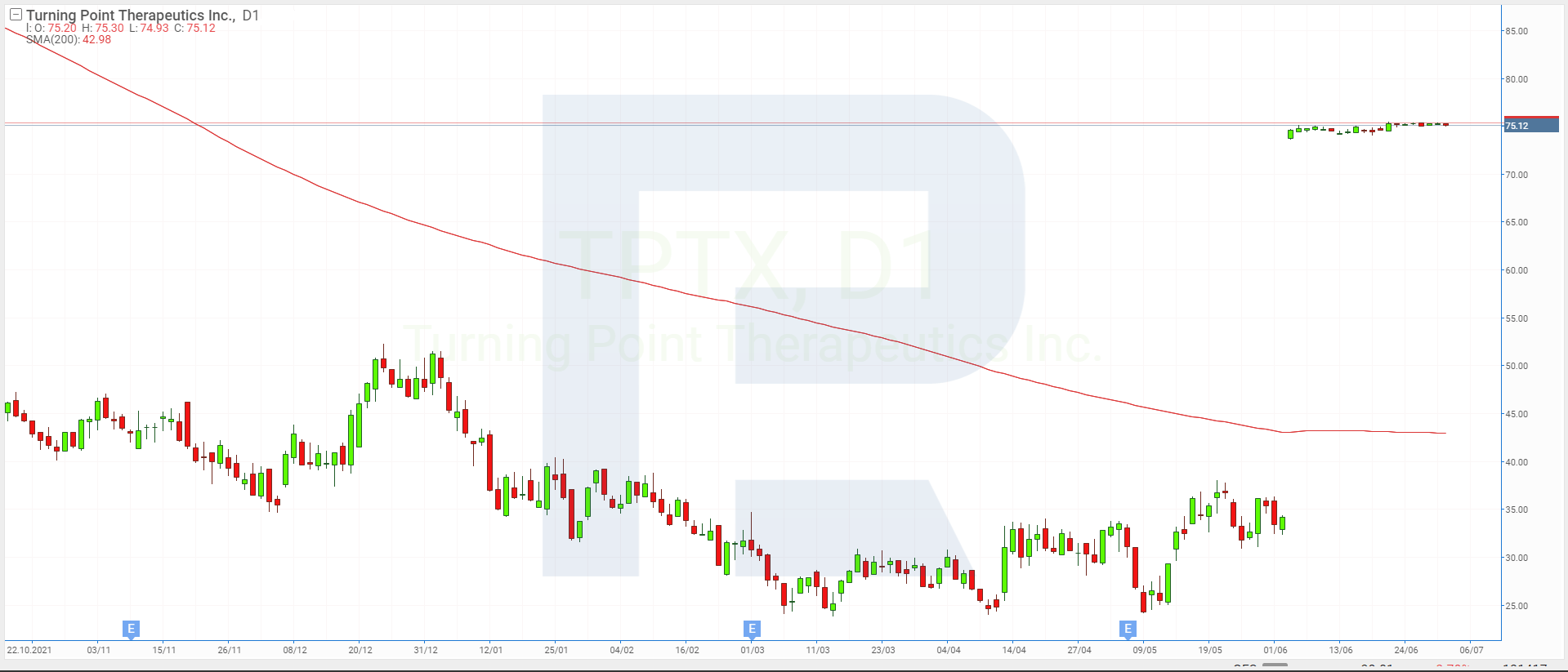

1. Turning Point Therapeutics – 112.8%

Founded in: 2013

Registered in: US

Headquarters: San Diego, California

Sector: biotech

Exchange: NASDAQ

Market capitalisation: $3.7 billion

Biopharma company Turning Point Therapeutics Inc. designs and develops treatment methods for the genetic factor of cancer. In June, the shares of Turning Point Therapeutics Inc. (NASDAQ: TPTX) skyrocketed 112.8% from $35.37 to $75.25.

On 3 June, the quotes surged 118.35% to $74.59 after the news about a contract with Bristol Myers Squibb. The latter will pay Turning Point Therapeutics $76 for each share, which means the agreement will amount to $4.1 billion. The parties expect the trade to close in Q3 2022.

2. Mirati Therapeutics – 71.4%

Founded in: 1995

Registered in: US

Headquarters: San Diego, California

Sector: biotech

Exchange: NASDAQ

Market capitalisation: $3.9 billion

Mirati Therapeutics Inc. designs innovative drugs for treating oncological diseases. In June, the shares of Mirati Therapeutics Inc. (NASDAQ:MRTX) recorded a 71.4% growth from $39.16 to $67.13.

At the beginning of June, the shares jumped 10.11% to $44.33. Then the quotes rose 36.45% more to $58.89 and kept growing for six trading sessions in a row.

These dynamics were the consequence of the positive results of testing Adagrasib, the drug for lung cancer treatment. Mirati Therapeutics expects that the US Food and Drug Administration will approve the use of Adagrasib against non-small cell cancer on an expedited basis.

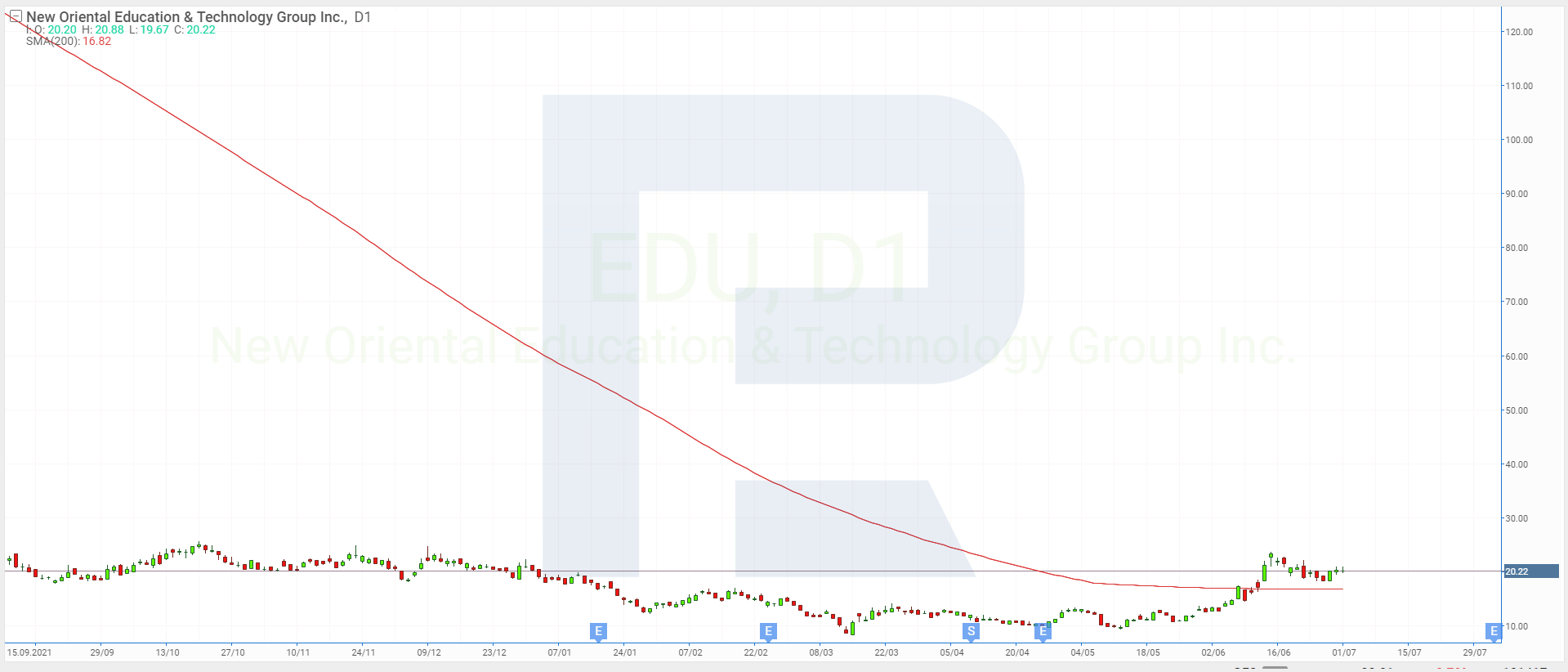

3. New Oriental Education & Technology Group – 55.9%

Founded in: 1993

Registered in: China

Headquarters: Beijing

Sector: education

Exchange: NYSE

Market capitalisation: $3.4 billion

Chinese corporation New Oriental Education & Technology Group Inc. provides private online education services to students in school and higher education in China. In June, the shares of New Oriental Education & Technology Group Inc. (NYSE:EDU) recorded a 55.9% growth from $13.06 to $20.36.

After the Chinese authorities toughened the regulations for companies in the sector of online education, thereby causing a crash in the market, New Oriental Education found a new business model – online streams in English. This new format that unites education, immediate communication with the audience, and electronic commerce resulted in an inflow of new users.

On 13 June, JPMorgan analysts lifted the target price of New Oriental Education & Technology Group shares from $14 to $24. This sent the shares of the company to rise 24.39% from $13.06 to $21.27.

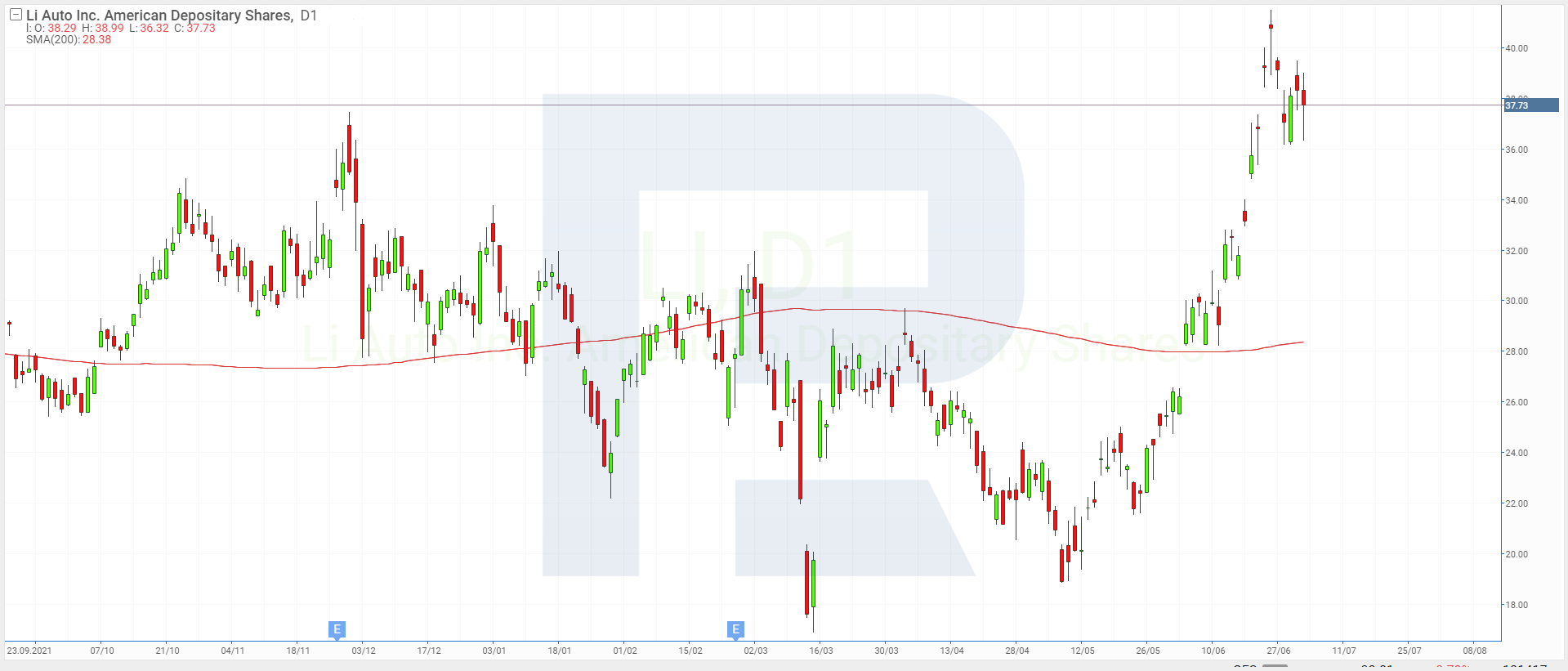

4. Li Auto – 52.8%

Founded: 2015

Registered: China

Headquarters: Beijing

Sector: car industry

Exchange: NASDAQ

Market capitalisation: $36.4 billion

Chinese Li Auto Inc. designs and produces electric cars. Last month, the shares of Li Auto Inc. (NASDAQ:LI) jumped 52.8% from $25.07 to $38.31.

The growth of the Chinese carmaker’s shares can be attributed to several factors simultaneously: The weakening of the quarantine measures, which had been imposed after a new surge of COVID-19 in China. The rumours that spread about Chinese authorities considering continuing the grant programme for electric car manufacturers. And the fact that only 72 hours after the presentation of its new flagship crossover L9, Li Auto received over 30,000 orders for this car.

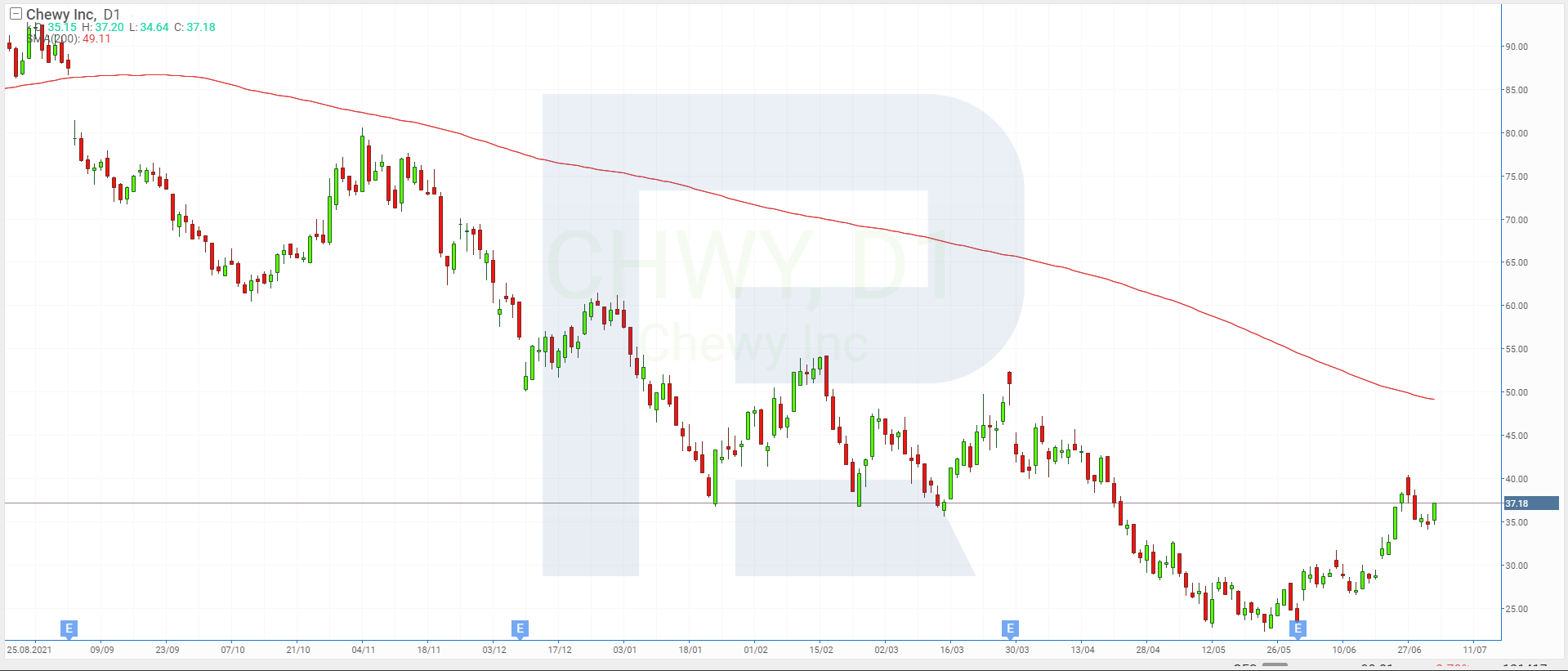

5. Chewy – 40%

Founded: 2010

Registered: US

Headquarters: Dania Beach, Florida

Sector: online retail sales

Exchange: NYSE

Market capitalisation: $15.6 billion

Chewy Inc. owns an Internet shop with the same name, selling goods for pets. In June, the share price of Chewy Inc. (NYSE:CHWY) grew 40% from $24.80 to $34.72.

At the beginning of June, the corporation presented its financial report for Q1 of this year, in which earnings increased 13.7% to $2.4 billion compared to Q1 2021, the client base grew 4.2% to 20.6 million people, and EPS reached $0.04 per share. Following this positive report, the stock quotes jumped 24.22% to $29.18.

On 21 June, Wedbush analyst Seth Basham changed the rating of Chewy shares from Neutral to Outperform and lifted the target price from $30 to $35. The shares of the company reacted with a 10.98% growth to $31.85.

Shares with most prominent decline in June

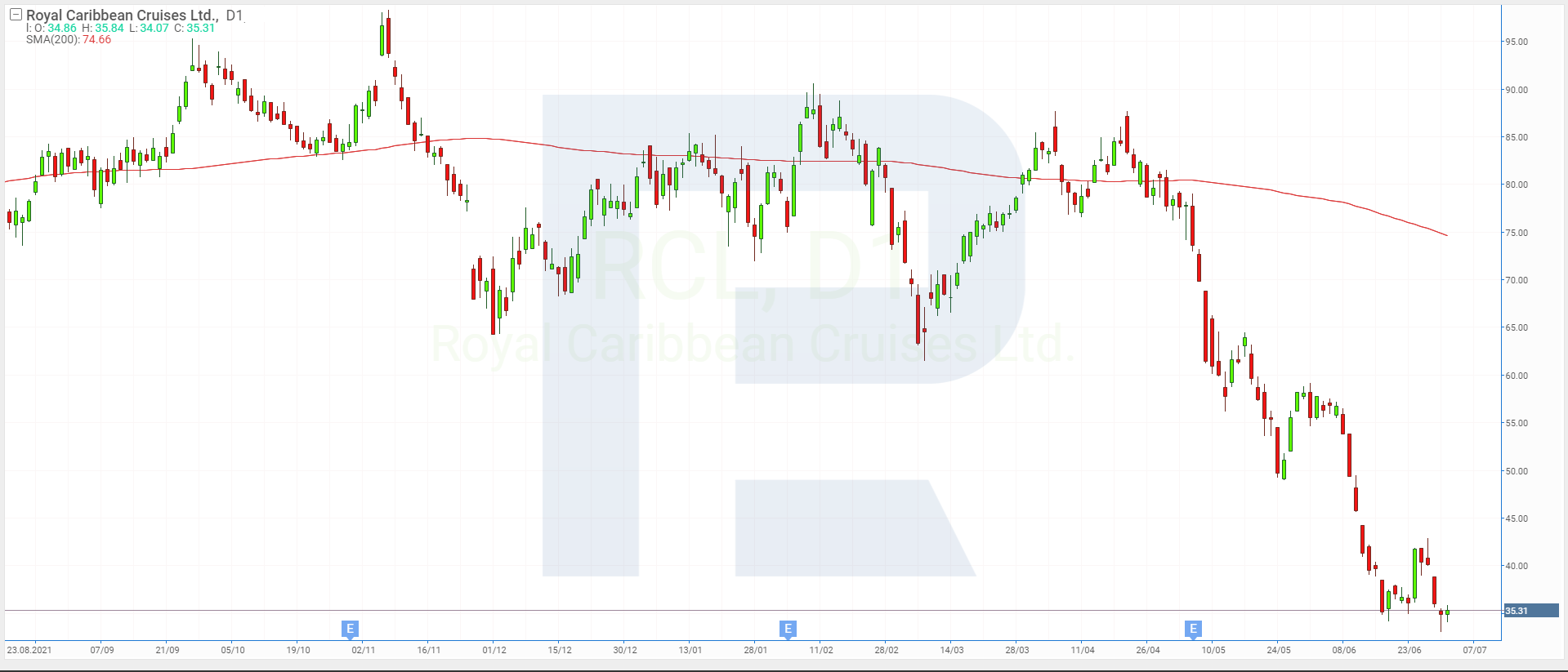

1. Royal Caribbean Cruises – 39.9%

Founded: 1968

Registered: US

Headquarters: Miami, Florida

Sector: tourist services

Exchange: NYSE

Market capitalisation: $9 billion

Royal Caribbean Cruises Ltd. is the second-largest cruise company in the world. It owns such famous brands as Royal Caribbean International, Celebrity Cruises, Azamara, and Silversea Cruises. Over the first month of summer, the quotes of Royal Caribbean Cruises Ltd. (NYSE:RCL) plummeted 39.9% from $58.07 to $34.91.

In June, only five trading sessions closed with the growth of the shares of the cruise company. Due to the COVID crisis, the debt of Royal Caribbean Cruises has doubled, reaching $8 billion, which the company must pay off in the nearest 18 months. Such a state of business has a negative influence on shareholders and investors.

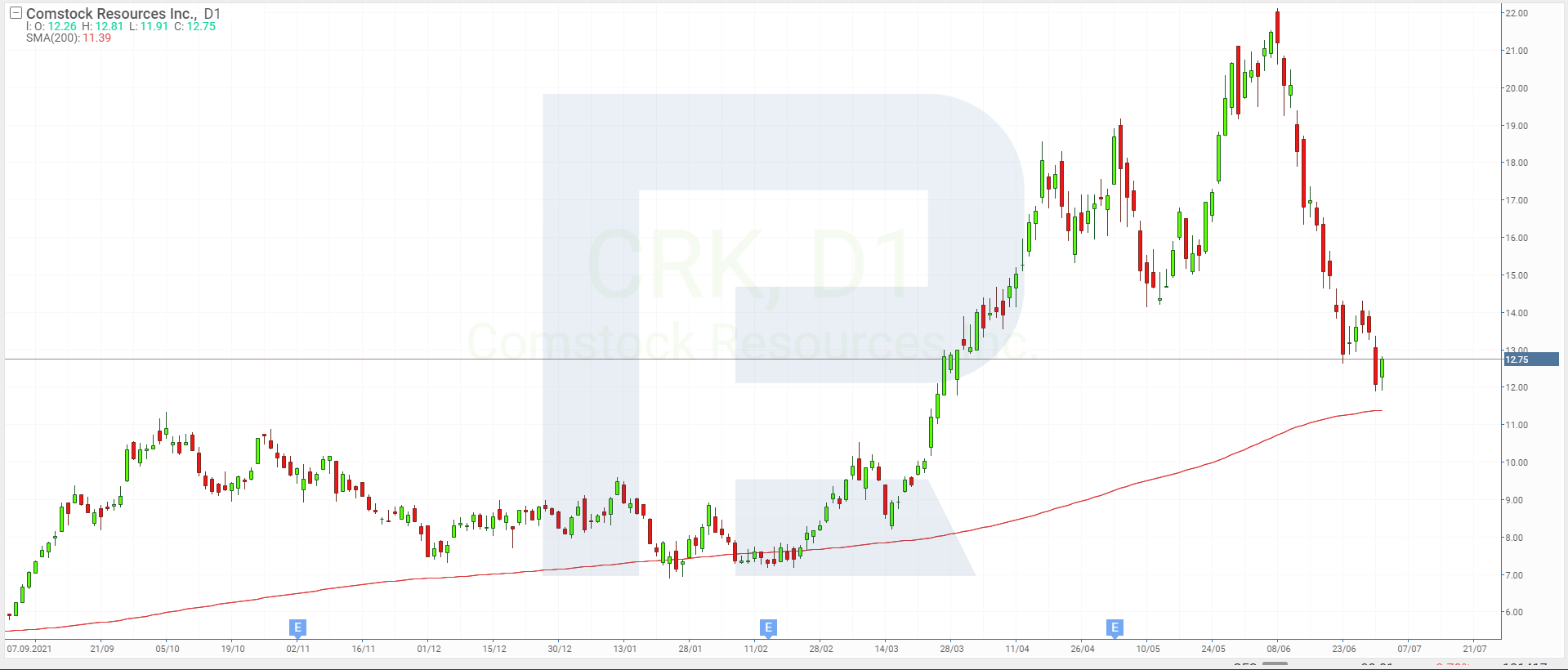

2. Comstock Resources – 37.4%

Founded: 1919

Registered: US

Headquarters: Frisco, Texas

Sector: energy

Exchange: NYSE

Market capitalisation: $3 billion

Independent energy company Comstock Resources Inc. explores and mines oil and natural gas. In June, the shares of Comstock Resources Inc. (NYSE:CRK) lost 37.4%, falling from $19.3 to $12.08.

The stock quotes of the energy company are going down due to the strong decline in the price of futures for natural gas in the US. There is a seasonal decline in demand for this resource and a noticeable increase in gas reserves.

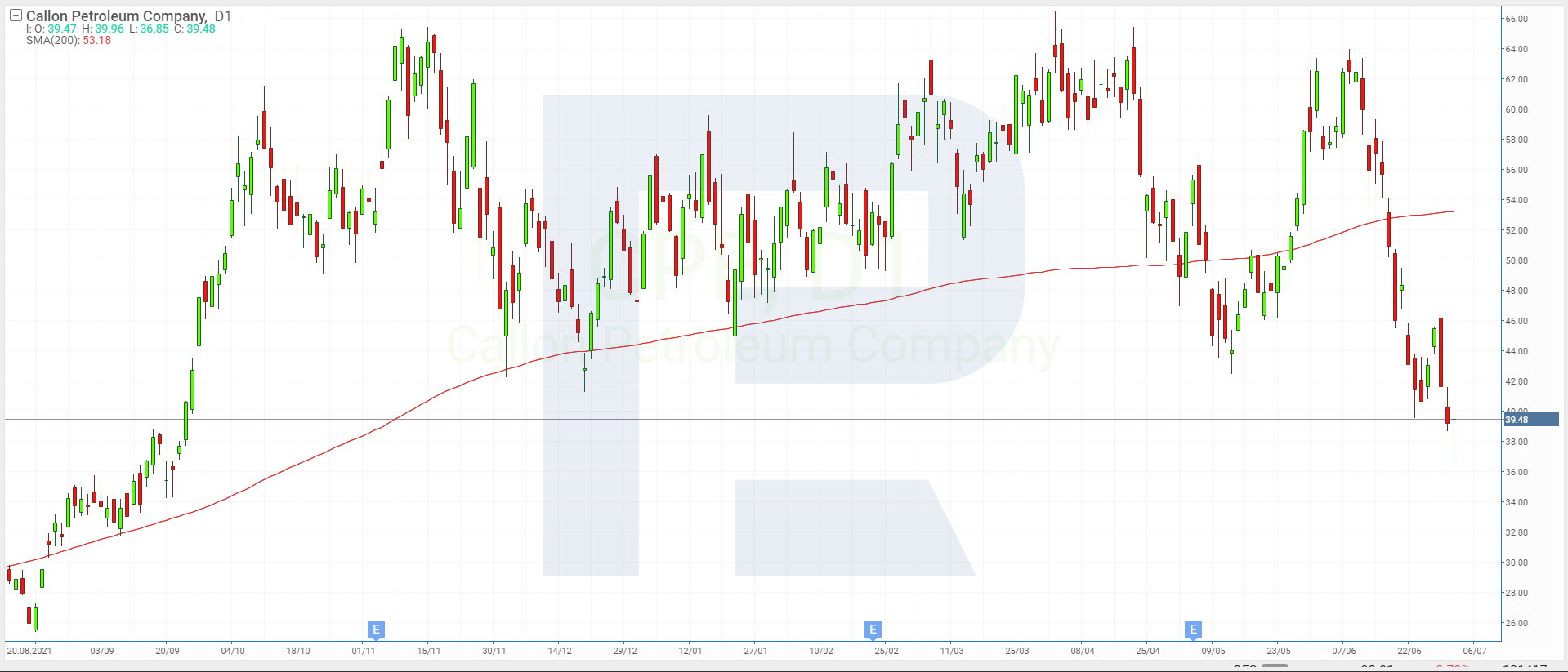

3. Callon Petroleum – 32.9%

Founded: 1950

Registered: US

Headquarters: Houston, Texas

Sector: energy

Exchange: NYSE

Market capitalisation: $2.4 billion

Callon Petroleum Company is another representative of the oil and gas industry on our list. The company specialises in the exploration and development of oil and gas reserves.

In the last month, the shares of Callon Petroleum Company (NYSE:CPE) dropped by 32.9% from $58.46 to $39.20. Similar to Comstock Resources Inc., the company lost some of its share prices due to the decline in the market of natural gas.

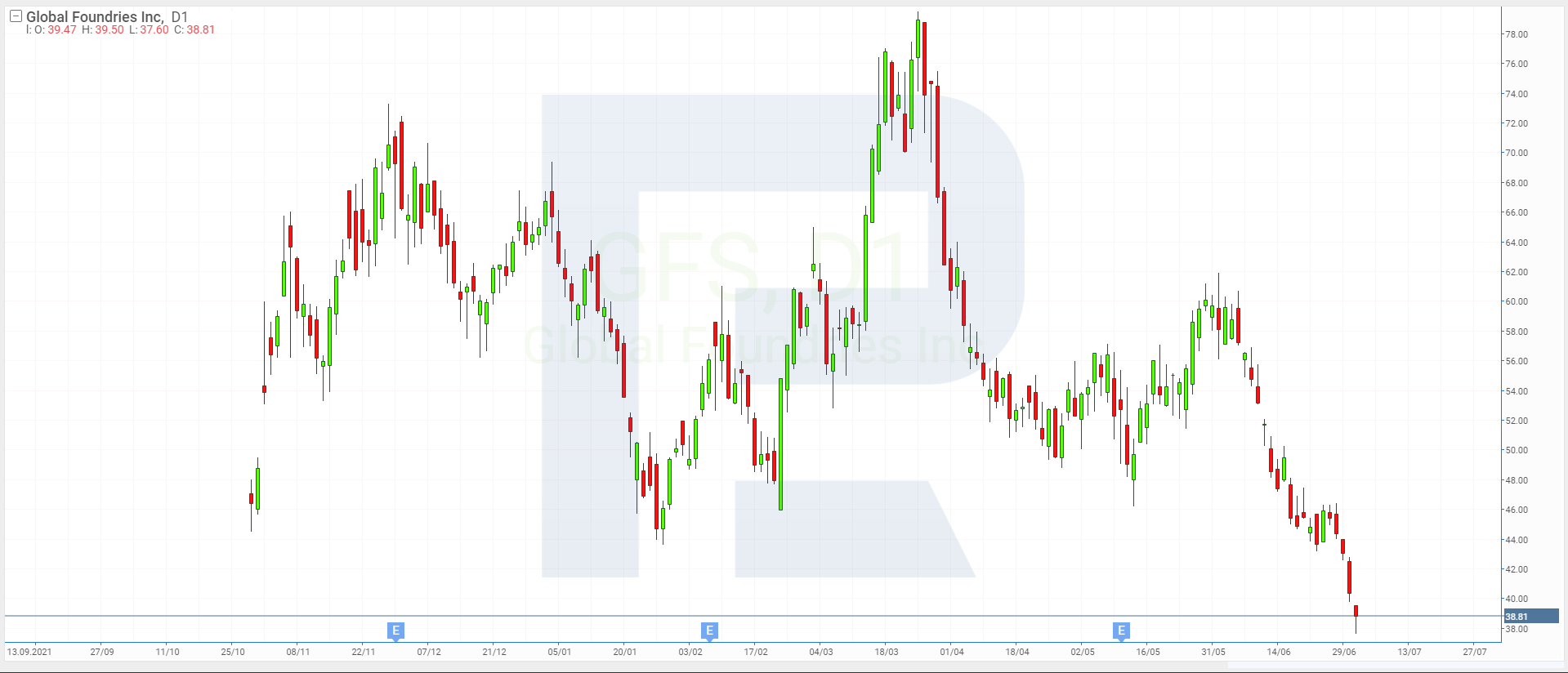

4. Globalfoundries – 32.4%

Founded: 2009

Registered: US

Headquarters: Malta, New York

Sector: technology

Exchange: NASDAQ

Market capitalisation: $21 billion

Globalfoundries Inc. designs, develops and produces a wide range of semiconductor products. It is one of the largest representatives of the segment. The decline of the stock quotes of GlobalFoundries Inc. (NASDAQ:GFS) last month was 32.4% from $59.69 to $40.34.

In June, only four trading sessions of the shares closed with growth. The negative trend must be so persistent because the market is tired of waiting for the draft bill to be accepted about a $52 billion grant for producing semiconductors and $200 billion for stimulating science and tech innovations in the US.

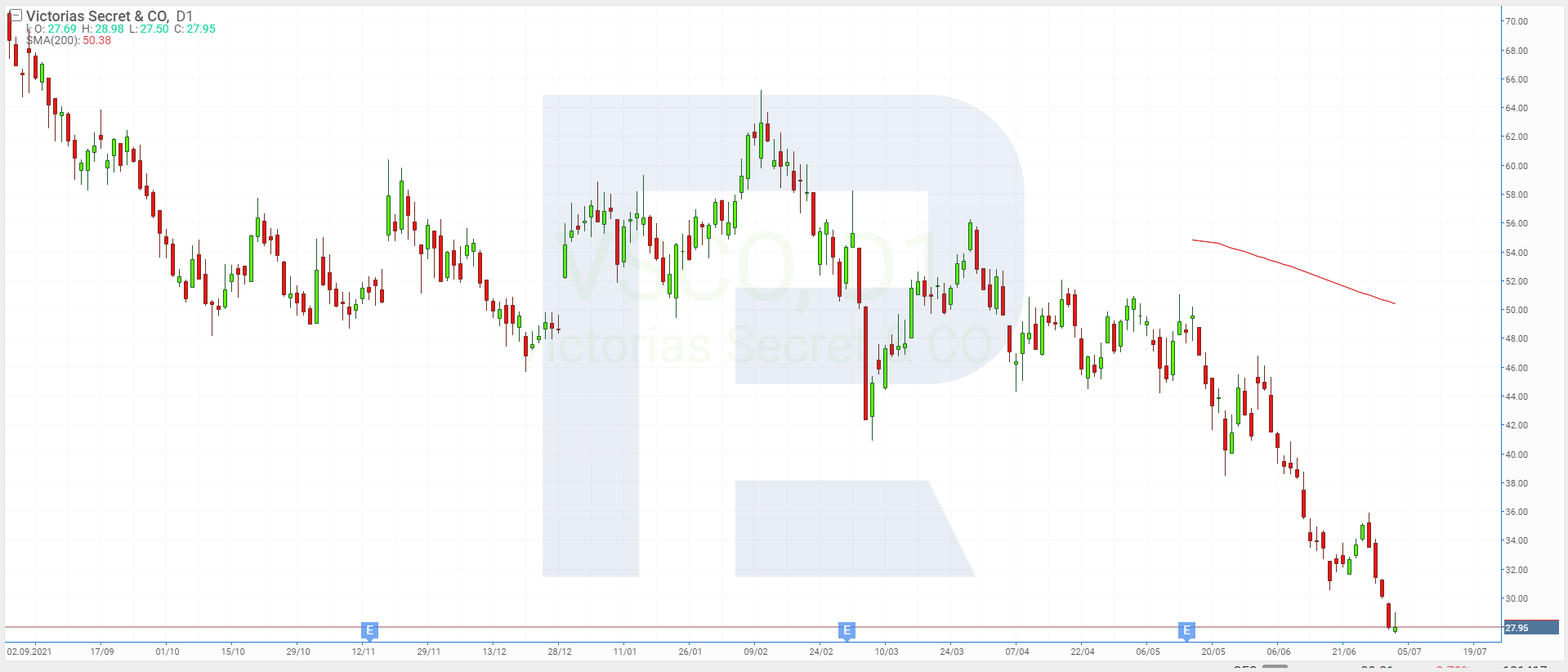

5. Victoria’s Secret – 32.1%

Founded: 1977

Registered: US

Headquarters: Reynoldsburg, Ohio

Sector: retail sales

Exchange: NYSE

Market capitalisation: $2.3 billion

Victoria's Secret & Co is one of the most famous global companies selling underwear for women, swimming suits, clothes, accessories, cosmetics, and perfume. Over the first month of summer, the shares of Victoria's Secret & Co (NYSE:VSCO) lost 32.1%, falling from $41.21 to $27.97.

On 31 May, the company presented its report for February–April this year which showed a 4,4% decline in the general earnings against the statistics of February–April 2021to $1.48 billion, while the net profit dropped 56.3% to $76.14 million, and EPS fell 52.8% to $0.93.

Analysts believe that retail sales remain in trouble, and if Victoria's Secret & Co manages to demonstrate dynamics comparable to those of last year, this will be a good result.

Which shares demonstrated the most noticeable dynamics in June?

The leaders of share price growth in June were Turning Point Therapeutics Inc., Mirati Therapeutics Inc., New Oriental Education & Technology Group Inc., Li Auto Inc., and Chewy Inc.

Meanwhile, the most prominent decline in stock quotes was demonstrated by such companies as Royal Caribbean Cruises Ltd., Comstock Resources Inc., Callon Petroleum Company, GlobalFoundries Inc., and Victoria's Secret & Co.

In June, almost every company above had its own specific reason for share price growth or decline. Only Comstock Resources and Callon Petroleum shared the same reason for the decline of the quotes – the serious drop in the price of futures for natural gas in the US.

This material and the information contained therein are for informational purposes only and should in no way be construed as providing investment advice for the purposes of the Investment Companies Act 87 (I) 2017 of the Republic of Cyprus, or any other form of personal advice or recommendation relating to certain types of transactions in certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high