Consumer Services: Top 5 Stocks of August

5 minutes for reading

Over the first 19 days of August, the most prominent growth in the consumer services sector was demonstrated by the stocks of such representatives as Tripadvisor Inc., DraftKings Inc., AMC Entertainment Holdings Inc., Peloton Interactive Inc., and H&R Block Inc.

Selection criteria

- Sector: consumer services

- The companies are not funds

- The stocks are traded on the NYSE or the NASDAQ

- Their share price is above $2

- Their market capitalisation is over $2 billion

- Their average trading statistics over the last 30 days is over 750,000 shares

Growth is expressed in percentage as the difference between the closing prices on 29 July and 19 August 2022. The market capitalisation of each company is relevant to the time when the article was being prepared.

Tripadvisor — 38.7%

Founded in: 2000

Registered in: US

Head office: Needham, Massachusetts

Platform: NASDAQ

Market capitalisation: $3.7 billion

Tripadvisor Inc. manages a popular Internet platform for booking dwellings, transportation, and restaurants, and planning trips. The online platform with user feedback about restaurants, cafes, and entertainment works in 40 countries and in 20 languages.

Since the beginning of August, the share price of TripAdvisor Inc. (NASDAQ: TRIP) has risen 38.7% from $19.01 to $26.36. The most prominent overnight growth was recorded on 5 August, the following day after a strong financial report for Q2 2022 was published. On that day, the stock quotes surged 18.94% to $23.86.

As you know, earnings of TripAdvisor Inc. in April-June, compared to the statistics of the same months last year, increased 77% to $417 million; net profit rocketed 177.5% to $31 million, and EPS 172.4% to $0.21. Such results might mean that the tourism sector is recovering, and the demand for travel is high.

DraftKings — 32.1%

Founded in: 2011

Registered in: US

Head office: Boston, Massachusetts

Platform: NASDAQ

Market capitalisation: $8.1 billion

DraftKings Inc. specialises in digital sports entertainment and games. One of its main businesses is betting services. Over the first 19 days of August, the stock of DraftKings Inc. (NASDAQ: DON'T) recorded a 32.1% growth from $13.73 to $18.14.

Analysts suppose that this growth can be attributed to the good results of Q2, and an increased financial forecast for this year.

In April-June, earnings of DraftKings Inc. increased 56.6% to $466.2 million, while the net loss dropped by 28.9% to $217 million, and the loss per share declined 34.2% to $0.5. DraftKings Inc. expects its annual earnings to reach $2.13 billion, which is 0.7% above the previous forecast.

AMC Entertainment Holdings — 23.8%

Founded in: 1920

Registered in: US

Head office: Leewood, Kansas

Platform: NYSE

Market capitalisation: $9.3 billion

The growth of AMC Entertainment Holdings Inc. stock (NYSE: AMC) – a company that owns one of the world's largest cinema chains – amounted to 23.8% this month, from $14.56 to $18.02.

This rise can be explained by the renewed interest of individual Reddit investors from the WallStreetBets community in the stock of the company. Meme shares are growing again.

Peloton Interactive — 23.4%

Founded in: 2012

Registered in: US

Head office: New York, New York

Platform: NASDAQ

Market capitalisation: $3.9 billion

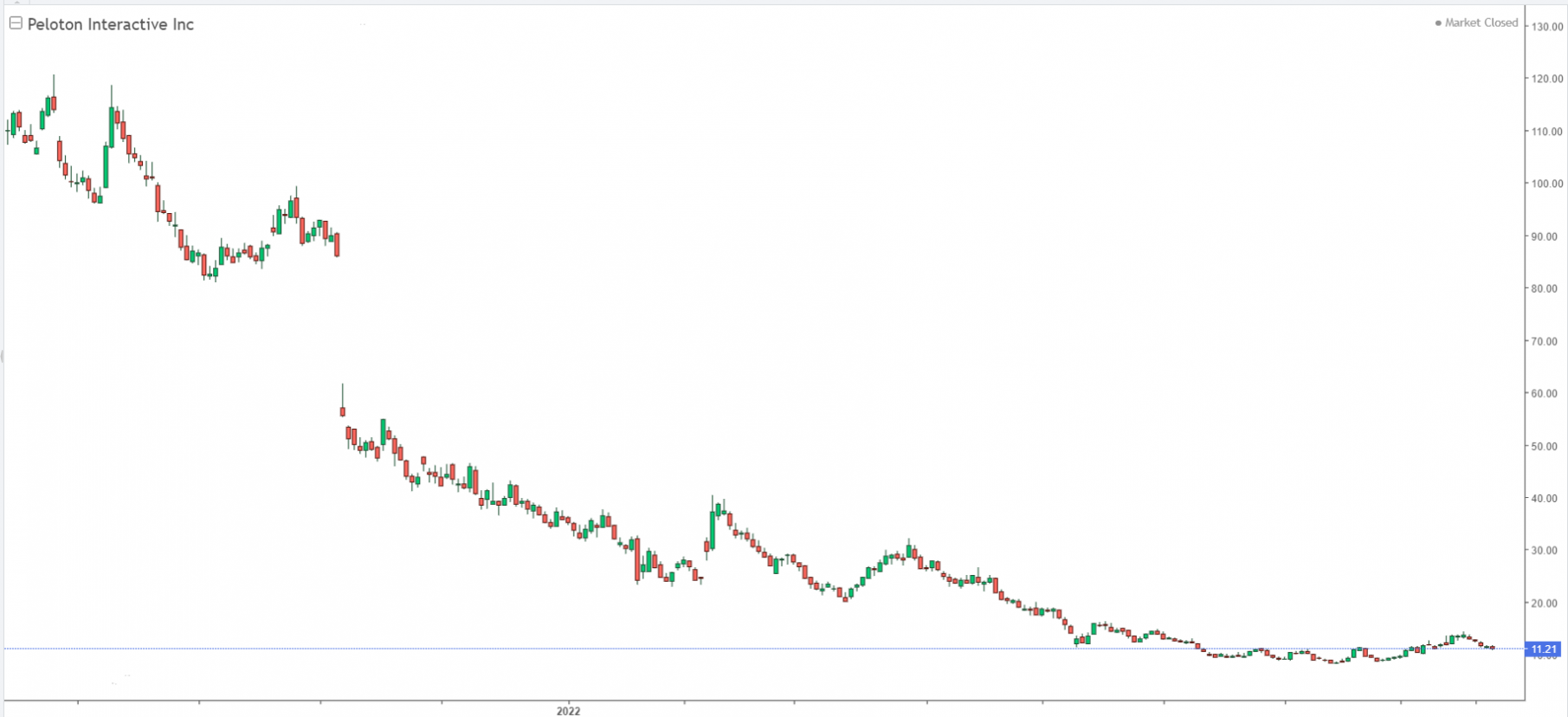

Peloton Interactive Inc. sells trainers and subscriptions to online home training courses. In the midst of the COVID-19 pandemic and quarantine measures, Peloton Interactive stock recorded remarkable growth, however, it is currently not going through the best times.

Over the first 19 days of August, Peloton Interactive Inc. stock (NASDAQ: PTON) recorded a 23.4% growth from $9.49 to $11.71. This growth can be attributed to the recent changes in the company's operations, which were announced this month.

Peloton Interactive Inc. reported a hike in the price for certain models of sports equipment for training and the layoff of 800 employees. Moreover, the company is handing over the supply of trainers and customer service to other companies.

H&R Block — 19.5%

Founded in: 1955

Registered in: US

Head office: Kansas City, Missouri

Platform: NYSE

Market capitalisation: $7.6 billion

H&R Block Inc. provides a wide range of professional tax services. It operates in the US, Canada, and Australia markets. The growth of H&R Block Inc. stock (NYSE: HRB) over the timeframe in question reached 19.5%, from $39.96 to $47.75.

The company reported better results than had been expected in the market for Q4 2022. This might have been the reason for the growth of the stock.

Earnings of H&R Block Inc. in April-June increased 0.4% to $1.05 billion, which is 6.2% higher than the consensus forecast. Net profit dropped by 8.6% to $222.7 million, and EPS grew 3.8% to $1.37, exceeding the forecast by 13.5%.

What influenced the growth of stock in the consumer services sector in August?

Over the first three weeks of August, the most prominent growth of share prices in the consumer services sector was demonstrated by such companies as TripAdvisor Inc, DraftKings Inc., AMC Entertainment Holdings Inc., Peloton Interactive Inc., and H&R Block Inc.

One of the main reasons for the growth of the stocks over this timeframe must be the publication of the financial reports for the previous quarter of 2022.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high