Electronic Technology Sector: Top 5 Stocks

6 minutes for reading

Over the last three months in the sector of electronic technology, the most prominent growth was demonstrated by the stocks of Axon Enterprise Inc., Rambus Inc., Extreme Networks Inc., First Solar Inc., and Altra Industrial Motion Corp.

Selection criteria:

- Sector – electronic technology

- The companies are not funds

- Their shares are traded on the NYSE or NASDAQ

- Their share price does not exceed $2

- Their market capitalisation is over $2 billion

- The average trading volume of the last 30 days is more than 500,000 stocks

Growth is expressed in percent as the difference between the closing price on 12 August and 14 November 2022. The market capitalisation of each company was valid at the time when the article was being prepared.

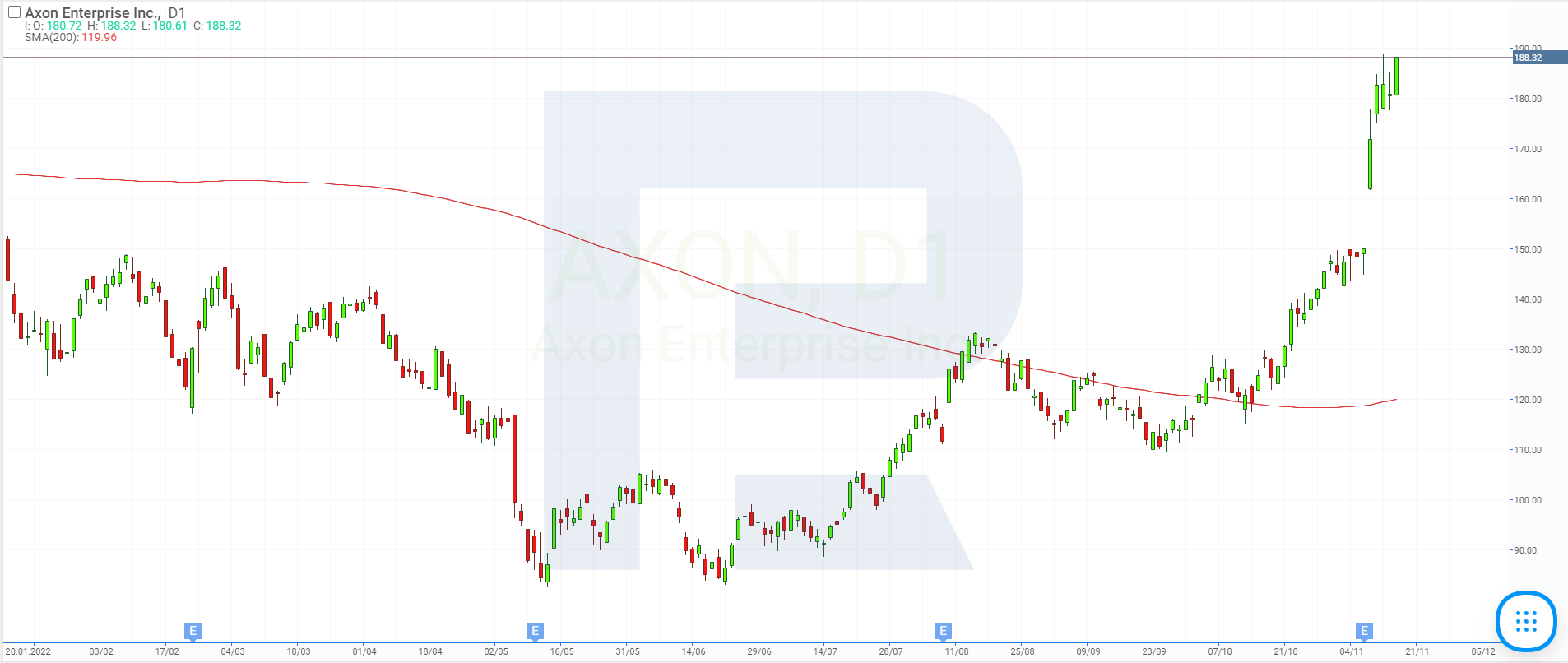

1. Axon Enterprise — 39.7%

Founded in: 1993

Registered in: US

Head office: Scottsdale, Arizona

Exchange: NASDAQ

Market capitalisation: $12.9 billion

Axon Enterprise Inc. develops and produces weapons, and body cameras, as well as software and cloud solutions for law enforcement, defence forces, security services, and civilians.

Over the last three months, the share price of Axon Enterprise Inc. (NASDAQ: AXON) recorded a 39.7% growth from $129.39 to $180.89. On 8 November, the company reported for Q3 2022 a 34% growth in earnings against the statistics of last year, to a record $312 million. The result was 12.55% higher than forecasted.

Net profit reached $12.1 million, and EPS was $0.17, which is 30% higher than the expert forecast. Note that Axon Enterprise Inc. has been exceeding EPS expectations for four quarters in a row.

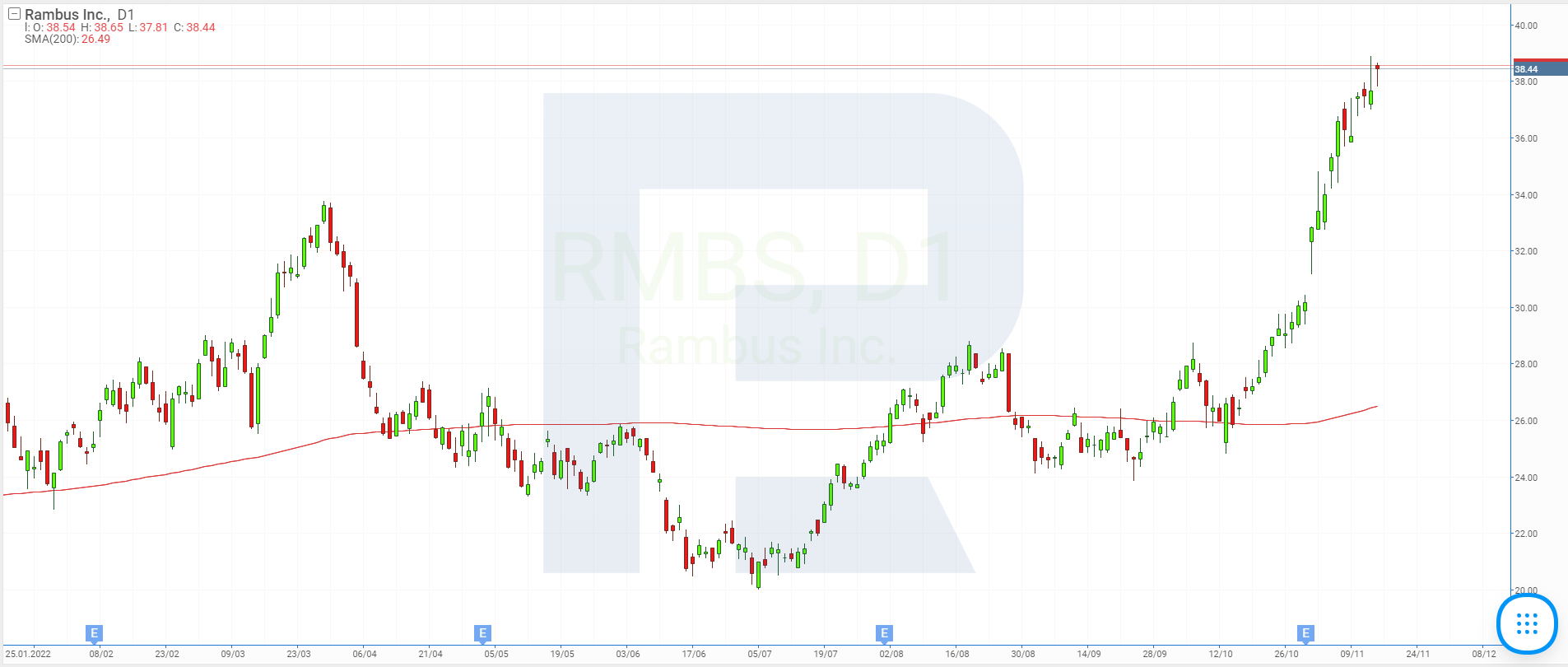

2. Rambus — 36.7%

Founded in: 1990

Registered in: US

Head office: San Jose, California

Exchange: NASDAQ

Market capitalisation: $4.1 billion

Rambus Inc. develops and sells semiconductor products, network interfaces, digital regulators, and technology for fast data transmission and data protection. The company owns a whole portfolio of patents for its high-tech developments.

Since 12 August, the quotes of Rambus Inc. (NASDAQ: RMBS) recorded a 36.7% growth from $27.54 to $37.66. On 12 September, the corporation announced the initiation of an accelerated $100 million stock buyback programme.

On 31 October, Rambus Inc. published its Q3 report: Earnings increased by 38% to $112.2 million, exceeding analyst expectations by 3%. Net profit amounted to $0.9 million, and the EPS was $0.01.

On the same day, the company reported an extension of the agreement and expansion of conditions of cooperation with Samsung Electronics. This grants the South Korean giant access to the patent portfolio of Rambus until the end of 2033. The details and conditions of the agreement remain confidential.

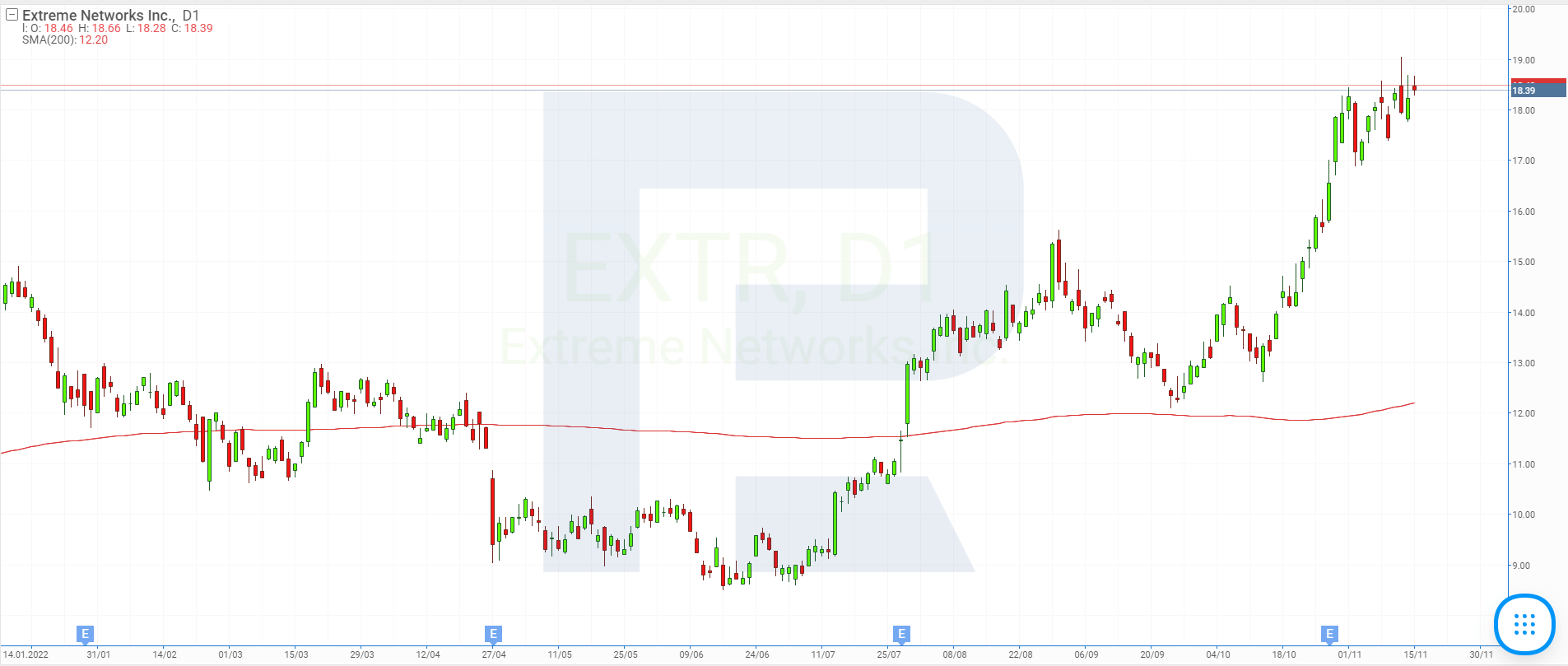

3. Extreme Networks — 32.7%

Founded in: 1996

Registered in: US

Head office: Morrisville, North Carolina

Exchange: NASDAQ

Market capitalisation: $2.4 billion

Extreme Networks Inc. produces equipment for the infrastructure of wired and wireless networks, software for network management and protection, and cloud solutions.

From mid-August through mid-November, the stock of Extreme Networks Inc. (NASDAQ: EXTR) recorded a 32.7% growth from $13.73 to $18.22. At the beginning of October, Extreme Networks Inc. announced its cooperation with Verizon Communications Inc. (NYSE: VZ). The two companies will be deploying a high-speed wireless network at Anfield stadium, the home stadium of the Liverpool football club.

On 27 October, Extreme Networks Inc. published its financial report for Q1, financial 2023. Earnings in July-September demonstrated an 11% increase to $297.7 million, exceeding the consensus forecast by 4.6%. At the same time, net profit dropped by 1% to $12.6 million, and EPS by 10% to $0.09.

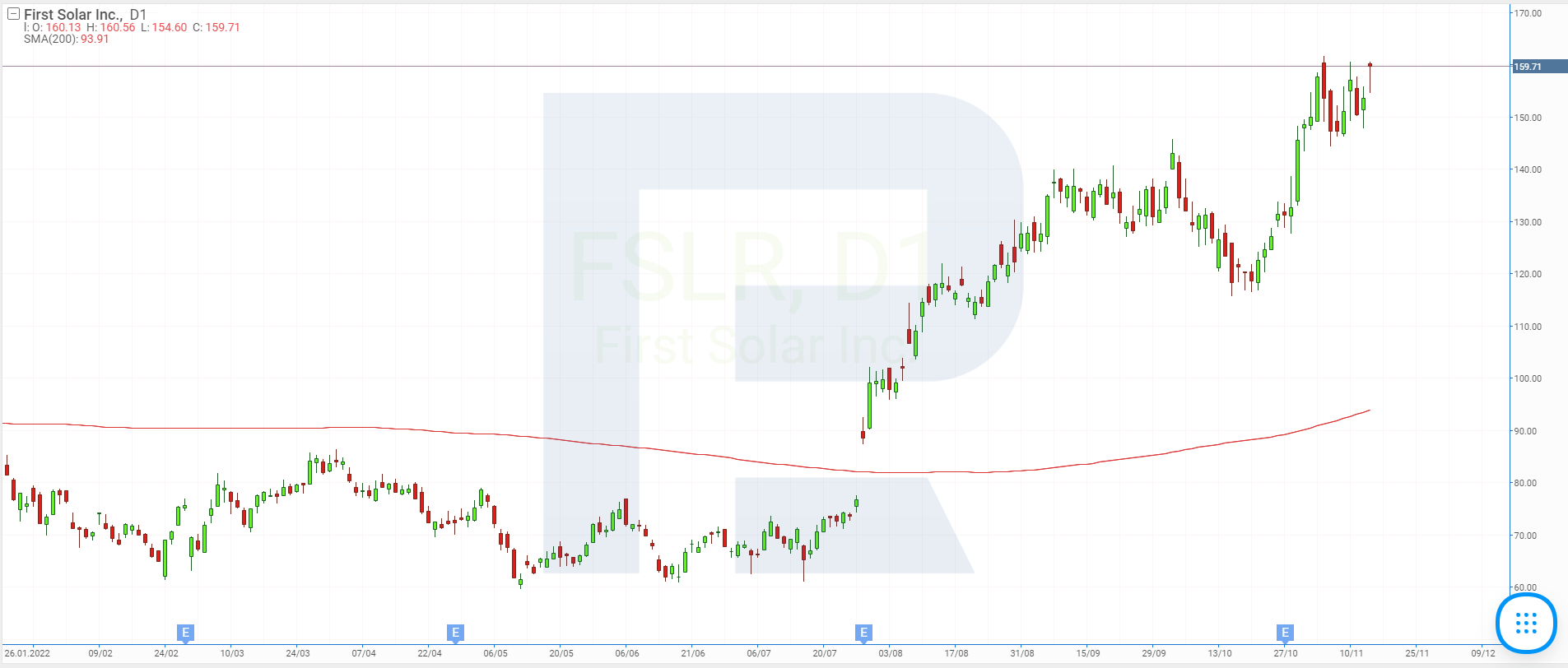

4. First Solar — 30.2%

Founded in: 1999

Registered in: Tempe, Arizona

Exchange: NASDAQ

Market capitalisation: $16.4 billion

First Solar Inc. specialises in the development and production of technologies for solar energy, including highly efficient and ecological solar modules. The company estimates its global yearly production power to exceed 20 GW by 2025.

Over the last three months, the shares of First Solar Inc. (NASDAQ: DSLR) recorded a 30.2% growth from $117.96 to $153.63. The quotes of this company and others connected to solar energy were positively impacted by the inflation reduction act into law signed by Joe Biden at the beginning of September.

The document encompasses several legislation acts meant for switching the US to green energy. In fact, solar energy is depicted as the main energy source in the country. Owing to the new law, the overall power of solar panels in the US is expected to increase from 129 GW to 336 GW over the next five years.

At the beginning of November, analysts from the Bank of America, Guggenheim Partners, and Piper Sandler increased the target price of First Solar stocks to $165, $233, and $200, respectively. As we can see, investment companies consider the prospects of solar module producers quite bright.

5. Altra Industrial Motion — 27.6%

Founded in: 2004

Registered in: US

Head office: Braintree, Massachusetts

Exchange: NASDAQ

Market capitalisation: $3.8 billion

Altra Industrial Motion Corp. is the world's leading developer and producer of a wide range of solutions for energy transmission management. These include the accessories, nodes, and systems that are necessary for the facilitation of the transmission.

The products of Altra Industrial Motion Corp. are used in the aerospace, defence, mining, and car industries, as well as in the energy sphere, agriculture, and production of special equipment.

Over the last three months, the shares of Altra Industrial Motion Corp. (NASDAQ: AIMC) recorded a 27.6% growth from $45.11 to $57.54. The main reason for this growth of the quotes was the news that Regal Record Corporation (NYSE: RRX) was acquiring Altra Industrial Motion Corp. for $4.95 billion.

On 27 October, the information about the merger with Regal Record Corporation sent the share price of Altra Industrial Motion Corp. surging 48.37% to $59.72. The parties plan to close the trade in the first half of next year.

What influenced stock growth in the electronic technology sector?

From mid-August through mid-November, the leaders of stock price growth in the sector of electronic technology were Axon Enterprise Inc., Rambus Inc., Extreme Networks Inc., First Solar Inc., and Altra Industrial Motion Corp.

The main reasons for the speedy growth of these stocks were the strong financial reports for July-September this year, and cooperation agreements with other large companies.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high