Electronic Technology: Top 5 Stocks in the Last Three Months

6 minutes for reading

Super Micro Computer Inc., Joby Aviation Inc., IonQ Inc., NVIDIA Corporation, and Rocket Lab USA Inc. are the companies in the electronic technology sector that have experienced the most significant growth in their stock values in the last three months.

Selection criteria for the companies:

- The sector is electronic technology

- The companies are not classified as funds

- The stock is traded on the NYSE and NASDAQ

- The share price exceeds 2 USD

- The market capitalisation is over 2 billion USD

- The average trading volume for the last 30 days is more than 750,000 shares

Growth values were determined as the percentage difference between the opening prices on 17 April and the closing prices on 17 July 2023. The market capitalisation of the companies was valid as of the time of writing.

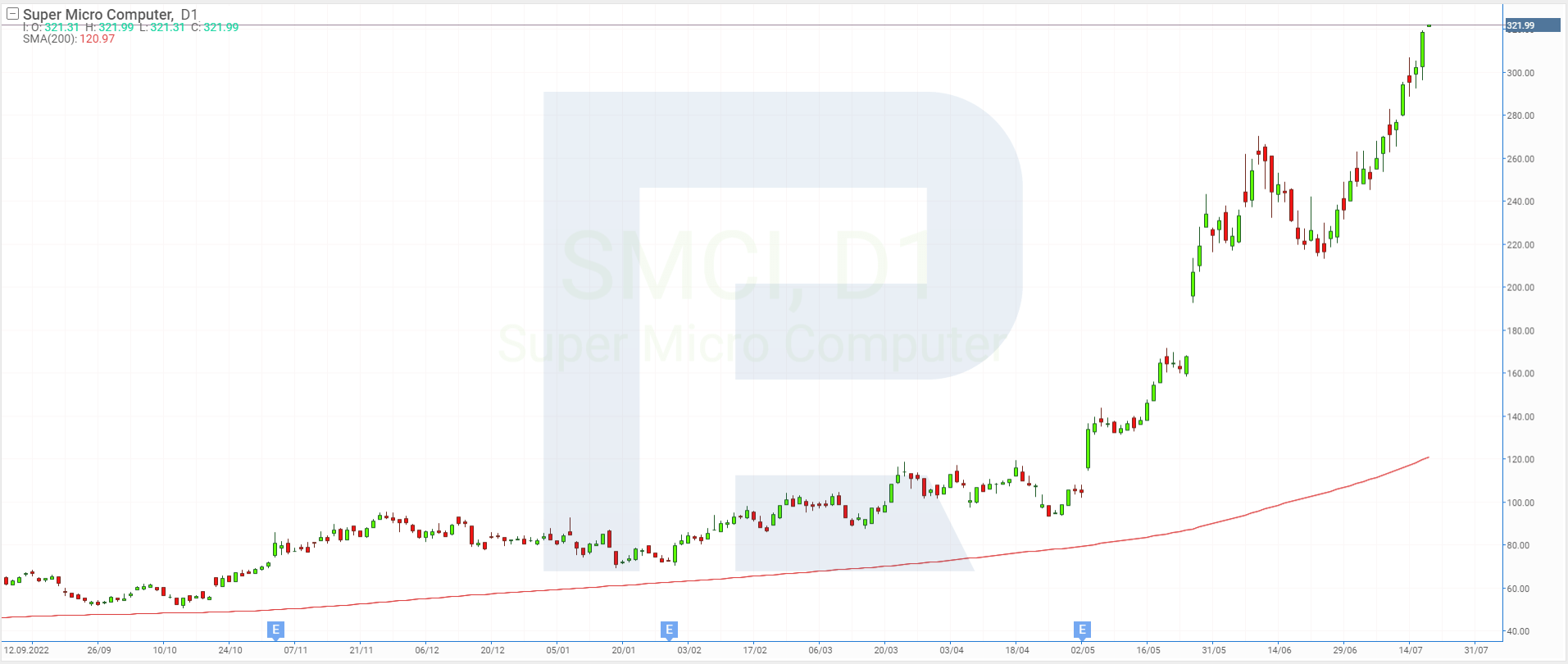

1. Super Micro Computer: +176.73%

Founded in: 1993

Registered in: the US

Headquarters: San Jose, California

Platform: NASDAQ

Market capitalisation: 15.78 billion USD

The stock of Super Micro Computer Inc. (NASDAQ: SMCI) – a large provider of comprehensive IT solutions for data storage and processing, cloud computing, AI technology, and 5G/Edge computing – skyrocketed 176.73%, rising from 109.15 USD to 302.05 USD per unit from mid-April to mid-July.

Super Micro Computer Inc. reported its Q3 fiscal 2023 results on 2 May. Revenue from January to March decreased by 5.33% to 1.28 billion USD compared to the statistics for the corresponding period of the last year, while net profit increased by 11.53%, rising to 85.85 million USD or 1.61 USD per share.

In addition, on 22 May, Super Micro Computer Inc. announced the launch of the industry’s first NVIDIA HGX H100 with 8 and 4-GPU H100 servers with liquid cooling. This innovation allows data centres to reduce power costs by up to 40%.

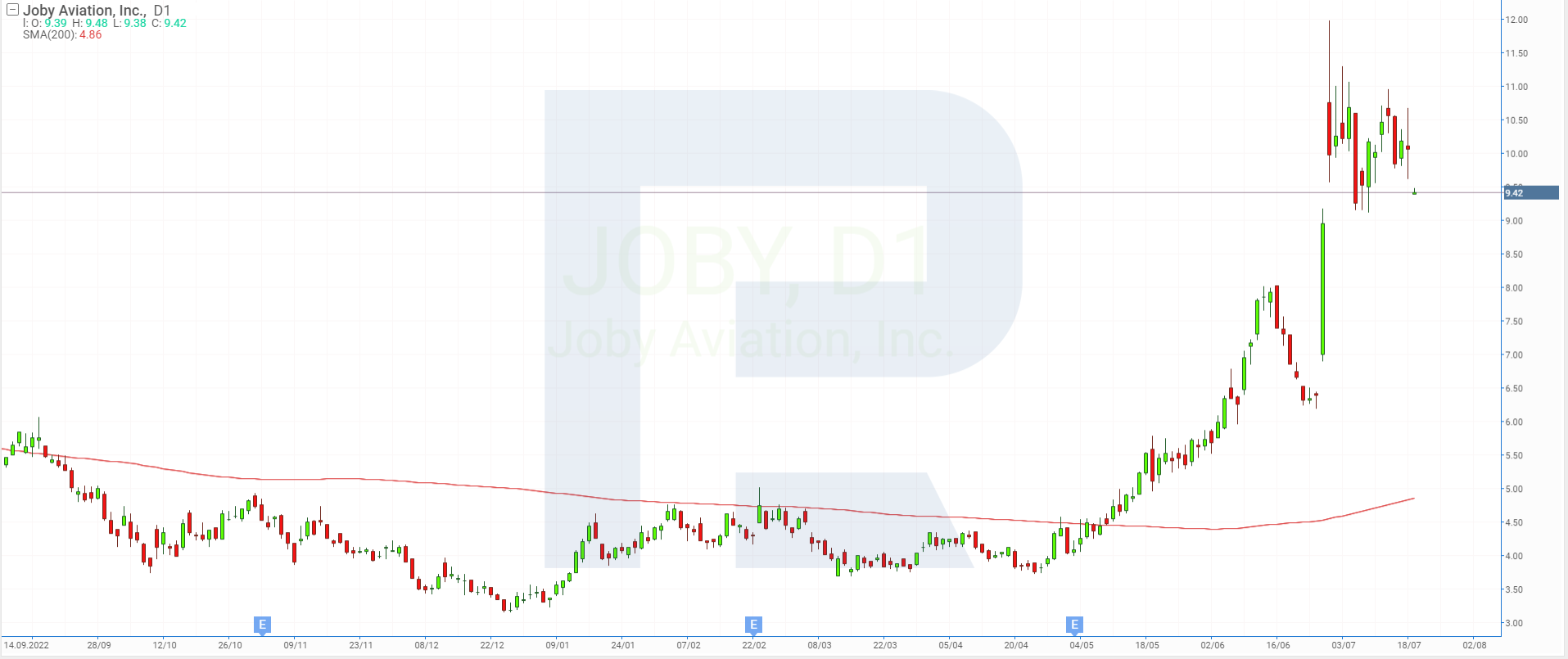

2. Joby Aviation: +156.03%

Founded in: 2009

Registered in: the US

Headquarters: Santa Cruz, California

Platform: NYSE

Market capitalisation: 7.40 billion USD

The shares of Joby Aviation Inc. (NYSE: JOBY) – a developer and manufacturer of fully electric aircraft for commercial passenger transportation – surged 156.03% in three months, rising from 3.98 USD to 10.19 USD per unit.

On 28 June, a press release on the company's website announced that the US Federal Aviation Administration (FAA) had approved flight tests for Joby Aviation's first production prototype. On the same day, it was revealed that Tetsuo Ogawa, president and chief executive officer of Toyota Motor North America Inc., had joined the Board of Directors of Joby Aviation Inc.

On 29 June, the corporation reported receiving a 100 million USD investment from SK Telecom Co. Ltd., South Korea’s telecommunications company. The collaboration with SK Telecom Co. Ltd. could create favourable conditions for Joby Aviation Inc. to enter the South Korean market.

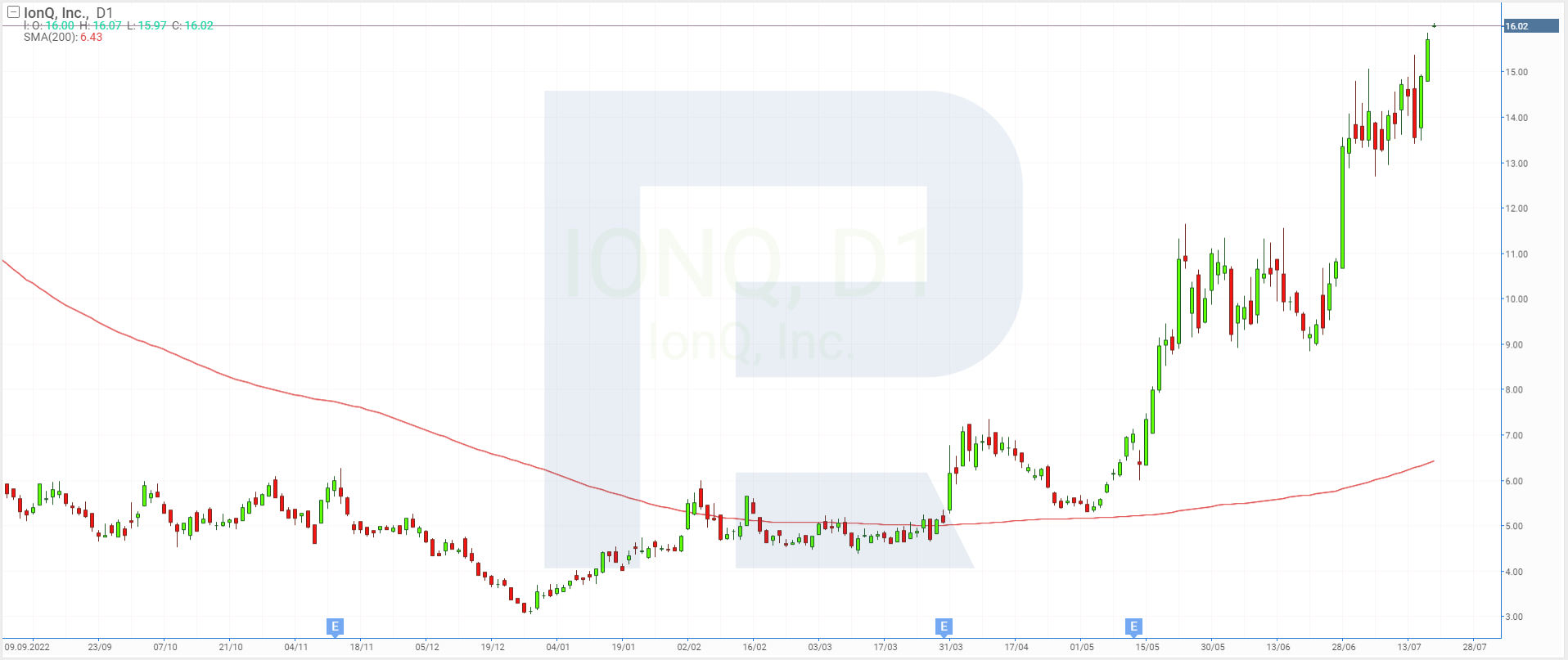

3. IonQ: +123.05%

Founded in: 2015

Registered in: the US

Headquarters: College Park, Maryland

Platform: NYSE

Market capitalisation: 3.20 billion USD

The stock of IonQ Inc. (NYSE: IONQ) – a producer of quantum computing hardware and software – soared 123.05%, rising from 6.68 USD to 14.9 USD over the past 90 days. On 5 May, the company released its Q1 2023 results, reporting an increase of 119.41% in revenue to 4.29 million USD, and a rise of 546.75% in net loss to 27.34 million USD or 0.14 USD per share.

On 22 June, IonQ Inc. announced that it had raised its bookings forecast for the full year 2023 by 25% to 45-55 million USD. The revision was influenced by a recent 28 million USD deal, as part of which the corporation will install two quantum systems in Europe.

On 29 June, IonQ Inc. signed a memorandum of understanding (MOU) with South Korea’s Ministry of Science and ICT, aiming to foster collaboration and create a regional quantum ecosystem in the Asian country.

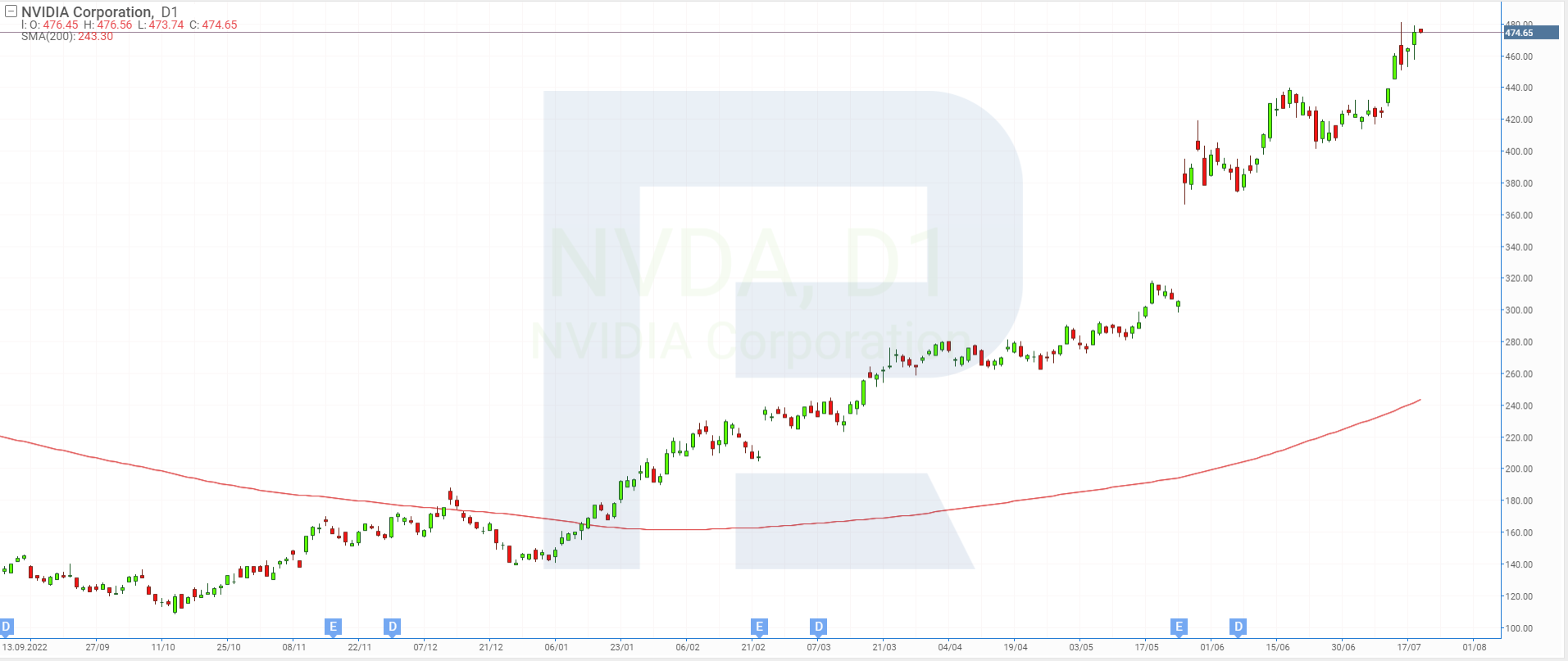

4. NVIDIA: +74.90%

Founded in: 1993

Registered in: the US

Headquarters: Santa Clara, California

Platform: NASDAQ

Market capitalisation: 1.16 trillion USD

NVIDIA Corporation (NASDAQ: NVDA) stock saw an increase of 74.90%, rising from 265.65 USD to 464.61 USD per share over the period in question. On 24 May, the developer and producer of graphics processing units and chips released its Q1 fiscal 2024 report.

NVIDIA Corporation’s overall revenue for February to April decreased by 13.22% to 7.19 billion USD, exceeding the consensus forecast of 6.53 billion USD. Gaming segment revenue declined by 38% to 2.24 billion USD, while revenue from the data centre segment increased by 14% to 4.28 billion USD. The forecast was 1.97 billion USD for the first indicator and 3.93 billion USD for the second one.

Net profit increased 26.27% to 2.04 billion USD or 0.82 USD per share. Management expects Q2 2024 revenue to reach a record 11 billion USD, while Wall Street analysts forecast 7.17 billion USD.

In addition, experts raised ratings and price targets for the IT giant’s stock. For example, Vivek Arya, a Bank of America analyst reiterated his Buy recommendation for NVIDIA Corporation’s stock and changed its price target from 500 USD to 550 USD per unit.

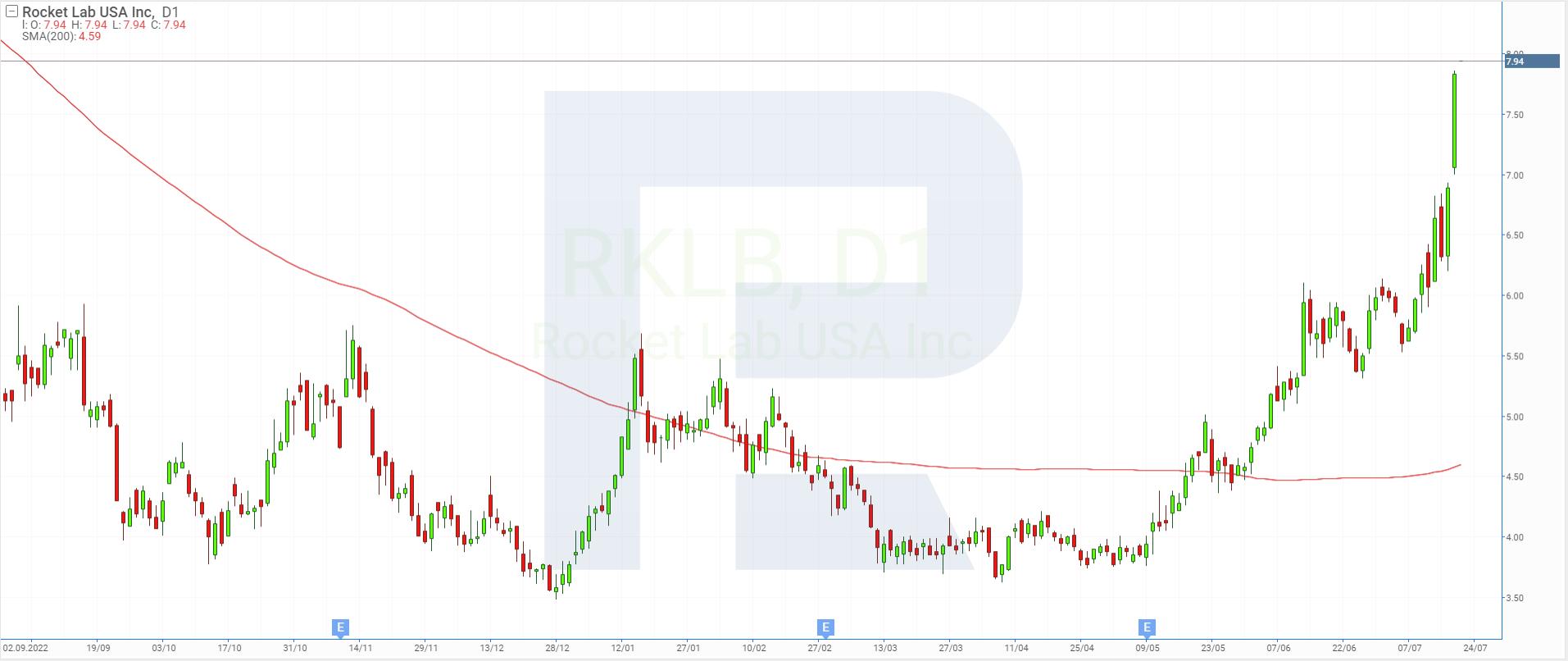

5. Rocket Lab USA: +71.82%

Founded in: 2006

Registered in: the US

Headquarters: Long Beach, California

Platform: NASDAQ

Market capitalisation: 3.46 billion USD

The stock of Rocket Lab USA Inc. (NASDAQ: RKLB) – a company that develops, manufactures, and launches satellites and rockets into space – gained 71.82%, rising from 4.01 USD to 6.89 USD from 17 April to 17 July 2023.

On 9 May, Rocket Lab USA Inc. announced its Q1 2023 results, reporting a 34.87% increase in revenue to 54.90 million USD, and a 70.79% rise in net loss to 45.62 million USD or 0.10 USD per share. The company expects revenue for the second quarter of 2023 to be between 60-63 million USD.

On 13 July, it was announced that Rocket Lab USA Inc. had signed an agreement with Japanese company Synspective, which specialises in gathering and analysing geospatial data about Earth, for the launch of two dedicated Electron missions.

Factors that influenced the growth of electronic technology stocks

The leaders of stock price gains in the electronic technology sector from mid-April to mid-July this year were Super Micro Computer Inc., Joby Aviation Inc., IonQ Inc., NVIDIA Corporation, and Rocket Lab USA Inc.

The key drivers of the surge in these stocks could be positive news, such as obtaining approval from the FAA and launching new products, reporting strong financial results, and securing collaboration agreements with private and government organisations.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high