Finance: Top 5 Shares with the Most Prominent Growth in May

5 minutes for reading

Over the first 16 days of May, the most prominent growth was demonstrated by the shares of such companies as Hilltop Holdings Inc., SoFi Technologies Inc., Federated Hermes Inc., Apollo Global Management Inc., and UWM Holdings Corp.

Selection criteria

- Sector – financial services

- The companies are not funds

- The stocks are traded on the NYSE and NASDAQ

- The share price is above $2

- The capitalisation is over $2 billion

- The average trade volume statistics over the last 30 days is over 750,000 shares.

Growth was expressed in percentage as the difference between the closing price on 29 April and 16 May 2022. The market capitalisation is relevant to the time when the article was being prepared.

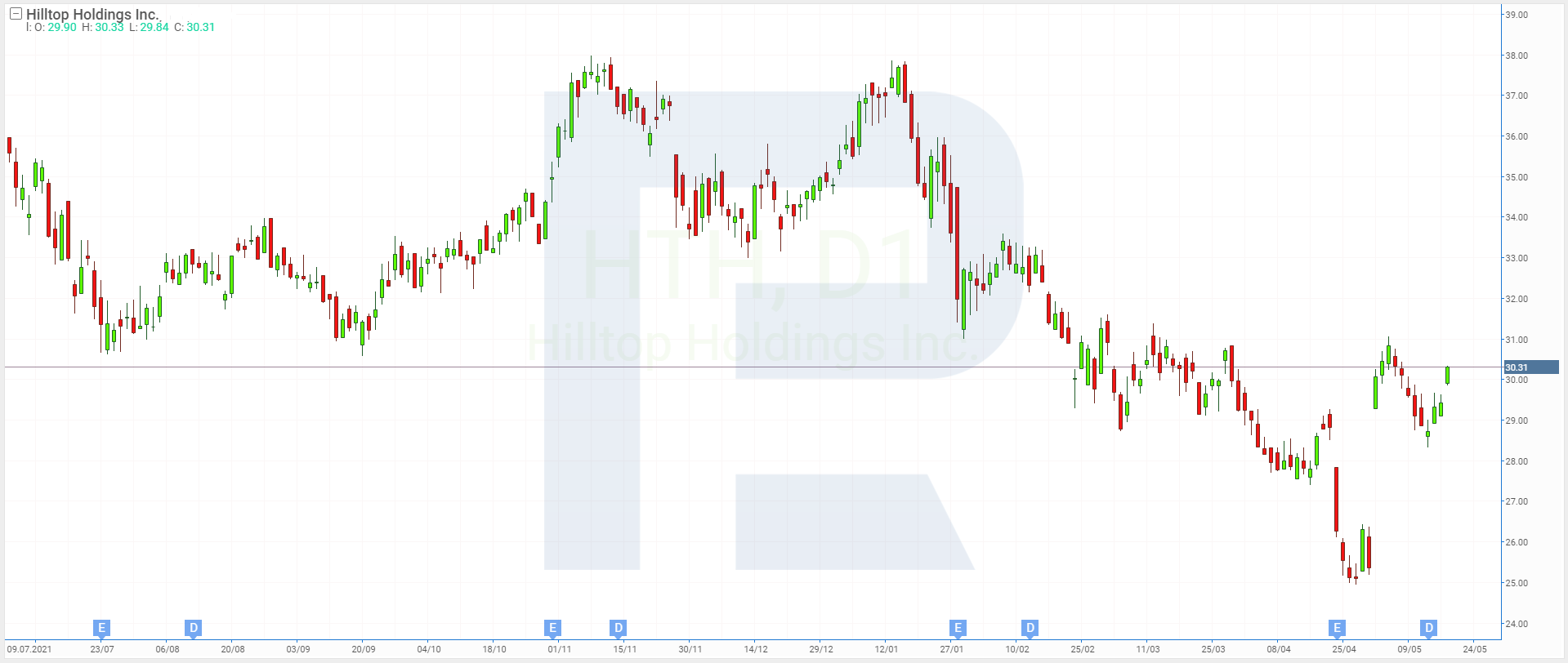

1. Hilltop Holdings - 15.5%

Year of establishment: 1998

Country of registration: US

Headquarters: Dallas, Texas

Exchange: NYSE

Market capitalisation: $2.3 billion

Hilltop Holdings is a financial company providing banking, brokerage and dealer services, and mortgage loans. It works with both businesses and individuals.

Over the first half of May, the share price of Hilltop Holdings Inc. (NYSE: HTH) recorded a 15.5% growth from $25.49 to $29.43. This noticeable growth is attributed to the news about the buyback of its shares.

On 2 May, it was heard that in the following month, the holding was planning to buy back its own shares for $400 million. This news sent the shares of Hilltop Holdings Inc. up 18.56% to $30.22 and they keep growing.

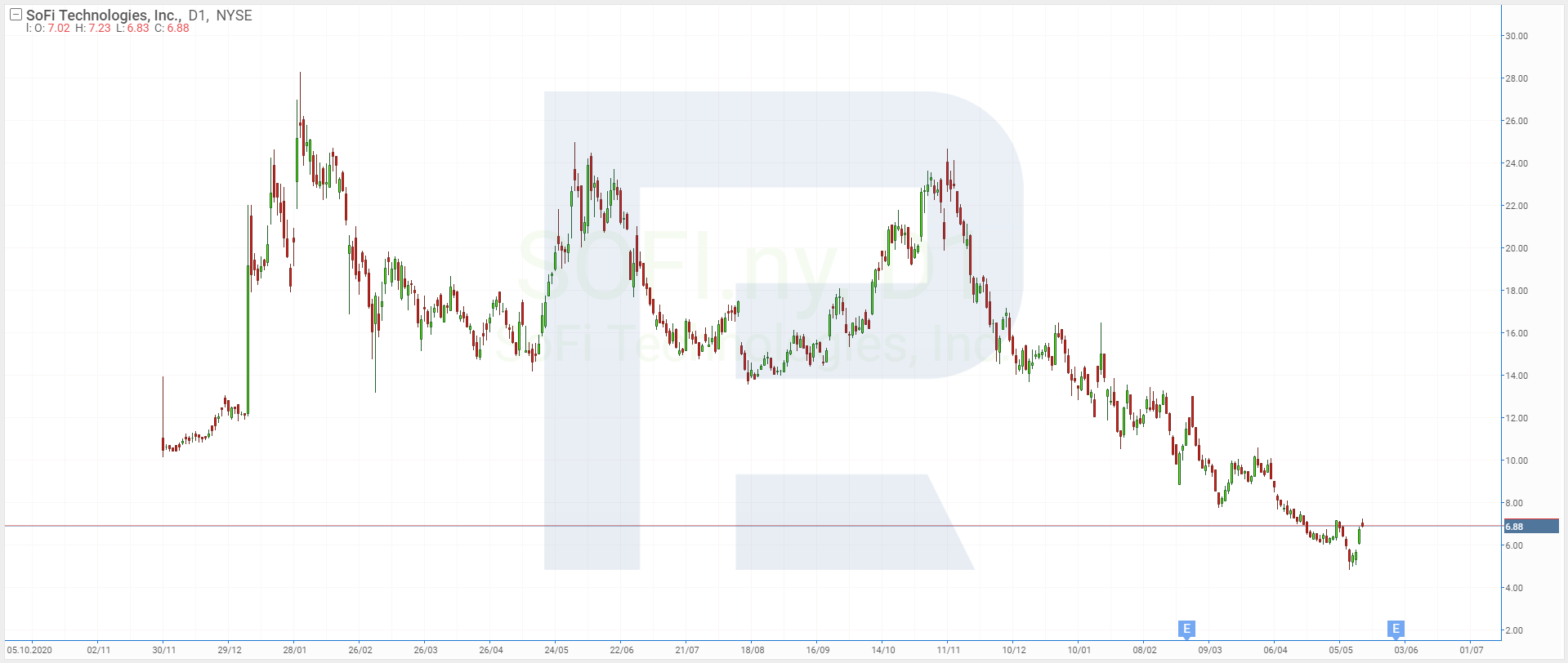

2. SoFi Technologies - 12.9%

Year of establishment: 2011

Country of registration: US

Headquarters: San Francisco, California

Exchange: NASDAQ

Market capitalisation: $6.3 billion

SoFi Technologies is a provider of a wide range of digital financial services: student and consumer credits, mortgages, savings, and investments. The company's tech platform works like an online bank.

Over the 16 days of this month, the shares of SoFi Technologies Inc. (NASDAQ: SOFI) saw a 12.9% growth, reaching $6.91. The most noticeable growth was recorded on 13 May: the quotes leaped up by 19.26% to $6.75, beginning a recovery.

The reason for such swift growth was the positive results reflected in the financial report for Q1 2022. Earnings of SoFi Technologies over January–March increased 69% to $330.3 million compared to the statistics of Q1 last year. Net loss shrank by 37.9% to $110.4 million, and loss per share narrowed by 91.3% to $0.14.

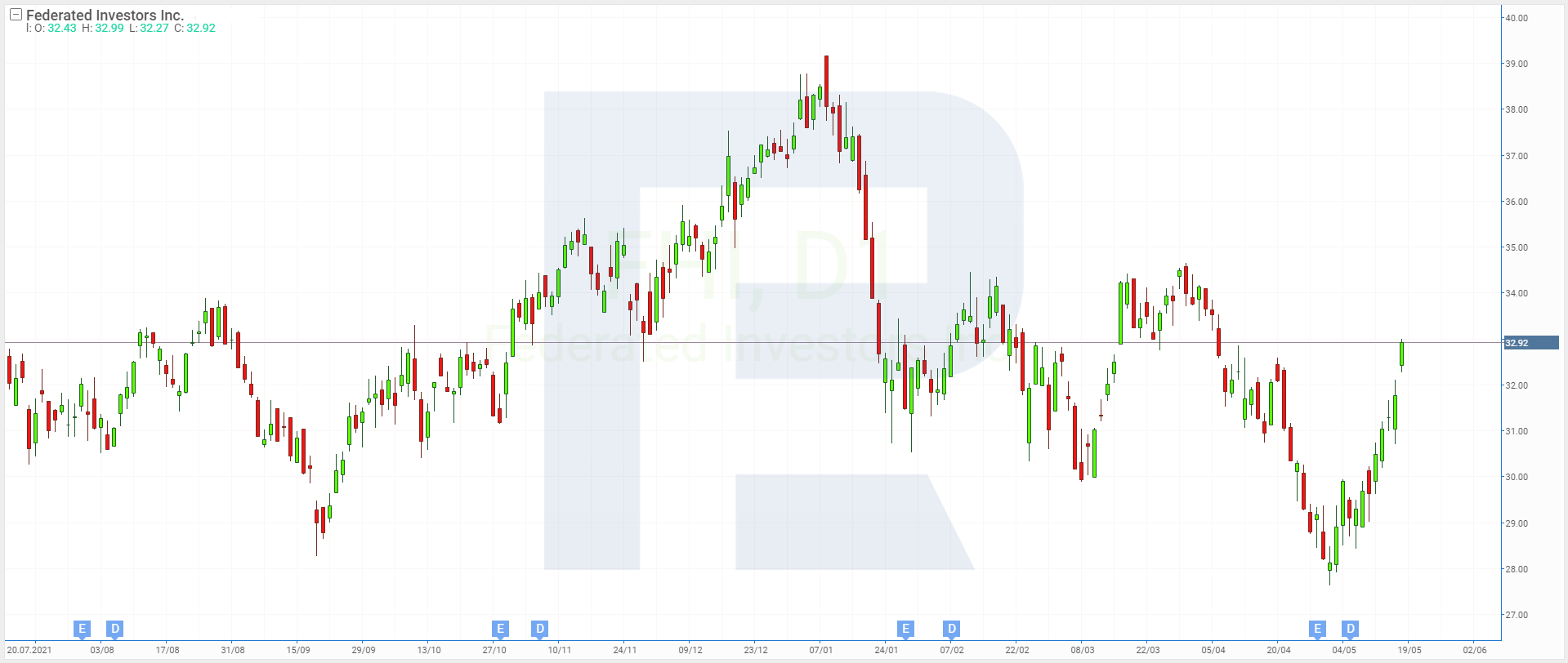

3. Federated Hermes - 11.6%

Year of establishment: 1955

Country of registration: US

Headquarters: Pittsburgh, Pennsylvania

Exchange: NYSE

Market capitalisation: $2.8 billion

Federated Hermes is a holding company that works with investments and manages capital. It works with banks, individuals, investment and pension funds, charities, and state institutions all over the world. The company's total managed assets are $631 billion.

Since the beginning of the month, the quotes of Federated Hermes Inc. (NYSE: FHI) recorded an 11.6% growth from $28.48 to $31.77. During the first weeks of May, the stock quotes did not demonstrate steep increases and kept growing stably: only 3 out of 11 trading days closed with a decline. Currently, the share prices continue rising, opening trading days with gaps.

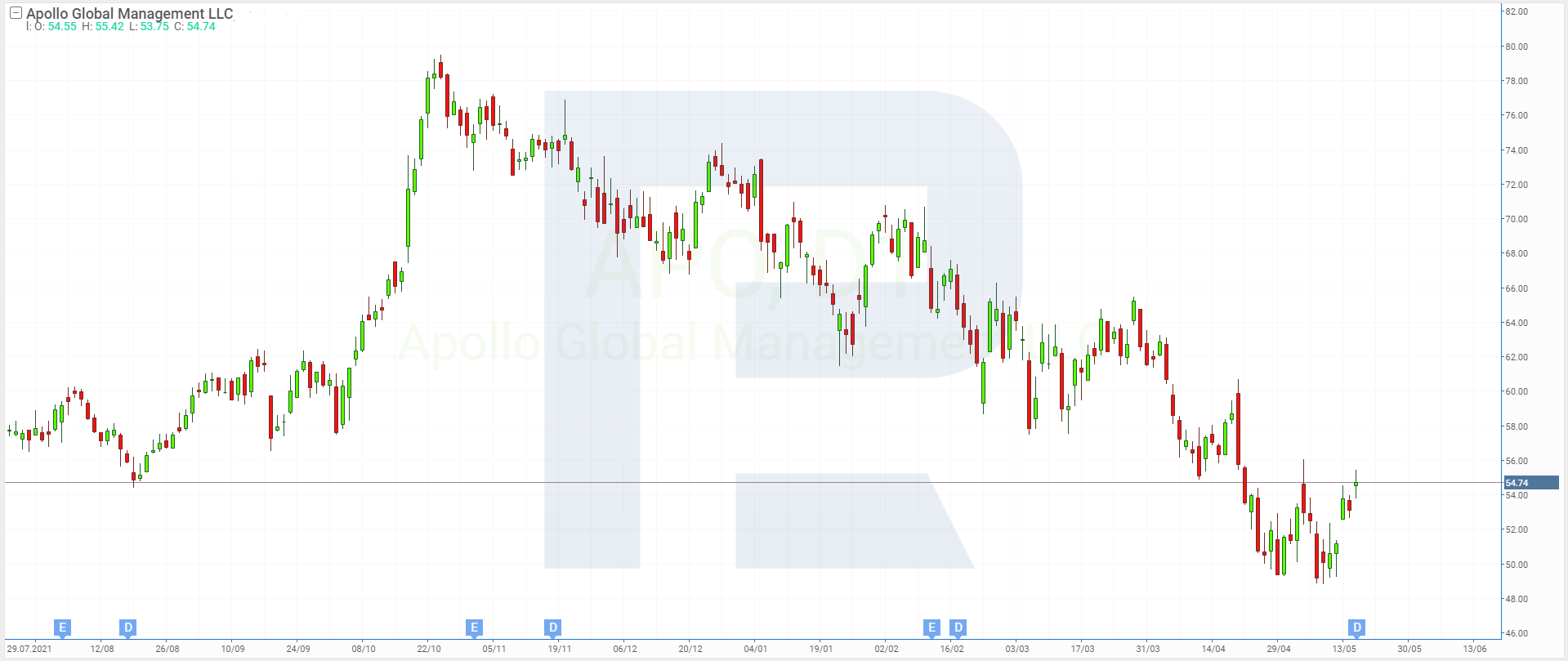

4. Apollo Global Management - 7.5%

Year of establishment: 1990

Country of registration: US

Headquarters: New York, New York

Exchange: NYSE

Market capitalisation: $30.5 billion

Apollo Global Management is a financial company that specialises in asset management and pension services. It invests in crediting, private capital, and real estate.

Over the first half of this month, the shares of Apollo Global Management Inc. (NYSE: APO) recorded a 7.5% growth from $49.76 to $53.51. This is considered a good result, especially alongside the financial report for Q1 2022, which the company shared on 5 May.

Apollo Global Management reported a decline in quarterly earnings by 61.9% to $875 million against the Q1 2021 report. Moreover, net loss increased by 229.9% to $870 million and loss per share rose by 153.4% to $1.5.

5. UWM Holdings - 5.1%

Year of establishment: 1986

Country of registration: US

Headquarters: Pontiac, Michigan

Exchange: NYSE

Market capitalisation: $6.1 billion

UWM Holdings is the main player in the US market of mortgaging. The company boasts a market share of 20%. It provides mortgage loans not to the final consumer but to independent brokers.

Over the first two weeks of May, the stock quotes of UWM Holdings Corp. (NYSE: UWMC) recorded a 5.1% rise from $3.71 to $3.9. The shares grew regardless of a weak quarterly report for Q1 2022.

According to the report, the quarterly earnings of UWM Holdings dropped by 30.9% to $1.19 billion, net profit fell by 47.3% to $453.3 million, and EPS dropped by 33.3% to $0.22. The stock growth must be attributed to the promises of the management to initiate a share buyback for $300 million.

What influenced the growth of the share price in the financial sector?

In the first half of May, the most noticeable growth of the share price in the financial sector was demonstrated by such companies as Hilltop Holdings Inc., SoFi Technologies Inc., Federated Hermes Inc., Apollo Global Management Inc., and UWM Holdings Corp.

The growth of the above-named stocks can be attributed to two factors: the publication of financial reports for Q1 2022 and the launches of stock buyback programmes.

This material and the information contained therein are for informational purposes only and should in no way be construed as providing investment advice for the purposes of the Investment Companies Act 87 (I) 2017 of the Republic of Cyprus, or any other form of personal advice or recommendation relating to certain types of transactions in certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high