Health Technology: Top 5 Stocks of Three Month

5 minutes for reading

Reata Pharmaceuticals Inc., BridgeBio Pharma Inc., Scilex Holding Company, Lantheus Holdings Inc., and Prometheus Biosciences Inc. were the companies from the Health Technology sector whose stocks demonstrated the most noticeable growth over the course of the last three months.

Selection criteria

- Sector: health technology

- The companies are not funds

- The shares are traded on the NYSE or NASDAQ

- The share price exceeds $2

- The capitalisation is more than $2 billion

- The average trade volume of the last 30 days is more than 500,000 shares

Growth and decline values were determined as the percentage difference between the closing prices of 17 January and 17 April 2023. The market capitalisation of the companies was valid at the time of writing.

1. Reata Pharmaceuticals: +153.45%

Founded in: 2002

Registered in: the US

Headquarters: Plano, Texas

Platform: NASDAQ

Market capitalisation: $3.55 billion

Reata Pharmaceuticals Inc. is a biopharmaceutical company that develops and commercialises new methods of treatment for patients with severe neurological diseases and chronic kidney diseases. Mid-January through mid-April, the stock price of Reata Pharmaceuticals Inc. (NASDAQ: RETA) saw an increase of 153.45% from $38.13 to $96.64 per unit.

On 28 February, the company announced that the US Food and Drug Administration (FDA) had approved the SKYCLARYS drug (omaveloxolone) for treating Friedrich ataxia in adults and adolescents of 16 years and older.

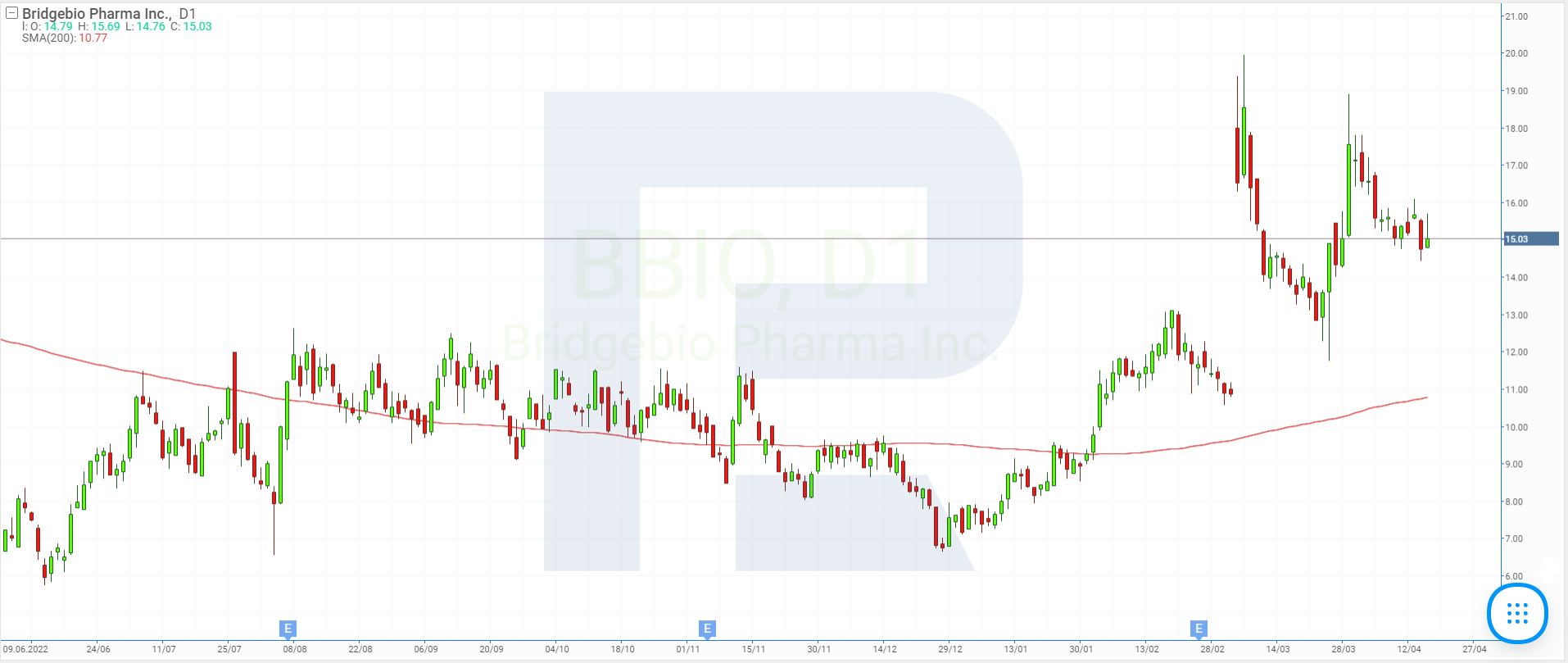

2. BridgeBio Pharma: +72.76%

Founded in: 2015

Registered in: the US

Headquarters: Palo Alto, California

Platform: NASDAQ

Market capitalisation: $2.41 billion

Over the three months in question, the stock price of BridgeBio Pharma Inc. (NASDAQ: BBIO) which develops, tests, produces, and sells innovative drugs for treating complex genetic diseases and cancer rose by 72.76% from $8.7 to $15.03 per unit.

On 6 March, BridgeBio Pharma Inc. announced positive results of phase two tests of PROPEL2, an experimental therapy using infigratinib for achondroplasia in kids. According to the company, the drug demonstrates potentially the best efficacy in its class and the cleanest safety profile.

It became known that BridgeBio Pharma Inc. had started the selection of children for phase three of the main test. Moreover, the management of the biotechnology company does not exclude that tests of infigratinib will start in patients with hypochondroplasia, a condition tightly bound to achondroplasia.

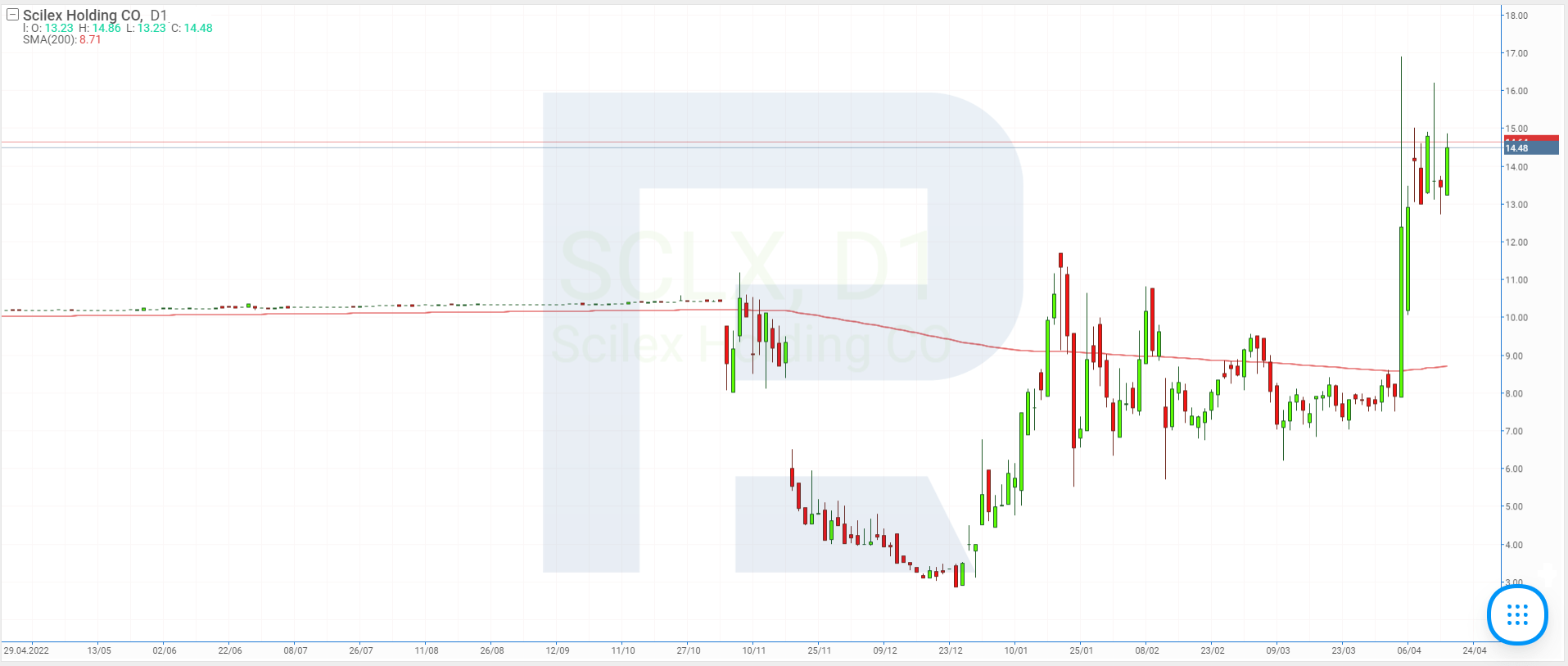

3. Scilex Holding: +68.98%

Founded in: 2009

Registered in: the US

Headquarters: Palo Alto, California

Platform: NASDAQ

Market capitalisation: $2.12 billion

Scilex Holding Company is a biopharmaceutical company that develops and commercialises non-opioid drugs against acute and chronic pains. It is a subsidiary of Sorrento Therapeutics Inc.

Over the last 90 days, the quotes of Scilex Holding Company (NASDAQ: SCLX) increased by 68.98% from $8.51 to $14.38. On 12 February, the company published a press release about buying the rights for ELYXYB in the US and Canada. As you might recall, this solution of oral celecoxib against acute migraine in adults has been approved by the FDA.

According to Evaluate Pharma, in 2022 the US market of oral drugs against migraine was assessed as $1.8 billion. As Brainy Insights forecasts, by 2030 this estimation will have risen to $9.26 billion.

4. Lantheus Holdings: +68.32%

Founded in: 1956

Registered in: the US

Headquarters: Bedford, Massachusetts

Platform: NASDAQ

Market capitalisation: $6.08 billion

Lantheus Holdings Inc. develops, produces, and sells innovative diagnostic and therapeutic products for detecting and treating heart and vessel diseases, oncology, and more. The stock price growth of Lantheus Holdings Inc. (NASDAQ: LNTH) over the period in question amounted to 68.32%, from $52.97 to $89.16 per unit.

On 23 February, the corporation presented its fourth-quarter and full 2022 report. The revenue in October-December saw an increase of 103.12% to $263.17 million from the same months of 2021. The net loss increased 196.35% to $119.19 million, or $1.74 per share. As for the annual revenue compared to the figure for 2021, it rose by 119.91% to $935.06 million, while the net profit reached $28.07 million or $0.41 per share. A year before, the company generated a net loss sized $71.28 million or $1.06 per share.

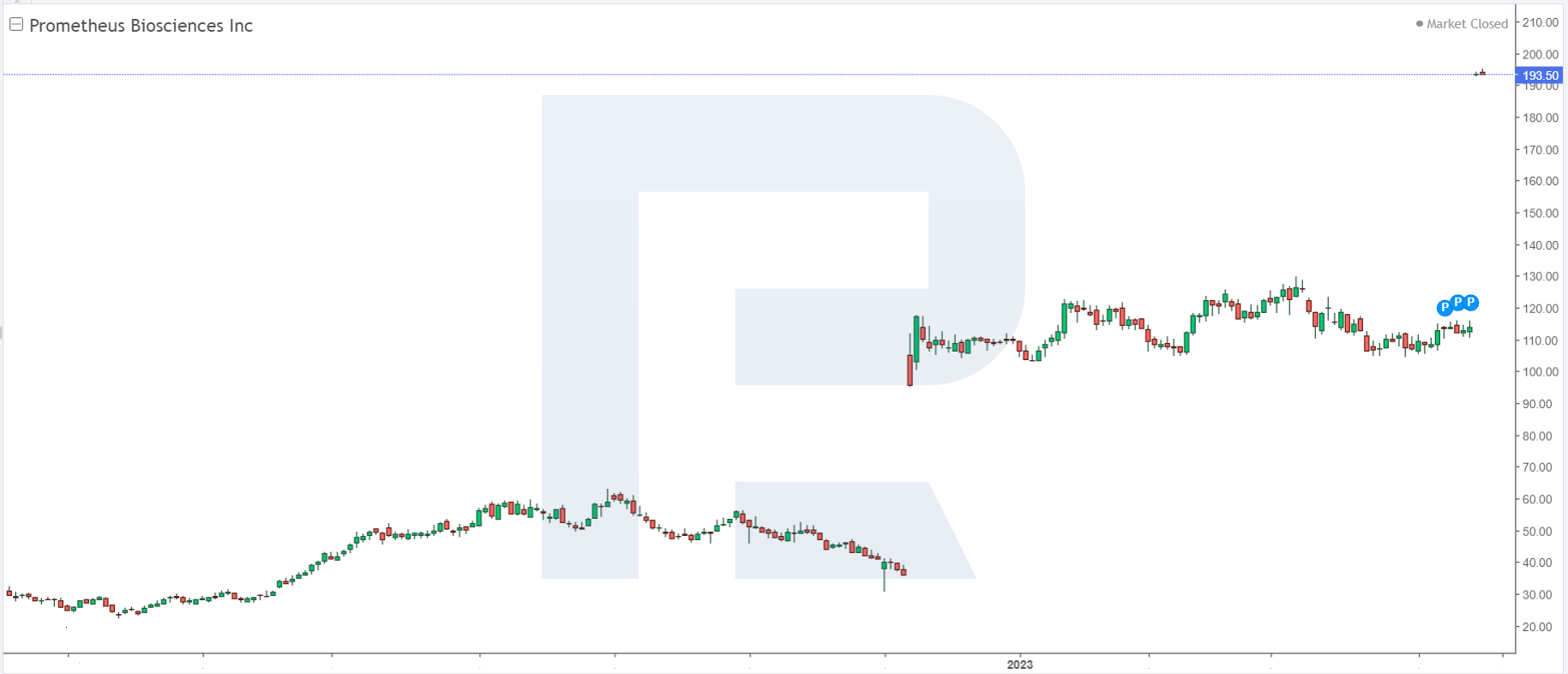

5. Prometheus Biosciences: +60.50%

Founded in: 2016

Registered in: the US

Headquarters: San Diego, California

Platform: NASDAQ

Market capitalisation: $9.24 billion

Prometheus Biosciences Inc. is a biotechnological company of the clinical stage that specialises in creating therapy for treating inflammatory intestine diseases and other autoimmune conditions. Until 2019 it used to be called Precision IBD Inc.

From 17 January through 17 April, the quotes of Prometheus Biosciences Inc. (NASDAQ: RXDX) saw an increase of 60.50% from $120.57 to $193.51. On 16 April, they presented a press release announcing that the company was going to be acquired for almost $10.8 billion by one of the world's largest biopharmaceutical corporations Merck & Company Inc. (NYSE: MRK).

What influenced the stock price growth in the health technology sector?

Reata Pharmaceuticals Inc., BridgeBio Pharma Inc., Scilex Holding Company, Lantheus Holdings Inc., and Prometheus Biosciences Inc. were the leaders of the health technology sector in terms of stock price growth from mid-January through mid-April.

It could be supposed that the main reason for the skyrocketing of the securities was good news, from receiving FDA approval and successful test results to the publication of strong financial reports and signing a contract with one of the whales of the pharmaceutical industry.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high