Process Industries: Top 5 Stocks of the Last Three Months

5 minutes for reading

Over the last three months, the most noticeable growth was demonstrated by the stocks of the following process manufacturing companies: ChampionX Corporation, Scotts Miracle-Gro Company, DuPont de Nemours Inc., Valvoline Inc., and Air Products and Chemicals Inc.

Selection criteria:

- Sector: process industries

- The companies are not funds

- Their stocks are traded on the NYSE or NASDAQ

- Their market capitalisation is more than $2 billion

- The average trading volume of the last 30 days is over 750,000 stocks

Growth was expressed in percent as the difference between the opening price on 13 October 2022 and the closing price on 13 January 2023. The market capitalisation of each company was valid at the moment when the article was being written.

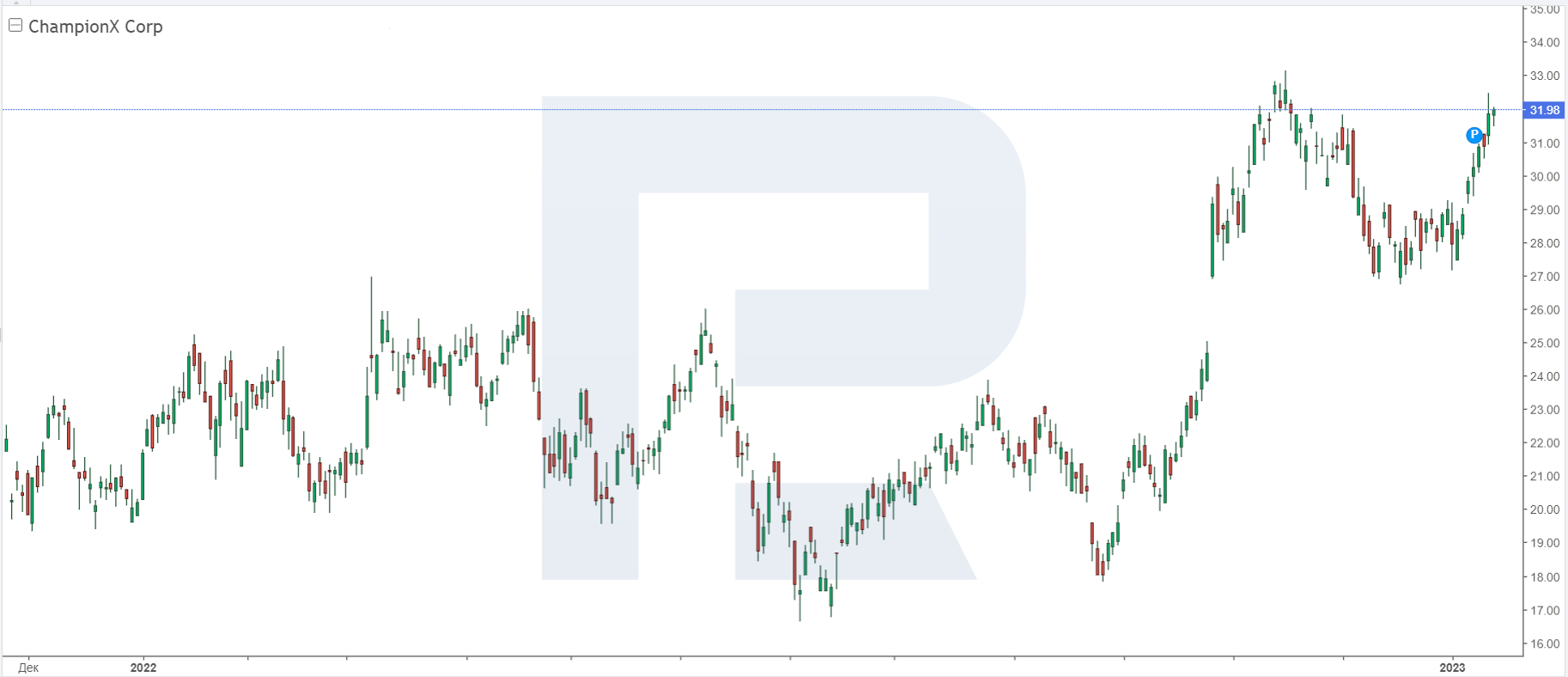

1. ChampionX — 58.3%

Founded in: 2017

Registered in: the US

Head office: Woodlands, Texas

Platform: NYSE

Market capitalisation: $6.4 billion

ChampionX Corporation develops and produces equipment for oil & gas field exploration, drilling, oil & gas mining, and transportation. One of the company's fields of work is creating innovative technologies for automating and optimising oil mining.

Over the last three months, the stock price of ChampionX Corporation (NYSE: CHX) recorded a 58.3% growth from $20.2 to $31.98. On 25 October 2022, the company presented its financial report for Q3 2022. In the period from July to September, revenue increased by 24.8% to $1 billion (compared to the statistics of Q3, 2021), while the net profit dropped by 59.4% to $23.1 million. The growth of the quotes is most probably explained by the high prices for hydrocarbons.

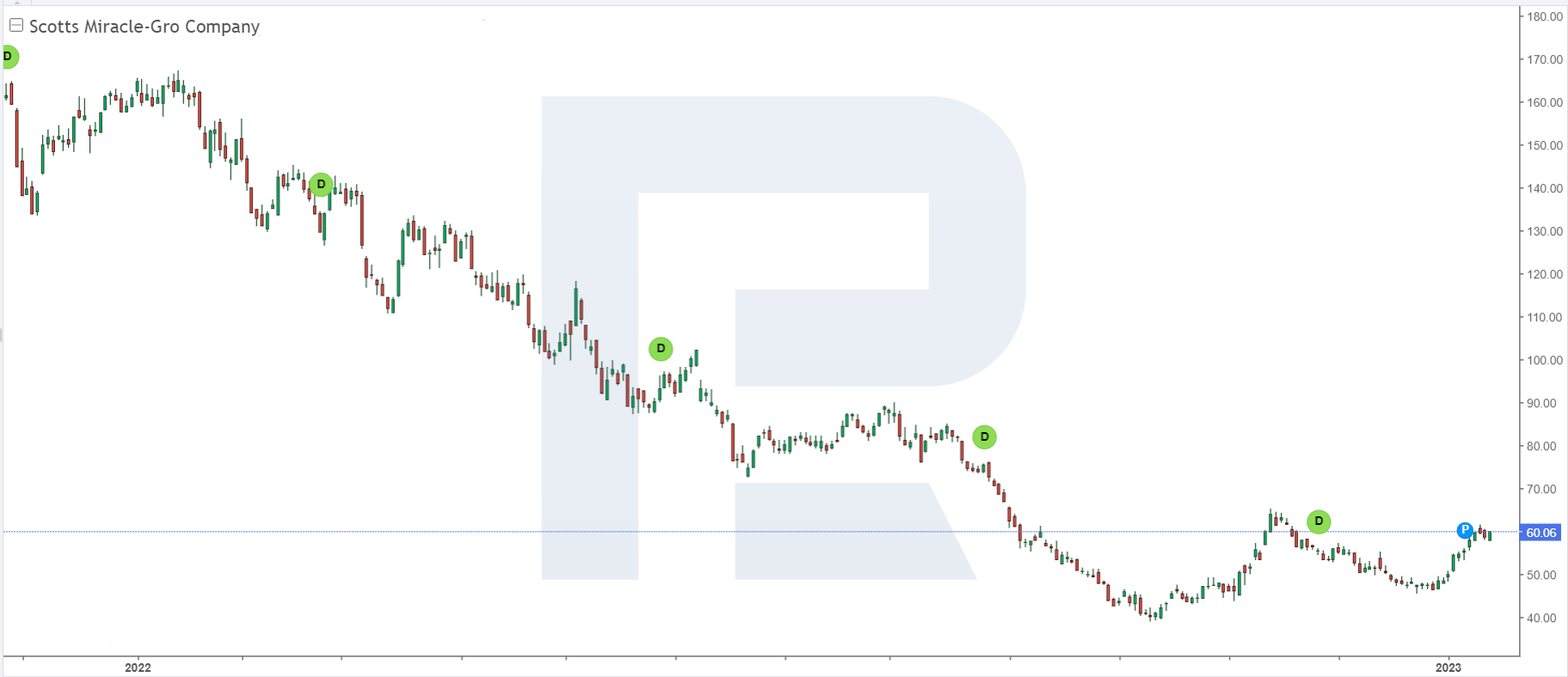

2. Scotts Miracle-Gro Company — 50.2%

Founded in: 1868

Registered in: the US

Head office: Marysville, Ohio

Platform: NYSE

Market capitalisation: $3.3 billion

Scotts Miracle-Gro Company manufactures and sells gardening goods for the mass market as well as everything for professional gardening. Its product range includes a variety of fertilisers, pesticides, top dressings, garden soil, herb seeds, and more. The company works in North America and Europe.

From Mid-October to mid-January, the stock of Scotts Miracle-Gro Company (NYSE: SMG) recorded a 50.2% growth from $40 to $60.06. On 8 November, the company reported its performance in Q4, financial 2022. Revenue dropped by 33% to $493.6 million, the net loss grew to $220.1 million, and the loss per share rose to $3.97.

According to The Motley Fool experts, the stock quotes of Scotts Miracle-Gro Company are now seeing growth because investors are confident that the company has overcome its challenges. The US CPI report in November showed that inflation is slowing down more than predicted. This is great news for the stocks of companies dealing with consumer demand.

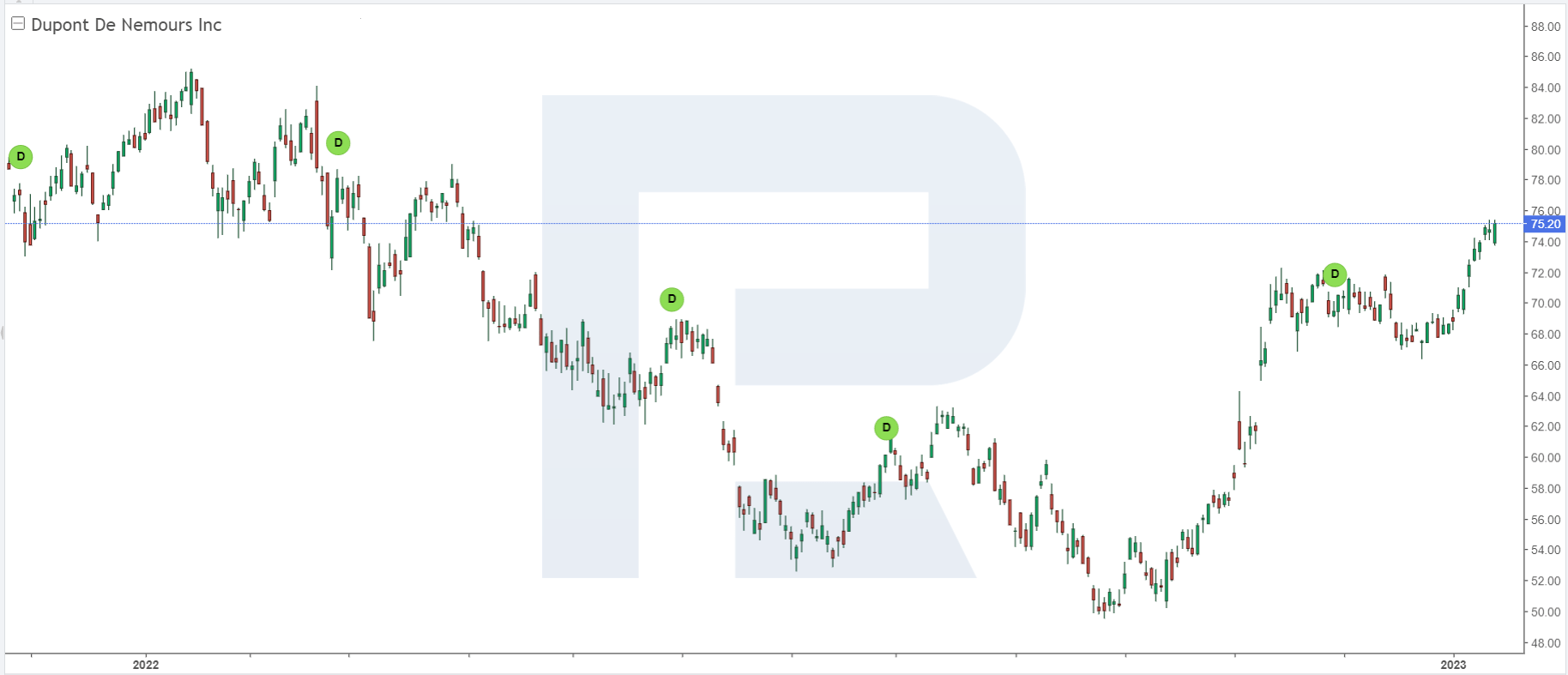

3. DuPont de Nemours — 48.4%

Founded in: 1802

Registered in: the US

Head office: Wilmington, Delaware

Platform: NYSE

Market capitalisation: $37.4 billion

DuPont de Nemours Inc. produces materials for semiconductors and integral schemes, construction materials, consumer goods, cloths, fibres, and nonwovens; medical equipment, individual protection materials, water cleansing solutions, packages, and much more.

Over the last ninety days, the stocks of DuPont de Nemours Inc. (NYSE: DD) recorded a 48.4% growth from $50.68 to $75.2. In November last year, the company published a report for Q3 2022, which indicates a growth of revenue by 3.7% to $3.3 billion and a decline of the net profit by 6.9% to $376 million, and EPS by 2.7% to $0.73. Moreover, a new stock buyback programme was approved for $5 billion.

Zacks Investment Research analysts attribute the growth of DuPont de Nemours Inc. stock to the high demand for its products in the main markets, especially in the semiconductor, water, and general industrial markets.

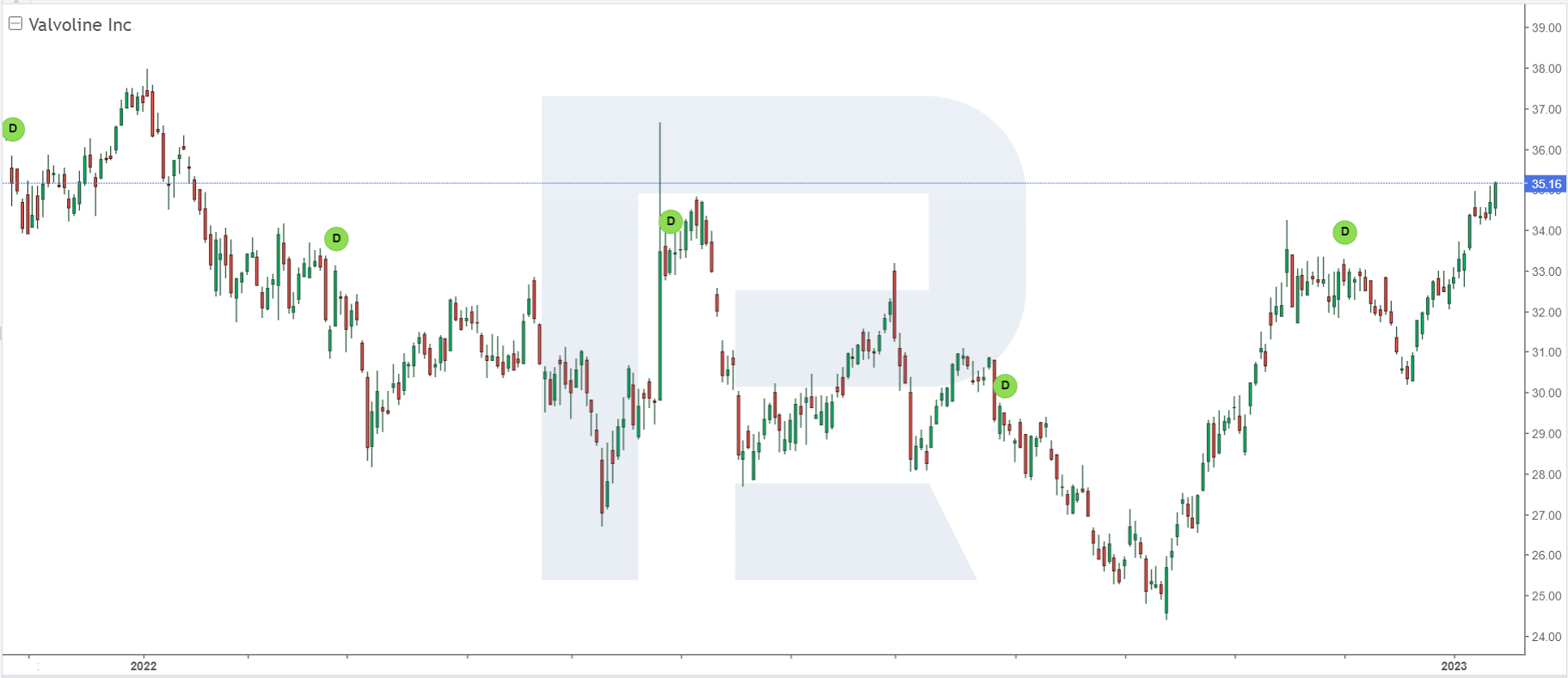

4. Valvoline — 41.1%

Founded in: 1866

Registered in: the US

Head office: Lexington, Kentucky

Platform: NYSE

Market capitalisation: $6.1 billion

Valvoline Inc. manufactures and sells engine oil, lubricants, and special car liquids. Moreover, the company owns a network of more than 1,700 service centres in the US.

Over the last three months, the quotes of Valvoline Inc. (NYSE: VVV) recorded a 41% growth from $24.57 to $35.16. On 15 November, the corporation published a report for financial 2022. The yearly revenue increased by 19.2% to $1.2 billion, net profit rose by 1% to $424.3 million, and EPS by 2.6% to $2.35. Moreover, the management approved a new stock buyback plan for $1.6 billion.

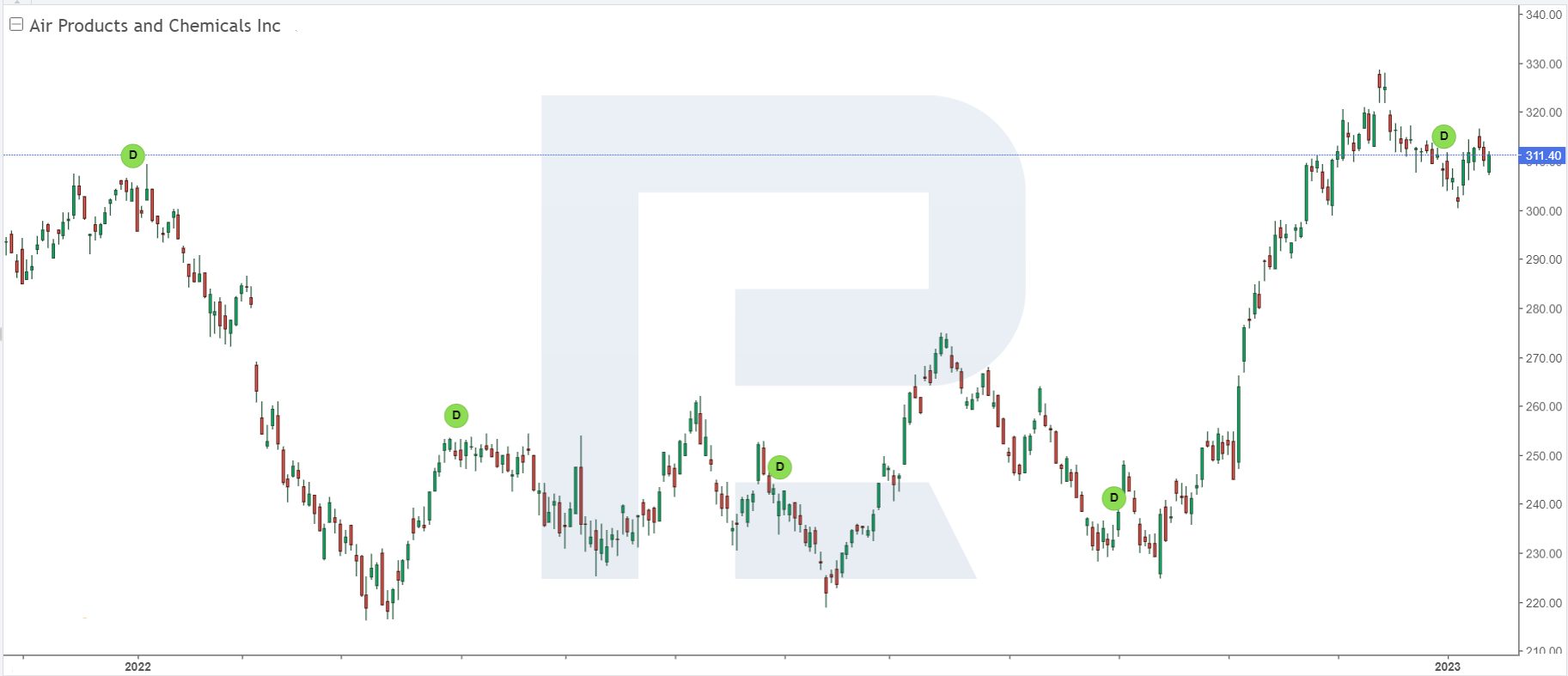

5. Air Products and Chemicals — 37.8%

Founded in: 1940

Registered in: the US

Head office: Allentown, Pennsylvania

Platform: NYSE

Market capitalisation: $69.1 billion

Air Products and Chemicals Inc. produces technical gases and concomitant gas equipment. Its products are used in oil refactoring, metallurgy, healthcare, production electronics, energetics, food & chemical industries, etc. The company has a presence in more than 50 countries.

From 13 October to 13 January, the stock of Air Products and Chemicals Inc. (NYSE: APD) recorded a 37.8% growth from $225.95 to $311.4. On 3 November, the corporation presented a report for financial 2022. Revenue increased by 23% to $12.7 billion, net profit by 7.2% to $2.3 billion, and EPS rose by 7.5% to $10.14.

Analysts from Zacks Investment Research attribute these strong yearly statistics to several factors, such as the growth of production powers, the relaunch of hydrogen production, optimised pricing, and an increase in the commercial demand for the products.

What influenced the stock prices of process industries companies?

The leaders of stock price growth among process manufacturing companies from mid-October to mid-January are ChampionX Corporation, Scotts Miracle-Gro Company, DuPont de Nemours Inc., Valvoline Inc., and Air Products and Chemicals Inc.

The main factors for their growth were the positive quarterly and yearly reports, and an increase in consumer demand for their products.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high