Producer Manufacturing: Top 5 Stocks of Three Months

5 minutes for reading

Over the last three months, the most noticeable growth in the Producer Manufacturing sector was demonstrated by the stocks of Axcelis Technologies Inc., The AZEK Company Inc., Terex Corporation, Evoqua Water Technologies Corp., and Mueller Water Products Inc.

Selection criteria

- Sector: producer manufacturing

- The companies are not funds

- The stocks are trading on the NASDAQ or NYSE

- The stock price exceeds $2

- The market capitalisation is over $2 billion

- The average trading volume of the last 30 days is over 500,000 stocks

Growth was expressed in percent as the difference between the opening price on 14 November 2022 and the closing price on 13 February 2023. The market capitalisation of each company was valid at the time when the article was being prepared.

1. Axcelis Technologies – 69.66%

Founded in: 1978

Registered in: the US

Head office: Beverly, Massachusetts

Platform: NASDAQ

Market capitalisation: $4.22 billion

Axcelis Technologies Inc. designs, produces, and maintains high-tech equipment for semiconductor products. It operates in the US, Europe, and Asia.

From mid-November to mid-February, the stock growth of Axcelis Technologies Inc. (NASDAQ:ACLS) amounted to 69.66%, from $75.64 to $128.33. On 10 January, the corporation changed its forecast revenue for 2022 to a record $900 million, which is $50 million above the previous estimate.

On 8 February, Axcelis Technologies Inc. presented its report for Q4 and the whole of 2022. The statistics exceeded Wall Street expectations. Compared to the same period in 2021, quarterly revenue increased by 29.35% to $266.05 million, net profit by 59.42% to $56.99 million, and EPS by 62.86% to $1.71. As for the yearly statistics compared to those of 2021, revenue grew by 38.88% to $919.99 million, net profit by 85.59% to $183.08 million, and EPS by 89.58% to $5.46.

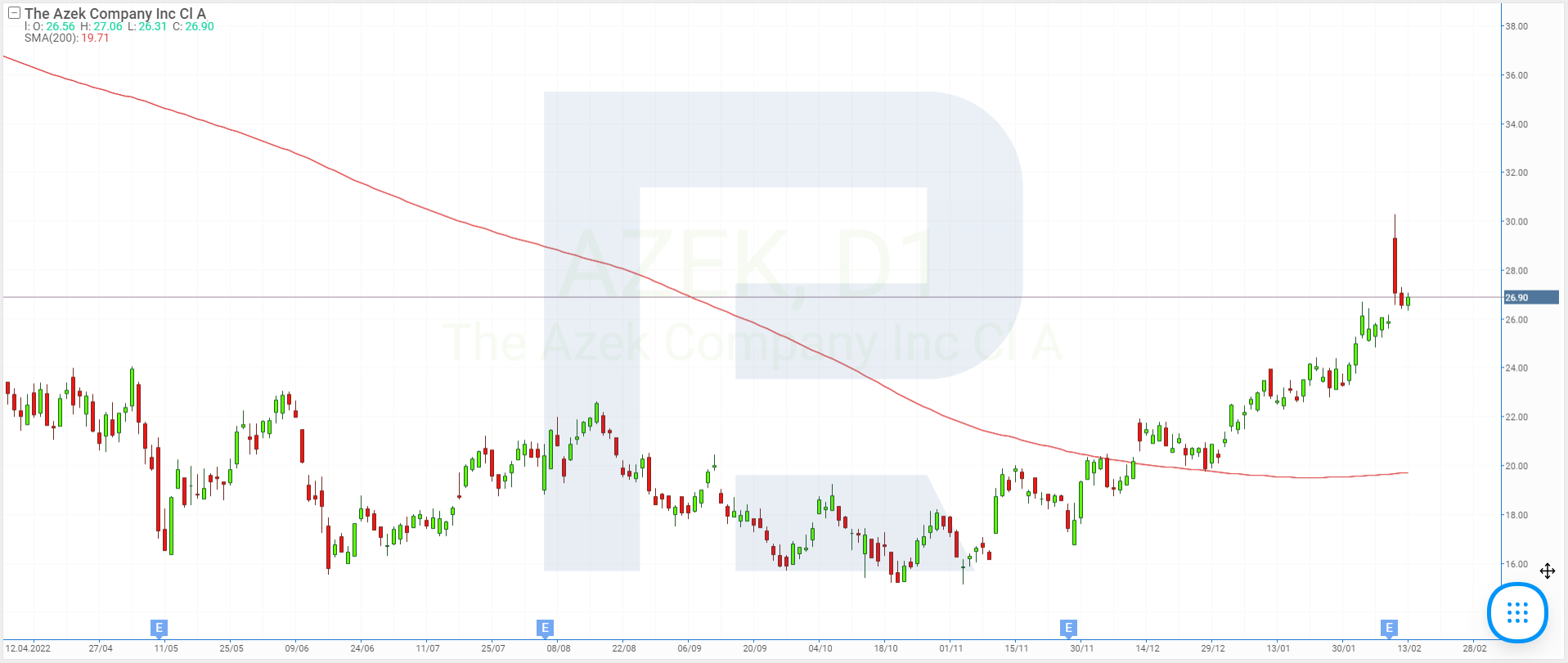

2. AZEK Company – 38.87%

Founded in: 2013

Registered in: the US

Head office: Chicago, Illinois

Platform: NYSE

Market capitalisation: $4.06 billion

The AZEK Company Inc. designs, produces, and sells an assortment of goods from recycled materials for the construction and maintenance of houses and commercial and industrial facilities. It trades under various AZEK brands, such as AZEK Exteriors, TimberTech, ULTRALOX, VERSATEX, VYCOM, and STRUXURE.

Over three months, the stock price of The AZEK Company Inc. (NYSE:AZEK) recorded a 38.87% growth, from $19.37 to $26.90. On 8 February, the company presented its report for Q1, financial 2023 which demonstrated a revenue drop of 16.73% to $216.26 million. The net loss reached $25.84 million, or $0.17 per share. Because the situation in the real estate and construction materials market is complicated, experts and investors took the news positively.

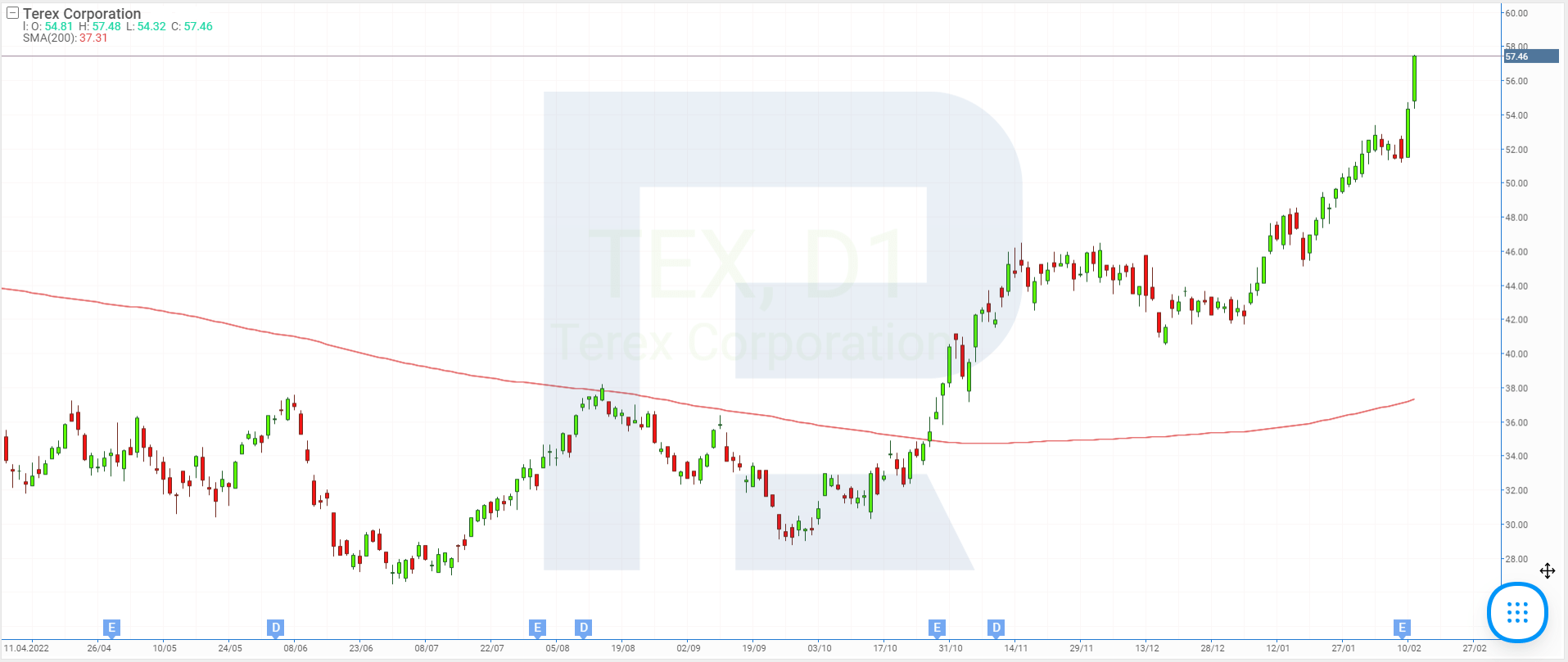

3. Terex – 28.31%

Founded in: 1986

Registered in: the US

Head office: Norwalk, Connecticut

Platform: NYSE

Market capitalisation: $3.88 billion

Terex Corporation designs, produces, maintains, and sells industrial equipment and special machines used in different sectors, including construction, energy, and mining. Its products are available under brands like Terex, Powerscreen, Fuchs, EvoQuip, Canica, Cedarapids, CBI, Simplicity, Franna, and more.

From 14 November to 13 February, the stock price of Terex Corporation (NYSE:TEX) recorded a 28.31% rise from $44.79 to $57.47. On 9 February, the company published its report for Q4 and the whole of 2022. Quarterly revenue increased by 22.98% to $1.22 billion, net profit by 56.81% to $92.20 million, and EPS by 63.41% to $1.34. Yearly revenue was up 13.66% to $4.42 billion, net profit rose by 35.81% to $300 million, and EPS increased by 40.72% to $4.32

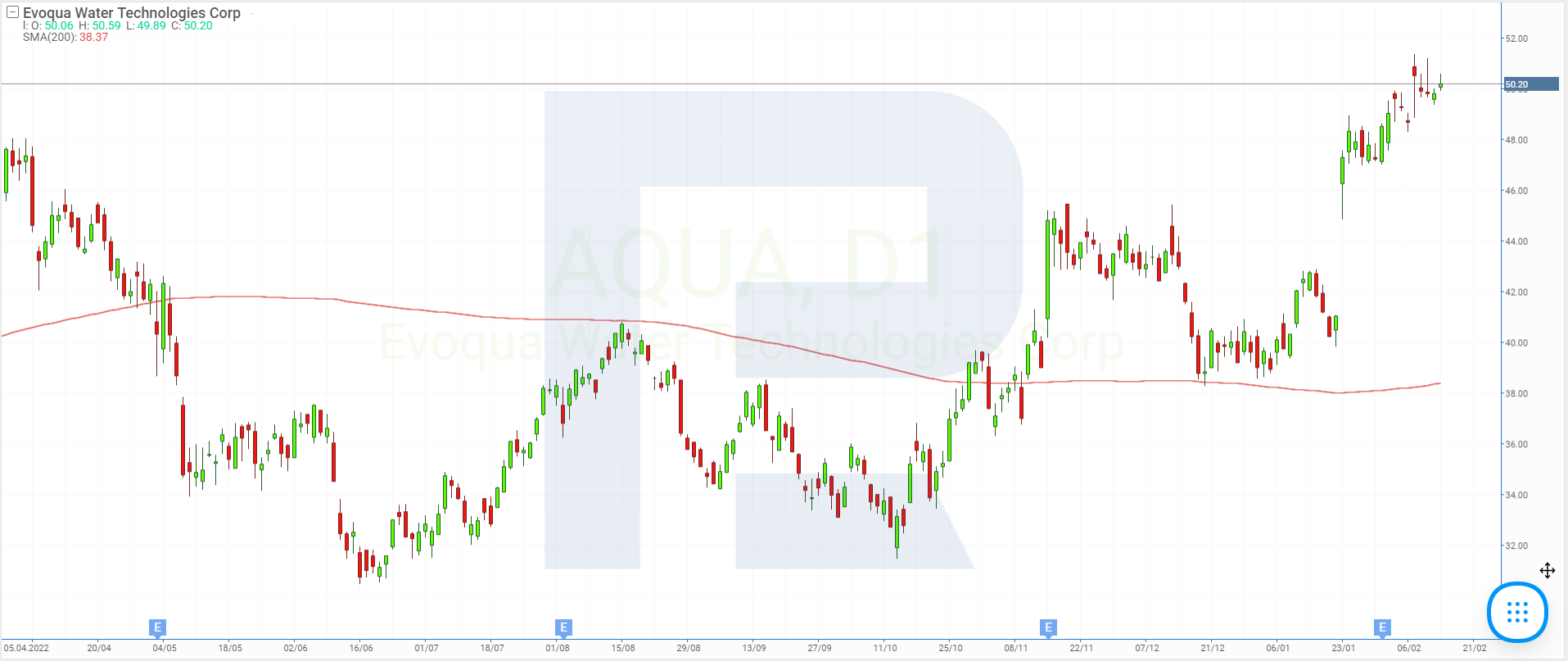

4. Evoqua Water Technologies – 25.55%

Founded in: 2013

Registered in: the US

Head office: Pittsburgh, Pennsylvania

Platform: NYSE

Market capitalisation: $6.12 billion

Evoqua Water Technologies Corp. is a producer of innovative systems and technologies for water cleansing. It works with municipal and commercial institutions in the healthcare, energy, chemical, food, and oil industries in the US and overseas.

The products of Evoqua Water Technologies Corp. are sold under such brands as ADI Systems, ATG UV Systems, Carbonair, Davco, Envirex, Environmental Treatment Systems, ETS-UV, Frontier Water Systems, Geomembrane Technologies, Ionpure, and more.

Over the last ninety days, the stock price of Evoqua Water Technologies Corp. (NYSE:AQUA) recorded a 25.55% growth from $40 to $50.22. On 23 January, it became known that Xylem Inc. (NYSE:XYL) that specialises in water supply technologies would acquire Evoqua Water Technologies Corp. for about $7.5 billion.

Moreover, on 31 January, Evoqua Water Technologies Corp. shared the results of Q1, financial 2023. From October to December, revenue recorded an 18.99% growth to $435.85 million, net profit rose by 52.23% to $9.27 million, and EPS increased by 40% to $0.07.

5. Mueller Water Products – 24.12%

Founded in: 1857

Registered in: the US

Head office: Atlanta, Georgia

Platform: NYSE

Market capitalisation: $2.16 billion

Mueller Water Products Inc. is a large manufacturer and supplier of equipment for the water supply infrastructure. The company owns such trademarks as Mueller, Echologics, Hydro Gate, Hydro-Guard, HYMAX, i2O, Jones, Krausz, Mi.Net, Milliken, Pratt, Pratt Industrial, Sentryx, Singer, and US Pipe Valve & Hydrant.

Over the three months, the stocks of Mueller Water Products Inc. (NYSE:MWA) recorded a 24.12% growth, from $11.11 to $13.79. On 2 February, the corporation presented its report for Q1, financial 2023. Revenue in the period October to December increased by 15.61% to $314.8 million, net profit rose by 15.98% to $22.5 million, and EPS by 16.67% to $0.14.

What influenced stock price growth in Producer Manufacturing?

From November to February, the leaders of stock price growth in Producer Manufacturing were such companies as Axcelis Technologies Inc., The AZEK Company Inc., Terex Corporation, Evoqua Water Technologies Corp., and Mueller Water Products Inc. Presumably, this stock price growth can be attributed to the good financial results in the quarterly and yearly reports.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high