Retail Trade: Top 5 Stocks in the Last Three Months

6 minutes for reading

The biggest stock gains in the Retail Trade sector in the past three months were recorded by ACV Auctions Inc, MercadoLibre Inc, DICK'S Sporting Goods Inc, Builders FirstSource Inc, and Boot Barn Holdings Inc.

Selection criteria:

- The sector is retail trade

- The companies are not funds

- Their stocks are traded on the NYSE and NASDAQ

- The value of the stocks exceeds $2

- Their market capitalisation exceeds $2 billion

- Their average trading volume statistics for the last 30 days is over 500,000 stocks

The growth value was determined as the percentage difference between the opening price on 13 December 2022 and the closing price on 13 March 2023. The market capitalisation of each firm was the current market value at the time of writing.

1. ACV Auctions – 31.47%

Date of foundation: 2014

Country of registration: US

Headquarters: Buffalo, New York

Exchange: NASDAQ

Market capitalisation: $2.02 billion

ACV Auctions Inc. is a technology company that owns an online platform and ancillary services for wholesaling used cars in the US. From mid-December to mid-March, ACV Auctions Inc. (NASDAQ: ACVA) stock gained 31.47%, from $9.31 to $12.24 per share.

The corporation released its fourth-quarter and full-year 2022 report on 22 February. Revenues for October-December last year declined from the same period in 2021 by 2% to $98 million, and net loss decreased by 6.83% to $24.52 million or $0.15 per share.

ACV Auctions Inc. managed to grow annual revenues by 17.6% to $421.53 million, even in the challenging macroeconomic environment, while its net loss rose 30.71% to $102.19 million or $0.65 per share.

ACV Auctions Inc. expects revenues in the first quarter of 2023 to reach $107-110 million and $460-470 million for the year. The forecast for the quarterly net loss was $27-29 million, and 104-109 million for the annual loss.

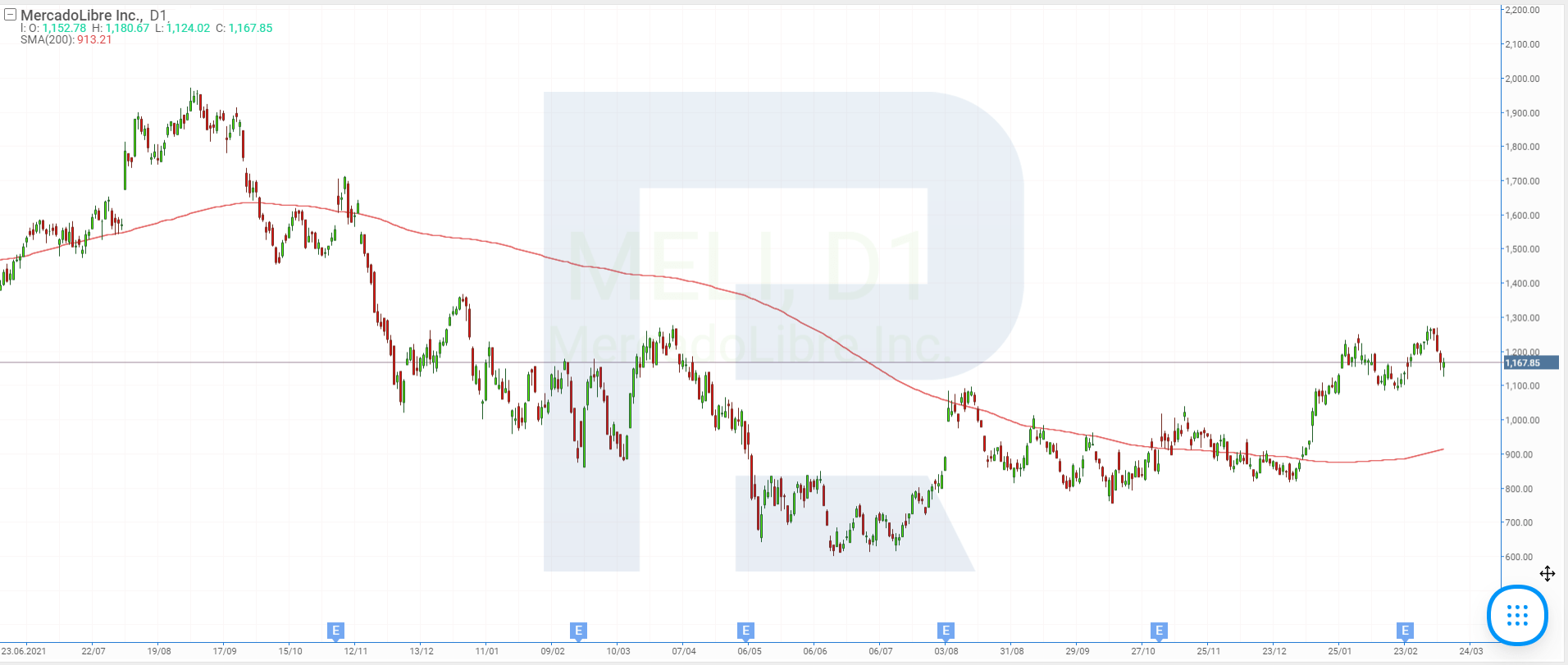

2. MercadoLibre – 24.78%

Date of foundation: 1986

Country of registration: Uruguay

Headquarters: Montevideo, Uruguay

Exchange: NASDAQ

Market capitalisation: $58.42 billion

MercadoLibre Inc. operates several technology projects in 18 Latin American markets. The company's main products include a marketplace, an online payment service, a financial investment platform, an advertising service, and a real estate and car trading platform.

MercadoLibre Inc (NASDAQ: MELI) stock price rose 24.78% in three months, from $931.48 to $1162.33 per share. According to the quarterly and annual reports released on 23 February, revenue for the October-December 2022 period increased 40.94% to $3 billion, and net income reached $165 million or $3.25 per share.

For the full past year, MercadoLibre Inc.’s revenue increased 49.06% to $10.54 billion, net income skyrocketed 480.72% to $482 million, and earnings per share rose 470.66% to $9.53. The number of active users of all the company services increased by 18.29% to 97 million in the quarter, and 5.71% year-over-year to 148 million.

3. DICK'S Sporting Goods – 17.01%

Date of foundation: 1948

Country of registration: US

Headquarters: Coraopolis, Pennsylvania

Exchange: NYSE

Market capitalisation: $12.1 billion

DICK'S Sporting Goods Inc. specialises in the sale of clothing, footwear, accessories, and equipment for sports and outdoor activities. The company owns and runs Sporting Goods, Golf Galaxy, Field & Stream, Public Lands, and Going Gone!

DICK'S Sporting Goods Inc. (NYSE: DKS) quotations have risen 17.01% over the last 90 days, from $124 to $145.09. On 7 March, the corporation reported for the fourth quarter and full fiscal 2022. Revenue for the November-January period rose 7.3% to $3.6 billion, net income fell 32% to $236 million and earnings per share fell 18% to $2.60.

Revenue for the full fiscal year, which ended on 28 January 2023, increased 0.6% to a record $12.37 billion, while net income fell 31% to $1.04 billion, and earnings per share declined 22% to $10.78. The company's annual dividend was $4 per share, up 105% from last year. The company expects fiscal 2023 net income to rise to $12.90-13.80 per stock.

4. Builders FirstSource – 15.71%

Date of foundation: 1998

Country of registration: US

Headquarters: Dallas, Texas

Exchange: NYSE

Market capitalisation: $11.02 billion

Builders FirstSource Inc., which was called BSL Holdings Inc. until 1999, manufactures and sells materials and products for residential and commercial construction and renovation. The company also conducts real estate appraisals, as well as provides design, and construction services. During the period of interest, Builders FirstSource Inc. (NYSE: BLDR) stock gained 15.71%, up from $69 to $79.84 per share.

The corporation presented its quarterly and annual results on 28 February. Revenue for the October-December period slipped 6% to $4.36 billion, and net income was down 11.57% to $0.47 billion or $3.21 per stock. Revenue for the year increased 14.24% to $22.73 billion, and net income rose 45.69% to $3.06 billion or $18.71 per share. Builders FirstSource Inc. expects revenues to reach $3.4-3.7 billion for the first quarter of 2023.

5. Boot Barn Holdings – 11.97%

Date of foundation: 1978

Country of registration: US

Headquarters: Irvine, California

Exchange: NYSE

Market capitalisation: $2.16 billion

Boot Barn Holdings Inc., which was called WW Top Investment Corporation until 2014, manufactures and sells western-inspired apparel (clothing, footwear, and accessories). The company runs a retail chain of 336 shops in 41 states.

Boot Barn Holdings Inc (NYSE: BOOT) stock gained 11.97% from 13 December 2022 to 13 March 2023, up from $64.75 to $72.50 per share. The corporation reported third-quarter fiscal 2023 earnings on 25 January. Revenue for the October-December period increased 5.89% to $514.55 million, net income declined 23.77% to $52.77 million, and earnings per stock decreased 23.35% to $1.74.

Boot Barn Holdings Inc. management plans to open 43 new shops during 2023, and forecasts revenues in fiscal 2023 to reach $1.68 billion, and net income to reach $167-170 million or $5.50-5.60 per share.

What influenced growth in Retail Trade stock?

The leaders in the retail trade sector between mid-December last year and mid-March this year were ACV Auctions Inc, MercadoLibre Inc, DICK'S Sporting Goods Inc, Builders FirstSource Inc, and Boot Barn Holdings Inc. One of the main reasons for the rapid appreciation of these corporations' stocks might be the financial results presented in the quarterly or annual reports.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high